You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Articles

Many traders use the selling of options as an income-generating device. A question that comes up in this connection is when, and whether, to do what is called rolling out your position.

What Is Rolling Out an Option Position?

Selling an option position that has not yet expired in order to buy another option position that has more time to expiration is called rolling out an option position.

Before we go into this further, first let’s back up a step and describe how an income generating option trade works in general.

Trading Options for Income Generation

One way to do this is to look at an asset, such as a stock or exchange-traded fund, that you currently do not own but which you would be willing to buy if you could do so at a good...

Recently I received a question concerning an option strategy known as in-the-money (ITM) covered calls. This is a variation on the more common out-of-the-money covered call, and it has some interesting uses.

What Is an In-the-Money Covered Call?

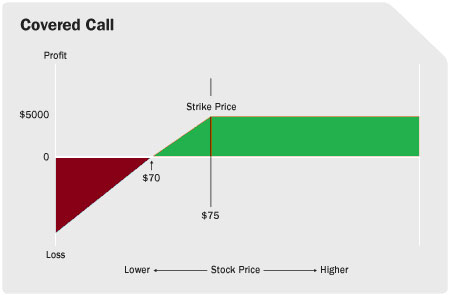

The ITM covered call can be used as a device to sell an appreciated stock at a price that is somewhat above the market price. It can also be used as a cash-flow generation strategy and tuned to be almost as conservative as treasury bills, or as aggressive as a biotech stock or anywhere in between.

How to Use an In-the-Money Covered Call

The mechanics are simple. You buy (or already own) 100 shares of a stock or exchange-traded fund. You then sell a call option, with a strike price that is...

When considering options expectations and what makes option prices change, it would be nice if we could visualize this in some way that makes the concepts of extrinsic value, intrinsic value and strike price more concrete. Below is one attempt at that, which I hope will add to your understanding.

What is depicted in the chart below is a partial list of the call options for the stock of Apple Computer when it was selling for $190.25 per share. All the options were for a certain expiration date a few weeks in the future.

In the table above right, each row shows a call option at a particular strike price. For each call, the amount of Intrinsic Value and the amount of Extrinsic Value are shown. Calls at strike prices below $190 (shown as...

If you have looked at option trading at all, you probably know that the price of an option has two components: intrinsic value and time value. Intrinsic value is easy to understand; time value is much more interesting.

To dispose of intrinsic value first, think of it as the amount of the built-in discount. If I own a call option at the $98 strike price, on a stock that is trading at $100, then exercising that option would get me the stock at a $2.00 discount. This discount (current stock price minus call strike price) is the call’s intrinsic value. The call will be worth at least that amount (except in rare cases we need not be concerned about).

Puts also have intrinsic value (at least some of them do). If I own a put at the $50...

Options are conditional derivative contracts that allow buyers of the contracts (option holders) to buy or sell a security at a chosen price. Option buyers are charged an amount called a "premium" by the sellers for such a right. Should market prices be unfavorable for option holders, they will let the option expire worthless, thus ensuring the losses are not higher than the premium. In contrast, option sellers (option writers) assume greater risk than the option buyers, which is why they demand this premium.

Options are divided into "call" and "put" options. With a call option, the buyer of the contract purchases the right to buy the underlying asset in the future at a predetermined price, called exercise price or strike price. With a...

One creative way in which put options can be used is to buy a desired stock at a discounted price.

This strategy works best when a stock has recently had a sharp drop, to a point that you believe is a bargain price. It will allow you to buy the stock at a discount from the current market, if the stock behaves as you expect. And if the stock suddenly soars, you may make a tidy profit even though you missed buying the stock. Here’s how it works.

When stocks drop sharply, some of the people who hold them buy put options as protection. From their point of view, they are buying a guaranteed stop-loss. This increased demand for puts drives up their price.

A savvy investor can then sell put options on the stock in such a way that the only...

You probably know that a Call option gives you the right to buy a stock at a fixed price; and that a Put option gives you the right to sell a stock at a fixed price. These rights are what give the option its value. When you take advantage of these rights it is called exercising options.

When Should You Exercise Option Calls or Puts?

Under what conditions would one want to exercise the rights the option gives? The answer is that exercising options is almost never beneficial. Only a small fraction of the options that are created are ever exercised, and for good reason.

Does this mean that most option buyers are buying something worthless? Not at all. It just means that there is almost always a more profitable way to close out an option...

When you open your first option trading account (or add option capability to an existing equities brokerage account), your broker assigns you an options approval level. Usually the levels run from Level One to Level Five. Your approval level determines which option strategies you are allowed to use in that account.

The idea behind the approval level structure is that the riskier an options strategy is, the more options experience and/or capital should be required. Here is a typical list of approval levels and the types of trades allowed:

Level 1 – Covered Calls, Protective Puts (i.e. option positions that also include a position in the underlying stock)

Level 2 – Level 1 items plus speculative call and put buying (i.e. buying calls...

When market conditions crumble, options become a valuable tool to investors. While many investors tremble at the mention of the word "options", there are many option strategies that can be used to help reduce the risk of market volatility. In this article we are going to examine the many uses of the calendar spread, and discuss how to make this strategy work during any market climate.

Getting Started

Calendar spreads are a great way to combine the advantages of spreads and directional option trades in the same position. Depending on how you implement this strategy, you can have either:

a market-neutral position that you can roll out a few times to pay the cost of the spread while taking advantage of time decay

or, a short-term...

In the financial markets, options are rapidly becoming a widely accepted and popular investing method. Whether they are used to insure a portfolio, generate income or leverage stock price movements, they provide advantages other financial instruments don't.

Aside from all the advantages, the most complicated aspect of options is learning their pricing method. Don't get discouraged – there are several theoretical pricing models and option calculators that can help you get a feel for how these prices are derived. Read on to uncover these helpful tools.

What Is Implied Volatility?

It is not uncommon for investors to be reluctant about using options because there are several variables that influence an option's premium. Don't let yourself...

One of the asset classes that can be productively used by many investors is fixed-income investments – bonds. I have been asked several times recently about the wisdom of investing in bonds in an environment of rising interest rates. That’s what I’ll address here.

The reason that the question comes up is that when interest rates go up, the value of all existing fixed-rate bonds goes down. If we expect that interest rates will go up, as most people do, then are we not saying that the value of any bonds that we invest in will go down? Could we have a net loss on the bond investments? If so, should we avoid bonds until we think that rates have peaked out? Or is there something else that can be done?

First, let’s briefly review the...

One of the primary benefits of trading options is the ability afforded to a trader to craft a position with specific reward/risk characteristics that are not available to the trader who deals only in the underlying stock or futures contract.

What this means is that the buyer of 100 shares of stock will make or lose $100 every time the stock rises or falls $1 in price. An options trader, however, is not limited to this straightforward equation; he or she can enter a position that will make money if the underlying security goes up a lot, goes up a little, stays in a particular range, goes down a little, and so on and so forth. The key to success is to understand the actual reward-to-risk characteristics for a given strategy and apply the...

Once upon a time, the retail investment world was a quiet, rather pleasant place where a small, distinguished cadre of trustees and asset managers devised prudent portfolios for their well-heeled clients within a narrowly defined range of high-quality debt and equity instruments. Financial innovation and the rise of the investor class changed all that.

One innovation that has gained traction as an addition to retail and institutional portfolios is the investment class broadly known as structured products. Structured products offer retail investors easy access to derivatives. This article provides an introduction to structured products with a particular focus on their applicability in diversified retail portfolios.

What Are Structured...

In September 2014, we introduced OMI (Option Mobility Index), an analytical tool measuring trending potential of the S&P500 index, which supplemented the ODI (Option Deviation Index) concept published in 2005. It didn’t take long to prove its usefulness, as the market ended its over 5-year bullish run and turned into a sideways moving phase, which for this index is very common.

Traditional trading using futures contracts for low-trending market conditions is a challenging task, as even though the market may stay within a certain range, its turning points usually flip through various levels within the channel. But for any market condition there is always an options strategy which may be applied.

As trading conditions get tougher...

As I’m writing this, it is the afternoon of January 6, 2016. The stock market has been in full-blown meltdown mode for the last five trading days. The S&P 500 index has dropped by about 4% in that time. The Chinese stock market is down much more after dropping 5% yesterday alone. Crude oil has dropped over 6% in that time. This is high volatility in anybody’s book.

And yet, there was one type of volatility that was curiously muted: implied volatility in the options market.

Implied volatility is the name we give to the fear reflected in options prices. The more fear there is, the more people are willing to pay for the insurance offered by options. This fear factor for the stock market as a whole is measured by the VIX, or Volatility...

Many traders know that options strategies provide an abundance of choices. But is it possible to construct an options trading strategy that will hedge against bad news—whether expected or unexpected? The answer is yes and no. Let's explore.

Known events or unknown events

In the markets as in life, there are often "known unknowns" and "unknown unknowns." Sometimes, we know when an event is going to occur; we just don't know what the result will be. Examples of these "known unknowns" are:

• Earnings reports

• Drug trial results or FDA panel reviews

• Economic reports

• Monetary policy decisions

• Election results

Other times, we don't know what will occur, when it...

So, you've decided that buying iron condors is a strategy that meets your needs and will help you meet your financial goals. However, when you buy an iron condor, there are often many choices you can make that can affect its outcome. Among the decisions you must make when setting up an iron condor are the following:

How much you should try to earn per iron condor?

How much risk to take when trying to earn that profit?

Which options to trade?

How far out of the money (OTM)?

How much time before the options expire?

How wide are the call and put spreads?

Which underlying asset to choose?

Faced with these choices, it's possible to be frozen with indecision. This article provides guidance in helping you set up an iron condor...

Most options traders - from beginner to expert - are familiar with the Black-Scholes model of option pricing developed by Fisher Black and Myron Scholes in 1973. To calculate what is deemed a fair market value for any option, the model incorporates a number of variables, which include time to expiration, historical volatility and strike price. Many option traders, however, rarely assess the market value of an option before establishing a position

This has always been a curious phenomenon, because these same traders would hardly approach buying a home or a car without looking at the fair market price of these assets. This behavior seems to result from the trader's perception that an option can explode in value if the underlying makes...

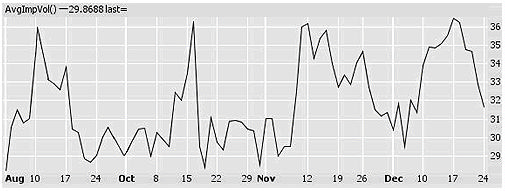

Currently the implied volatility levels in the stock market are much higher than they have been for quite some time. What does this mean for our option trading?

One of the main factors in the profitability of our option trades is the “inflatedness” of the prices of the options. When the consensus of option traders is that stock prices will move rapidly, then the prices of options will be inflated. We say that “implied volatility” is at a high level. At such times, as a general rule we want to use options strategies in which we sell options short. We then hope to buy them back later at lower prices, if we have to buy them back at all.

In times when option prices are deflated (implied volatility at a low reading), we use different...

When you click the “Buy to Open” button on your option trading platform, from whom are you buying? And does it matter? Well yes, it does matter. It can affect the price you pay for the option, to the degree that it might make the difference between a winning trade and a losing one.

The options market is made up of multiple exchanges. Each exchange hosts many options “market makers.” The market makers are broker/dealers, whose job is to buy options wholesale and sell them at retail. These dealers are always present in the market.

The market makers’ computer systems make sure that they have a bid price and an offered price in the market at all times for all the options they deal in. This is true whether any trades have taken place in...

Many investors find volatile – fast moving markets to be very unsettling, but low volatility – sideways markets can be equally frustrating because while risk could be lower, the potential for profit is probably reduced as well because option premiums are lower during these periods.

Here I’ll discuss a few strategies that I believe may be better suited for a low volatility – sideways moving market:

Out-of-the-money (OOTM) Covered Calls

If you already own a stock and it is worth at least as much as you originally paid for it, covered calls can be a great way to generate income. If you sell out-of-the-money calls and the stock remains flat, declines or even increases a little, the options will likely expire worthless and you’ll keep the...

Options provide investors with ways to make money that cannot be duplicated with conventional securities such as stocks or bonds. And not all types of option trading are high risk ventures; there are many ways to limit potential losses. One of these is by using an iron butterfly strategy that sets a definite dollar limit on the amounts that the investor can either gain or lose. It's not as complex as it sounds.

What Is An Iron Butterfly?

The iron butterfly strategy is a member of a specific group of option strategies known as “wingspreads” because each strategy is named after a flying creature such as a butterfly or condor. The iron butterfly strategy is created by combining a bear call spread with a bull put spread with an identical...

Binary options are a simple way to trade price fluctuations in multiple global markets, but a trader needs to understand the risks and rewards of these often-misunderstood instruments. Binary options are different from traditional options. If traded, one will find these options have different payouts, fees and risks, not to mention an entirely different liquidity structure and investment process.

Binary options traded outside the U.S. are also typically structured differently than binaries available on U.S. exchanges. When considering speculating or hedging, binary options are an alternative, but only if the trader fully understands the two potential outcomes of these "exotic options." In June 2013, the U.S. Securities and Exchange...

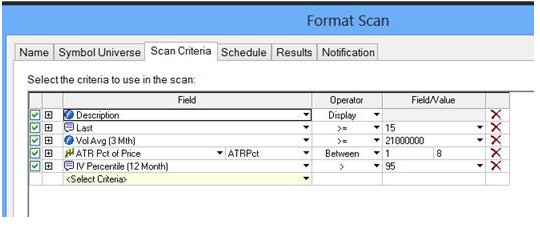

Options are exciting to trade for many reasons. They offer so many opportunities that the sheer volume of possibilities can be overwhelming. How can we go about finding the good ones?

To answer this, we need to think about what the sources of options profits are. What makes their prices move? The important factors are:

Stock price movement

Changing crowd expectations

The passage of time

When looking for option opportunities, we can choose to emphasize any of these.

If we look closer, we will see that the last factor, passage of time, is largely a function of the second one – crowd expectations. Here’s how: when expectations for movement are high, people pay more for options. When they pay more, there is more value in the...

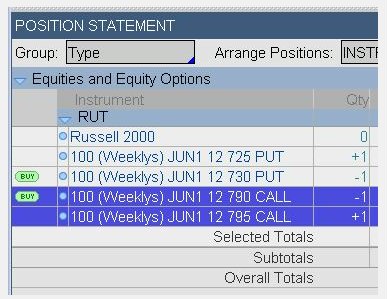

One of the questions that I often get asked is: “How do you enter a stop loss for a complex trade such as an Iron Condor?” This article is aimed at visually displaying the step by step process of entering the complex type of order that is known as Order Cancels Order or OCO using Thinkorswim. In the case of the Iron Condor, we will create an OCO containing the best possible scenario of reaching our target, and the worst scenario, getting stopped out.

Iron Condor OCO Order to Close

Using the example of an Iron Condor, the best possible scenario, or the target, is to see the whole thing expire worthless. However, it is best to buy back the short units for 5 cents as soon possible to get out of the risk and enable the use of the...

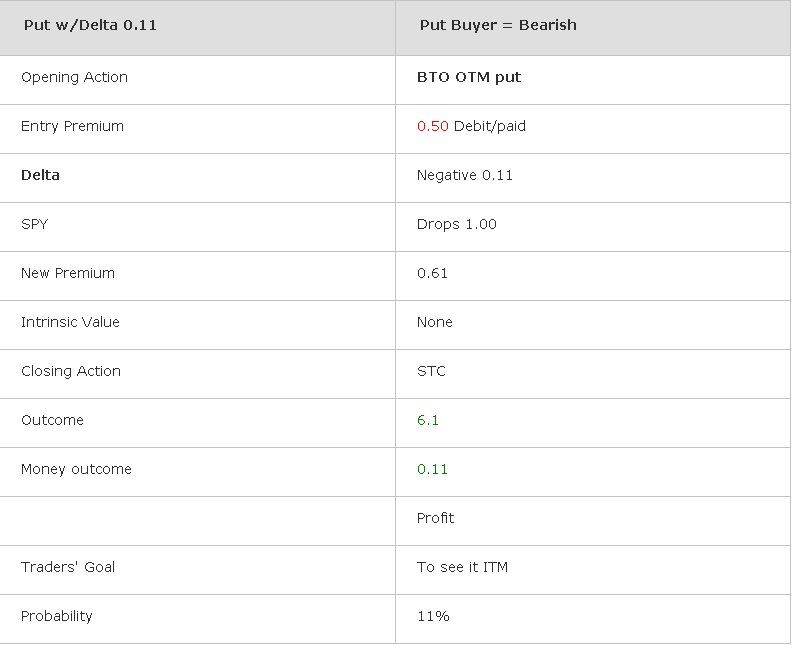

This article looks at the same put strike for a long put and also a short put. First, focus will be placed on the long put's Delta. Then the same put strike price that was used for the long will be analyzed from the perspective of the short put.

Delta has multiple levels of meaning. One of the most commonly quoted definitions is that Delta is a measure of the change in an option's premium with respect to a change in the price of the underlying. The Delta of a long call and also of a short put are positively correlated to the movement of the underlying. While in the case of a long put, as well as the short call, the Delta is negatively correlated to the movements of the underlying asset.

Delta could also be an approximate Measure of...

The aim of this article is to explain how the option premium of an ITM long call changes as the underlying moves on the price chart. There will be three points in time that we will examine.

We will use DIA, the Dow Jones Industrial Average Exchange Traded Fund, for our example. At the first point in time that we will use, the Dow was trading at 126.50 and a one step in the money long August call was selected.

PART I: Friday close 07/08/2011

On July 8th, after the Dow (and the DIA) had been in a strong uptrend for a number of days, it became evident where the next area of resistance would be – at the 127 level. Figure 1 shows the daily chart of the DIA creating, at that time, a formation that seems like a Bull Flag.

Figure 1: Daily...

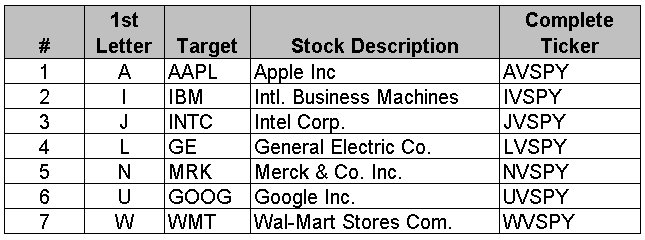

There are new options out there called NASDAQ OMX Alpha Indexes Options. This article will explain some of the aspects of this "New Kid on the Block" for options. It is not a recommendation to buy or sell of any of these products. The information presented here is for educational purposes only. The accuracy of what is discussed can be verified on the official NASDAQ website, as well as Investopedia.com.

Prior to explaining what the new NASDAQ OMX Alpha Index options are, we should first be familiar with what the Alpha term actually stands for; so let us define it. According to Investopedia.com, there are two definitions of Alpha. The first dictionary definition states that Alpha is "A measure of performance on a risk-adjusted basis...

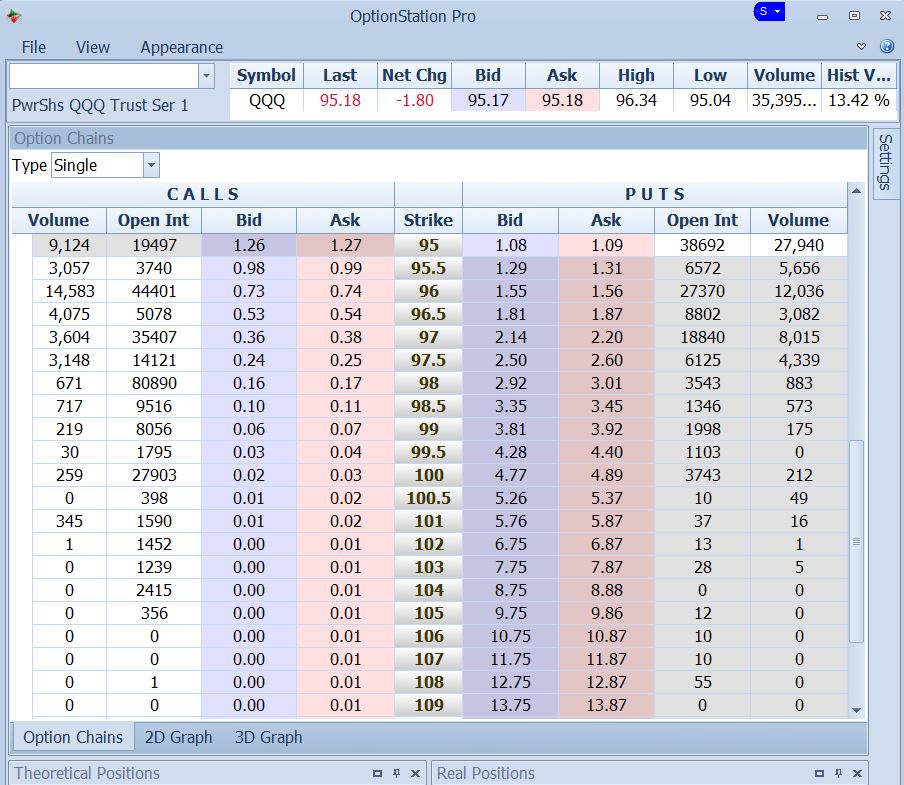

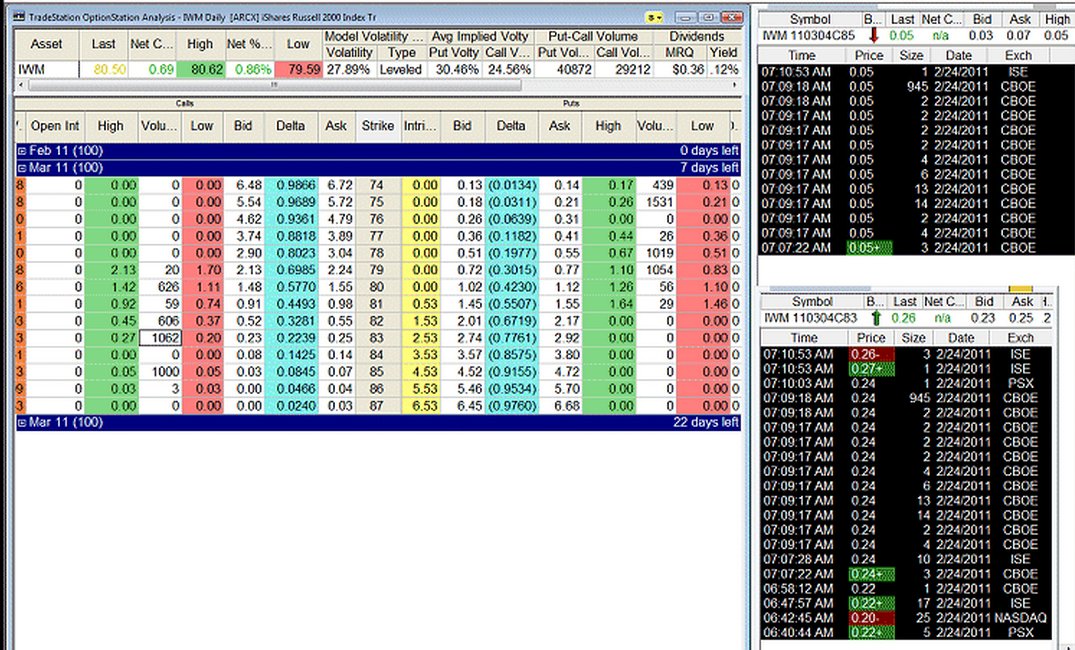

Often, tape reading is viewed as something that held value back in the 1990s, yet I would argue that there is still value in it today, especially when it comes to options. This article will walk the readers through the process of discovering a possible trade using tape reading and then follow its evolution chronologically.

Day One: Weekly Options are Listed

Every Thursday morning weekly options are listed on a small number of ETFs (Exchange Traded Funds). On Thursday, 2/24/2011, I was considering placing a trade on the IWM (Russell 2000 tracking ETF). Figure 1 shows three TradeStation windows, the most colorful one being the Options Analysis window. The columns that one needs to focus on are Open Interest, in white, and the Volume for...