You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Articles

Every successful trader learns to manage risk so they can avoid large losses like those that have crippled many Wall Street firms. In this article, we'll show how traders manage risk, identify the lessons we can learn from JPMorgan, and detail a way that technicians can duplicate the value at risk (VAR) metric that many large firms use to help add insight to their potential losses.

In what has become a fairly regular event and taking a past example from a few years ago, a Wall Street firm announced in May 2012 a multibillion-dollar trading loss. JPMorgan told analysts and investors in early May that year that a hedge trade they had made would lead to a loss of at least $2 billion. CEO Jamie Dimon said that the firm "screwed up" and a...

It is not a mystery that in the financial markets there are two distinct groups, those that make money a large portion of the time (banks and institutions) and, on the other side, those who don’t (the general trading and investing public). These folks tend to struggle to keep up with market returns at best; or end up washing out and losing all their money at worst.

On Wall Street, the cohort that makes money consistently is referred to as the smart money and the aforementioned latter group is referred to as, let’s just say, not so smart money. To be fair, the vast majority of retail traders and investors, through no fault of their own, just don’t know how financial markets really work. They’ve bought into what all the trading books...

One of the most enduring sayings on Wall Street is "Cut your losses short and let your winners run." Sage advice, but many investors still appear to do the opposite, selling stocks after a small gain only to watch them head higher, or holding a stock with a small loss, only to see it worsen.

No one will deliberately buy a stock they believe will go down in price and be worth less than what they paid for it. However, buying stocks that drop in value is inherent to investing. The objective, therefore, is not to avoid losses, but to minimize the losses. Realizing a capital loss before it gets out of hand separates successful investors from the rest. In this article, we'll help you stand out from the crowd and show you how to identify when...

Risk management is an essential but often overlooked prerequisite to successful active trading. After all, a trader who has generated substantial profits over his or her lifetime can lose it all in just one or two bad trades if proper risk management isn't employed. This article will discuss some simple strategies that can be used to protect your trading profits.

Planning Your Trades

As Chinese military general Sun Tzu's famously said: "Every battle is won before it is fought." The phrase implies that planning and strategy - not the battles - win wars. Similarly, successful traders commonly quote the phrase: "Plan the trade and trade the plan." Just like in war, planning ahead can often mean the difference between success and failure...

A common perception among the general retail investing and trading public is that in order to garner large profits, you must take on big risk. So where does this view come from? Who perpetuates it? And is it necessarily true that low risk trading isn’t possible?

Can Low Risk Trading Result in High Profit?

This view comes from the fact that most people perceive volatility and leverage as high risk. Therefore, if one engages in the markets during periods of high volatility using a leveraged product, the odds are very low (high risk,) but the profits can be huge if things work out. This is the common perception. In essence, the belief is that because most people are risk-averse they should settle for only mediocre returns as higher...

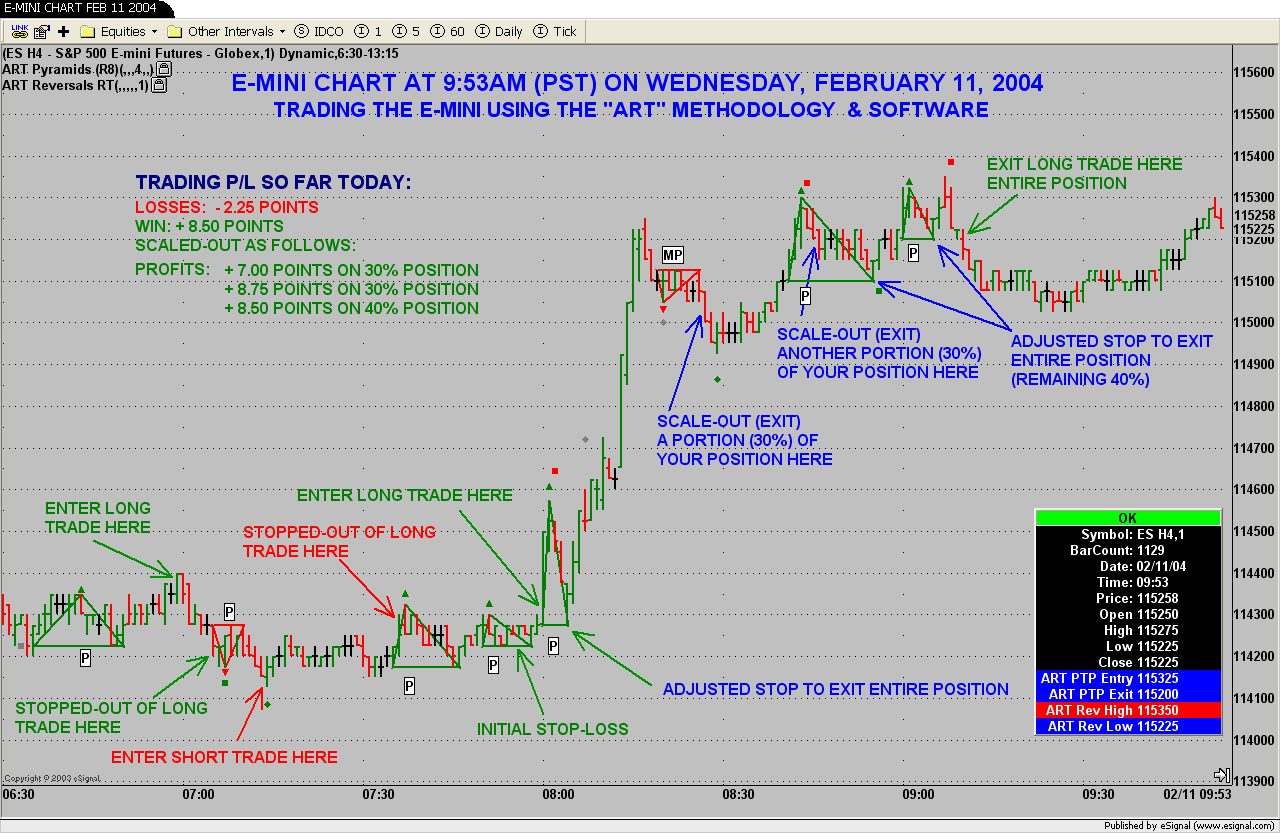

One of the key components of successful trading or investing, is the ability to trade around a CORE position. The “core” position as we say, is the main position of the investment or the primary amount of shares or contracts that you wish to have on during the majority of the time you are in a particular trade. Sadly, most people have no understanding of how to apply such a concept, and they plow into a trade or investment in just one single entry. Giving yourself one entry or at best two, has very limiting implications, but what is even more limiting is the idea of holding just 1 or 2 lots for the entire move.

It is true that a majority of market players approach the market in this fashion. They enter once or twice at best and they...

Most of us would prefer not to relive 2015 it is my guess. Equity markets weren't very friendly with treacherous volatility towards the end of the year. Moving sideways from about June on, markets sneaked slight gains but most investors felt the burn of "nothing to show" for the year. China fears of slowed global growth and the increasing stockpiles of crude oil put a lot of downward pressure on the growth in equity markets around the world.

The Federal Reserve finally gave us hope in a Federal Funds Rate increase of 0.25% in December. Monetary policy baffles me. Central banks are seemingly more influenced by "sunshine or doom and gloom" trading headwinds than actual economic data. When the smoke cleared, the NASDAQ was up 5.73%, the...

In almost all instances, the root cause of a financial crisis is an asset bubble. But how does this bubble form, what finally causes it to pop and how can investors profit before it goes bust?

In order for a market to attain the excessive valuations necessary to prompt a crisis, a prolonged period of price appreciation combined with a large number of new entrants to the market is usually necessary.

Crisis in the Making

The combination of price appreciation and an increase in new entrants to the market are defining characteristics of market bubbles. Investors should remember that many bubbles are based on attractive fundamentals, which explain why money flows into the market in the first place. However, at some point, so much money...

"To invest successfully over a lifetime does not require a stratospheric IQ, unusual business insights, or inside information. What's needed is a sound intellectual framework for making decisions and the ability to keep emotions from corroding that framework." Warren E. Buffett (Preface to "The Intelligent Investor" by Benjamin Graham)

Any veteran market player will tell you that it's vital to have a plan of attack. Formulating the plan is not particularly difficult, but sticking to it, especially when all other indicators seem to be against you, can be. This article will show why a plan is crucial, including what can happen without one, what to consider when formulating one as well as the investment vehicle options that best suit you...

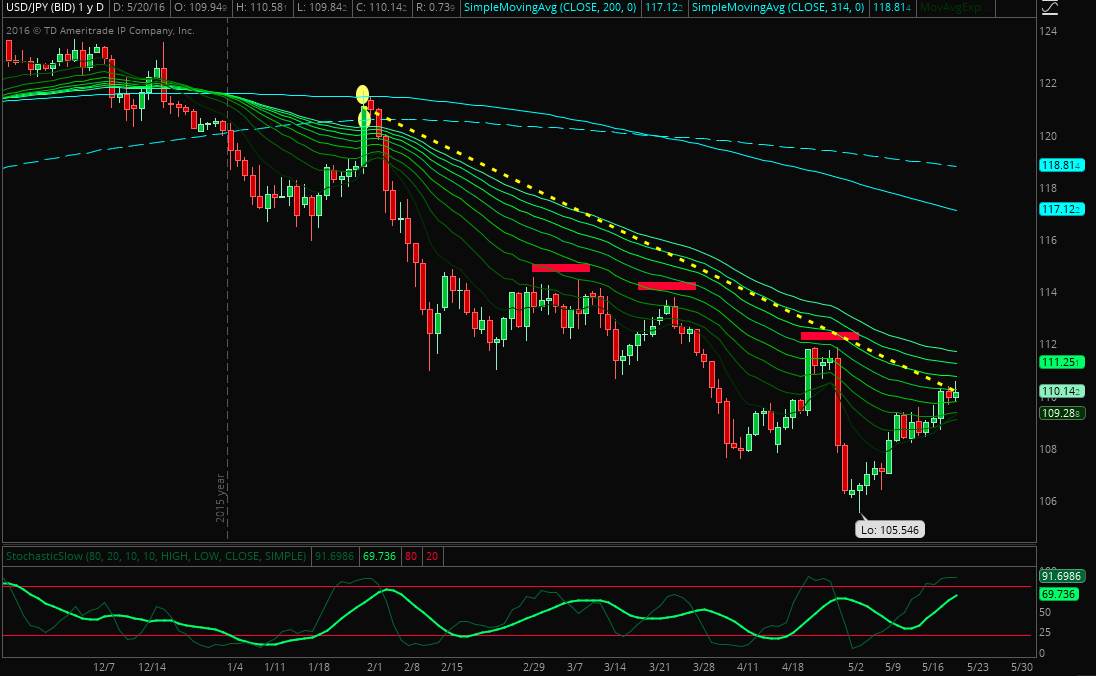

If anyone has forgotten how volatile financial markets can be, the beginning of 2016 has certainly served as a stark reminder. In turbulent times it is even more important than usual to have a robust risk management system, and one that can adapt to changing levels of volatility.

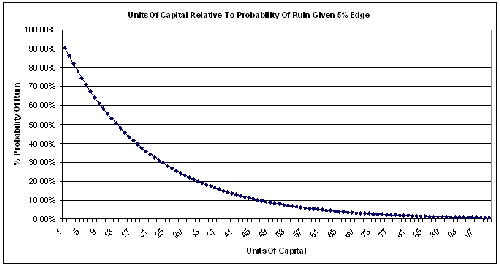

Most traders are aware that there will always be losers, no matter how accurate the trade selection methodology. But what some don’t consider is the probability of a devastating string of losses. Consider these statistics from hedge fund manager Larry Hite. Assuming 50% of your trades are winners, over a series of ten trades you can expect at some point to have three losers in a row; over a series of 100 trades the expected run of sequential losses rises to...

Shorting covered calls is a very popular option trading strategy that involves shorting a call option and taking a long position in underlying stock. On the upside, there is limited capped profit to the trader with limited and proportionate loss on the downside. Experienced traders apply this strategy with the right timing and careful selection of the expiry and moneyness of call options

The risks in selling covered calls

There's a common misconception that any option that is shorted, the potential for loss is unlimited. The same is thought of short covered calls, but this is not true. In fact, the maximum risk in a short covered call position is limited and can be managed efficiently - with the proper timing of the trade and selecting...

I hadn’t made any significant changes to my strategy for over ten years, but last year was different – I stopped using a stop-loss. Shock! Horror! Trading suicide? Or is there another way to control risk?

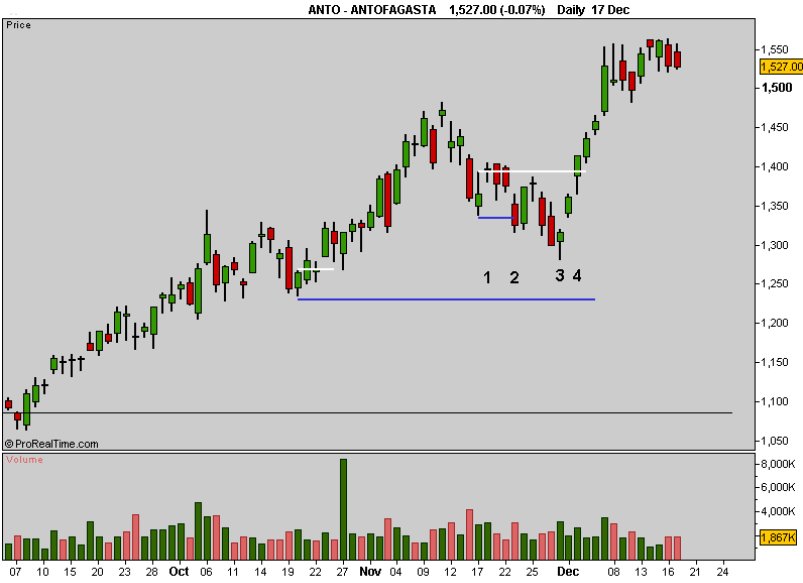

Let me explain. I trade potential trend continuation after retracement on UK equities mainly drawn from FTSE100. When the market is rising the equities that trigger will generally be in a good up trend, strong and outperforming the FTSE100 index. Conversely, when the market is falling they will generally be in a good down trend, weak and under performing the index.

I’ve always had problems with my stop-losses on two counts. Firstly, that all too familiar and frustrating experience of price taking out my stop and then shooting off in...

For this article I would like to illustrate three particular scenarios which deal with various aspects of risk management. In addition to the required and necessary skill-sets involved in consistent speculative trading, maintaining a constant and disciplined approach to capital preservation is ultimately the number one objective for any professional in the field. Failure to adhere to these risk management principles will typically result in ongoing frustration and concern for any individual aspiring to attain market success.

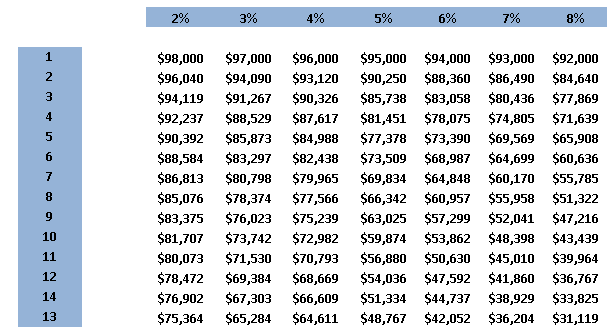

In the classroom learning environment, I always advise my students to maintain a risk parameter of between 1% and 2% of their account balance. Therefore, should they be working with let's say a $10,000 trading...

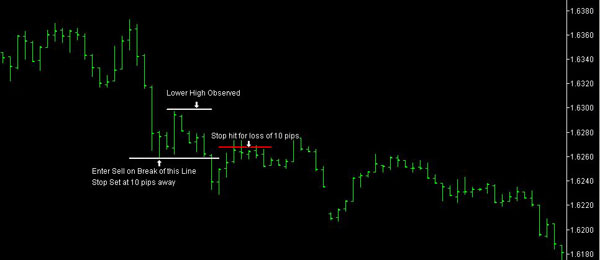

Many beginning and intermediate level traders may benefit from learning a new approach to risk management which I intend to discuss in this article. There are two types of trader that this may apply to and the first, (Trader A), is the one who enters a trade with a stop set at a fixed distance away from their entry and it is always the same distance regardless of the market or instrument being traded. Trader A places a stop entirely based on a fixed monetary risk and when the amount of money that they have set aside for the trade has departed their account they close the trade.

The second trader, (Trader B), places a stop that can vary in distance from their entry and is based on “Technical” reasons as to why the trade is no longer...

Introduction

In this article we'll take a look at two related practices that are widely used by traders called Backtesting and Data Mining. These are techniques that are powerful and valuable if we use them correctly, however traders often misuse them. Therefore, we'll also explore two common pitfalls of these techniques, known as the multiple hypothesis problem and overfitting and how to overcome these pitfalls.

Backtesting

Backtesting is just the process of using historical data to test the performance of some trading strategy. Backtesting generally starts with a strategy that we would like to test, for instance buying GBP/USD when it crosses above the 20-day moving average and selling when it crosses below that average. Now we could...

What Is The Risk Of Ruin?

Please excuse me if I start off a little technical in this article. There is nothing complicated about the risk of ruin concept but it does require a quick calculation.

Simply stated, the risk of ruin is the percentage probability that a trader's account balance will reach zero. This will either result in the trader ceasing to speculate on the financial markets, or having to stump up another chunk of capital in an attempt to make back the first tranche before making net profits.

Having a solid trading strategy which is applied with discipline is clearly crucial, however understanding your probability of success or failure given certain actions must be more so. By using the risk of ruin formula a trader can...

In this article we take a more detailed look at more advanced money and trade management strategies.

Introduction

The term “Trade Management” refers to methods and manipulations which can be followed before and after a trade has been made to ensure a protection from undesirable movements of the tradable and at the same time to guarantee that if the position finally proved to be right, the profit will compensate the risk taken. There are two concepts of trade management mentioned in the literature: the use of trailing stop and the reward-to-risk ratio (also known as Profit/Loss ratio) .

In respect to the trailing stop, in the case of a long position, the trader sets an initial stop loss level which is raised as long as the price of the...

Implementing sound money management encompasses many techniques and skills intertwined by the trader's judgment. All three of these ingredients must be in place before the trader is said to be using a money management program along with their trading. Failure to implement a good money management program will leave the trader subject to the deadly "risk-of-ruin" exposure leading eventually to a probable equity bust.

Whenever I hear of a trade making a huge killing in the market on a relatively small or average trading account, I know the trader was most likely not implementing sound money management. In cases such as this, the trader more than likely exposed themselves to obscene risk because of an abnormally high "Trade Size." In this...

I get more questions about stop losses than about any other subject. Clearly this strategy causes traders a lot of pain and confusion. Some of it stems from the schizoid nature of our modern markets. But most of it reflects an underlying weakness in trade management skills.

What takes place at the end of a trade usually reflects decisions made at the beginning. In other words, the best entries usually lead to the most profitable exits. This is the most urgent wisdom I can give when it comes to stop-loss placement.

We can spend hours deciding whether a stock is a good buy or a good sell, but this emphasis is often misplaced. Over time, carefully chosen exits are more important than great entries. You don't believe me? Just ask all...

We can spend hours searching for the perfect pattern but fail miserably when its time to turn opportunity into profit. As it turns out, most traders do a poor job managing positions, regardless of experience level.

I've received hundreds of questions about this subject over the years and have complied them into a Q&A to help you make the right choices during the trading day.

Q - What time-frame charts do you use in real-time?

A - I track daily, hourly, and 15-minute charts for all my setups and positions. I don't look any other time frames, except for an occasional glance at the weekly charts. This arrangement doesn't change with liquidity, sector or any other variable. I watch these charts simultaneously on three screens, so I don't...

In the first part of this article, which can be read here, we looked at choosing an instrument and timeframe to trade, as well as establishing the set-up and entry rules. In the second and final part we will consider how to establish exit rules as well as various filters and money management rules to maximise the profitability of the system.

6. Stop Loss Rules.

Our strategy already has a natural stop loss in the stop order that does not get filled. The objective of the strategy is to capitalise on those days where the high or low for the day is in place early (9.30-11.45am). If we enter a trade on a breakout of either the high or the low and then the market subsequently hits the other stop we know that our trade is invalid. We know...