You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

bracke said:erie

I don't know if rainman is confused but I am.

I have looked at post 1 by dbp and the springboard on his chart appears very similar to that shown on rainmans.

1 If rainmans is not a springboard, what is it?

2 Is dbp's a springboard?

3 How do the two differ?

Regards

bracke

Bracke,

I don't see this very clearly, either. I suppose that this is meant to be a clue that something is going to happen and has to be used with the stop. If the stop triggers, bad luck.

Split

I posted earlier on this thread about the importance of the order book and the difference of trades at bid/trades at ask as an important hints as to which way the market is likely to break from periods of price indecision. Here is a nice example from today's KOSPI. Each bar is 2000 contracts wide. Black line is VWAP.

Attachments

firewalker99

Legendary member

- Messages

- 6,655

- Likes

- 613

ymonly said:with all due respect i contend they are both the same...of little to no value...it either runs or chops...imho...thanks

"Little or no value"?! 😱

sorry ymonly... has to be the most surprising post to read in this thread!

if you know how to trade them they can be extremely profitable...

firewalker99

Legendary member

- Messages

- 6,655

- Likes

- 613

bracke said:What about this chart. Results are due on 28 March, woild you trade now or wait for the breakout?

Let me know how it pans out today.

firewalker99 said:"Little or no value"?! 😱

sorry ymonly... has to be the most surprising post to read in this thread!

if you know how to trade them they can be extremely profitable...

From what I see, they are no better than other patterns. Sometimes they work and sometimes they don't, To me, the first chart represents a failed high with the start of a new trend. If that was interpreted correctly, as such, it, too, would have signalled a successful short..

In the same way, with Rainman2's chart, post 107, the initial uptrend found a new high at the end, where he shorted and got stopped. A difficult chart to figure but, still, that is what I see. At the very end, I see it going for another high which, if it failed and broke below 62.5, would get me out of the long trade. Could you tell us how that chart went, Rainman2?

Split

firewalker99

Legendary member

- Messages

- 6,655

- Likes

- 613

Splitlink said:From what I see, they are no better than other patterns. Sometimes they work and sometimes they don't, To me, the first chart represents a failed high with the start of a new trend. If that was interpreted correctly, as such, it, too, would have signalled a successful short..

In the same way, with Rainman2's chart, post 107, the initial uptrend found a new high at the end, where he shorted and got stopped. A difficult chart to figure but, still, that is what I see. At the very end, I see it going for another high which, if it failed and broke below 62.5, would get me out of the long trade. Could you tell us how that chart went, Rainman2?

Split

It depends if you consider the move up near the end a new high or not. I would not (it only goes a couple of ticks higher) and hence would be out (if I was long) after it failed to go higher than the previous highest high.

firewalker99 said:It depends if you consider the move up near the end a new high or not. I would not (it only goes a couple of ticks higher) and hence would be out (if I was long) after it failed to go higher than the previous highest high.

Yes, but if I had been in the trade, (all hindsight, I'm afraid 😕) I don't think that the fall from the previous high would have stopped me out, but the fall from the last high to below the lower red line would have done, I think. If the latest price went back below 62.50 I think I would work on the assumption that a new trend might be in place and short it, treating the pattern as a failed high.

As to what I consider new highs/lows, I draw my R/S lines across the bodies of the bars, ignoring the spikey parts as "returnable". That would, just, justify me calling that one a new high. The devil's in the rules 😈

firewalker99

Legendary member

- Messages

- 6,655

- Likes

- 613

Splitlink said:As to what I consider new highs/lows, I draw my R/S lines across the bodies of the bars, ignoring the spikey parts as "returnable". That would, just, justify me calling that one a new high. The devil's in the rules 😈

That's why I prefer not to stick to a single line, but consider it an area of support or resistance, with the "spikey parts" the extreme ends of that area and the bodies of the bars where price travels most of the time as the "normal" area of S/R...

Splitlink said:Bracke,

I don't see this very clearly, either. I suppose that this is meant to be a clue that something is going to happen and has to be used with the stop. If the stop triggers, bad luck.

Split

Splitlink

I still remain confused.

Surely we should use stops on all our trades?

Regards

bracke

bracke said:Splitlink

I still remain confused.

Surely we should use stops on all our trades?

Regards

bracke

Yes, always. What I was trying to say, not very well, is that something else is needed with springboard. By itself, it is a warning that something is about to happen but direction still has to be decided.

Split

Splitlink said:Yes, always. What I was trying to say, not very well, is that something else is needed with springboard. By itself, it is a warning that something is about to happen but direction still has to be decided.

Split

Splitlink

Generally agree but remember sp can move sideways for a long time and as dbp has pointed out the hinge may just resolve itself into more sideways movement.

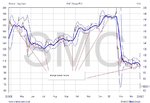

However the chart I posted last week of SMC has seen the platform resolve itself. See chart below.

Attachments

an intraday chart with more than 10 min time frame doesn't see those very often....so we need springboards and hinges to tell us it is going to explode one way or the other...a simple ma usually tellls me which is the way very high probability.or, maybe a hand drawn demand supply line.......of course, i could be an ET/ES journal paper/rear view mirror trader and be correct everytime. We can only take what we have proven to be correct a very high percentage of the time and go with it..to capture points consistently............ .if that is a simple moving average/oscillators/volume/s/r and/or combos that boggle the mind and look like a tangled pile of different colored ropes and each with it's individual pet name as we "discovered it" ourselves, then great....if it works....won't be an overnight adventure if one succeeds...

bracke said:Splitlink

Generally agree but remember sp can move sideways for a long time and as dbp has pointed out the hinge may just resolve itself into more sideways movement.

However the chart I posted last week of SMC has seen the platform resolve itself. See chart below.

Could I ask you if you traded this share and at what point did you enter? It seems that one would have had to come to a decision to trade before the event. If that is the case, then I cannot see an advantage over other systems that traders may use. Take a look at my chart of SMC using a Bollinger Band.

Attachments

there is the ultimate mechanical system...no thinking allowed......next is discretionary /reading charts with no oscillators, etc....also id'ing apex is utopia...can it be done? yes, but not to the exact point, most of time...but very close...too close to talk about......spbds and hinges are really okay for thinking guy.....my emotions prevent me from being what i wish to be in the trading arena.....even with system doing the work......another issue..... IMHO only

dbphoenix said:A springboard is not a system; it is a characteristic of auction markets. Bollinger Bands are simply a measure of standard deviation.

Does it matter, though?

ymonly said:until the run reverses it doesn't mattler to me...it is chop....chop and run is all i see......or my systems sees adn sends me the early message....yes or no...manual or machine it delivers..

The expression chop and run is not known to me. Would, you clarity that, please?

Split