You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Articles

Filters

Show only:

Loading…

Introduction

The Holy Grail is quite possibly the most famous piece of Christian mythology. Almost every archaeologist, historian, Christian and capitalist would love to find it, and many dedicate their lives towards its pursuit. It is said that those who drink from The Grail will be blessed with eternal life, whether that is spiritual or physical is open for debate (unless you have read "The Da Vinci Code" where the last thing you would do is drink from it!). Perhaps that explains why Indiana Jones may appear in a fourth film despite his increasing age.

When we talk about the Market Holy Grail we don't mean a cup that promises ever lasting life, more a cup that you can dip into the markets and pull out a never ending supply of money...

Jack is a trader, but not the cool, calm, collected sort of trader you would think. Yet he stills manages to be profitable by tailoring a trading strategy to suit his mindset. So how does he do it?

Our Jack is a trader. Not that you'd employ him because he is not the cool, calm, non-emotional, confident and steady-under-fire character of the job description. A highly emotional chap is our Jack. He is always scared stiff and sure every trade is going to go wrong. He hates losing and any loss wounds him deeply and stays with him for weeks. He is as greedy as hell and absolutely hates giving money back and watching his profit deteriorate. On top of all that, he's frozen fingered and can always be relied upon to come up with some reason...

What are the major pitfalls that every new trader faces? And how can you avoid them?

So you want to trade, eh? Or have you already started? What drew you to it? Was it the huge profit potential? Maybe it was the excitement. Or perhaps you love the challenge of solving a big, multi-dimensional puzzle.

Trading can be rewarding. You can make lots of money. You can have tons of fun. You can have something to brag about to your friends. Unfortunately, trading can also just as easily lead to financial distress and high blood pressure if you don't go about it the right way.

Whatever the case, there's certainly a number of things that make trading the financial markets worthwhile. At the same time, however, there are some huge obstacles...

This brief video clip is one of a growing library of over-the-shoulder videos I have made to help people learn tape reading by seeing examples for themselves. They are not structured teaching videos as such, more commentary.

As they were created live at the time I was able to point out some of the features as different participants including market makers and ECNs moved in and out of the bid and ask sides and other factors as well, such as the trades printing off on Time and Sales and so on. Because they are live it simply isn't possible to mention every single factor influencing the moves in the time frame of the action, so they are worth watching several times to spot all the influences.

In this particular video you will see my...

In this article we take a more detailed look at more advanced money and trade management strategies.

Introduction

The term “Trade Management” refers to methods and manipulations which can be followed before and after a trade has been made to ensure a protection from undesirable movements of the tradable and at the same time to guarantee that if the position finally proved to be right, the profit will compensate the risk taken. There are two concepts of trade management mentioned in the literature: the use of trailing stop and the reward-to-risk ratio (also known as Profit/Loss ratio) .

In respect to the trailing stop, in the case of a long position, the trader sets an initial stop loss level which is raised as long as the price of the...

What are the significant factors that need to be considered when looking to create a trading system. In this article we look at how to start creating your own system.

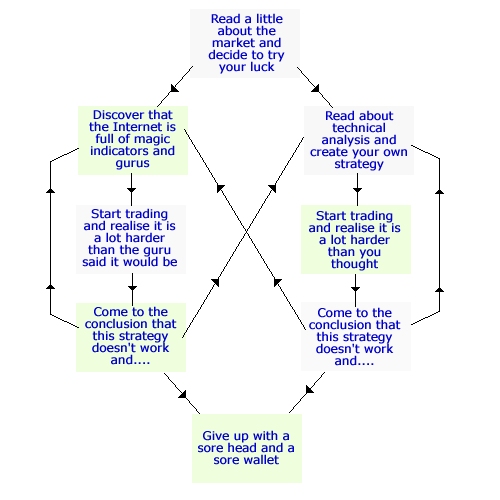

Its long been understood by most and proven by experience that trading is a hard trade to ply, and those who decide to tread on this path have to take their bearings on a variegated sea of information, diverse and, oftentimes, controversial. A tyro trader is flabbergasted by the panoply of approaches, trading means, and celebrated personalities as soon as he opens his first trading magazine. Poised for choice, he kicks off browsing Internet forums, turns for dubious advice to his slightly more versed acquaintances or joins one of the guru-lead sects that dispense...

Having been trading stocks and options in the capital markets professionally over the years, I have seen many ups and downs.

One story told to me by my mentor is still etched in my mind:

"Once, there were two Wall Street stock market multi-millionaires. Both were extremely successful and decided to share their insights with others by selling their stock market forecasts in newsletters. Each charged US$10,000 for their opinions. One trader was so curious to know their views that he spent all of his $20,000 savings to buy both their opinions. His friends were naturally excited about what the two masters had to say about the stock market's direction. When they asked their friend, he was fuming mad. Confused, they asked their friend...

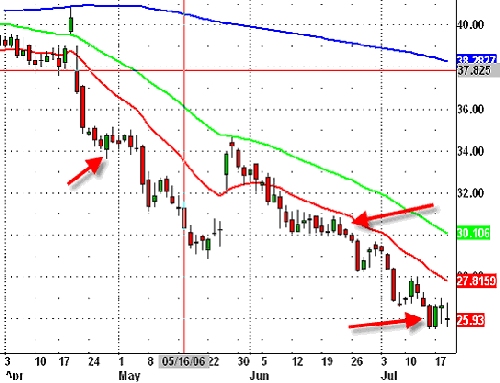

Are we actually now in the bear market? And was the fall we saw in May only a prelude of what is to come? Here we take a look at the current market situation.

The markets spent most of the week preceding the Labor Day weekend hesitating right at key Short-Term resistance, as marked in our last article. This led to some pretty miserable trading conditions, as Wednesday and Thursday yielded a painfully tight 4 point range in the S&P. This is just about as tight I have seen the markets. By Friday, the market managed to break through and sustain above our 1303 mark in the S&P500, and this puts a new multi-year high into play over the short-term for the S&P500. For the DOW, a new all-time high comes into play over the Short-Term with...

In the Forex market, sometimes you get the fruit and sometimes you get trapped and shot. Why?

A friend of mine volunteers on a regular basis to rid his neighborhood of rodents and animal riff-raff: the woodchucks, groundhogs, and possums that eat up gardens, attack family pets, and so on. He sets a trap with ripe fruit or tuna fish. The animal enters the trap for the food. If the animal can't find its way out, it is eventually shot and buried.

Possums are relatively easy to catch. They go for the fruit, they get caught, and then, when the trapper approaches the trap, the possum simply plays dead. It plays dead because that's the best defense mechanism that it has.

A woodchuck is tougher to trap. A big one might enter the trap, eat...

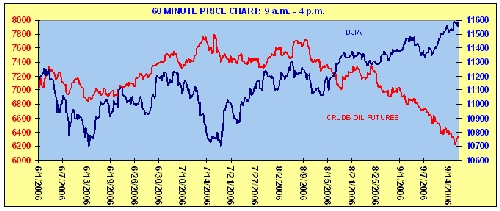

Is there a correlation between Crude Oil Futures and the Dow? And can this correlation be quantified?

In my August 30, 2006 market summary, I wrote how "we would be foolish not to avail ourselves of the inverse pricing relationship between crude-oil and the Dow Jones Industrial Average." Since then, the price of crude has fallen $6.35 and the Dow is 227 points to the upside.

But, now that the distance between these two indicators appears to be excessive, will this wide discrepancy begin to shrink?

In August, energy prices were approaching $80 a barrel, the major equity indices were flat, but as the continuous NYMEX light sweet crude-oil futures contract (CL #F) was sputtering, the markets began spurting upwards. If you compare the...

In this article we look at the fundamentals behind stock prices and why the P/E ratio is not perhaps the best indicator.

I use the P/E ratio as a secondary indicator for buying and selling stocks but I don't use the ratio in the same a manner as many value investors teach. I will explain the difference in my methodology for using the P/E ratio to your advantage.

Many value investors will pass on a growth stock that has a P/E ratio higher than a predetermined level. For example, they may discard all stocks that have a ratio of 15 or higher, no matter what industry group they come from. Some investors will discard any stocks that have P/E ratios above the industry group averages, concluding that they are grossly overvalued. I am not...

The author looks at ways of protecting your capital when trading commodities.

The commodities / futures markets empty the accounts of thousands of traders every year. For most entering trading, and this is true for over 90%, trading commodities means a very certain financial death.

The markets are ruthless and will send people home empty-handed without a care.

The opportunities for making money are numerous, and the leverage entices so many people to jump in head first, that it is unreal. It is the ultimate, white collar get-rich-quick arena.

Unfortunately, like all other areas that the get-rich-quick opportunities are being sold, the ratio of losers to winners is absolutely horrific.

First thing to do to avoid being one of the...

There are times when all traders question their logic for entering a particular trade. Here Dr Doug examines how to maintain your objectivity when trading.

Perhaps one of the most challenging skills in becoming a successful trader is Maintaining Objectivity in trades. While there are a variety of factors which contribute to you losing objectivity in a given situation, there is a clear and defined path you can follow to re-gaining it. In simple terms, it is called Thinking Backwards.

The Issue

More times than not, losing objectivity occurs when you micro-manage a situation. It may be in the form of watching the tape or over-thinking a position but in essence, you lose sight of the MACRO picture or WHY you were in the trade in the first...

In this article the author gives an example of how to put together all the information learnt in the past articles Covered Calls - Part 1 and Covered Calls - Part 2.

It's time to put it all together - all the stuff you've learned to this point. We're going to go through the process of selecting a position - without adult supervision. We're going to make believe we have an opinion about the direction the market is going. What is this opinion based on? It came via a fortune cookie from last night's Chinese carryout. First it gave you next Saturday night's lottery numbers. Then, it told you that EBAY was going up eight points in the next month.

Wow! What a tip! However, you look at a chart of EBAY and see that it's trading near its...

Trading is a stressful business, none of us would deny this. This article looks at ways of reducing stress levels to ultimately make us more relaxed and profitable traders.

The Health & Safety Executive defines stress as "The adverse reaction people have to excessive pressure or other types of demand placed on them".

Trading is precisely the kind of profession that provides plenty of "the excessive pressure" that causes stress. And unless managed properly, stress can have an extremely negative effect on your ability to trade effectively.

Stress can make you excitable, anxious, jumpy and irritable - not exactly the ideal attributes conducive to profitable trading. Stress can interfere with your ability to formulate judgments and...

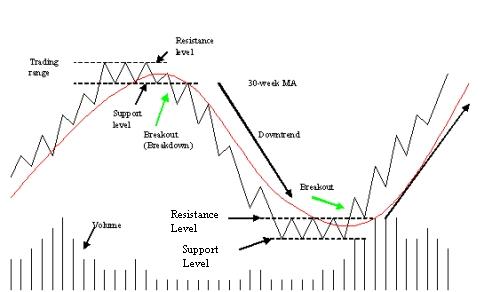

The author looks at ways of profiting from trends by using Moving Averages.

Identifying and profiting from trends can be at times divergent topics and this dissociation can easily translate to losing trades. While trend analysis, as defined by trend and channel lines, ratio and extension analysis is vital, traders should also go beyond pattern recognition and employ quantitative methods of analysis. One of the most popular tools is moving averages.

What Is a Moving Average?

A moving average smoothes market swings, as some traders prefer to keep the statistical noise at a low level. To calculate a simple average, simply determine the arithmetic mean. To make an average move, just add the last price of the period of you choice, while...

So you want to trade for a living? In this article Geoff Turnbull looks at what you need to consider before you take the plunge.

There can't be many traders who haven't at least considered the idea of telling the boss what they think of him, throwing it all in and going off to trade the stock market for a living. It's a big risk financially, and that uncertainty is what stops most from jumping ship. Is it really possible to trade for a living?

The Dream

You know how it is, you're sitting in a traffic jam at some unearthly hour of a particularly wet and miserable morning, on the way to the same office you have sat in for too long to remember, and you're thinking - there must be a better way - life shouldn't have to be like this. Your...

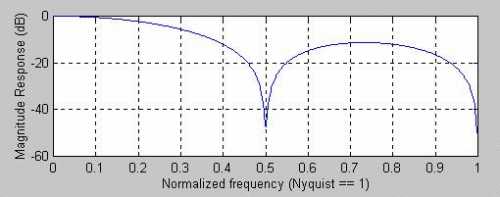

Simple Moving Averages are a subset of FIR Filters. Exponential Moving Averages are a subset of IIR filters. Traders are not necessarily limited to the selection of one or the other. This article describes how you can make hybrid filters and realized the best characteristics of both.

Many traders have come to me, asking me to make their indicators act just one day sooner. They are convinced that this is just the edge they need to make a zillion dollars. While their profit expectation may not be realized, it is true that lag is the downfall of many trading systems. If you want to shorten the lag of your indicators, or if you want to get more smoothing from your filters, the techniques in this article may be just what you have been...

In this article the author looks at the Seven 'Sins' of Trading and what action we can take to avoid them.

By studying at the most frequent reasons for failure, we can avoid making the same mistakes as the crowd, and thus turn these negative points into positives. In this article, I will be looking at the seven most common mistakes I see made by traders.

Mistake Number One - Switching Strategies

or "The Hunt For The Holy Grail"

The holy grail of trading - we've all looked for it - the super system that never loses. We've searched forums, read books, been to seminars, discussed in chatrooms, but the secret system that wins every time continues to elude us.

Why do we waste so much time and effort searching for something that doesn't...

The emerging market meltdown that occurred between May 12 and June 13, 2006, had an impact on currencies, the carry trade and incredible growth in derivatives over the last decade, as described in Part 1.

In summary, here are the issues we will be examining in part 2.

An index that has been uncannily accurate in providing advance warning of emerging market trouble and what it is saying now.

What the yield curve inversion for the third time in the last six months means. How accurate has it been in the past in warning of a pending slow down?

Based on the importance that real estate and related construction activities play in economies around the globe, what impact will a real estate correction have?

Real wage growth, a principal...

What sort of trader are you? A Trigger Happy Terry or a Fatalistic Fred. In this article the author looks how most traders fall into certain trading 'types'.

?Know thyself? exhorted the ancient Greeks. Pursue intelligent, disciplined self enquiry and you will come to understand the treasures of the self. This timeless Delphic dictate could, I believe, serve well as a focus for effort for those who today would profit from trading the financial markets. Know your own strengths and weaknesses, physically, mentally, emotionally and spiritually. Accept and understand them and learn how they relate to and feature in the market environment and you give yourself some valuable edges.

You gain clarity of purpose. You have the conviction to...

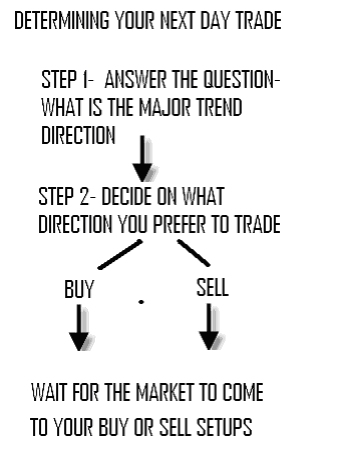

A look at the key features to be considered when day-trading forex.

Until recent years, the opportunity to put on a trade was governed by the cycle of day and night. But a unique characteristic of Forex trading is its round the clock sequence of trading. Starting Sunday when the sun rises in Asia, until Friday late afternoon, when the New York markets close, Forex trading is available. So the question arises, what is a Day trade in Forex, if technically Forex is a continuous week of trading? To answer that question we do not need to delve into the nature of human circadian biorhythms. One has to be arbitrary. We can effectively define a Forex day trade as a trade that is completed during the waking hours of a trader. A day trade might...

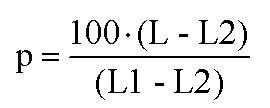

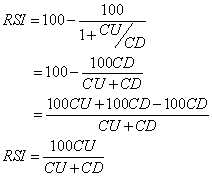

There is more to smoothing an RSI than just taking a moving average after the RSI is computed. By applying some advanced filters in the process of computing the RSI you can not only get better smoothing but also enhance the turning points of this proven indicator.

Smoothing indicators usually means making a tradeoff between the amount of smoothing you desire and the amount of lag you can stand. It turns out that the RSI can be smoothed and enhanced with minimum lag penalty. The thesis of this article is to show you how this is done.

Welles Wilder defined the RSI as

RS is shorthand for Relative Strength. That is, CU is the sum of the difference in closing prices over the observation period where that difference is positive...

It was once one of the darlings of the FTSE, but over the past year the telecommunications sector has had a rough ride. So is it out of woods yet, or is there worse to come?

Changes in the telecom sector since the turn of the century have made the telcos a markedly different investment proposition since the high flying days of the tech boom. At the height of the bubble incredibly optimistic industry growth projections propelled the share prices to record heights. Inevitably the bubble burst, and in the aftermath investors shunned the sector.

However, today company balance sheets are stronger, prospective earnings multiples are generally in the low to mid teens, and surplus cash is flowing back to shareholders via increased dividends...

As a new trader, you are probably impatient to get to the study of charts and evaluation of various trading strategies. Surely, winning involves predicting future market direction using sophisticated technical analysis to identify the best entry and exit points for our trades? So why delay discussion of all that stuff for a look at a bit of mundane statistics?

The reason is simple. If you regard the trading game as some kind of super intelligence test where you are pitching your skills against the rest of the world, you are unlikely to play the game with the right attitude and expectations. On the other hand, if you see trading as a numbers game, then you are more likely to approach it correctly.

So, if it is a numbers game (which it...

In this article we look at the current market correction with an eye on price and volume and observe how this has marked changes in market sentiment in the past.

The financial papers do not have a problem creating plausible stories that attempt to explain the recent market downturn. Although many fundamental factors have contributed to this recent blowout, as technicians, we take a completely different perspective. Besides looking for clues that might give us insight into the causes of this correction, we are looking for symptoms of a reliable recovery as well.

In the past 37 trading days, the cues (NASDAQ-100: QQQQ) went from an intraday trading high of $40 to a $36.62 close on 7/25/06. Most technicians will automatically inspect...

What effect does conflict and war have on the stockmarket? In this article we look at past wars/conflicts and examine what the future might be with the current conflict in the Middle East.

Maybe I should stop taking my two-week Nantucket trip each summer. Last year during our stay we were glued to the news over the London terrorist bombing, and this year it was Hezbollah's kidnapping of two Israeli soldiers, prompting the current fighting in the Middle East.

There's a thought on Wall Street that investors should be

"buying when the cannons sound and selling when the trumpets sound."

When thinking about this view I harkened back to mid-March of 2003, when on the eve of the current Iraq war, Schwab's Investment Strategy Council (which I...

A look at what is happening in the markets at the moment and if this is just a correction or the start of a longer term down-trend.

As I was about to write my alert, I happened to see the above quote and figured it was just too good not to put in the letter. In many ways, it explains the serious problems we are currently facing. Our illustrious leaders in the U.S. government (and I direct this squarely at both parties) have failed us in the biggest way. They have depreciated our currency; created incredible debt; run up mind boggling deficits; created a derivatives time bomb; got us into two wars that we can't possibly win (but they cost us dearly in money we can't afford to pay and precious lives); succeeded in making us the world's...

The rules that should be 'Utterley Simple Rules of Trading' but which we all seems to find 'Utterley Difficult!'

The world of investing/treading, even at the very highest levels, where we are supposed to believe that wisdom prevails and profits abound, is littered with the wreckage of wealth that has hit the various myriad rocks that exist just beneath the tranquil surface of the global economy. It matters not what level of supposed wisdom, or education, that the money managers or individuals in question have. We can make a list of wondrously large financial failures that have come to flounder upon these rocks for the very same reasons. Let us, for a bit, have a moment of collective silence for Long Term Capital Management; for...