You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Articles

Filters

Show only:

Loading…

It's the first week of the month in Extended Learning Track (XLT) class. This is always a good week because new traders get exposed to the lessons that will shape their trading strategy for years to come. While they don't know it yet, I know that what they learn in week one is the key ingredient for their success. Using price action alone, we cover exactly how to quantify demand (support) and supply (resistance), the "odds enhancers" that give us our objective probability score on each trading opportunity, and a set of rules for entry and exit during week one. The information we cover is applicable in any time frame which allows us to keep things very simple and rule-based.

I really don't use any indicators or oscillators myself and...

Every year at New Year we hear of people making resolutions of all varieties. Have you ever noticed that these resolutions are usually made without any serious thought or planning involved? This is the difference between a resolution and setting goals.

Goal setting is:

A focused plan based on proven methods to achieve desired results

A predetermined set of rules and regulations

We often hear about having a trading and or business plan to succeed in trading. Then comes the education needed to be successful. Before long we are at the screens trading for a living. Day in and day out we follow all our rules and can actually see our account size growing. We are enjoying our trading career for all that it has to offer. Then, one day you...

As a trader, one of the key things that I try to consciously do is to cultivate my instincts by talking with other traders and investors as often as possible. It still amazes me how large the divergence of opinion that exists regarding what people believe will unfold as we enter the new millennium. Many very respected names are literally predicting an economic earthquake that will measure a 10 on the Richter scale while others having looked at the exact same research claim that the consequences will be very mild. As a trader I have to evaluate the data and develop a strategy that I feel not only gives me an edge but allows for a great deal of error while still being low risk!

In his book, "Business Without Economists" author William J...

It is time to revisit an ever important topic. I have been in the trading and trading education world for many years. This has allowed me to watch traders grow at different levels and reach different levels of success and failure. I have often wondered and speculated on the difference between those who achieve success and those who fail. For me, the answer lies in the proper definition of success when it comes to trading, or any occupation for that matter.

Let me explain a scenario that I have experienced hundreds of times with individuals going through trading education. There was a gentleman back in 1999 whom I met at a trading seminar. He walked up to me before it started and introduced himself. He had been reading my daily trading...

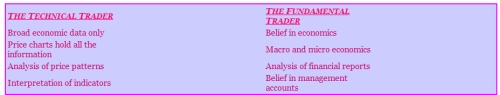

Part of the learning process is for you to understand the different types of traders. In essence there are two, and these are a fundamental trader or a technical trader. For you to succeed as an online trader you must understand the differences. Both have very different views in the techniques they use to assess market conditions and the direction an instrument may take.

Whilst there is some overlap, these are two very distinct methodologies, and you need to be comfortable with one or the other. You will come across this terminology all the time. Whilst there are huge differences in the approach, it is safe to say that most large financial institutions now employ both methods as both have their strengths and weaknesses. Fundamental...

I was driving in my car the other night with my twin daughters when the conversation somehow turned to what they wanted to do when they grow up.

Naturally, being only nine years old, they had many ideas. There were those that I was very happy with - an astronomer, a veterinarian, a professional soccer player, or a guitarist in a rock band. And there were some suggestions that I just didn't like at all. Not that it's my decision! I'll naturally support them in whichever path they chose for their life; however let's just say a nine year old should not know what a Forensic Scientist does.

I asked if either were interested in trading, to which Caitlin replied, "But isn't trading just guessing?"

That was unexpected! I was a little taken...

Ever wonder what makes a winning trader consistent? In my opinion that consistency is due to the trader having his own "edge" over other traders. This "edge" is what each trader must find for himself. Often traders focus on their results so much that they forget that every other trader in the world is doing the same thing: Trying to profit from price action alone. Trading this way can make you money, but what if you had an added edge to your strategy? In Commodity Futures, we have something called Open Interest that just may provide that advantage.

What is This Open Interest?

Open Interest is the total number of outstanding contracts that are held by market participants at the end of the day.

Contracts that are held overnight have...

At the core of any significant economic, political, scientific, social, medical, psychological or cultural theory lies a quest to understand and quantify the forces of change, action, or energy. The theories that attempt to quantify "force" that have stood the test of time, date back centuries and are extremely simple. In 1686, noted physicist Isaac Newton suggested in his laws of motion that an object will remain in motion until it is met with an equal or greater force. Noted economist Adam Smith suggested hundreds of years ago that when supply exceeds demand at a price level in a given market, price will decline. Smith and Newton didn't create or invent the laws and principles for which they are famous. Supply, demand, motion, and the...

The following situation happens quite often to many traders. Look it over and see if it has been happening to you:

You have been faithfully following your trading plan and the rules you've set for trading. By following them you are now in a trade that doesn't look so good. At the same time, by following your trading plan, you see that you've missed a beautiful move in a different market, one that could have made you a lot of money.

You are in a bad trade and you've missed out on a great trade. You become disgruntled. You think to yourself that your trading plan must not be so great. You think there must be a better methodology that you should use that will prevent this from happening. You think to yourself, "Yes! That's it, I'll...

This week I would like to discuss Spread Trading in Commodities. I will write future articles on this topic as it would be near impossible to cover all aspects of this method of trading in one article. This article will be an introductory lesson on Spread Trading in Commodities.

Welcome to Spread Trading

Spread - The purchase of one Futures contract against the sale of another Futures contract of the same or related Commodity.

Spread Trading has been referred to as "Hedge Trading". Remember that Hedging is the method Commercial traders use to help reduce price risk volatility. They may own the physical Commodity and short a Futures contract against it or they may need the Commodity at a later date and buy the Futures contract until...

From birth, we are conditioned to trade incorrectly. We naturally run from things we are fearful of and are drawn to things that make us feel good. If you take this action in trading, you are headed for trouble which in the trading world means losses. For example, if your invitation to buy into a market comes only after an uptrend is well underway, all the indicators are pointed up, and the news is good on that market, where do you think price is in that market? Yep, it's likely very high. To buy here completely goes against how you make money buying and selling anything and is very high risk. Never forget, when you buy, many people have to buy after you and at higher prices or there is no chance you will profit in your trade. To obtain...

While traders constantly search for new and improved methods on their quest for the "holy grail" trading system, they often overlook the most significant element that dictates their success. This inherent element is pacing. Proper pacing means you flow with the market. When the market is running fast out of the gate, so should you. When the market slows to a crawl, so should you.

In a nutshell, have you ever made nice profits in the first hour of the trading day only to give it all back gradually throughout the day? Uh huh.

Before I delve too far into this, let's first start off understanding why pacing is overlooked. Traders tend to believe that a method should be working in all market conditions at all times. When the method doesn't...

Three losses in a row are tough. That's about the most consecutive losses that novice traders are psychologically prepared to accept before they feel compelled to take action and 'correct' the situation.

If you're anything but a total newbie, I'm sure you'll recognize the symptoms:

Frustration - Why me? I've worked so hard. Everyone else in the forum appears to be getting good results with this strategy? Nothing ever works out for me.

Anger - That strategy developer is a liar and a crook. My broker is running my stops. Someone should be held accountable for this.

Doubt - What if the strategy doesn't work? What if I can't trade? How am I going to support my family?

Fear - I can't lose more money, what will everyone say about me when...

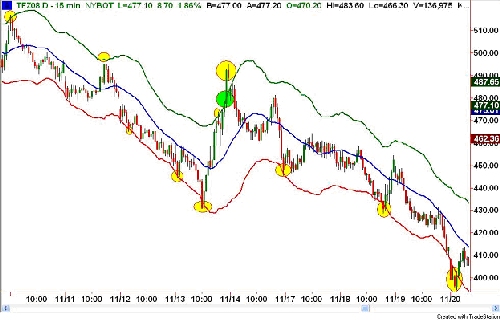

Markets quite often exhibit tendencies that, for the astute trader, may translate into profits. One such tendency is what I refer to as the "rubber band effect." Markets tend to overshoot, similar to a rubber band that's stretched to its extreme and snapped back to its normal tension; so, too, do the markets. In mathematics, it's known as reversion to the mean. This theory is based on a phenomenon stating that when the price of any market deviates substantially away from its medium price, the odds are enhanced that it will revert or move back towards the average. This pattern is repeated quite often in the markets and is extremely worthwhile in identifying, as it may uncover some very attractive risk/reward opportunities.

The...

Being the trader/trainer in the Extended Learning Track (XLT) Futures and Forex classes, I get this question all the time. Due to the ongoing evolution of these two markets, the answer is not as simple as you may think. In this piece, I will discuss what these markets are, identify the advantages and disadvantages of each of these two markets, and discuss how we deal with these markets in the XLT.

To begin with, both of these markets are where global currency values (exchange rates) are determined. These are fantastic markets as they are always moving and the moves and trends are larger than you will find in any other set of markets. The "spot" market is the cash market which means the current value (exchange rate) of where the...

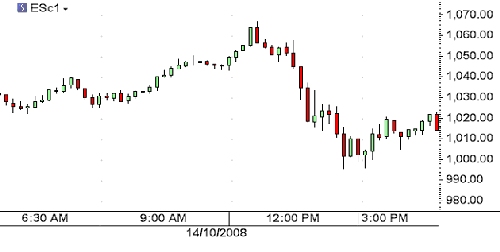

I'd like to walk you through a trade that was placed in October, using a technique that might seem a little unusual - the use of intra-market relationships and correlations to create trading opportunities in the Forex market. Sound complicated? It's really not, so please sit back and enjoy as we explore the use of the stock market as a leading indicator to trade Forex.

On Monday, October 13, 2008, the Dow Jones Industrial Average skyrocketed to its biggest point gain ever, a whopping 936 point move. The 11.1% gain was the biggest in percentage terms since 1933, and the fifth largest percentage gain in the history of the index. Similar moves were also seen on the S&P 500 and the NASDAQ, as the markets celebrated the end of capitalism as...

In a previous article I mentioned that my analysis involves monitoring price action, in order to gain an insight into the short term sentiment of the market. Determining who is in control at that time - the bulls or the bears. And assessing how they're likely to respond to changes in the market.

I thought today I'd prepare a quick article to give an overview of how I analyze price. Those of you who know me know that I'm a great fan of candlestick charting. However, price analysis is much more than just watching for your favorite candlestick patterns. Too many people just teach the candlestick patterns, which are fine, but in my opinion there's some essential analysis missing that an astute trade needs to consider BEFORE they look at...

One of the most frustrating aspects of trading commodities is getting comfortable with how each contract is quoted, what the point value or multiplier of each contract is and most importantly how to calculate the profit, loss and risk of a trade. Each commodity futures contract is standardized but in comparison to those with differing underlying assets they are often worlds apart. This can be extremely overwhelming for a new trader; I hope that the following explanations shorten your learning curve and give you the information that you need to begin your journey in the challenging yet lucrative trading arena known as options and futures.

Unfortunately, until recently there hadn't been much in the way of uniformity in commodities. With...

There are an unlimited number of ways to skin a cat and trading is no different. Despite your strategy, risk tolerance or trading capital, having a plan is one of the most important components of achieving success in these treacherous markets. However, perhaps the most important characteristic of a profitable trader is the ability to adapt to ever-changing market conditions. Knowing this, it seems logical to assume that a trading plan should be established but just as rules are meant to be broken, trading plans should be flexible to accommodate altering environments and new events.

The premise of a trading plan is similar in nature to a business plan. It is a relatively detailed outline of the structure of the trade and the...

Recently, I wrote an article about trading and gambling. Specifically, how trading is the one form of speculation on the planet that allows you to stack the odds in your favor before putting any of your hard earned money at risk. That discussion was fine but now I want to look at how we qualify the difference between some higher probability opportunities and lower ones as knowing the difference is a key to success.

In the Extended Learning Track (XLT) - Futures Trading and Forex Trading programs, a market situation we are often faced with is a gap. We use a simple checklist based on objective information to determine exactly what action to take (or not to take). The checklist helps us determine the probabilities, risk, and reward. Here...

If we consider that the two key variables to achieving trading profitability are having a trading strategy with edge and a positive expectancy combined with the ability to consistently execute that strategy, then assuming a trader has the first one (and developing this is a primary concern) then it is the consistency of execution that becomes the key focus.

Trading Success Formula

Trading Strategy With Edge + Ability To Be Able To Execute It Consistently

/Positive Expectancy

In my work with traders I have seen many traders who do not have the first ingredient in place and this is the primary cause of their lack of trading success and also the emotional challenges that they have experienced. Of the traders...

Did you know that there is a whole 'other world' of technical analysis that most novice traders are either totally ignorant of, or fear to go due to the fact that it might actually require some work?

Well, there is! And I'd suggest that if most novices fear to go there, then perhaps it might be worth some investigation.

What is technical analysis? For most novice traders it seems to be one of, or a combination of, the two following approaches:

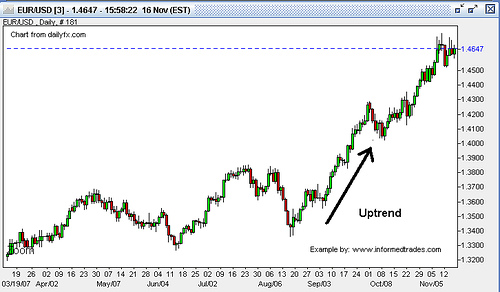

The art of defining recent price action through classical charting techniques such as the Dow Theory definitions of an uptrend and downtrend, and recognition of patterns such as channels, triangles, head and shoulders, cup and handles, and on and on, or

The art of representing price action...

Before Putting Your Money on the Line - You Should Know the Basics

If you are like most people, you work hard for your money and the last thing you want to do is see it evaporate in your trading account. Throughout my journey in the markets, I have yet to find a fool proof way to guarantee profitable trading, but what I am certain of is that you owe it to yourself to fully understand the products and markets that you intend to trade before risking a single dollar. What you will learn from this article is merely a stepping stone but without fully understanding the basics you may never lay the foundation necessary to become a successful trader.

When most people think of commodities they imagine fields of grain or bars of gold...

Advances in technology have been the driving force behind the change and growth in the world of market speculation. One of the many recipients of faster and stronger technology is system trading as high speed computers now help retail and institutional traders develop systems, crunch numbers, and back test hypothetical results in seconds. In the world of professional money management, I have seen plenty of trading systems. Ironically, most don't seem to work and of the ones that do, they typically work for a bit and then fail. Being on the education side of the industry as well, I have seen hundreds of automated systems yet, I can only say that I have seen less than a hand full actually produce a consistent profit year after year. I...

Most consider the father of technical analysis (the science of forecasting market movements based on price patterns) to be Charles Dow, the founder of Dow Jones and Company which publishes the Wall Street Journal. Around 1900 he wrote a series of papers which looked at the way prices of the Dow Jones Industrial Average and the Dow Jones Transportation Index moved. After analyzing the Indexes he outlined his belief that markets tend to move in similar ways over time. These papers, which were expanded on by other traders in the years that followed, became known as "Dow Theory".

Although Dow Theory was written over 100 years ago most of its points are still relevant today. Dow focused on stock indexes in his writings, but the basic...

Despite all the hype from the internet marketers who try to sell you the latest trading 'secrets', the fact is there are NO secrets.

Identify setups which provide the potential for lower risk and/or higher probability trades.

Enter and manage those trades in a consistent and disciplined manner.

Minimize risk.

Manage your money.

Manage your emotions.

Journal your results, and review them to identify what's working and what's not working.

Keep doing what is working, and

Improve what is not working.

If you're not trading successfully, it's because you're not doing one (or perhaps all) of these things.

There are no secrets!

So, it's time to stop searching for this holy-grail solution and get down to some good old-fashioned work...

One fascinating realization I have come across during my years as a private trading coach and instructor is how different female and male traders can approach, analyze and trade the markets. Without offering outrageous generalizations, it has been my experience that women possess a particularly logical mindset that can give them a substantial advantage in market speculating. Simply, the trading method I developed and use quantifies the supply/demand and human behavior relationship that ultimately determines price in any market. It is based on a very objective and mechanical set of criteria. In other words, the goal is to learn the method and then simply follow the rules. The female mind has a much easier time doing this than the male...

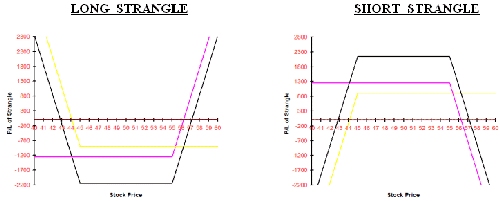

This week we'll learn about the Straddle's first cousin, the Strangle. Let's start off with a definition.

Definition: A long (short) Strangle is the purchase (sale) of an out of the money (OTM) Put and an OTM Call on the same underlying stock with the same time to expiration. There's also a similar strategy, called a Guts, where both of the options are ITM.

With XYZ stock trading at $50, an example of a long Strangle would be the purchase of the XYZ July 45 Put and the July 55 Call. If the Call is trading for $1.25, the Put for $.90 and we bought 10 Strangles, the total cost (excluding commissions) would be $2,150. Of course, if we sold the Strangles, we would receive a credit for that same amount coming into our account. Like the...

You should ignore analysts on TV, the radio, the newspaper and all other TALKING HEADS when it comes to investing!

What stocks do they talk about? - The same old group, every day of every year - Why? Because they don't know any better, they are sheep like the general public, repeating what every economic textbook says and every other economist tells them to say. Everyday, the same companies are highlighted on the evening news -

Why?

They aren't going anywhere. Some of the stocks that make the headlines every night were leaders of the market 20 years ago. New cycles bring new leaders; this has been proven year in and year out. So many of these TALKING HEADS shout out about "buy and hold" but what are they really holding? They hold old...