You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Articles

Filters

Show only:

Loading…

Are your beliefs creating a barrier to your trading success?

Prior to Rodger Banister breaking the four minute mile barrier in 1954 it was a widely held belief that no human could possibly run a mile in under four minutes. The month following his feat, no less than 30 runners broke the four minute mile barrier.

What happened? Did these 30 runners suddenly develop better leg muscles or bigger lung capacities? Clearly not, what happened was far more powerful, it was the birth of a belief. Suddenly at the point of Roger Banister breaking that barrier he created beliefs within other runners that they could do the same.

We can liken his feat to when a market reaches a support or resistance level and is unable to break through that...

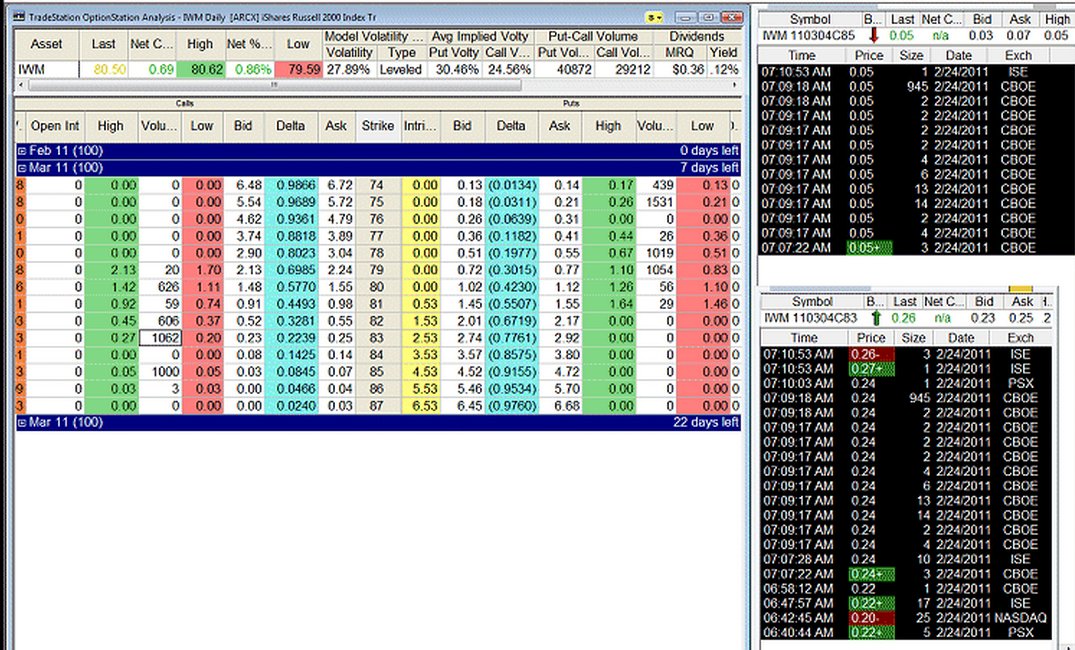

Often, tape reading is viewed as something that held value back in the 1990s, yet I would argue that there is still value in it today, especially when it comes to options. This article will walk the readers through the process of discovering a possible trade using tape reading and then follow its evolution chronologically.

Day One: Weekly Options are Listed

Every Thursday morning weekly options are listed on a small number of ETFs (Exchange Traded Funds). On Thursday, 2/24/2011, I was considering placing a trade on the IWM (Russell 2000 tracking ETF). Figure 1 shows three TradeStation windows, the most colorful one being the Options Analysis window. The columns that one needs to focus on are Open Interest, in white, and the Volume for...

Apply Deep Practice and Elevate Your Trading

Many traders may believe that the reason success eludes them is due to their natural talents. They may think that their level of intelligence is not quite adequate, or their personality makeup, perceptual ability, temperament or other inborn traits are somehow lacking. But the reality is such characteristics have little to do with how successful a trader you can become. Although certain inherited characteristics may be helpful and others may pose challenges, our innate qualities in and of themselves do not determine how good we become at trading or any other performance activity. Take sport for example. Although body size in sport becomes relevant, this is the only natural...

There are many similarities between speculating in the financial markets and playing poker. Most participants in either or both endeavors would agree that both are equally challenging of one's discipline and mental acuity. In addition, understanding statistical probabilities as well as knowing who your opponent is when entering the field of battle are essential for victory in the two.

I've often heard professional poker players comment on how they love to spot "soft" or "weak" tables as a source of income. This means that the more inexperienced players there are at the table, the easier it will be for the seasoned pro to take their money. It's really no different in the trading world. Finding the consistent loser or novice trader is...

Consistent low risk profits from trading and investing is a challenge many millions of people take on, yet only a select few are ever able to attain. The objective and mechanical rules for consistent low risk profits are very simple, yet the layers of illusion keep most from ever seeing what is real in trading and investing.

The two main forms of analysis in trading and investing are technical and fundamental analysis, and they are very real. However, thinking that mastering these two forms of "conventional" analysis will lead to consistent low risk trading and investing profits is an illusion second to none. The more an individual attempts to master these types of analysis, the more they may be layering complex, subjective illusions...

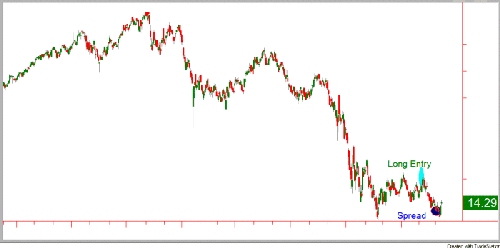

Over-trading is one of the biggest mistakes you can make in financial markets. Having a great idea and acting upon it before the time is right can lead to losses, even if the idea behind the trade is truly fantastic.

Take EURUSD. Ever since the European Central Bank’s January meeting ECB President Trichet has been labelled hawkish. Anyone who watches the interest rate markets would have seen the spread between German (proxy for Eurozone) and US government bond yields start to widen in Europe’s favour. Eventually, this spread equated to EURUSD reaching 1.4000.

This sounds like a good trade since FX markets are sensitive to interest rates, but as of the start of February this level has been elusive. For those traders who put the...

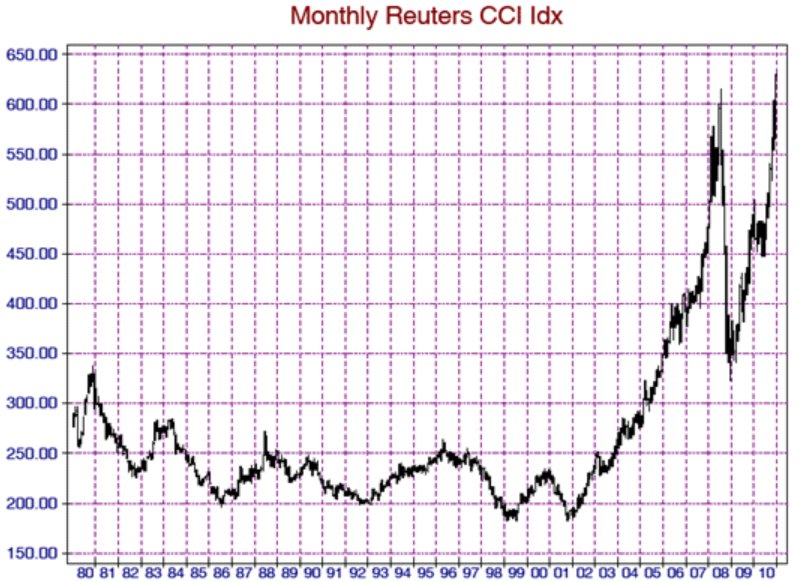

As we start the New Year, we look back on 2010 and find that Commodities outpaced any other asset class with a 15% return based on a basket of Commodities. Compare this to Stocks 13%, Bonds 5%, and Dollar-based trades of 2%. Why is this? For starters, we are in a secular bull market for Commodities that started in approximately 2004. Commodity markets typically trend for 16 – 18 years during these cycles. We are in the infant stages of this bull market.

Commodity markets are true supply and demand markets. Some sectors are:

Energy

Metals

Grains

Food

Livestock

Think of these sectors and how every day of our lives we come into contact with the majority of them. Compare this to a product a company makes like an iPod. Do we really...

Despite their knowledge of trading, the vast majority of traders experience fear on a level that compromises their capacity to trade effectively. This problem eventually comes to a boiling point somewhere in the evolution of a trader. At this turning point they either leave trading, continue to suffer losses, or begin to take a closer look at themselves. They recognize that the Holy Grail is not “out there” in their system or methodology. The trouble lies within them. And the culprit is fear. The solution also lies within them.

So much energy is then focused on mastering fear in trading (rightfully so) that another question is never raised. What then? The battle has never “been out there” in the markets. When you learn how to manage...

In my nearly 20 years in this industry, and almost five years of teaching, I have come to the not-so-startling conclusion that there are two types of traders in the world - those that make money and those that don't. I call these two groups the 90 percenters (the money losers) and the 10 percenters (the money makers). While these statistics on trading success are open to debate, they make it easier to demonstrate some common mistakes that unsuccessful traders habitually do.

A very common mistake that the 90 percenters do is change their reason for being in the trade. In every class I teach, this question/example is always asked, and without doubt, most of the students laugh and admit to making this very basic mistake.

When determining...

The Chinese capital market has experienced dramatic development over the past twenty years. We can read the stories in the candlestick charts of every rise and fall. By recalling past market performance, we are able to understand the theme that ran through the history of the A-shares.

A turn of peaks and dips

According to the large cycles that comprise both the bull and bear markets that the A-share market has experienced over the past twenty years, we can divide the history of Chinese A-share market into three stages.

The first stage was from 1990 to 1999, during which time the A-shares experienced the swapping of bull and bear markets four times. The Shanghai Composite Index started at 100 points, making 1,000 points its average...

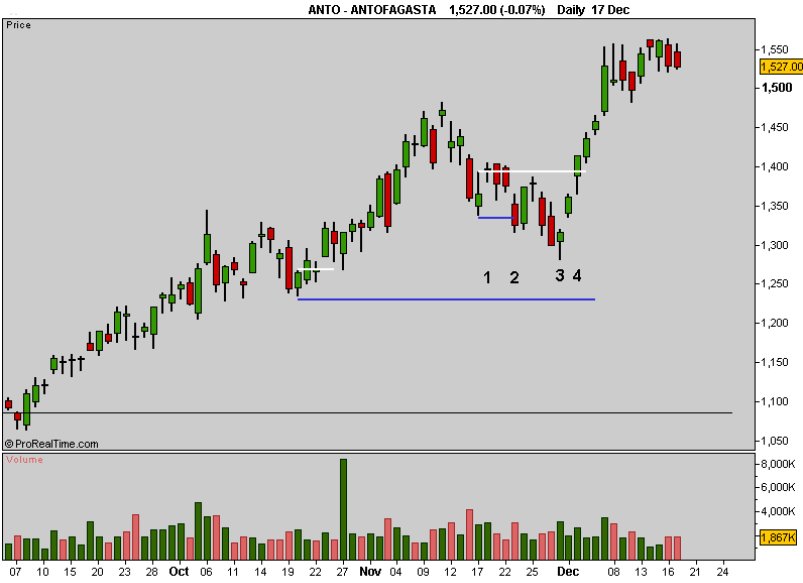

I hadn’t made any significant changes to my strategy for over ten years, but last year was different – I stopped using a stop-loss. Shock! Horror! Trading suicide? Or is there another way to control risk?

Let me explain. I trade potential trend continuation after retracement on UK equities mainly drawn from FTSE100. When the market is rising the equities that trigger will generally be in a good up trend, strong and outperforming the FTSE100 index. Conversely, when the market is falling they will generally be in a good down trend, weak and under performing the index.

I’ve always had problems with my stop-losses on two counts. Firstly, that all too familiar and frustrating experience of price taking out my stop and then shooting off in...

Information is integral for trading and markets wouldn’t run without it, but sometimes keeping on top of the constant flow of news, economic data, numbers and central bank speakers can seem overwhelming. Trying to read every piece of investment research can have a detrimental effect on traders as they get caught up in knots attempting to digest the many opposing viewpoints and trade ideas that permeate the market.

The most successful traders are not necessarily the most well-read; instead they can think clearly, formulate rational trading strategies and remain disciplined. One such trader was Nicolas Darvas. He made $2 million in 2 years trading the stock market during the bull market in the 1950’s. He wasn’t a fund manager or...

For this article I would like to illustrate three particular scenarios which deal with various aspects of risk management. In addition to the required and necessary skill-sets involved in consistent speculative trading, maintaining a constant and disciplined approach to capital preservation is ultimately the number one objective for any professional in the field. Failure to adhere to these risk management principles will typically result in ongoing frustration and concern for any individual aspiring to attain market success.

In the classroom learning environment, I always advise my students to maintain a risk parameter of between 1% and 2% of their account balance. Therefore, should they be working with let's say a $10,000 trading...

9:30 AM New York Time. The US equity market just opened. Orders start flying through the time and sales window. The first candlestick is forming on the 5 minute chart. You are sitting there, anxious to place a trade, with your finger on the trigger ready to grab that $50,000 position.

In the background, CNBC is on and it just so happens that they are talking about the stock you want to trade. They just mentioned an analyst upgrade, which you think explains the large green candle that just closed. You have your news source open on one of your other monitors, and you glance over to see positive news coming out from the company in pre-market. You notice that the stock is soaring higher, up about 1.5% already today.

As if this wasn't...

Many of us are already using support/resistance levels to locate possible turning points in the markets. We can identify these by looking at multiple time frame charts. Depending on your style of trading (investor, swing trader, day trader, etc), you could use two larger time frame charts to identify trends and support/resistance levels. For a day trader this could be perhaps a daily and a 30-minute chart. Once we have an idea of potential turning points from the bigger picture charts, we can step down to a smaller chart. This could be a 5-minute chart that we will use to manage our trade once we enter the position. Our next chart will be our action chart. This one will be the smallest time frame in our charts we look at. Perhaps a 1 or...

Lex van Dam stumbled on his first City job almost by accident but there's been nothing accidental about his success ever since. By contrast, he thinks millions of people who believe their money is in safe hands are taking a massive gamble. Now the man whose TV show Million Dollar Traders proved he could teach complete beginners to outsmart the City experts talks to Paul Mullen about all aspects of his trading experience and the launch of his new trading academy.

Paul: = Paul Mullen (Interviewer)

Lex: = Lex van Dam

Paul: How did you get started in the trading industry?

Lex: I was a student in Holland and I really enjoyed student life. I was not in a rush at all to start working full time, but one summer I did some work experience...

One the many questions traders have once they have learned how to trade is, which market or markets should I trade? While there are many things to consider when making this decision, I wanted to share with you today a market that I consider to be one of my favorites, the Ten Year U.S. Treasury Note (TY) Futures. This is one of the biggest and most important global treasury markets. Interest rates that affect all of our lives from a financial perspective are determined here. In other words, this is the free market for interest rates. There are other bond/treasury markets as well but this is one of the biggest.

This market is attractive for a few reasons. First, the Ten Year U.S. Treasury Note Futures market has tons of volume making it...

It is the job of every serious-minded Forex trader out there to keep abreast of the latest news and events, which could potentially have an effect on their day-to-day trading activities. This month is a big month for the world of Forex trading in that we have seen brand new legislation enforced which will no doubt ripple across the activities of all Forex traders participating or looking to participate in the markets over the course of the future. This ruling has been met with praise by some and scorn with others, yet needless to say, it is here to stay and we should all be aware of its appearance moving forward. The ruling I am talking about is the introduction of the latest Commodity Futures Trading Commission (CFTC) Compliance rule...

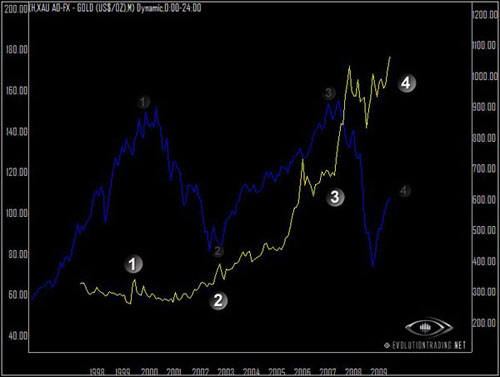

Over the coming week, the legion of earnings announcements will hit the market and will continue over the next few weeks. Being in the seasonally most volatile period of the year and hand in hand with some very interesting technical developments recently, we look to this period to bring in precious volatility and exciting price action.

The big event over the last several days in the financial markets is a fresh, multi-year breakout in Gold to new, All Time High. In our June 28th Newsletter as well as some recent discussions in the Evolution Trading Studio, we pointed out some Bullish price behavior and that the Gold market was beginning to "heat-up." It is gratifying to see the price follow through on our expectations, and the time has...

In this article, I will go over three possible outcomes for a Bear Call spread at the expiry. Those scenarios involve the price of the underlying closing within the spread, above the sold call, and below the sold call.

Last week's article, "Iron Condor Revisited", had addressed the issue of two vertical credit spreads. Since then, a student whom I shall leave unnamed, has emailed me pleading with me to explain to him a trade in which the student has gotten into without knowing much about spread trading. From the email, it could be inferred that the student has taken a bigger position from what is normal. Again, without disclosing anything more about the student, I will go over the facts of the trade. (I do have the student's consent to...

I have previously alluded to the importance of trading psychology by discussing two types of trading errors: Decision Making Error and Data Error. Some readers have indicated their desire to learn more about it. In this article, I will dive deeper into the topic of option trading and trading psychology.

Trading options and trading psychology are closely interrelated. The goal of this article is to show some of those close connections between the two. Let us start by describing what option trading really is. One of the easiest ways to describe option trading is by simply comparing it to equity trading. Most people are more familiar with equity trading so I will use that as a bench mark. Equity trading involves physically owning a...

In this article we will examine a specific case of a debit and a credit spread in order to point out that there is virtually very little difference between the two.

Instead of attempting to explain the concept by using a fictitious example, the stock XYZ with the one strike price being at this level and the other one at that level, etc, we shall utilize a couple of my recent trades for the same purpose. Again, this scrutiny is for education purposes only and it is not intended to be a recommendation of any kind.

My normal criteria for trading optionable stocks is the liquidity which is evident in the volume of the underlying as well as the high open interest and volume on individual strike prices. The Chevron Corporation has passed...

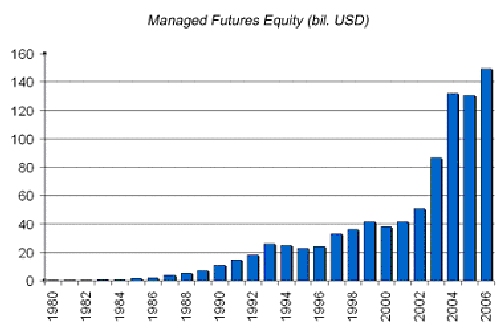

The total amount of assets under management in managed futures is today estimated to be in excess of $200 billion. Investors can choose from about 1000 programs, whose risk characteristics can extremely vary. It is therefore very important to fully understand the strategy each underlying manager is pursuing. We can not think of strategies on a stand-alone basis as a lot of managers employ them in combination, for example one main and several complementary strategies.

Technical approach

Here traders use technical analysis. It means that they monitor chart patterns and expect that they will repeat themselves in the future. The most common technical indicators usually include moving averages and strategies developed on the idea of a...

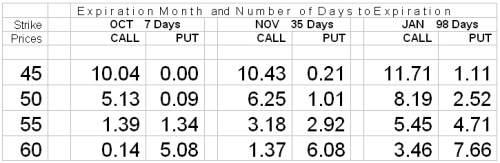

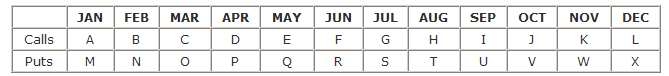

Today I'd like to talk about a strategy called the Vertical Spread. For those of you who are wondering how the terms Horizontal and Vertical came into common usage, ponder no more. In a typical options chain or montage, the options are typically displayed in the format shown here. Calendar months listed horizontally and strike prices listed vertically!

As I typically like to do, let's start out with a definition.

Definition: A Vertical Spread is an options strategy in which options are bought and an equal number of options of the same type (Puts or Calls) are sold with different strike prices, but with the same expiration date.

Vertical Spreads are directional strategies and are either bullish or bearish. This is what the generic...

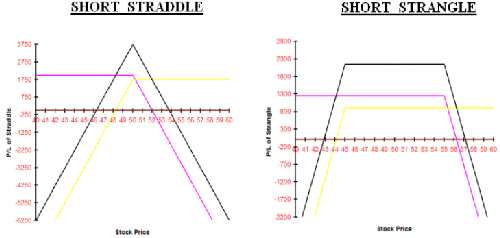

I've recently written about the popular strategies of Straddles and Strangles. For the most part, they were discussed from the long side, in other words, buying the Straddle or buying the Strangle. Obviously, there is another side to this story, and that is the short side, selling the Straddle or Strangle.

There were 2 main reasons why I emphasized the long side. The first has to do with the fact that brokerage companies don't just let everyone trade short naked options. Each company has their own set of rules and requirements regarding what they require to allow a customer to trade short options. Factors taken into account can include the customers' length of options trading experience, their income and net worth, and the size of...

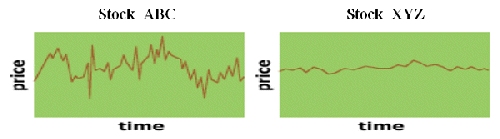

I've probably mentioned the term volatility in every article I've written about options trading. Everyone probably has an intuitive feel as to what volatility means, for example looking at the following charts of stocks ABC and XYZ, it's pretty clear which one is more volatile. If you think it's XYZ, you probably should hold off a little before you start trading options (or anything else for that matter.)

So how do we define volatility and how do we measure it? In general terms, volatility is the rate that the price of a security moves up or down. It is measured by the annual standard deviation of the daily price changes in the security. Digging down a little deeper, the standard deviation is calculated by taking the square root of...

A question recently came up about the symbols that represent options and what seems like a relatively boring and mundane topic is actually filled with twists and turns and many surprises. Okay, so it probably won't make you rich knowing more about option symbols than 99 percent of the non-professional options traders out there, but it will keep you from making mistakes when dealing with your broker, and in some circles, can make you a hit at cocktail parties.

The truth of the matter is that the system which has been in place for 25 years (since 1973) has not kept up with available technology and has become extremely unwieldy. In the industry, rumor has it that a particular large brokerage company, whose name I probably shouldn't...

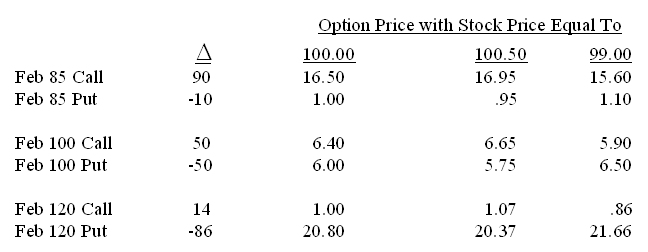

I'll bet you probably never considered how international options trading can be! We know there are American options, which can be exercised at any time from when they are bought until their date of expiration (we call that "early exercise.") There are also European options, which cannot be exercised early, and can only be exercised on their expiration date. Well today we're going to learn about the "Greeks." This term should not be new to anybody who is already trading options. The reason is that they are so important, that unless you have a basic understanding of what they are, and how to use them, you are going to be trading with a serious disadvantage.

So what are these Greeks? Simply put, we can call them risk measurements, (sorry...

Since the introduction of exchange traded options in the 1973, they have become more and more popular. In fact, it seems that almost every month I get an email from the Chicago Board of Options Exchange (CBOE) announcing that a new record number of contracts have traded and showing the month to month and year to year increase in options trading.

What accounts for this increase in options volume? Well, while banks and other institutions have been using exchange traded and over-the-counter options for many years, the general public is beginning to recognize that options don't have to be as risky as their reputation may imply. In fact, they can be used in many conservative ways to hedge a portfolio, provide portfolio insurance, generate a...