You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Articles

Filters

Show only:

Loading…

My wife and I are Olympic junkies. There are only a couple of television shows that we will watch together during the week. But when the Olympics are on, there is a lot of family TV time.

Having played hockey in my youth, I was of course glued to the TV for the men's USA vs. Canada gold medal hockey game.

The game was as spectacular as we all hoped it would be; clean checking, great play-making, fast action. What more could you ask for? Well, I suppose I could have asked for the US to score in overtime to win the game. But Canada did seem to out-play the US just a bit, so I was not terribly surprised at the outcome. Nor was I terribly surprised at the look of despondency on the US players? faces as they received their silver medals...

Many traders do not use volume in their market analysis and trading. They rely on price bar patterns and technical indicators. Price alone can be misleading and technical indicators frequently signal miss-fires. Understanding the interaction of price and volume can help put the trader on the right side of the market regardless of the trading method used. Here is a recent example of how the S&P e-mini market unfolded. Reading the interaction of price and volume led to both intraday and swing trades.

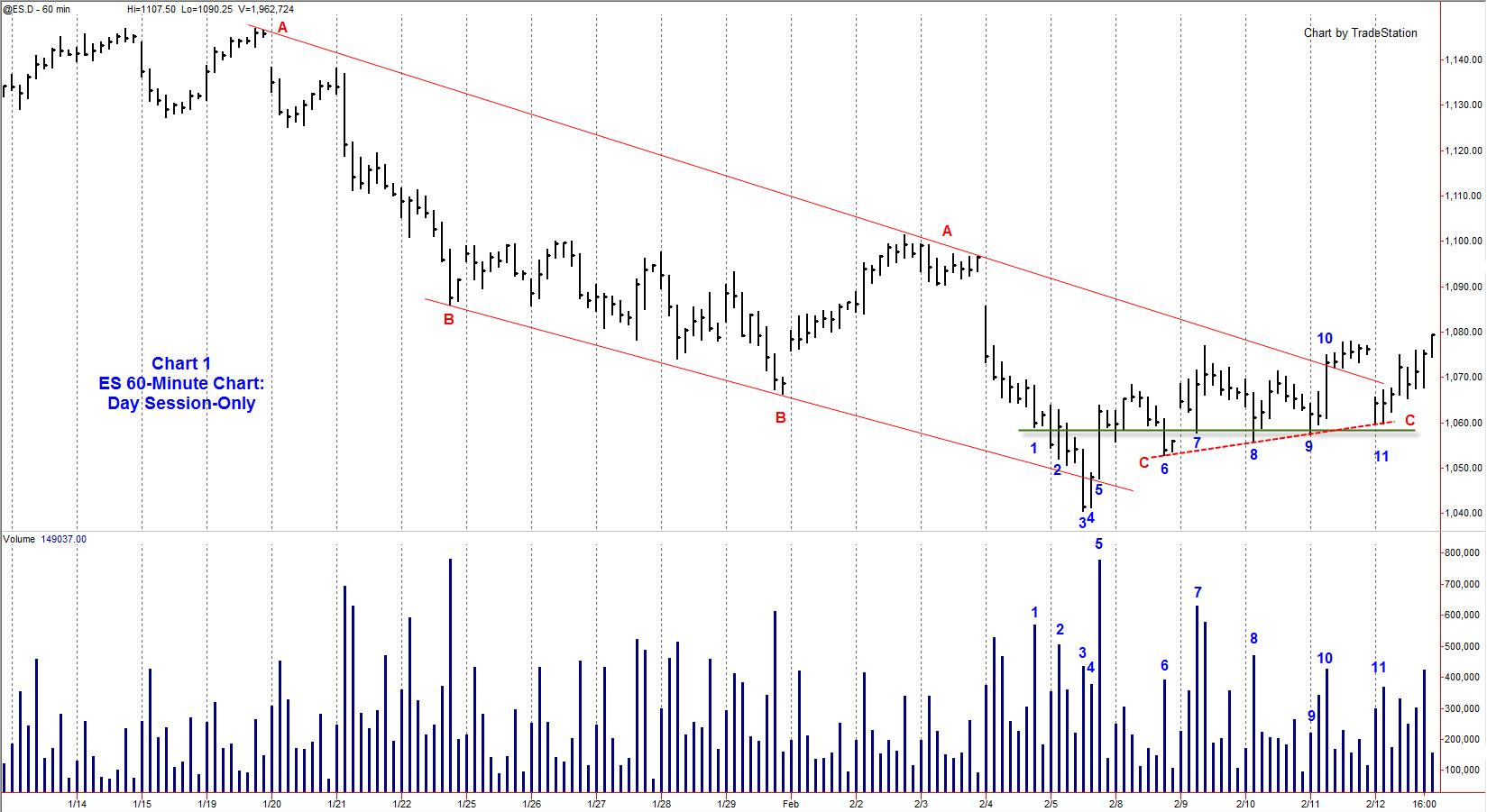

Background: 60-Minute Chart

The S&P e-mini market had reacted into early February from its highs in January 2010. The reaction was well-defined on the hourly chart (Chart 1) by the trend lines AA and BB, which together formed a channel. Line...

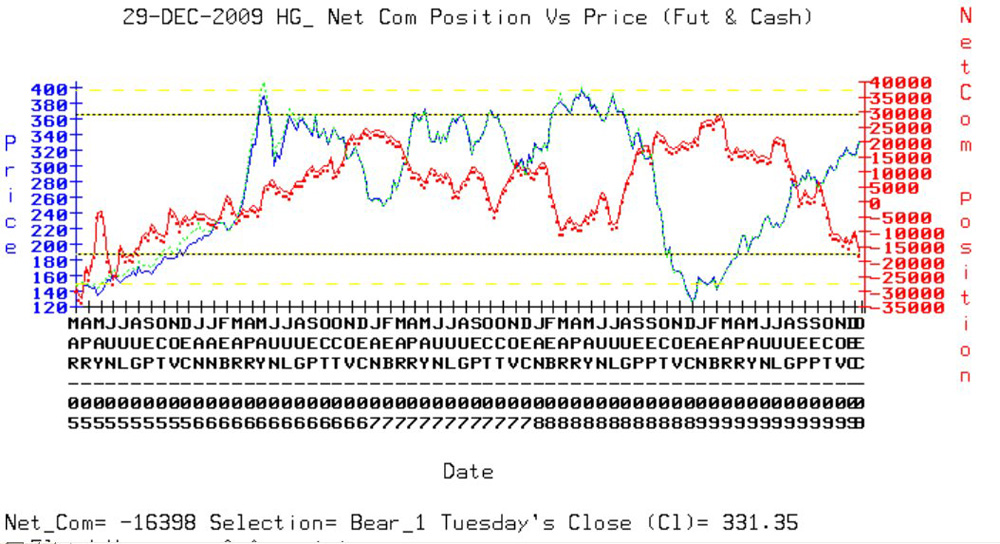

The Disaggregated COT Report

The first Commitments of Traders ("COT") report was published back in 1962 and antecedents of the report can be traced all the way back to 1924. Since its inception, the COT report has gone through numerous changes and improvements over the years. The Commodity Futures Trading Commission ("CFTC"), an independent US agency created by congress in 1974 to regulate the US commodity futures and options markets, is responsible for maintaining the COT report and publishes the data on its website (www.cftc.gov). The CFTC also provides several decades of historical COT data on their website.

The COT report provides a breakdown of the buying and selling that takes place in the futures markets each week. By...

PM: = Paul Mullen (Interviewer)

RJ: = Richard Joyson (Mr Charts)

PM: What markets do you trade and what do you do?

RJ: I trade almost entirely U.S. shares on a day trading basis. I'm in trades for really anything from half a minute to as long as two or three hours. So, there isn't an average length of time that I'm in a trade. I'm in a trade as long as it's going my way, and if I get a signal to exit the trade, I take the signal. If the signal comes a minute after I enter, then I exit. If a signal doesn't come for another two hours, then that's when I exit.

Basically, I trade the U.K. afternoon, (which is the U.S. morning). Occasionally, I trade in the evening, but generally not. I used to trade the evening and the evening only...

Aside from charting tools and market research, there are two important but often overlooked decisions for a trader to make; choosing a brokerage firm and a specific broker. Each of these decisions are capable in having a profound impact in your overall trading results and you owe it to yourself to take the time to make an educated judgment.

Choosing a brokerage firm

Deciding on a brokerage firm is a significant decision and shouldn't be taken lightly. Before committing to a firm it is imperative that you research their services, experience, trading platforms and commission structure but more importantly whether your trading style and personality will be compatible. For example, a beginning trader shouldn't look to a deep discount...

The Australian Open Tennis Championship is now over and there is a lot we as traders can learn about trading psychology from the men's final between Roger Federer and Andy Murray.

Federer, arguably the best player to ever have swung a tennis racquet, beat Andy Murray, the British hopeful, in three straight sets. Federer has won more grand slam titles (sixteen in total) than any other male player in the history of the sport. Despite this incredible record, Andy Murray has played Federer better than any other player on the tour. In fact, Murray has won more matches against Federer than he has lost (6-5). So, what might have contributed to this loss and what lesson can we, as traders, learn?

A Lack of Drive?

It certainly wasn't a lack...

PM: = Paul Mullen (Interviewer)

BT: = Ben Tippen (US Stock Scalp Trader)

PM: What is a stock scalp trader and what you do?

BT: A stock scalp trader is someone who takes small moves out of the market but with bigger size.

PM: Okay, and when you say small moves in the market with bigger size, what kind of size move are you talking about?

BT: One to three cents.

PM: What kind of size would be involved in that?

BT: That obviously varies, depending on the skill of the scalper, but I would say once you get into a situation to where you make a living out of it, I would say 10,000 shares and then once you've become a bigger player you'd be up to 50,000 to 100,000 shares.

PM: What you said there is a 10,000 share move would be something...

In the 1970s, I grew up with the Bradys. Bobby, Cindy, Marsha, Jan, Greg, Peter, they were all my friends. Not only did we all spend 30 minutes together every day, but I'm more than a little embarrassed to admit that we shared quite a bit of the same fashions.

It's not difficult for me to recall an entire Brady Bunch story line after just a few seconds into a rerun. And I have to admit, I still get hooked whenever I see the Brady kids perform their songs with those unmistakable dance moves.

In my top 10 favorites is the episode where Peter Brady's voice begins to crackle under the pressures of teenage adolescence. Because of this, the Brady children wrestle with dropping Peter from their upcoming singing performance. The family is in...

Time and time again, I have said that all humans were never designed to become consistently profitable traders. There are many reasons why the majority of individuals fail to make regular profits from Forex trading, but in the end, it all stems from the simple fact that most people are completely unaware of the difference between perception and reality.

Ever since people began to speculate in the money markets, there has been this common belief that only the top guys in Wall Street have the experience and knowledge to do it successfully. The average Joe has always been advised to stay well away from making their own trading and investing decisions and instead hand over their hard-earned cash to the experts in the institutions to make...

If you were to ask most retail day-traders what is the most important factor for them when trading, there would probably be many different answers given. For me the most important and overriding consideration is the ability to close an open trade. For most people this does not go beyond setting a stop loss whether fixed or trailing.

However, there are many possible scenarios that could result in large losses being incurred if not catered for and in this article I will be discussing a number of these and how to overcome them.

Issue 1 - Loss of Power

A sudden loss of electrical power could cause a much bigger problem than you thought possible. If you are trading using a desktop computer and the power fails you could be in an open trade...

Each year as we prepared for these holidays, we planned for all those we had bought gifts for and careful thought was put into each person's gift:

* We planned where we will shop for the gift

* Our trips to the stores were planned to eliminate too much back-tracking

* Consideration for the type of wrapping paper and bows was given

* After all this, we then had to plan on how we would get the gifts to the people and still allow for the time to get it done

Wow, seems like a lot of work? Believe it or not, most traders will plan this type of event out on paper so that there will be no mistakes. Come that special holiday morning, they will be sitting back and enjoying the holiday because everything on the checklist was done just like...

Back when John Belushi and Dan Aykroyd were regulars on Saturday Night Live (SNL), a younger and wilder Steve Martin frequently joined that outrageous cast during guest-appearances. A relatively new face in comedy, Steve Martin fitted in perfectly. I remember some absolutely hilarious SNL moments from those days.

One particular skit that Steve Martin did stands out in my mind. It was called, "How to be a millionaire and not pay taxes." Standing all alone on stage wearing his trademark white suit and black tie, Steve Martin looked into the camera and carried on like a cheesy investment guru trying to rustle up clients with a ploy that went something like this:

"Yes, you too can be a millionaire and not pay taxes. How, you ask...

Many traders seem to know that a trading journal can be important to their success, but when asked why this is so, they draw a blank. Many traders do not understand how a trading journal can be a vital tool for self-development. This may be one of the reasons why many traders don't bother with one. Failure to keep a trading journal, however, is a disservice to the trader and may be an important factor in why traders continue to struggle with trading.

The Compounding Effect of Keeping a Daily Trading Journal

The trading journal is one of the best ways to improve your trading every day. If you were able to improve just a little each day, can you imagine how skilled you would be after, say, 90 days? What about a year? The effects...

I have previously discussed the fractal nature of markets and specifically the fact that there are always smaller tendencies contained within the larger more dominating trends. Also the old Wall Street maxim "buy low, sell dear," adding that though this concept is seemingly easy to understand, the reality of putting it into practice is a bit more challenging.

In this article, I'm going to elaborate on the notion of buying when prices are moving lower, and selling, or shorting, when prices are heading higher, all within the context of a trend. This concept is sometimes hard for new traders to understand, as it seems to run contradictory to trading in the direction of the line of least resistance.

I often get a bewildered look from...

PM: = Paul Mullen

CK: = Christopher Koozekanani

PM: Welcome Chris and thank you for giving your time today. Can I start by asking how long have you been in the industry, and how did you get started?

CK: I guess even since a young child, I have always been very interested in current affairs, what's going on in the world economies, and that sort of thing. That's always been in my mind. My initial career path after high school was I went to Embry-Riddle Aeronautical University, got a degree in aeronautical science, and then immediately went into the army. In the army, I flew AH-1S Cobra attack helicopters and was also involved in a maintenance officer type of capacity, so I was flying and I was helping to coordinate and get maintenance...

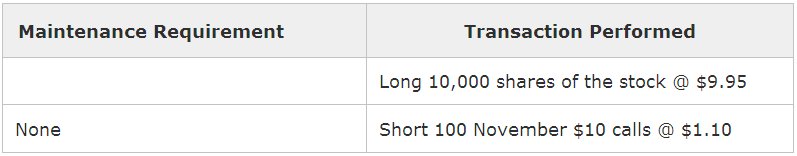

Part 1

At the end of one my classes at Irvine, an option trader stopped by for some small trading chit-chat. By the look in his eyes, I could tell that he had a large position that was eating away at his sleep as well as his finances. Without disclosing the trader's identity, I would like to describe the situation in which the trader had found himself. He owned 10,000 shares of an unnamed pharmaceutical underlying which, at the time of his entry was trading at $9.95 ($9.95 times 10,000 equals $99,500 in a single trade). Knowing as much as he did about options, he had chosen to sell credit calls on the shares that he owned. As a reminder, each contract controls 100 shares, so if a trader has 10,000 shares (divided by 100) he could sell...

The danger signal has been on my Alerts since August 6th and some people have asked for me to explain why since the market has been going up since that time. First of all, my objective in writing these is not to be a short term trading service, it is to provide you with a big picture look of where we are in the overall cycle and what that is likely to imply. That is why I frequently refer to "the sequence of events in the cycle". Let's go over that for a moment. If I was talking about seasons and began advising my readers to prepare for a hot summer, everyone would wonder whether I had lost my mind because we are in November and the proper comments would have to do with winter, not summer. Everyone knows "the sequence of events" in the...

PM: = Paul Mullen (Interviewer)

AR: = Alan Rich (Stock Trader, Coach & Mentor)

You can listen or download this interview by clicking this link:

Alan Rich Interview mp3

PM: Hello to everyone from Trade2Win, this is Paul Mullen. I've today got Alan Rich with me and we're going to be talking about trading, probably NASDAQ stocks more than anything else. Alan is a coach and a mentor and has been trading a long time. He has his own website and you can contact him there, at www.alanrichtrading.com. We'll be talking today about what's going on. A warm welcome to Alan. I'm glad that you've agreed to do this and I'd just probably like to ask you the first question, and that is why is it you trade NASDAQ stocks?

AR: I think I've been trading...

A Christian Traders' Dilemma

I recently heard a story about a Texas hold'em poker player trying to reconcile the apparent contradiction between his Christian faith, which opposes gambling, and his desire to be a professional card player. With a bit of humility, he explained, When I sit down at that table, Jesus tells me, 'Son, you're on your own'.

As a Christian, my role as a steward of God's resources gives me pause about gambling. And as a trading coach, I continue to receive phone calls and emails from suffering traders who equate their trading with gambling. They ask me, Bill, do you think it's because God is against trading that I'm continually losing money? Does the Bible forbid trading?

Generally speaking, gambling is the...

A month ago we reviewed gold and our conclusion was that the fifth attack on the $1,000/oz level in two years was highly likely to lead to a decisive upside breakout. We looked and saw that a suspected massive short position in gold was likely to lead to an explosive rally, as shorts were forced to cover. We analyzed the weekly chart (below) as well as a daily chart to come up with our target of $1,300 - $1,500/oz.

Keep in mind that targets can be dangerous if we hold to them with an iron fist. The key fact is that gold is in uptrend. A target is merely a device to help formulate a trading plan in the direction of that trend.

Last month we recommended trading gold futures and stocks from the long side and offered several tactical...

Three Trading Psychology Tips to Better Handle Losses

Recently, I was asked by a trader if there was a medication available to help to keep the trader's mood up after a loss. This trader takes losses hard; he was looking for a way to not feel so bad when the inevitable losses occurred.

This is not the first time I've been asked this. As both a psychologist and a trader, I hear it more than others might. Often, the trader says it as a joke, Hey, if only there was a pill ". Yeah, if only there was a pill. I know that behind the supposed levity there is a serious request there, How can I feel good in the face of a loss" or, maybe more to the point, how can I not feel so terrible when I lose money in trading?

Medication is not a...

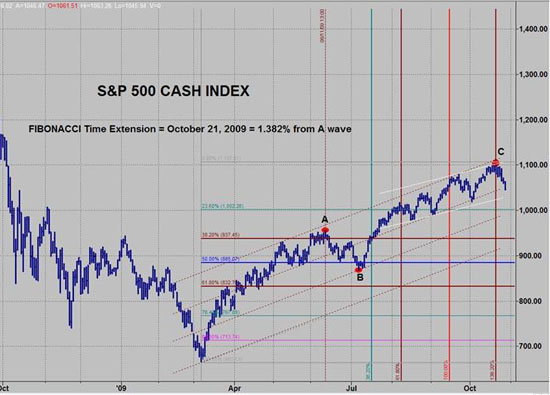

I began putting the DANGER signal on my Special Alerts to "alert" everyone to Danger (duh). I know this stage of the market well as I have seen it time and time again in many different markets. As I said over and over, "the job of this rally is to draw in as many players as possible" (and then give them a thorough drubbing for being so foolish). There were two "turning points" to potential tops (August 7 and mid September). Both were tops, but only temporarily (very temporarily).

MARKET TOP - (The title of this article), I can't get much more "up front" than that it means that everything I was looking for to produce a market top had occurred and that anything beyond that would send me back to the drawing board. I now think the odds are...

PM: = Paul Mullen (Interviewer)

JF: = John Forman (Forex Analyst)

You can listen or download this interview by clicking this link:

Forex Analyst Interview mp3

PM: Hello to everyone, from Trade2Win. Today I have John Forman with me, who is a professional Forex analyst. John is also an author, and has written a book called The Essentials of Trading, and if you wish to contact John, then details of how you can do this will be available at the end of our discussion. So, a very warm welcome to you John, and the first question I would like to ask you is what is a Forex analyst and what do they do?

JF: Well, in my case, I work for a division of Thomson Reuters, which is a name probably most people know, on one level or another. It's...

One of the most regular and largely misunderstood phenomena of trading, particularly for newer traders, is the gap. What precisely is a gap? What causes one to happen? And most importantly, how should one trade a gap when it occurs?

In this article, I'll answer these questions, and delve into identifying higher probability assessments for trading gaps.

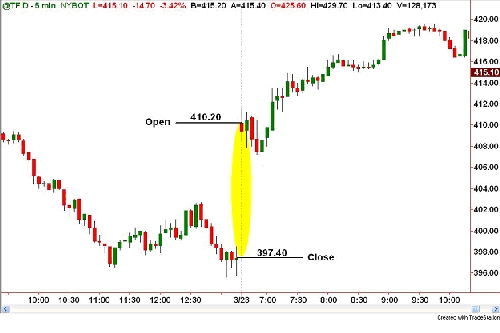

First, a gap is the discrepancy between one day's opening price and the prior day's closing price. The chart below clearly illustrates a large gap in the E-mini Russell 2000 (TF) which occurred on Monday, March 23. Note that the Russell closed at 397.40 on Friday the 20th, and opened at a price of 410.20 the following Monday, forming a 12.80 point up gap.

By any standard, this would...

P: = Paul Mullen (Interviewer)

J: = James (Equities Analyst)

You can listen or download this interview by clicking this link:

Equity Analyst Interview

P: Hello, and welcome to everyone. My name is Paul Mullen. I'm also known as Trader333 and I'm the Content Development Editor for Trade2Win.

Today, I'm interviewing James, who is an equities analyst working in London, so a very warm welcome to you James. We'll start straightaway by asking you what is an equities analyst, assuming that is what you are?

J: Yes, that is what I am. It's quite a complicated role because I think the way it's perceived is people see the end product being written reports, generally, with recommendations and price targets, and so on. That's actually a very...

Many beginning and intermediate level traders may benefit from learning a new approach to risk management which I intend to discuss in this article. There are two types of trader that this may apply to and the first, (Trader A), is the one who enters a trade with a stop set at a fixed distance away from their entry and it is always the same distance regardless of the market or instrument being traded. Trader A places a stop entirely based on a fixed monetary risk and when the amount of money that they have set aside for the trade has departed their account they close the trade.

The second trader, (Trader B), places a stop that can vary in distance from their entry and is based on “Technical” reasons as to why the trade is no longer...

Veteran member of T2W and site moderator, Mark Williams talked about the past, present and future of his trading career in this exclusive T2W interview.

Starting Out

How long have you been trading for?

Holding shares for 9 years, but only trading seriously for the last 5 years.

How did you first get involved in trading?

My parents were offered Norwich Union shares when they floated, and I brought £150 worth.

Do you remember your first trades?

Yes. I still have nightmares about them now! The strategy was to buy anything that was a takeover target. Very risky.

What were your first few months like? Were you profitable initially?

Mixed results. The profitable trades were more by luck than judgment.

Has your trading style changed...

For many of you, your trading and investing career is just beginning, and for others like me, it has been going on for a long time. My career began during the greatest bull market of all time, from 1990 - 2001. That market taught me a very important lesson that I want to share with you. It will help you understand trending markets, range bound markets, and above all, help you to control your emotions.

If you have been watching the stock market at all since late 2007, you have seen a period of high prices followed by a severe sell-off during 2008 and 2009. Hopefully, you did not buy or hold any stocks during this time, but if you did, you should have learned a valuable lesson. This lesson is no different than the first time you touched...

Through my years of trading, one thing I have found is that one strategy does not fit all. We all have different risk tolerances and monetary goals. One of my goals in each E-mini Futures class I teach is to show the students a strategy and have them take it home and use it as a foundational starting point for defining their own strategy. My style is to follow the trend and enter on pullbacks. You could call this style Intraday Swing trading. This works for me because it fits my personality, patience and discipline. I understand that trading is a business dealing in probabilities and that it takes a series of trades to make a trader, not just one or two trades. However, with that said, not everybody trades like me. Of course, that is a...