You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Articles

Filters

Show only:

Loading…

Why do people trade? For most, their primary motivation is to make money. Sure, there are secondary reasons however they all stem from the undeniable urge to make money.

Ironically, this would have to be the main reason why people fail. With most of our trading decisions, it is only natural that we focus on making money because this is the main reason we consider trading in the first place.

Whilst I concede the idea of making money is important, it is not as important as protecting the money that you have to trade with. I think Paul Tudor Jones says it best when he said, "Don't focus on making money, focus on protecting what you have."

Stephen Waugh is a former Australian cricketer and was the captain of the Australian Test...

Introduction

The importance of well-placed stop orders to a FOREX trader cannot be over emphasized. The margin percentage required in a typical FOREX account is so small that a fully leveraged trader could easily lose a substantial amount of their net worth from a single position if it moves too far in the wrong direction. The name of the game is risk control and the key tool for protecting your account from substantial losses is the stop order.

That being said however, I do know some traders who claim never to place stops. Usually the rationale for this is that their trades are very short term (on the order of just a few minutes) and they are watching the market during the entire trade, finger twitching on the exit trigger ready to...

What is a TICK?

A TICK is the number of NYSE upticking stocks vs downticking stocks. If 1000 stocks are upticking and 600 stocks are downticking you will get a TICK reading of + 400.

The TICK is a useful market internal tool to gauge market sentiment, design trading strategies, to prevent one from chasing, etc...

Traders use the TICK in various ways: some choose to fade TICK extremes, others use it to confirm market direction, and others incorporate the TICK into their trading setups.

In this article, I want to go over some of the TICK strategies and methods I personally use in my trading.

TICK HOOK

Let's begin with a TICK hook. The difference between a candlestick TICK chart and a line on close TICK chart is the visual TICK hook. A...

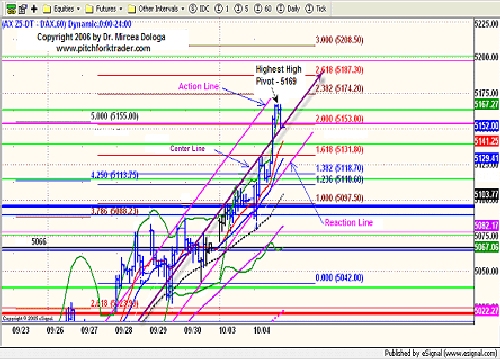

In this article we look at preparation, techniques and money management for using integrated pitchfork analysis.

Spotting the Trade Opportunity

The process of low-risk high-probability spotting trades is very systematized for the experienced trader. He/she should visually scan the various choices of the operational time frame charts: 60-min, 30-min, 15-min and less frequently the 5-min chart. Our goal is to detect candidates representing low-risk high-probability trades. Once these opportunities revealed, we will employ different techniques with all the recommended disciplined rigour and patience. One of these is the zoom-and-retest technique, which is applied to a German Dax up-sloping failure.

Finding the Optimal Set-Up

In this...

Over the years, traders have pointedly asked why they should spend so much money for Neuro-Linguistic (NLP) counseling to solve their trading problems. A fair number of these traders have gone through traditional therapy, taking months or years, of weekly and bi-weekly sessions that are relatively inexpensive per session. If these same traders have not achieved the results they wanted through such an extended therapy, how can I justify asking for a major financial commitment for two days of work? An excellent question, I will begin my answer by telling one of my favorite stories:

$1.00 for tapping

$999.00 for knowing where to tap

Psychological Changes Happen Instantly

Just as it is important to know where to tap to get machinery...

Charles H. Dow

It is interesting and amazing to note that not until Charles Dow started compiling the Dow Jones Industrial and Dow Jones Rail Index and started writing about the stock market a little over a hundred years ago, stock speculation was regarded merely as a game for the rich or as gambling for the brave. Sure, there were the tape readers, but the majority of the public regarded Wall Street as a source of excitement - the entertainment provided freely (unless you were on the wrong side) by figures such as Cornelius Vanderbilt, Jay Gould, and the infamous Daniel Drew.

In a series of stunning editorials for the Wall Street Journal at the turn of the century, Dow laid out the foundation of his own theory on the stock market...

I love to collect quotes as they concisely promote a philosophy which is readily understandable.

In my 25+ years of investing I have collected hundreds of quotes related to Wisdom, Wall Street and Success. I submit this small selection with the hopes that it will enlighten the forces required for your future financial success. Enjoy!

1) ?Money really isn't that important. Is a guy with fifty million dollars happier than a guy with forty eight million dollars?? - Milton Berle

2) ?With money in your pocket, you are wise and you are handsome and you sing well too.? -Yiddish Proverb

3) ?Money is always there, but the pockets change.? - Gertrude Stein

4) ?Spend at least as much time researching a stock as you would choosing a...

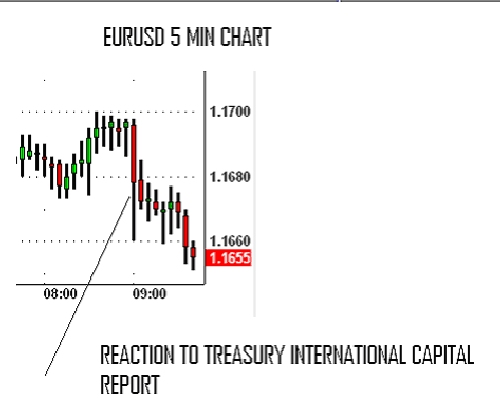

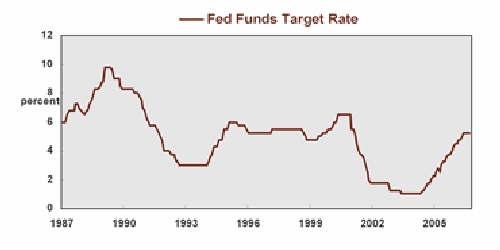

Shorting the Japanese Yen has been one of the best and easiest Forex trades over the past six months. Japan's anemic benchmark interest rate of 0.25% makes it an easy target for the "carry trade", allowing Yen bears to collect interest on their trades. Banks, hedge funds and other traders have shorted JPY vs. higher yielding currencies such as the Great Britain Pound, the New Zealand Dollar, the Australian Dollar, and the Euro to take advantage of this interest rate differential. This has ignited a downtrend in the Yen, which has been exacerbated as these institutional traders add to their short positions. Fears that the Bank of Japan would embark on a campaign of interest rate hikes, which would make the carry trade less viable, has...

A brief look at the different ways in which an FX trader can diversify within their account.

While there are an unlimited number of publications covering the advantages of portfolio diversification, few of them explore the possibilities of trading Forex along with typical stock, bond and real estate investments. It is even more rare to find theory on diversifying within a FX portfolio. Although fund managers are very aware of the importance of diversity, speculators often overlook its value. As we have all come to realize, you can't expect consistent success by being a conformist.

As all currency traders know, the Forex market is a great way to hedge the economic risk of a pool of investments. Studies have even suggested that the...

In this lesson Bo Yoder looks at the current forex markets and what happens when the trend ends and consolidation follows.

Click here to view the video (will appear in new window).

Risk management isn't just about having your 'stop-loss' in place. So what else is it about?

Any trader who knows his salt will tell you that Risk Management is the single most important aspect in trading, regardless of style or technical strategy. Yet, most traders are really not able to define what "Risk Management" really is. Let's pause for a moment, and think: can we define, in one brief sentence, what Risk Management is? "Loss control" would probably be the best broad definition, but to me this is a little more precise: In the business of trading the financial markets, Risk Management is the constant modulation of Risk Exposure to a constantly changing market. What is this exactly?

Most participants will relegate their entire...

Wise trade selection can be a key good trading. So how do you start to select those all important trades?

Your trading week can bear witness to the fulfillment of a lot of long range planning, and the big payoffs that such planning brings to those who are wise and patient-those who want the best of the best. Many times it really pays to be patiently waiting for a trade to burst forth and make some nice gains.

A number of the spreads we do are the result of patient waiting for the two sides to come into proper alignment. We plan these trades days or even weeks in advance.When a major entry signal such as the breakout of a Ross hook are being made, every effort within reason should be made to be aboard, even if only for a couple of...

You've probably seen it mentioned in various trading forums. It may have even happened to you a few times. It's enough to make your head explode. What is it? It's called Stop Hunting.

Here's a typical trading situation. You're convinced that the USD/JPY is heading up. You've entered a long position at 123.40 and you've set your stop at 123.05, slightly below an obvious double bottom. You set your initial target at 124.50, giving you more than a 3:1 ratio of reward to risk. Unfortunately, the trade begins to go against you and breaks down through the support. Your stop is hit and you're out of the trade. You're sure glad you had that stop in place! Who knows how far it could drop now that it's broken that support, right?

Wrong. Guess...

Stick With The Plan

This may seem like a common sense statement, but the reality of market timing is that the majority of timers "think" they can stick to a timing strategy, however when the market moves against them, as it always does as some point, they are swayed by financial news stories, the desire to be "with" the crowd, and their own emotions, often exiting the strategy at exactly the wrong time.

Think about it. Let's use a fictional market timer named Mark for this example.

Mark has a strategy he knows has, over many years, outperformed the stock market. Mark knows going in there will be times when the strategy will lose. He sees this in the historical trades. He accepts this or at least he thinks he does.

But then, the...

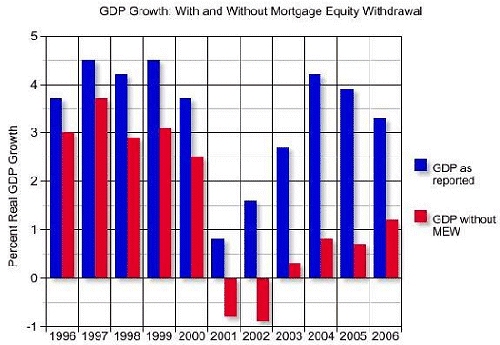

How has another year come and gone so quickly? It seems like someone hit the fast forward button. And once again, all too soon, it is time for me to demonstrate my masochistic nature and write a forecast issue. Rather than going into details on every topic, I will try and stick to the big picture and leave the fine points for later letters.

Each year as I do this forecast, I look for a theme. What will be the driving factor which will set the stage for the economy? In 2001 it was the coming recession; in 2002 it was a weak recovery and the beginning of the Muddle Through Economy; in 2003 it was Surprise and Transition. In 2004 it was the Silver Lining Economy; in 2005 it was the See-Saw Economy. Last year it was The Gripping Hand, as...

If "volume precedes price" as is often suggested then it should be possible to apply analytical techniques to certain volume attributes that will have some predictive capabilities with regard to future price development. Using various techniques that come under the general heading of money flow analysis it becomes feasible to decide whether a particular security is being accumulated or distributed. A security that is undergoing accumulation can be expected to gain in price and a security that is displaying the characteristics of distribution will probably offer opportunities on the short side. Equally, it can be very informative to see whether there are divergences between the security's price behaviour and its volume behaviour.

The...

Do you need to catch the initial move to trade a breakout, or are there other ways of trading it? In this article we look at an alternative method using Fibonacci retracements.

When markets move, particularly in Forex, they move fast. We all have witnessed breakouts and have had the occasion to lament a trade that got away. The beginning trader sees breakouts as a way of riding a strong wave of volatility and providing a quick profit. The problem with the strategy of playing a breakout is that breakouts are technically unstable. They present difficult questions to answer, such as: How long will it last? Especially when there is an absence of news, the question of what caused it is difficult to determine. The better way to trade a...

Our neurological system is comfortable with our habitual behavior patterns and will support us with that status quo. So if you are losing, winning or leveled out with consistent profits but not growing, you are very likely to stay in that situation unless you are willing to do what is necessary to stretch. Most people who want to increase their performance are willing to read a book or go to a seminar, but not willing to consistently follow through on what they have learned over the long haul. The question is, what does it take to stretch, and are you seriously willing to make that commitment? If you are not, then expect the same results. If you are, then get ready to take a ride on a trip to the next level of success where, in six...

Here we take a beginners look at what the Stock Market is and how it works.

Introduction

Apart from the glitz and panache of Hollywood or the iconic World of the pop star the stock market is probably seen as the most glamorous way of making a living (and a very healthy living at that!). Over recent times advances in technology have made the Stock Market far more accessible to the general public. This has made the possibility of becoming rich from stocks far more realistic than obtaining a record deal or a landing a role in a Hollywood production.

Unfortunately involvement in the Stock Market is not a one-way street. It is commonly acknowledged that losing a fortune in Stocks is much easier than gaining one. You will constantly see...

"We begin with a clean slate"

There is something refreshing about the first day of a New Year - for a brief period of time, it feels like a clean slate where we have the opportunity to begin anew and possibly right the wrongs of the year that just ended. Let's all hold that thought and see if we can "will" some good things for 2007. It would appear that the machine that runs our country can use all the help it can get.

As bad as the news was on occasion last year, the market put in a good showing. The following performance for the major indices is worth viewing:

The stock market did well in 2006. It was robust into the spring; had a sharp decline into the summer and then came on strong the rest of the year. The blue chips were the...

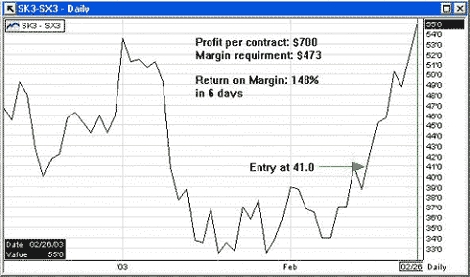

Ever wondered about Futures Spread Trading? In this article the author looks at the basics and the best way to trade them.

How professional traders optimize profits

Futures spread trading is probably the most profitable, yet safest way to trade futures. Almost every professional trader uses spreads to optimize his profits. Trading spreads offers many advantages which make it the perfect trading instrument, especially for beginners and traders with small accounts (less than $10,000).

The following example of a Soybean-Spread shows the advantages of futures spread trading:

Example: Long May Soybeans (SK3) and Short November Soybeans (SX3)

Four Advantages of Futures Spread Trading

Advantage 1: Easy to trade

Do you see how nicely this...

Today there are many scams involving forex and a great number of us will have seen emails or websites promising untold riches. So what are the main points to look for in spotting a scam?

In recent years, investors have witnessed increased number of investment opportunities and offerings. While the complexity and success of these investment products vary, technological innovation has made the Forex market one of the fastest growth areas. Many of the leading Forex brokers reported up to 500% rise in the number of new retail customers. However, the growth of the Forex market has been accompanied by a sharp rise in foreign currency trading scams.

Many of these Forex scams are promoted on the radio, television, newspapers and the Internet...

Introduction

The key to successful trading is having a methodical approach and not being emotional about your trading decisions. Never forget that it is always best to accept when you are wrong and cut your losses where appropriate.

Technical analysis, also referred to as "charting", involves the use of charts or graphs to present historical performance and price changes at a glance and the ability to use this information in order to make investment decisions.

The first golden rule of technical trading is, where possible, to keep charts as simple as possible.

Technical Analysis and Charting

Even those new to trading will be familiar with the image of a chart in relation to the financial markets. They appear on City Traders? screens...

In this article the author explains the basics about Neural Networks and looks at the myths that have formed around them.

In this age of previously unheard of technological progress many technology-related things either come unnoticed as they appear or, vice versa, are vastly extolled and turned into totems that inevitably attract a following of ardent worshippers. If such a popular technology-related phenomenon can make a difference to your business, it is, sometimes, vital to learn about this phenomenon as much as possible before you start with it so that you know what to expect from the selected technology and what to beware of while using it. For a modern trader, one of such potentially important phenomena is neural nets.

So what...

Pivot points can be a useful tool when trading the forex enabling the trader to see where the price is in relation to the previous market movements.

It is useful to have a map and be able to see where the price is relative to previous market action. This way we can see how is the sentiment of traders and investors at any given moment, it also gives us a general idea of where the market is heading during the day. This information can help us decide which way to trade.

Pivot points, a technique developed by floor traders, help us see where the price is relative to previous market action.

As a definition, a pivot point is a turning point or condition. The same applies to the Forex market, the pivot point is a level in which the...

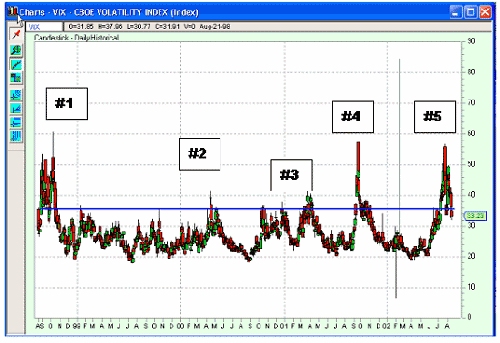

The author looks at the Vix indicator and its use in predicting the market turn of 2002.

In the last 2 weeks, I have seen the "VIX" on both CNBC and Bloomberg TV talked about as if it was something new. Well, for all you OTA Grads, you know we have been using it for years. For the rest, let's review and see how this "new" indicator can help us.

Let's look back at the turn in the markets in 2002.

The VIX is provided by the Chicago Board of Options Exchange (CBOE) and, basically, measures the volatility in the options markets, which of course, are directly related to the underlying security in the stock market. VIX (generally, you can see this with the VIX symbol, but your platform may require a prefix or suffix such as $vix, /vix...

A detailed step by step guide of how to trade a falling wedge has been illustrated in a free video, to view it please click on the following link

http://www.4x4u.net/review/51/51.html

Key aspects of a falling wedge are summarised as follows;

A Wedge formation is similar to a triangle in appearance in that they have converging trendlines. A falling wedge is generally a bullish chart pattern that begins wide at the top and contracts as the prices move lower. This pattern has a series of lower highs and lower lows.

The following chart on EURGBP (Nov2006) illustrates a good example of a falling wedge, and this was covered live at one of my live Webinar enabling traders to pull the trigger, thus far it has been a very good profitable...

Does your ego get in the way of your trading? After a couple of wins do you think you can't fail and go on to lose all your days gains? Here we look at ego and how to control it when trading.

Imagine a stage populated by the main characters that comprise your inner "trading decision making committee". It's a short odds bet that the loudest shout for leading man / woman will come from the ego. Brushing aside rationality and requests for inclusion alike, the ego will pronounce his / her pre-eminence and sieze control.

Trading is a magnet for ego. It is full of promise and challenge and all egos relish a good scrap,especially when the odds are stacked against them and they have a sniff of heroism in the sweetened air. Statistics that...

In one of those "it was all I could do not to actually pinch myself" moments, I had the great pleasure of interviewing former Fed Chairman Alan Greenspan last week in front of a "small" audience of 3,000. The event was IMPACT, Schwab Institutional's annual conference, and Greenspan was the opening keynote speaker. He prefers a Q&A format over a speech, and I jumped at the chance to have a "conversation" with him last Monday morning. Some of the most interesting aspects to the conversation were not on stage, but behind the "curtain" in the green room.

Green room redirect

In the green room, after initial pleasantries with Greenspan and our own Chuck Schwab, the first question asked was by Greenspan to me: "Please don't tell me you're...