You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Articles

Filters

Show only:

Loading…

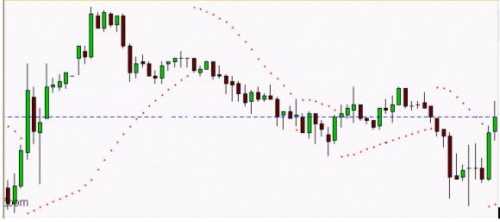

Recently I sent out to my free newsletter subscribers a lesson I had written a couple years ago dealing with what I call the PAUSE formation. The reason for this was that a market that I had been sharing future cycle turn dates on had formed the early warning sign for a PAUSE formation and may present an opportunity for a trade. At the very least, it should help those looking to learn more about cycle turns, swings, pivots and other associated phenomena to cycles. The more you understand a tool or indicator the better you can exploit it.

The PAUSE formation is very simple to identify. But what I want to discuss first is what to look for in order to determine a POTENTIAL PAUSE formation. Unless you have some advanced warning, who cares...

The most important thing in any type of trading is to have a solid set of rules and then to have the self control to follow those rules. Day traders especially need to have rules to follow as emotion can and will have you buying and selling at the wrong time.

Day Trading Rules:

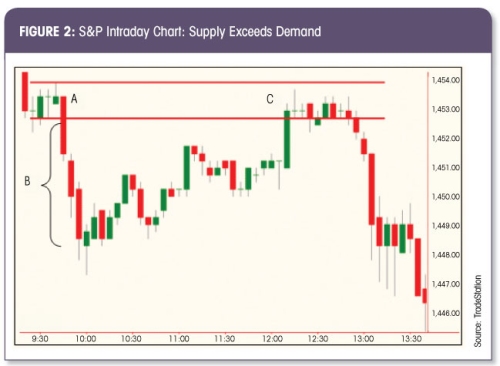

Only enter trades when price is at a support (demand) or resistance (supply) level, no matter what time of day or night.

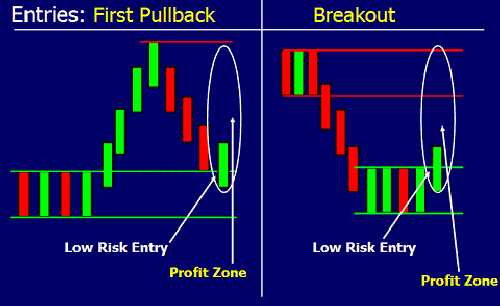

Two types of entries: Breakouts and first pullbacks (see below).

Each day, identify one demand and supply level in each market, using a larger intra-day time frame. Always know where the market is in the larger picture with regard to supply and demand.

Only trade opportunities that offer at least a 3:1 profit zone to the first target...

One day after a particularly spectacular trading debacle, my Uncle Joe took me aside and consoled me with some hard facts about how the stock market works. You see, Uncle Joe owns a very unique company and has an insider's perspective on how stock price movement is managed.

His company, Widgets & Co., is the only company in the States that distributes widgets, and it does so under license from the government. It has been buying and selling its unique widgets for many years. Now imagine also that these widgets have an intrinsic value, they never break, and that the number in circulation at any one time is the same. So, Uncle Joe, being a clever man with many years of experience managing his business, realized early on that just buying...

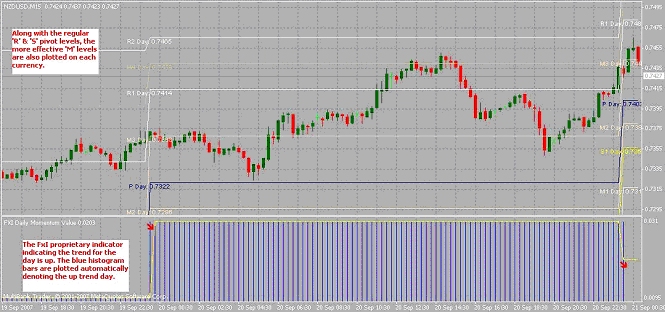

The Pivot point system is a technique developed by floor traders, to help ascertain where the price is relative to previous market action. It can be classified as a technical indicator derived by calculating the numerical average of the high, low and closing prices, of any currency / index / stock etc.

A look at market movement tells us that price always fluctuates between a level of support and a level of resistance. Properly identifying key support and resistance levels can improve the ability to enter, exit, and manage your trades.

The pivot point is a level at which the sentiment of the market changes. It can tell us where the sentiment of traders and investors changes, from bull to bear or vice versa.

The main advantage of this...

dis ci pline (n.) 1. Training intended to produce a specified character or pattern of behavior. 2. Controlled behavior resulting from such training. 3. A state of order based upon submission to rules and authority. WEBSTER'S CONCISE DICTIONARY.

How do you react to rules? Do you find them to be a burden, a drudgery to observe and obey? Do you look at them as something negative, a restriction to your freedom perhaps?

Or, do you instead see rules as beneficial, as a protection from possible harm? Do you find that rules are necessary in your trading?

While growing up, we were constantly confronted with rules of one type or another. We received rules in proper hygiene, how to address other people, how to respond to various signs on the...

As traders, we soon come to realise and appreciate how difficult it can be to take money consistently from the markets. We learn that to have a chance of doing so requires us to make a lot more effort than we may have imagined. We need to have extensive knowledge of the markets and instruments we intend to trade, a sound grasp of technical analysis, a thorough macro-economic overview and also to have secured for ourselves an appropriate amount of "risk" capital. However, most importantly, and the issue this article seeks to address, is the effort that is required to study ourselves when we trade and specifically to understand how the patterns of behaviour we come to observe in ourselves whilst trading, once identified, can be...

There are too many items to keep track of in the market. The trader must understand that he cannot "know it all". If you could, you would be the ultimate trading machine. This being said, we realize that we are imperfect. We have only 100% of our mental energy to use in any given time frame. Some of it is used in maintaining our bodies - breathing, walking, talking, etc. Some is used in keeping track of our lives - what time is it, did I turn off the coffee pot, and did I pay the phone bill? Most of it is used in trying to understand the complexity of our world - the sensory input from our senses and their identification and categorization. In using this last energy, we tend to trap ourselves into sorting out signals and identifying...

There are literally hundreds of options strategies, many more if you include the vast array of complex strategy combinations. Why so many? Simple, it s because most options speculators can't figure out price direction. Instead, they rely on complex option strategies and a variety of standard pricing models that don t work and simply add illusion to a constant simple reality of all markets: supply (resistance) and demand (support).

When you filter out illusion and replace it with pure supply and demand analysis in options trading, you not only simplify the useless complexity of options, you discover endless low risk-high reward opportunity based on a set of objective rules. This opportunity is one in which the reality-based options...

When traders talk about the 'Positive Expectancy' of a strategy or system, what is it that they mean?

I have been watching as a several people on a forum discuss, argue and lend their ideas about entry techniques. They are going crazy over what the proper entry should be and why one chart pattern is better than the other. One person has even said how they purchased massive amounts of software to help them enter the market. Now don't get me wrong, I always use techniques to get me in the market but I understand that this is the least important factor weighing on an investor's overall success. I use technical analysis every day and I study patterns that allow me to enter with the ideal buy point (what I believe to be the ideal entry) but...

Parallel channels are one of the most commonly seen patterns in charts. They give many opportunities to profit whether or not the market is trending. Horizontal channels are better known as trading ranges when the market is not trending; rising channels occur when market is trending up and falling channels appear when the market is trending down. Regardless of the market conditions seen, parallel channels can be found in all shapes and sizes.

Trade Recap

During the weeks in mid-June to early July, 2007, S&P 400 MidCap E-mini future has been moving up steadily inside a rising channel, as seen on the 60-minute chart below. Although the MidCap has been moving near the all time high, it has been trading in a large trading range. This...

We take a basic look at what Swing Trading is and how to use it in trading.

Trading Categories

In our opinion, there are three broad categories that can be used to classify all trading methods. These categories are based around the amount of time a speculator holds his or her position in the market. These classifications are described below:

Short-term - Traders hold positions from a matter of seconds to several hours but rarely longer than 1 day. Examples: Day Traders: Scalping, momentum breakouts.

Medium-term - Once a position is held for longer than one day it can be classified as a medium term or swing trade. Traders hold positions from several days to weeks. Examples: Technical and fundamental swing traders.

Long-term - Traders...

You've decided to get started as a trader or investor, but where do you start? The answer as always is very simple and the process I will take you through applies to virtually all markets (particularly shares, stocks and derivatives of these i.e. options and spread betting) Once you move into other markets (currency for example) you would have a different set of data and charts.

One important point to note, is that those of you who have full time employment and are just doing this for longer term investment, or to build up experience, all of the following can be done in the evenings or at the weekend. You may remember that I have said before, you do not need live data to start with - end of day data is fine. You also do not have to be...

Newton's Third Law of Motion states that

"for every action, there is an equal and opposite reaction."

Such 'action' can be by direct contact, such as from friction, tension or applied forces. Then you have such 'actions' as a result of gravity, electrical and magnetic.

Forces come in pairs. For every action, there is opposite reaction. The size of the reaction is equal to the size of the action. Nature is filled with such evidences of this law. For example, when a bird flies it uses its wings to push air downwards. As a result, the air reacts by pushing the bird upwards. The size of the force on the air equals the size of the force on the bird. The direction of the force on the air is opposite the direction of the force on the bird...

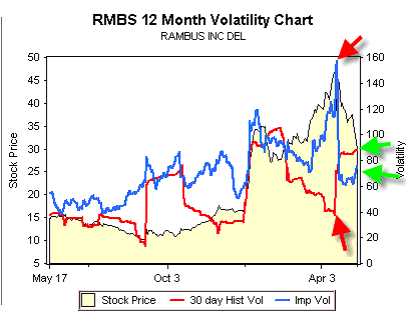

How does volatility affect Options trading and is it a good or bad thing?

A little violence is one's life can be very exciting, and profitable. No, I'm not suggesting you go rob your neighborhood liquor store. I'm talking about your trading life. The violence I'm referring to is the up and down fluctuations in the stock market. How severe these fluctuations are is measured by what is called "volatility."

Obviously, when there are dramatic spikes, the volatility can be very high. Conversely, when the stock is moving sideways, and not moving up and down, the volatility is reduced. Remember, earlier we discussed the components of an option price based on the Black Scholes pricing formula. Volatility is one of the ingredients. Basically...

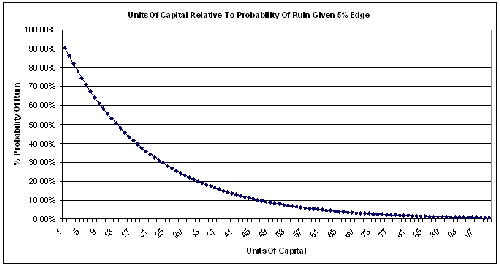

What Is The Risk Of Ruin?

Please excuse me if I start off a little technical in this article. There is nothing complicated about the risk of ruin concept but it does require a quick calculation.

Simply stated, the risk of ruin is the percentage probability that a trader's account balance will reach zero. This will either result in the trader ceasing to speculate on the financial markets, or having to stump up another chunk of capital in an attempt to make back the first tranche before making net profits.

Having a solid trading strategy which is applied with discipline is clearly crucial, however understanding your probability of success or failure given certain actions must be more so. By using the risk of ruin formula a trader can...

Have you gone out of your way NOT to take care of your Trading results? Why would some traders deliberately hamper their success - make trading decisions that are doomed to fail?

A video tutorial with chart examples of real trades is illustrated in this tutorial, where traders sabotage their success;

http://www.4x4u.net/review/sabotage/sabotage.html

Self Sabotage behaviour is when there is no logical or rational explanation of your action. It is making the same mistake over and over gain. Self sabotage is not following your rules, or in many cases not having a trading plan.

How do you break free from self-sabotage behavior?

Just think where you could take yourself if you were able to manifest your goals, you are able to take care of...

Have you ever wondered how Warren Buffet made his millions? In this article we look at the concept of compounding.

Some of you know about this, some of you don't. Either way I'm going to give you the basics of compounding, plus a couple of new slants on the concept. I suggest you read The Magic of Compounding not just once, but several times. If you have children, print this write-up and give it to them to read. If they master this concept they will become rich.

The Basics

Compounding describes how numbers, or money, can grow. Numbers can grow in an arithmetic progression, for example 2,4,6,8,10,12 or 3,6,9,12,15,18, where one unit is added on at each step in the progression and that action provides the growth, or, numbers can grow...

As the online Forex trading market becomes increasingly saturated and the choice of brokers becomes wider, the decision of which broker to run with becomes increasingly important for the trader. Although the majority of brokers provide the same basic trading platform, there can be a vast difference in what they offer their clients, both in terms of trading conditions as well as customer support. By simply visiting a company's homepage it may be hard to separate the second-rate firms from the professionals, therefore this article will examine the main parameters that should be taken into consideration before creating an account and depositing.

Account type

The decision of which type of account to open will most likely depend on the...

Gaps are a common occurrence in the markets. Everyday there is always at least one stock that has gapped up or down when the market opens. Why? As long there is some event happening somewhere between the market close of the previous day to the opening of today, there will be gaps. Even if the markets eventually move little by little toward the inevitable 24-hour format, there will always be gaps. After all, somewhere around the world, there is some event happening during the weekends as well. Plus, there is always an excited group of investors who making a big deal out of something or even for no reason unknown to the rest of us. So, gaps are a fact of life and there is no avoiding them. The best thing to do is take it in your stride...

If there is one thing that a trader would want to know for certain, it would be to catch the bottom or top of a trend.

But simple as it sounds, it is easier said than done.

Knowing that a certain price wave is completed, or is just a retracement in the larger trend, becomes more of an art than a science.

In such situations, using multiple sources of confirmation helps to avoid the potential false signals, and preserve our capital for only those situations that provide us with the most favorable risk to reward scenarios. Keeping that in mind, we will use two very different indicators - the ADX (Average Directional Movement Index) and the PSAR (Parabolic Stop & Reverse) - to form a system which should help us to trade as close to the...

A brief look at the three commodities that are said to drive inflation - silver, sugar and soybeans.

In the commodity markets, many inter market relationships exsist. Crude Oil, Gasoline, and Heating Oil are an example, the same for the bean complex with Beans, Bean Oil, and Bean Meal all being obviously related. The reason for the relationship is simple and easy to understand. They are all comprised of a common ingredient the.... Mother Commodity

However history has shown that there is many inter market relationships that are not as obvious. The reason for the relationship may not be as clear and, like many legends, could be subject to interpretation. They also are not necessarily as tight or as in sync as the aforementioned...

The eagerly watched for retest (of the prior lows) finally came to fruition on Wednesday of last week. Although, the ER2 (Russell 2000) didn't quite make it down far enough to touch the recent nadir. This was not the case for the S&P and the Dow. These two benchmarks actually exceeded their prior low points before the Bears finally decided that - enough was enough - and began covering or buying back their short positions. In addition, the market sell-off had gone far enough that the Bulls found a perceived "value area" in which they could put new money to work. This chain of events created a massive order imbalance that precipitated the violent reaction that is the rebound. Much like a rubber band that is stretched to its limit, the...

After last Wednesday's brief pullback, the market resumed its upward trajectory, this in defiance of those skeptics who continue to espouse their bearish views. I'm sure at some point the market will experience a considerable correction or even go into a full- blown Bear market (we haven't had one of those in over 4 years). For now at least, every piece of news is being spun positive. The inflation data, the housing data, good news is good news and bad news is good news. The glass is half full. This is emblematic of a market in a bull phase.

As traders, my view is that we should take our directive only from the market itself; not the media nor the pundits nor anyone else for that matter. I believe a trader's job is to get good at...

Welcome to the wonderful world of equity options. You may have heard that option trading is high risk, and indeed it is, for much the same reasons that spread betting is high risk. The instruments themselves are derivatives from the cash markets, and are highly geared, but options themselves were originally introduced to the US markets in the mid 1970s as a tool for hedging risk. In other words they were a form of insurance. You paid a premium, a bit like car insurance, which covered you in the case of an accident. In the financial markets you bought some protection in case the market went in the opposite direction. In this article we look at equity options, which are those derived from the cash market share or stock.

In the early...

First of all, congratulations to everyone who made money on the recent Japanese Yen rally. One of my students caught some nice chunks of the recent move lower in USD/JPY, earning 70 pips and 85 pips on successive trades. Way to go, M!

The recent strength in the Japanese Yen created some terrific moves, but we should keep things in perspective - the gains made during the recent move lower in NZD/JPY (New Zealand Dollar/Japanese Yen), GBP/JPY (Great Britain Pound/Japanese Yen), and EUR/JPY (Euro/Japanese Yen) and other Yen pairs are nothing compared to the huge profits earned by long-term traders who were short the Japanese Yen when these pairs were rallying. For a case in point, have a look at the daily chart of NZD/JPY (see figure 1)...

Here we take a brief look at how the forex market began and how it has evolved over the years.

The foreign exchange, FX or forex market, as we know it has been evolving for hundreds of years. It is believed that the concept of banking first arose in ancient Mesopotamian times. Royal palaces and temples were used to store harvested commodities which in turn created the need for receipts. These receipts were used for transfers to those who made the deposits and to third parties. The very same banking and receipt business was also used in ancient Egypt. Receipts were often used to settle debts with priests, tax collectors and exchanged with traders. It wasn't until the early forms of coinage came about that we saw the first real currency...

Finding your very own unique commodity trading edge is a worthwhile goal. Without one you are lost in the masses, struggling to push your head above the sea of expenses. Trading edges do exist, though for short periods of time. Psychological edges are more permanent. You need many. Here's how to find yours.

First let's talk about a good market for day trading. Next, we'll talk about finding a trading "edge."

The S&P 500 Index futures contract market may be the best futures game around for day-trading. It's liquid and the swings are usually large enough every day to make it worthwhile. The electronic e-mini futures market (the mini S&P 500) is lightning fast for executions that rival or even exceed the floor-trader advantage. However...

What does it mean to short a stock?

This means that you borrow the stock from your broker to sell to a third party. The idea is to buy back the stock at a lower price, returning the shares to your broker while leaving the remaining cash in your account as a profit. Put another way, a short seller does not own the stock before they sell it. Instead, they borrow it from another investor who already owns it. At a later date, the short seller buys back the stock they shorted and returns the stock to close out the loan. If the stock has fallen in price since they sold short, they can buy the stock back for less than they received for selling it. The difference is your profit.

Short selling is a transaction made on margin. This means that...

If you buy a stock for $50 and it reaches an all time high of $100, but you sell at $75, why do you feel that you've made a loss?

Minds and Markets

In most people's minds finance and economics are the domains of clear, quantitative thinking. Economists merely uncover financial truth one after another as they develop new mathematical tools for modeling capital and how wealth is created. Markets, likewise, are ethereal natural forces tapped into rather than created. In truth, the assumptions that underly the pricing models used for the past three decades are based on two basic principles:

Meanwhile, down the hall on university campuses, researchers in cognitive science have uncovered evidence that humans are not quite the rational...