You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Articles

Filters

Show only:

Loading…

Trading in the financial markets is subjective and almost exclusively. There are as many approaches to the process as there are traders; and many of them are successful along with so many, many more that are not.

Additionally, trading can be defined in a number of ways. For example, “A transfer of funds from those who do not know what they are doing and have little emotional management, to the accounts of those who do know what they are doing and are exercising strong emotional management” and “Trading is a journey in self discovery” and “Trading is an art and must be practiced like practicing the medical arts or practicing law or any other endeavor that requires a high level of proficiency.” Furthermore, like medicine and law, the...

Binary options are a simple way to trade price fluctuations in multiple global markets, but a trader needs to understand the risks and rewards of these often-misunderstood instruments. Binary options are different from traditional options. If traded, one will find these options have different payouts, fees and risks, not to mention an entirely different liquidity structure and investment process.

Binary options traded outside the U.S. are also typically structured differently than binaries available on U.S. exchanges. When considering speculating or hedging, binary options are an alternative, but only if the trader fully understands the two potential outcomes of these "exotic options." In June 2013, the U.S. Securities and Exchange...

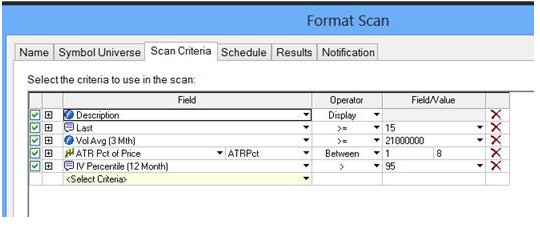

Options are exciting to trade for many reasons. They offer so many opportunities that the sheer volume of possibilities can be overwhelming. How can we go about finding the good ones?

To answer this, we need to think about what the sources of options profits are. What makes their prices move? The important factors are:

Stock price movement

Changing crowd expectations

The passage of time

When looking for option opportunities, we can choose to emphasize any of these.

If we look closer, we will see that the last factor, passage of time, is largely a function of the second one – crowd expectations. Here’s how: when expectations for movement are high, people pay more for options. When they pay more, there is more value in the...

The forex market is the largest and most accessible financial market in the world, but although there are many forex investors, few are truly successful ones. Many traders fail for the same reasons that investors fail in other asset classes. In addition, the extreme amount of leverage - the use of borrowed capital to increase the potential return of investments - provided by the market, and the relatively small amounts of margin required when trading currencies, deny traders the opportunity to make numerous low-risk mistakes. Factors specific to trading currencies can cause some traders to expect greater investment returns than the market can consistently offer, or to take more risk than they would when trading in other markets.

Forex...

It’s with some trepidation that I accepted timsk’s invitation to tell you a little about myself and my trading as it has developed over the years. I hope that this will be the first of many such articles by members - so I will kick off and trust that those who follow have a much more interesting tale to tell.

Before getting into it I want to make it crystal clear that I am strictly an amateur and my trading has never been, nor is today, more than a reasonably profitable sideline. I simply haven’t the balls to even have considered doing it for a living and I doff my cap to those who do.

My background

Here I am then, at the back end of life with nearly fourteen years of retirement under my belt after a working life in HM Customs &...

During our development years, we are taught/conditioned to think certain ways. Our years in grammar school, high school, and university are key belief system building years. One of the major conflicts during these years occurs when we are taught how to buy stocks and then how we are taught to buy and sell anything else in our life.

The basic principle of buying low and selling high or selling high and buying low is how we derive profit when buying and selling anything. When we buy cars or houses, we never offer what the seller is asking. We always offer a lower price and typically end up somewhere in the middle. Smart shoppers look for deals where they can buy what they are looking for at a lower price than others pay. We all typically...

In 2008 I wrote an article for T2W entitled: Housing Boom – is the party over? in which I categorically stated that I expected house prices to fall substantially and that investors should look to invest in the stock market from 2008 onwards. I was right on both counts. House prices in some areas have dropped as much as 25%, while the average stock market index has nearly doubled.

After a decade long boom due to lower interest rates and easy lending, the party finally came to a sticky end for U.K. property prices in 2009. According to Land Registry, property prices in the U.K. rose by an astronomical 200% in a decade.

Five years on, I find it difficult to make a case for increases in house prices in the U.K. based on numerous factors...

When you start as an analyst in a retail FX shop and your background has largely been fundamental analysis you can quickly find yourself being ostracised, worse even ridiculed for your “old fashioned” view of the market.

Yep, you’ve guessed it, I’m writing from personal experience. But soon after moving into the retail world, I devoured tombs on technical analysis, progressing to inter-market analysis and then pretty fancy technical strategies. This ended up being the perfect complement to my fundamental background. While some traders are technical purists, I am not. I take the best bits from both to navigate the choppy waters of the markets.

With both my institutional and retail FX experience, I still come to the same conclusion...

With the final approval of Germany's supreme court in hand, Germany can now legally join the latest eurozone bailout attempt in the hopes of offering more time and more stability to an area still roiling with the fallout of sovereign debt crises in multiple states. While the citizens and governments of many other European countries would no doubt deeply resent the idea of the European Stability Mechanism (ESM) as a "German bailout," make no mistake - without Germany's ongoing participation and financing, there would be serious turmoil in European financial markets.

In for a Pfennig, in for 190 Billion Euros

With the approval of Germany's supreme court in mid-September, the ESM can now move forward as the latest effort to stem the...

I know a trader, let’s call him Leon. He day trades Futures. He has been actively trading for several years. His profits are erratic and undependable, often going dramatically up and down in the same session. When Leon is making money his confidence soars and he feels like he is a power trader. On the other hand, when he loses money, which is more times than he cares to admit, he feels like a failure, a loser and stupid. For quite some time Leon has wondered why he can’t be consistently successful, and why his drawdowns tend to be much larger than his profits. He wonders this even though he has no Business Trade Plan, doesn’t consistently document his trades and despite having numerous rules, tends to violate them regularly. Leon...

Introduction

Many traders think that to make consistent profits in the markets, all you need is a holy grail. From my experience, a trading methodology or system is only one of the ingredients of success. The advancement of technology blinds us into thinking that all we need to be successful is state-of-the-art kit and the latest software. After all, banks fit into this category and they tend to do pretty well. However, technical wizardry is only of value if you know what to do with it. Does Warren Buffett rely on the latest technology to make his investments, or does he put his faith and his money into time tested principles of yesteryear? Modern technology is a useful tool for many traders, but to ensure it’s used wisely and to full...

How should investors assess risk in the stocks they buy or sell? As you can imagine, the concept of risk is hard to pin down and factor into stock analysis and valuation. Is there a rating - some sort of number, letter or phrase - that will do the trick?

One of the most popular indicators of risk is a statistical measure called beta. Stock analysts use this measure all the time to get a sense of stocks' risk profiles.

Here we shed some light on what the measure means for investors. While beta does say something about price risk, it has its limits for investors looking for fundamental risk factors.

Beta

Beta is a measure of a stock's volatility in relation to the market. By definition, the market has a beta of 1.0, and individual...

This is one of the most frustrating situations for a trader. You think you understand the economic back-drop and you have a brilliant case for why a currency or a stock should move in a particular direction and then they move exactly the opposite way.

The summer rally is a prime example. Who would have thought that the markets would be poised to rally if Spain was to request a bailout? Now that the ECB has put in place its bond-buying OMT programme the markets have decided that a Spanish bailout is a risk positive event even though Spain has the fourth largest economy in the currency block, its growth is in free-fall and the Eurozone’s creditors have no firm grasp how large Madrid’s liabilities will be. Likewise, public policy...

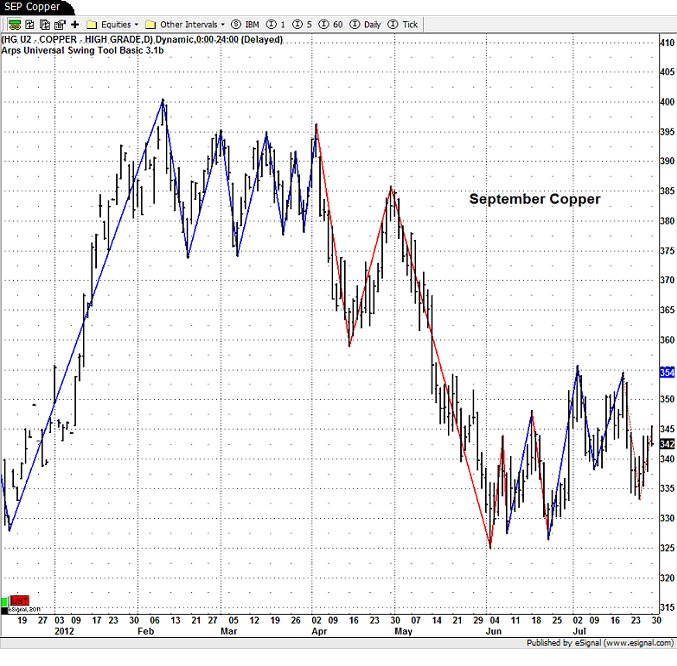

Spread trading has been around since markets and exchanges were first developed. Exchanges and their markets were designed not for speculation but to transfer risk from one party to another; speculation made them more efficient through increased volume and tighter price spreads (bid/ask). Commercial trading companies and financial institutions apply hedging (long/short positions) to reduce their exposure and offset risk to their principal underlying positions across every type of commodity or financial instrument. This risk-averse approach is the driving force to their market activity and success.

As a trader we can only speculate on price movement. In many markets, in particular futures, the price activity can be volatile and...

According to traditional financial and economic theories investors are assumed to be rational actors, seeking to maximize their wealth in logical ways. But in the real world investors and traders often act irrationally and unpredictably, often to their financial detriment. Behavioral finance is a discipline that blends psychology and finance to help explain why investors act the way they do. Over the last few decades behavioral theorists have identified a set of cognitive errors repeatedly committed by financial market participants. By understanding some of behavioral finance’s key concepts, traders can avoid some of the common pitfalls that can wreak havoc on their account balances.

Loss aversion and the disposition effect

It...

Paulo breathed a heavy sigh as he thought about the next day’s preparation. He was still attempting to recover from today’s session, which was emotionally whipping him, as my grandfather used to say, “like he stole something!” He felt fragmented and frustrated; and he knew that his research and preparation for tomorrow’s trading was crucial. Paulo also knew that his state of mind was not conducive to the sharp focus of his A-Game, which was required for preparation that was not distorted by poor judgment or distracted by noisy negative thinking.

He actually had a number of mental/emotional tools that he could use when his emotional temperature was too extreme for making prudent decisions. But, he was so disgusted with his results...

With slow economic growth persisting in many developed nations, investors have taken a liking to emerging market economies. Featuring the right combination of fast-growing populations, fiscal responsibility and burgeoning middle classes, these nations have become portfolio necessities.

Much of investors' fascination with emerging markets is pointed towards the BRIC. Rightfully so, as Brazil, Russia, India and China have all seen tremendous growth in their economies due to having the right combination of resources. Collectively, it is estimated that these countries account for more than 40% of the world's population and hold more than one-third of the total foreign exchange reserves and gold. However, there are more fish in the sea...

Swing Trading combines fundamental and technical analysis in order to catch momentous price movements while avoiding idle times. The benefits of this type of trading are a more efficient use of capital and higher returns, and the drawbacks are higher commissions and more volatility. Swing trading can be difficult for the average retail trader. The professional traders have more experience, leverage, information and lower commissions; however, they are limited by the instruments they are allowed to trade, the risk they are capable of taking on and their large amount of capital. (Large institutions trade in sizes too big to move in and out of stocks quickly.) Knowledgeable retail traders can take advantage of these things in order to...

Headging is often considered an advanced investing strategy, but the principles of hedging are fairly simple. With the popularity - and accompanying criticism - of hedge funds, the practice of hedging is becoming more widespread. Despite this, it is still not widely understood.

Everyday Hedges

Most people have, whether they know it or not, engaged in hedging. For example, when you take out insurance to minimize the risk that an injury will erase your income, or you buy life insurance to support your family in the case of your death, this is a hedge.

You pay money in monthly sums for the coverage provided by an insurance company. Although the textbook definition of hedging is an investment taken out to limit the risk of another...

Hello traders! I’d like to discuss a common misconception that new traders have – that professional traders sit and stare at their computer all day, making dozens of trades during their trading day. In addition, I’ll suggest a progression of trades you can add to your trading plan to help keep you from over trading.

During the classes that I teach, the question often comes up as to how many trades I take during a day or a week. Many new students are surprised when I give my answer of “between zero and three trades a day.” Their surprise is especially evident when discussing the forex market because it is open 24 hours a day, from Sunday afternoon to Friday afternoon! With all that time to find trades, why don’t we trade dozens of times...

We’ve all heard pundits refer to the first ten years of the new millennium as the “lost decade.” Folks who invested in a stock-index fund such as the DIAMONDS Trust Series ETF (DIA) at the beginning of 2000 and held it through December 31, 2010 saw a gross return of around zero. Factor in inflation and the real return drops to around minus 3% per year. In other words, cash was king and it would have been better to keep your money in bonds or in the bank.

Some experts, including Martin Pring author of a new book entitled Investing in the Second Lost Decade (McGraw Hill, 2012), believe that with high levels of debt, persistent high unemployment rates and economic turmoil around the globe, that there is a good chance that we will see...

The spot forex market is said to trade at over $1 trillion a day. Combine that with currency options and futures contracts, and the amounts could literally be another couple of trillion traded on any given day.

Historically Speaking

In its 2009 report, the Foreign Exchange Committee at the Bank of International Settlements estimated the total numbers of forex related transactions to be $3.2 trillion. With this type of money floating around an unregulated spot market that trades over the counter with no accountability, forex scams can only increase with the lure of earning fortunes in limited amounts of time. Many of the old popular scams have ceased, due to serious enforcement actions by the Commodity Futures Trading Commission (CFTC)...

The Mindset That You Brought into Trading is NOT the Mindset That Will Bring Success in Trading

The Journey Begins – Stumbling Out of the Starting Gates

Traders begin the journey into trading with high hopes. They believe, with good training and enough screen time, they will be able to master trading and achieve their dreams through trading. They practice diligently in simulation, back-test their methodology, and/or use a trading organization’s “near money” until they clearly see that they can win at this game with their own money. Confident from their past experience of hard work and ambition having paid off in the past, they assume this ethic will lead them to success in trading also. Methodically, they have trained themselves to...

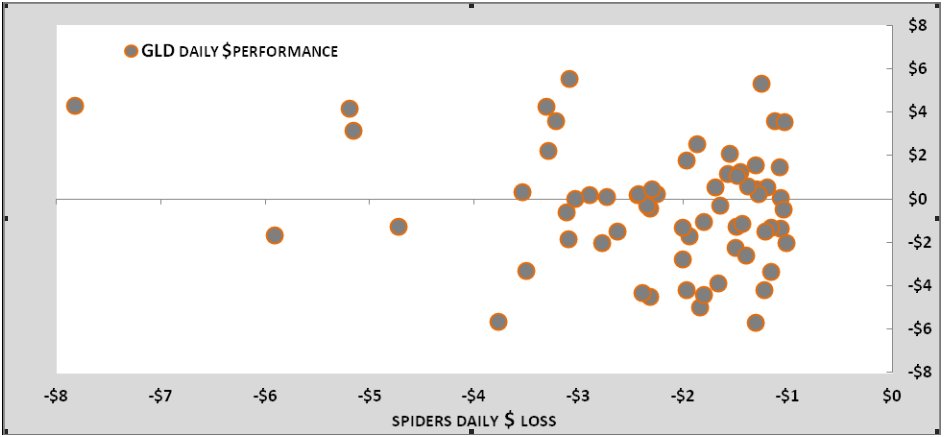

When the equities market is in distress, is taking a long position in gold a profitable strategy?

The conventional thinking among pundits supports taking a long position in this precious metal as a way of mitigating strong losses in the equities market. Fortunately, many active market participants prefer to run the numbers before acting on this long held assumption about market direction. This study attempts to prove or disprove this form of hedging strategy by performing an analysis on two active funds: the spiders (SPY), which are the best representation of the equities market (averaging 205 million shares per day), and the SPDR Gold Shares fund (GLD) with 15.7 million shares a day serves as our dependent variable.

In this study...

The price action moved steadily upward on the 5 minute Russell E-mini chart. At that moment Stacey sighed heavily as she was in a short which was prompted by a level upon level supply zone that she had identified on the 60 minute time frame. She had placed her stop just above the top zone’s line amounting to 3 points. She had faith in her trade plan, but the price action seemed to be of another mind. It was perilously close to stopping her out. She couldn’t help but think about the many times that the price action hit her stop, took her out, then retraced to go on and hit the planned target leaving her behind and bemoaned. But, she also remembered the many other times when she gave in to the anxiety that acted like a pressure...

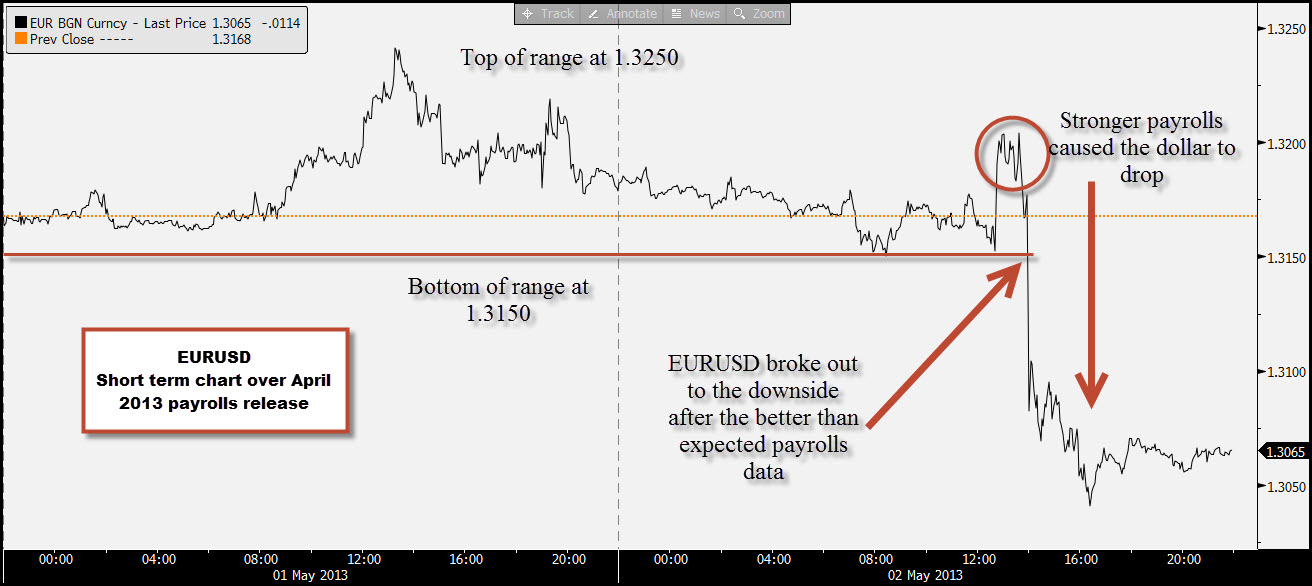

The non-farm payroll (NFP) report is a key economic indicator for the United States. It is intended to represent the total number of paid workers in the U.S. minus farm employees, government employees, private household employees and employees of nonprofit organizations.

The NFP report causes one of the consistently largest rate movements of any news announcement in the forex market. As a result, many analysts, traders, funds, investors and speculators anticipate the NFP number - and the directional movement it will cause. With so many different parties watching this report and interpreting it, even when the number comes in line with estimates, it can cause large rate swings. Read on to find out how to trade this move without getting...

In my 10+ years experience in the Forex trading industry, one of the most common debates I've seen traders engage in is fundamental analysis vs. technical analysis. Which one is better? Which one should be used for trading?

For me, it's a no-brainer: the answer is both. Even if you are an intraday trader trading off the tiniest moves in the Forex market, having some idea of the fundamentals can alert traders to changes in regulations that effectively alter the game. So, at the very least, fundamentals are important because they may affect regulation, which affects all traders regardless of their approach. Because traders need to be aware of regulatory changes that inherently alter the game of trading, they will benefit from monitoring...

How would you like to make $1,287 in 10 minutes? Well, if you had purchased a $100,000 lot of U.S. dollar/Japanese yen on Dec. 10, 2003, at 107.40 and sold 10 minutes later at 108.80, you could have. It would have worked like this:

1. Bought $100,000 and sold 10,740,000 yen (100,000*107.40)

2. Ten minutes later, the USD/JPY increases to 108.80

3. Sell $100,000 to buy 10,880,000 yen, to realize a gain of 140,000 yen

4. In dollar terms, the gain would be 140,000/108.8 = $1,286.76 USD

So, who was on the other end of the trade taking the huge losses? Believe it or not, it was the central Bank of Japan. Why would they do this? The act is known as an intervention, but before we discover why they do it, let's quickly review the economics of...

Based on experience, here are my thoughts on what makes a successful trader.

I have been teaching beginners to trade for many years, and over all those years I have found that things do not change very much, with one exception – the technology improves. When I started out, never in my wildest dreams could I envisage trading from a mobile phone or an iPad. However, it can be confusing to the newcomer. I’m sure if I was starting my trading adventure right now I would be faced with mind boggling choices and really wouldn’t have a clue where to start. When I started all those years ago, there were very few places you could go to get a solid foundation in the basics of trading.

Now, you are spoilt for choice. There are literally hundreds...