You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Articles

Filters

Show only:

Loading…

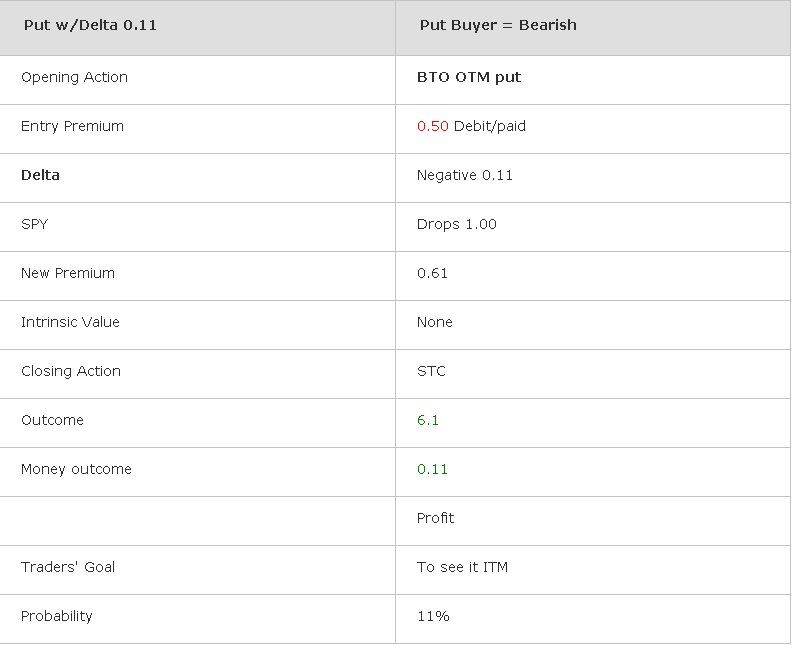

This article looks at the same put strike for a long put and also a short put. First, focus will be placed on the long put's Delta. Then the same put strike price that was used for the long will be analyzed from the perspective of the short put.

Delta has multiple levels of meaning. One of the most commonly quoted definitions is that Delta is a measure of the change in an option's premium with respect to a change in the price of the underlying. The Delta of a long call and also of a short put are positively correlated to the movement of the underlying. While in the case of a long put, as well as the short call, the Delta is negatively correlated to the movements of the underlying asset.

Delta could also be an approximate Measure of...

Europe may be in calmer waters after the currency bloc’s leaders hashed out a EUR 1 trillion plan to save the currency bloc and pull Greece out of the way of default, but the last few weeks have taught us valuable lessons that we would be wise not to forget. Trading is always risky and there are always events that can happen that you can never plan for.

Trading currencies is even riskier. Since a currency ‘s value depends on a huge multitude of factors including politics, economics and even social issues, you can prepare as best you can, but the chances are at one time or another you will get caught out.

For example, a developed western nation had not defaulted for nearly 70 years, yet here we are talking about how close Greece was to...

What is price action?

Price action is the behavior of the price of a specific currency, commodity, stock, or other security over a specific period of time. All financial markets display the price movement of a security over varying periods of time on price charts. The price action on a price chart reflects the aggregate belief of all market participants about the value of a security’s price during the specified period of time reflected by the price chart.

Price action analysis allows you to see exactly what is happening in any given market at any given time because price action is the visual trail of the supply and demand situation of the given trading instrument over a specified period of time. A chart’s natural price action...

Not long ago, I was spending time with a friend of mine who I have been close with since we were children. For years, anytime my career comes up in conversation, he insists that trading is nothing more than gambling. I actually get this question from others at trading events as well. It is a very hard question for me to answer because I think the whole question is wrong.

Whether you are a trader, gambler in a casino, Pepsi buying advertising space on a network, retail store owner, casino, car dealer, franchise owner, street vender, someone who buys and sells things on eBay, and so on, YOU ARE A SPECULATOR at some level. The trader takes on risk in a market for a potential reward. The gambler risks a $5.00 chip on the black jack table...

PM: = Paul Mullen (Interviewer)

MP: = Michael Patak (Trading Scout)

PM: What is a trading scout and what do you do?

MP: As a trading scout I evaluate and monitor recruits who are in our Combine program (similar to the NFL Combine). At the completion of the Combine, I review trade reports and analyze each recruit’s trading methodology to ensure they have adhered to our scouting evaluation form. This review allows me to determine if a trader is prepared to begin trading a live account, which is fully funded by our equity partners.

I also work as a managing trader, in this role I monitor the daily progress traders we have recruited from the Combine who are now trading a live account. In addition to daily monitoring I also work with them...

Allen looked quizzically at the charts on his monitors. For the fourth time today, he had been stopped out and he had only taken five trades. But he smiled to himself despite the four losses because he knew that he had traded this entire session "as" a winner (meaning that he had planned every trade, had traded every plan and he had followed all of his rules – explicitly). He knew that he had achieved a private victory today as he also realized that it was critically important to approach his trading one day and one trade at a time. He had learned that trading requires 100% of his attention in order to focus intently on what matters most in the trade, and that to do that, he had to remain in the moment, for the moment, fully available...

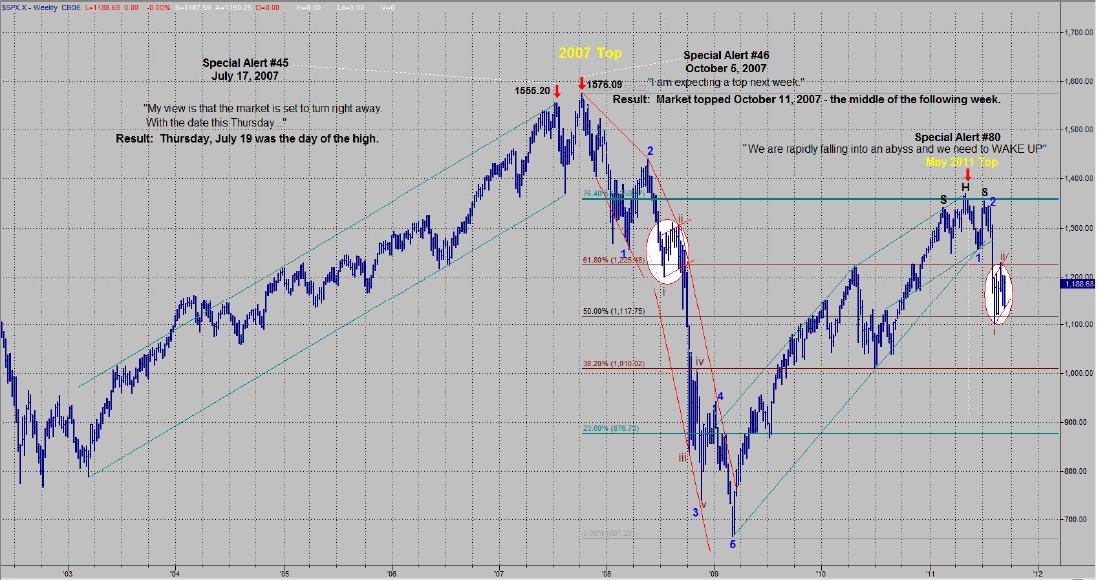

Let's begin by looking at the chart in figure 1. At this stage of the cycle, my main purpose in writing is to "alert" you to potential danger in the market. I attempt to do this by explaining the Long Wave cycle, sharing its history and accuracy, and then pointing out where we are in the cycle ... and the implications of being there. As a refresher, we are in the very late stages of a roughly 75 to 80 year cycle. In my observation, I refer to these cycles as "life cycles" because they last expectancy at the late stages of the cycle Kondratieff wrote about cycles, they lasted about 50 years which was the average 'life cycle' or life expectancy of that era. Currently, the average life expectancy is about 78 years. Is it a coincidence...

Continuing on from last week, I am hoping to give even more compelling reasons to consider other trading approches to that of only day trading.

Profit per hour of trading is hugely inefficient for day traders

When day trading currencies it is not unusual to be at your pc for up to 10 hours a day. If you are fortunate enough to be able to make a net profit of $200 per day (which most people are not able to achieve) then that is the equivalent of earning $20 per hour which is not unreasonable earnings. Most people who day trade don’t make anywhere near this amount and many spend 10 hours a day in front of their pc and end up with a net loss on the day. It is also very difficult to be able to do anything else when in a trade and requires...

In recent times there has been a huge increase in the number of people trading currencies or forex as it is more commonly known. Most of those taking up this venture have turned to day trading as opposed to position trading or swing trading as their chosen approach. As a longer term trader myself, I am at a loss as to why so many choose to day trade when it is highly inefficient and ultimately costs a lot more in both time (sat in front of a pc all day) and money (commissions or cost of the spread). I can though easily see why the retail providers of forex trading facilities prefer day traders to any other type of trader and that is because it is much more profitable for them. As such they will market their services in such a way as to...

I started my 24th year of Futures trading this month and have been reminiscing about the path that the Futures industry and I have both taken during this time:

Instant fills on electronic platforms compared to waiting minutes to hours for a price fill from the exchange floor

No more watching price trade through your limit order in the Bond pits and then calling to ask for your fill price and hearing "unable to fill, still working the order"

Computers that now plot charts as far back as 25 years or more on some markets with just the click of a mouse instead of paper charts plastered to the office walls with X's and O's all over them

News on your screen almost as fast as it happens instead of reading about it in the paper the next...

I am often asked by traders I meet, "How do I become a successful trader? What does it really take?" In any endeavor - whether the goal is to become a competent trader, surgeon, athlete, psychologist, musician, lawyer, or pilot - the path is the same: Dedication to the goal, a lot of hard work, and a willingness to keep picking yourself up when you fall, over and over. I would like to be able to say it is easier than all that, but it really isn't.

Here are seven essentials needed to become a competent, successful trader. With dedicated effort, these steps can help you to eventually become a great trader:

1. Have a vision about your trading. Understand why you trade. It is never just about the money. Money can be had in any...

As with any balanced force… ying and yang… pleasure and pain… etc., it’s OPPORTUNITY and DANGER that confronts the trader in extremely volatile times.

Since the purpose of a disciplined trader is to keep you mentally and emotionally strong in your trading, I thought I’d offer 4 ‘structural’ tips to stay focused to run your trading plan.

“Structural” tips are things that you can do mechanically in your trading to better keep you on the side of calm, cool and collected, as opposed to “inner mind” tips that you should be engaged in all the time anyway… training your subconscious mind to hold the values of a disciplined trader. Knowing you must win the BATTLE WITHIN YOURSELF first, before you can win with the markets.

OK, here are some...

The aim of this article is to explain how the option premium of an ITM long call changes as the underlying moves on the price chart. There will be three points in time that we will examine.

We will use DIA, the Dow Jones Industrial Average Exchange Traded Fund, for our example. At the first point in time that we will use, the Dow was trading at 126.50 and a one step in the money long August call was selected.

PART I: Friday close 07/08/2011

On July 8th, after the Dow (and the DIA) had been in a strong uptrend for a number of days, it became evident where the next area of resistance would be – at the 127 level. Figure 1 shows the daily chart of the DIA creating, at that time, a formation that seems like a Bull Flag.

Figure 1: Daily...

PM: = Paul Mullen (Interviewer)

JP: = Joel Parker (Tape Reading Trader)

PM: What is it that you do related to trading?

JP: I’m primarily a trader but I do have a service where I educate other traders about price action trading and reading tape.

PM: What is it you trade and how long have you been doing it?

JP: At this point in my trading career, I trade futures – usually the emini S&P and crude; I bounce around a lot between other futures contracts depending on what clients want to look at. I started out trading back in the mid-nineties and at that time I was trading equities, a little longer timeframe, anywhere from a month to three or four months, what you would probably call a short-term investor. I quickly became addicted to...

Amber is a well-adjusted, successful businesswoman and trader; however, she had considerable difficulties when she first began to trade. She earned a PhD in college and her nose-to-the-grindstone attitude helped her excel in business, but this attitude worked to her detriment in trading. She experienced herself wanting to trade the way she worked - endlessly, putting many deliverables on her plate at once, and barrelling through her workday. She said she liked her day this way because it gave her an edge, but when she used this same tactic in her trading, she had dismal results and it almost depleted all of her capital. She knew there had to be something driving her thinking and creating such depressing results. After working with her...

I had an interesting conversation with a colleague recently. He used a good analogy for recent market action: imagine if you had been away from a trading screen for the last three months, you then came back and were asked where you thought EURUSD would be. What would you say?

Probably 1.1000/ 1.1800 maybe. You have seen all the negative comments and the Sovereign debt debacle spread its tentacles into Greece, then Portugal and Ireland and now maybe even Italy, so surely the euro had to decline, right? Well no, it’s higher than it was at the start of the year.

This is a good analogy for market action in recent months since it has been extremely difficult to make money. Sure there have been some trends: EURCHF, USDCHF, GBPCHF, but other...

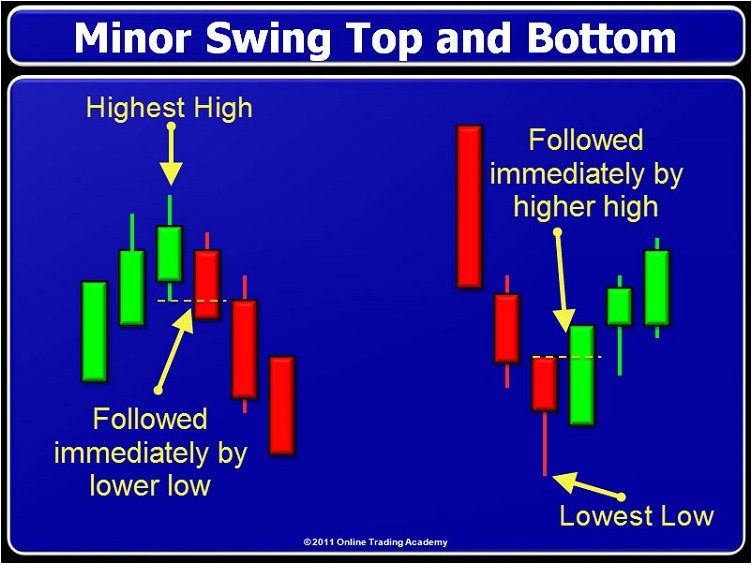

There is a saying in trading, "Look left to make the right decisions." We will do the same. To determine the major trend of our stock, we can start at the current price and look left until we find a major top or major bottom. If we come to a major bottom, then we are likely in an uptrend and should trade in that direction until the major bottom has been violated. Should a major top come first, then we would be looking for shorting opportunities until that top has been violated by higher prices.

Figure 1

Once we have found the major trend, we can enter into that trend once an intermediate or minor trend is signaled. In the above chart, we saw that from the right edge of the chart, we first found a minor top. Since this doesn't give...

In previous articles I have discussed swing highs and swing lows and also touched upon a different type of analysis called Gann Theory. This is a popular style of analysis that looks at patterns and repeatable price action based on time. After receiving some emails on the subject, I decided it best to examine Gann Theory a bit further in my articles. I am not going to go into the history of Gann Theory or give a biography of W.D. Gann. Instead, I will discuss some practical applications of some of his theory.

There are three trends applicable to any time frame which you are analyzing: Minor, Intermediate and Major. That also means that there are three types of swing highs and lows that correspond with these trends. Let's examine the...

Dale grew up in a hard working farm family in Arkansas. His parents, while growing up during the Great Depression, had nearly lost their farm. That experience really changed them. They hoarded what little money they had and came to believe bad things can happen if you can’t be certain about the future. And Dale was born into this legacy.

Leaving the farm for greater opportunity, Dale became a banker in a trust department of a bank where he protected the value of assets placed under his care. He was a natural at his job of maintaining certainty in the face of threats to his clients' capital. As time went on, the bank was gobbled up and Dale was fed up. In a career change, he moved into day trading. He learned a proven methodology...

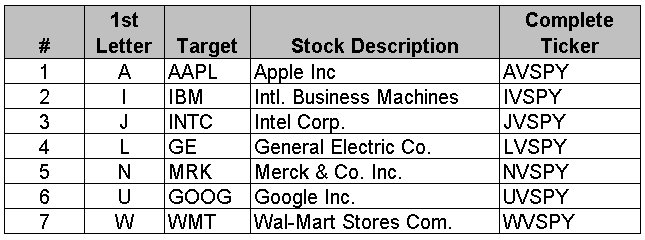

There are new options out there called NASDAQ OMX Alpha Indexes Options. This article will explain some of the aspects of this "New Kid on the Block" for options. It is not a recommendation to buy or sell of any of these products. The information presented here is for educational purposes only. The accuracy of what is discussed can be verified on the official NASDAQ website, as well as Investopedia.com.

Prior to explaining what the new NASDAQ OMX Alpha Index options are, we should first be familiar with what the Alpha term actually stands for; so let us define it. According to Investopedia.com, there are two definitions of Alpha. The first dictionary definition states that Alpha is "A measure of performance on a risk-adjusted basis...

Whilst I generally shudder when I recall my first naïve steps in the world of trading and the hoard of indicators I had on my charts, there is one indicator I feel stands apart from the rest. It’s not based on price and so represents an additional dimension on which to make decisions. I also think it is a very close relative of tape reading. In this article, we will look at some of the basics of using Cumulative Delta.

The Delta Theory Simplified

For a trade to occur in the markets, we need two things - a buyer and a seller. Price does not move down because there are more buyers than sellers. This is impossible, for every buyer there must be a seller. Price moves down when sellers are aggressive and buyers believe that sellers are...

In this article I will examine more closely the common belief that those darn Forex brokers are "running" or "hunting" our stop loss orders. First, let's define what this means. Running or hunting stops basically means that you enter a long (short) position with a sell (buy)stop loss a few pips below (above) your entry. The price action then comes to your stop order, takes you out, then the price action immediately reverses direction – often going directly to your first price target! Has anyone had this happen to them before? Do a quick internet search and you will find tens of thousands of references to this.

There are two main problems with this belief. The first is the psychology involved with this belief. Do you REALLY believe that...

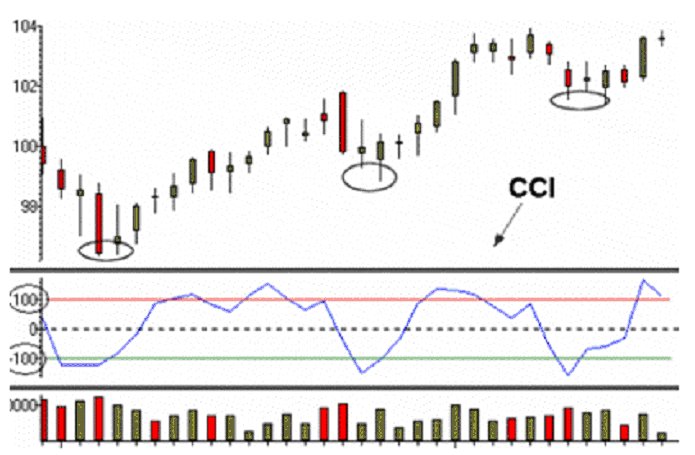

Most traders are glued to indicators and oscillators and that's ok if you use them correctly. The issue is that many traders take each conventional buy and sell signal an indicator or oscillator produces and that can lead to trouble. For those new to trading, the following information should provide a good foundation of an understanding of how to properly use oscillators, if you're going to use them at all.

To illustrate my points, I will use the Commodity Channel Index (CCI). This is certainly not because CCI is my favorite oscillator; I don't use any indicators or oscillators in my trading at all. The goal in trading is to achieve the lowest risk, highest profit margin, and highest probability entry point into a trade. The only way...

In previous articles we have spoken about our preference for combining technical analysis with macro factors and the benefits of keeping up-to-date with economic data, central bank speak and interest rate decisions.

In our view this is one of the best ways to create winning trading strategies. But recently it is easy to get extremely frustrated with the wave of fundamental factors that have caused havoc in the financial markets and had the potential to wipe out positions in an instant.

That can be extremely frustrating to a technical trader. We will look at a few examples here and try and give some tips on how to dodge those macro curve balls.

The first example is the US dollar and the Federal Reserve’s quantitative easing policy...

In this "information-is-power" age, you need knowledge and skill to succeed at any goal. There is a tremendous amount of Fundamental and Technical minutia involved in successful equity, futures and currency trading. However, getting that knowledge can be a daunting task. Also, your attitude regarding your internal stories about your ability to learn and assimilate knowledge can be either helpful or harmful to the process. Often, you become your own worst enemy due to those internal stories. For instance, you determine what you need to learn and to do; then you play the story in your head about how difficult it's going to be, or how you "flubbed" it up the last time you tried it. This type of internal story is called a "negative feedback...

One of the most common areas of confusion for the new trader is chart reading. For example, I had a trader who had been trading for years, but he did not know the difference between the two types of candlestick charts. As we were going through the technical analysis material, it was clear that he understood the basic candlestick concept, but nothing more.

The basic candlestick concept is in all of Steve Nison's books and similar books on conventional technical analysis. Yet the info presented there is somewhat single dimensional because it focuses only on a single trading session. For instance, every candle has four points which are well-known. They are the (H) high, (L) low, (O) open and (C) close. The range is the distance between...

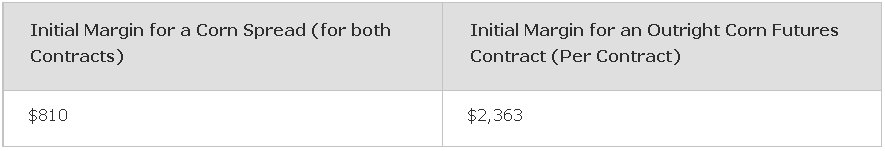

Spread trading is very good for the smaller account traders after they figure out how to trade Spreads. The capital required to trade these Spreads is a fraction of an outright Futures contract. Figure 1 shows a comparison of a Corn Spread to an outright Corn position.

Figure 1

Spreads generally move much slower than outright Futures positions, thus reducing some of the risk involved. By combining the use of Spreads and Seasonal Patterns of Commodities, we can get that added edge that most traders don't have. Spread trading is one of the best kept secrets on the exchange trading floors. Not many small traders follow these, but you can be assured that the large traders and commercial traders are looking at and using these Spreads...

Choosing what currency to invest in can be a daunting prospect. If you want to invest in a company you can check out its latest accounting statement to get the basic information you need: whether it is making or losing money, how much debt is held on the balance sheet etc. But there is no similar snap shot for individual currencies. A successful forex trader needs to keep up to date with economic data, geopolitical tensions as well as political landscape since all of these factors can move forex markets.

But, luckily for FX traders, there are some historical relationships that help make sense of the wider currency market. Firstly, the safe haven. Japan may have a debt-to GDP ratio of close to 200 per cent, yet the yen is considered a...

In this article I will focus on the correlations of currency pairs and how they can help us trade. Occasionally, a trader may notice that a particular currency pair may lead another currency pair - that is, have turning points that happen a candlestick or two earlier. While it is rather rare for two different currency pairs to do EVERYTHING in the same way for long - be it trending or channelling - occasionally, we can be alerted to a potential turn in one pair when its dance partner turns first.

The first currency pair and its partner that we will examine is the EURUSD and the USDCHF. Before we examine the charts, always remember that with the USD on different sides in these two pairs, we have a reasonable Economics 101 belief that...