You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Articles

Filters

Show only:

Loading…

My Background

Let’s see. Where to begin…

Well, to start, I’m from the States. Grew up and lived the vast majority of my life in the Northeast – Rhode Island and Massachusetts specifically. As a teenager I was heavily into computers, and had originally planned on earning a college degree in computer science. My secondary interest in the markets ended up taking over somewhere along the way, though, and I ended up studying finance instead. That saw me take a job as a junior analyst coming out of school.

My career path since then has been quite convoluted. I wrapped three periods in the employment of Thomson Reuters (originally Thomson Financial) around grad school and a 7 year stint as a full-time volleyball coach. While in the industry I...

The answer is, because “simple” works, but that’s not enough information to fill up an article. So, let’s take a look at some unrelated examples to really see if “simple” is the best approach to most of the things we do.

Have you been to a gym lately where they offer personal training? I have been going to the gym for as long as I can remember and my routine has not really changed much over the years. These days, however, I see some interesting exercises going on during personal training sessions around me. I see people standing on one foot, on a big rubber ball, doing arm curls. The first time I saw something like that I thought of the circus. Just the other day I was bench pressing and to my left I saw this man walking toward me with...

Traders generally buy and sell securities more frequently and hold positions for much shorter periods than investors. Such frequent trading and shorter holding periods can result in mistakes that can wipe out a new trader's investing capital quickly. Here are the 10 worst mistakes made by beginner traders:

Letting losses mount

One of the defining characteristics of successful traders is their ability to take a small loss quickly if a trade is not working out and move on to the next trade idea. Unsuccessful traders, on the other hand, get paralyzed if a trade goes against them. Rather than taking quick action to cap a loss, they may to hold on to a losing position in the hope that the trade will eventually work out. In addition to tying...

Shorting covered calls is a very popular option trading strategy that involves shorting a call option and taking a long position in underlying stock. On the upside, there is limited capped profit to the trader with limited and proportionate loss on the downside. Experienced traders apply this strategy with the right timing and careful selection of the expiry and moneyness of call options

The risks in selling covered calls

There's a common misconception that any option that is shorted, the potential for loss is unlimited. The same is thought of short covered calls, but this is not true. In fact, the maximum risk in a short covered call position is limited and can be managed efficiently - with the proper timing of the trade and selecting...

My Background

I’m tomorton, Tom for short. I started life in sub-polar North West England. The North West is cold and wet but friendly. I’m now in the sub-tropical South West, which is warm and wet and friendly. It’s also roomy and very laid back.

My early employment was in local government. I was one of those cheery inspectors who come to your workplace and tell you you’re breaking ‘ealth and safety rules. I also used to go round to people’s houses and tell them to play their music quieter, and stop their dog from barking, and stop having a smelly house that sickened the neighbours.

Needless to say, my colleagues and I were welcomed wherever we went and afforded the warmest hostility.

As soon as I’d built up a decent pension pot I...

With the new year only a few days old, there’s still plenty of time for retail investors to craft their strategy for 2015. Like last year, 2015 is full of promise and better overall economic conditions are ahead. Globally, we should continue to improve since the depths of the Great Recession and credit crisis. But the best conditions for stock market gains could be found in the United States.

According to several market strategists and analysts, the U.S. is still the best nation to bet on in 2015. For investors, that means staying strong or even adding to their U.S. stock holdings in the New Year.

Hoping For a Four-Peat

When it comes to picking which stock market may be the best horse to ride, investors may want to stick with the...

The best trade could be in the opposite direction when a classic price pattern doesn’t behave according to perfect rules outlined in popular books and web sites. In fact, well-known patterns such as the head and shoulders and bull flag have clearly defined levels that can trigger trade entry signals that are contrary to the direction in which they're naturally leaning. Alex Elder examined this phenomenon with his Hound of the Baskervilles signal in Trading for a Living when he highlighted a head and shoulders neckline that just wouldn’t break, encouraging observant traders to jump into long positions, rather than following the herd and selling short

We're taught early in our trading careers to buy breakouts and sell breakdowns, but...

Many traders look to volume as a method for identifying the strength or weakness of a trend. It may also be used to gauge turning points at supply and demand. In looking at volume, most traders will place the volume histogram at the bottom of their chart to see it correlating with the candles and thus the trend.

There is another way to incorporate volume into your charts. You can combine volume with the candles themselves. Volume charts are created in the same way as normal candles. However, instead of being based on time, a new candle is created only when a certain number of shares are traded. Time is irrelevant. Until enough shares are created to complete the current candle, it will not close and a new one will not be formed...

Fundamental and Technical Analysis

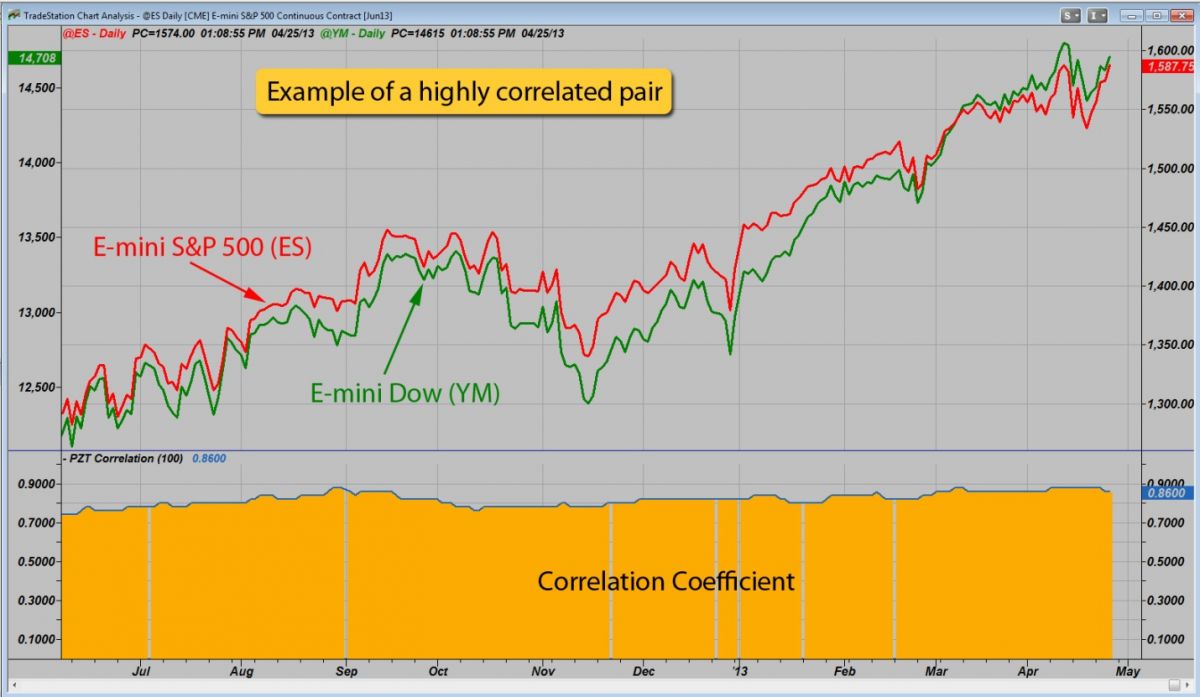

Pairs traders employ either fundamental or technical analysis, or a combination of the two, to make decisions regarding which instruments to pair, and when to get in and out of trades. Many pairs traders apply technical analysis techniques and then confirm the findings using fundamentals. This extra “layer” of analysis can be used simply to ensure that the trade “makes sense”. For instance, if all technical analysis points to taking a long position in stock ABC and a short in XYZ, but the fundamentals show that stock ABC will have a weak earnings report, the position may need to be reconsidered.

Fundamental factors

Fundamental analysis examines related economic, financial and other qualitative and...

Introduction

Pairs trading is a market-neutral trading strategy that matches a long position with a short position in a pair of highly correlated instruments such as two stocks, exchange-traded funds (ETFs), currencies, commodities or options. Pairs traders wait for weakness in the correlation, and then go long on the under-performer while simultaneously going short on the over-performer, closing the positions as the relationship returns to its statistical norm. The strategy’s profit is derived from the difference in price change between the two instruments, rather than from the direction in which each moves. Therefore, a profit can be realized if the long position goes up more than the short, or the short position goes down more than...

You don't need to look to other traders, books, videos or courses to find a day trading strategy as with a bit of guidance you can develop day trading strategies of your own. One of the ways to journey into day trading strategy development is by using technical price or chart patterns. Price patterns are recurring themes you see day in and day out, which more often than not can lead to a certain defined outcome which you can capitalize on. Finding these pattern and ultimately developing a strategy for trading them will require five broad steps.

Money Management

Most successful trade traders risk less than one or two percent of their account on each trade. Your first step in developing a strategy is assessing how much capital you're...

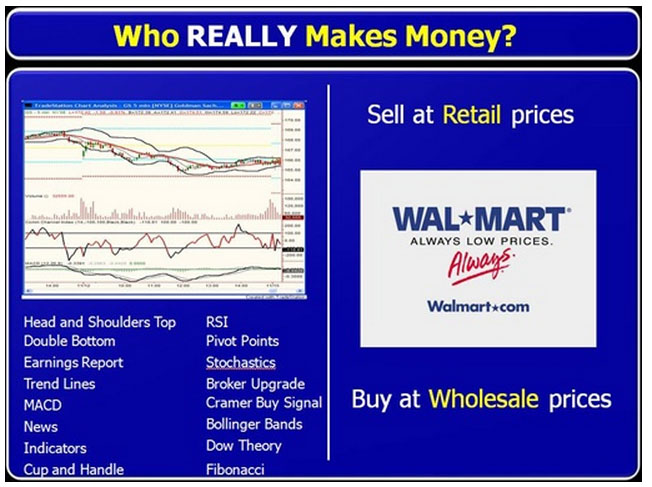

Movement in price is based simply on supply, demand and the human behavior relationship that exists in any market. And, clearly, opportunity always arises when this equation is out of balance. Whether trading the S&P, buying a house, a car or a Michael Jordan rookie card, how we make money buying and selling never changes.

My Path

Let me begin by saying that I have never read a trading book from cover to cover. Also, I started my career on the floor of the Chicago Mercantile Exchange (CME), not looking at a screen-based chart for the first year. On top of that, from an early age I was always taught not to accept something as true just because someone says so. What I do is apply simple logic to everything that presents a challenge, and...

Much is made of the "Wall Street analyst" as though it were a uniform job description. In reality, there are significant differences between sell-side and buy-side analysts. True, both spend much of their day researching companies and industries in an effort to handicap the winners or losers. On many fundamental levels, however, the jobs are quite different.

The Sell-Side Job Description

Simply put, the job of a sell-side research analyst is to follow a list of companies, all typically in the same industry, and provide regular research reports to the firm's clients. As part of that process, the analyst will typically build models to project the firms' financial results, as well as speak with customers, suppliers, competitors, and other...

Over the years my views, comments and evidence against technical analysis have been called controversial by many on the retail side of the business (although most professionals I talk to view them as perfectly reasonable). So, I thought, if I’m to be viewed as controversial I might as well go the whole way and I’m sure that this article will really get the technical analysts reaching for their quills!

I am a big fan of Derren Brown, who for those of you who don’t know, demonstrates psychic readings, hypnosis, conversing with passed loved ones as a medium and other similar skills, yet he does not believe that these techniques have any validity. What he shows is that those who perform these activities do not posses supernatural or...

Well, I have to confess to being very surprised at being asked by Tim to create a short background piece. I haven’t been around T2W much lately, and when I do pop up it’s usually just to shoot somebody down with an acerbic comment or two and then disappear again for another few weeks. Even when I was most engaged and active with T2W a few years ago, I don’t think I was ever the most popular member. I got a few bans for arguing and standing my ground. I like to call a spade a spade and an idiot an idiot.

Karl6666 summed it up best with the quote I use in my signature: 'Why doesn’t anybody like you R_E, is it because you shout?'

My Background

I’m ex-British Forces, that most famous of oxymoron’s, Army Intelligence. I subsequently spent...

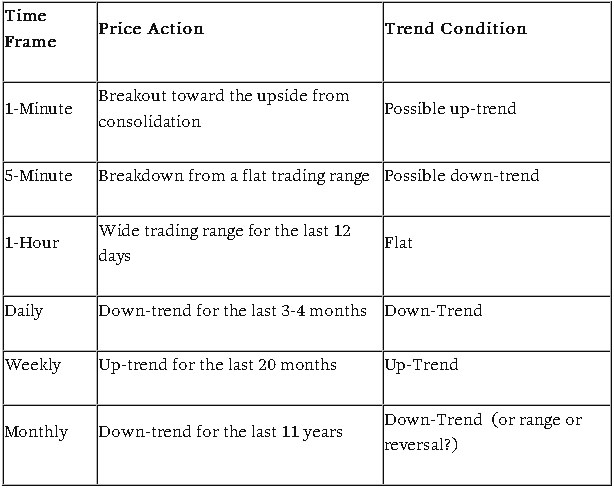

If you have been involved in the markets for more than a short while, you have probably heard the expression “The Trend is Your Friend.” In fact, it is so common that it almost seems trite. Maybe it is, but that doesn’t mean it’s not true. Simply put, over the years many traders have concluded that it is generally a higher probability strategy to trade with the current flow of money, rather than paddle upstream.

Let’s say, then, that you too decide to swim with the current. Is there a strategy that lets you dive in but decreases the chance of immediately drowning? The answer is a resounding “yes!” Welcome to “The Pullback”

As the name suggests, a pullback is a short term move in the opposite direction of the longer term trend. It can...

Trend does not exist in the now and the phrase, "the trend" has no inherent meaning. -Ed Seykota

Among the various foundational concepts in technical analysis, trend occupies a unique space in its peculiarity. This article aims to explore the peculiar aspects of “trend” – a concept which may seem simple and familiar, yet is highly paradoxical when viewed from a critical perspective.

From a technical standpoint, the concept of trend is fairly straightforward and easy to grasp. Identifying a trend on a chart, or distinguishing trending from non-trending movement, is a fairly intuitive exercise. With regard to form, trends seem to possess a distinct clarity and singularity. With regard to progression, trends seem to exhibit a sense of...

The colossal size of the global foreign exchange (“forex”) market dwarfs that of any other, with an estimated daily turnover of $5.35 trillion, according to the Bank for International Settlements’ triennial survey of 2013. Speculative trading dominates commercial transactions in the forex market, as the constant fluctuation (to use an oxymoron) of currency rates makes it an ideal venue for institutional players with deep pockets – such as large banks and hedge funds – to generate profits through speculative currency trading. While the very size of the forex market should preclude the possibility of anyone rigging or artificially fixing currency rates, a growing scandal suggests otherwise.

The Root Of The Problem: The Currency “Fix”

The...

Computer applications have made it easy to automate trading, especially for short term intensive activities like day trading, making the usage of trading software very popular. The debate continues on the profit potential which can be realistically derived from day trading activities, as brokerage and commissions are said to take away the major portion of available profit potential. It thus becomes very important to select the right day trading software with a cost benefit analysis, assessment of its applicability to individual trading needs/ strategies, as well as the features and functions you need.

Day trading is a time bound trading activity where buy or sell positions are taken and closed on the same trading day, with an aim to...

My Background

Timsk’s brief was to draw a pen-picture of my trading self – so I’ve attempted to show how I have adopted a trading style to suit my personality and character rather than vice versa. I was born into the post-war baby-boomer generation which benefited from grammar schools, free University, early retirement, easy access to the housing ladder and youthful participation in the 1960s – what a golden age! I spent my early years as a small cog in the Cold War machine having been attracted by an RAF advert showing a fast jet flashing down a Welsh valley at not many feet above the ground. It invited dreamers to cut out the picture and doers to send off the coupon. This I did, and some years later I came to relive that advert for...

The Coppock Curve (CC) was introduced by economist Edwin Coppock in Barron's, October 1962. While useful, the indicator isn't a commonly discussed amongst traders and investors. Traditionally used to spot long-term trend changes in major stock indexes, traders can use the indicator on any time and in any market to isolate potential trend shifts and generate trade signals.

Coppock Curve

Coppock initially developed the indicator for long-term monthly charts; this will appeal to long-term investors as signals are quite infrequent on this time frame. Drop down to a weekly, daily or hourly time and the signals become progressively more abundant.

The indicator is derived by taking a weighted moving average of the rate-of-change (ROC) of a...

Currently the implied volatility levels in the stock market are much higher than they have been for quite some time. What does this mean for our option trading?

One of the main factors in the profitability of our option trades is the “inflatedness” of the prices of the options. When the consensus of option traders is that stock prices will move rapidly, then the prices of options will be inflated. We say that “implied volatility” is at a high level. At such times, as a general rule we want to use options strategies in which we sell options short. We then hope to buy them back later at lower prices, if we have to buy them back at all.

In times when option prices are deflated (implied volatility at a low reading), we use different...

There are times when an investor should hold onto a stock when a company has just reported solid earnings or made some other positive announcement. However, there are also times when an investor should bail the second good news hits the tape. So how can you tell when to "sell on the news"? Let's take a look at some of the instances where bailing out might be the best option.

Look for Something Offsetting

Very often, companies are aware that a particular piece of bad news will have an adverse impact on their stock price. In an effort to limit the potential damage, they combine it with a positive announcement and then disseminate it to the wire services, hoping that Wall Street will overlook it. Don't be fooled by this tactic! Read the...

My Background

I was raised in Yorkshire, the youngest of three children and had a very happy - yet uneventful - childhood. I left school and headed off to university where I acquired a BA (Hons) in Business Management. I look back at the university years as some of the best years of my life; I met many people and made some wonderful friends, and retain two very close friendships to this day.

My most endearing memory of university was meeting a stunning brunette who, after several futile attempts at getting her to accept a date, succumbed to my then boyish charm. Several years later she became my wife, and we went on to have two children, a girl and a boy now 22 and 19 respectively.

After university, I followed my parents’ path into...

Noise removal is one of the most important aspects of active trading. By employing noise-removal techniques, traders can avoid false signals and get a clearer picture of an overall trend. Here we take a look at different techniques for removing market noise and show you how they can be implemented to help you profit.

What Is Market Noise?

Market noise is simply all of the price data that distorts the picture of the underlying trend. This includes mostly small corrections and intraday volatility. To fully understand this concept, let's take a look at two charts - one with noise and one with noise removed:

Before noise is removed:

Fig1

After noise is removed:

Fig2

Notice that in Figure 2, there are no longer any areas in which...

When it comes to money and investing, we're not always as rational as we think we are - which is why there's a whole field of study that explains our sometimes-strange behavior. Where do you, as an investor, fit in? Insight into the theory and findings of behavioral finance may help you answer this question.

Behavioral Finance: Questioning the Rationality Assumption

Much economic theory is based on the belief that individuals behave in a rational manner and that all existing information is embedded in the investment process. This assumption is the crux of the efficient market hypothesis.

But, researchers questioning this assumption have uncovered evidence that rational behavior is not always as prevalent as we might believe...

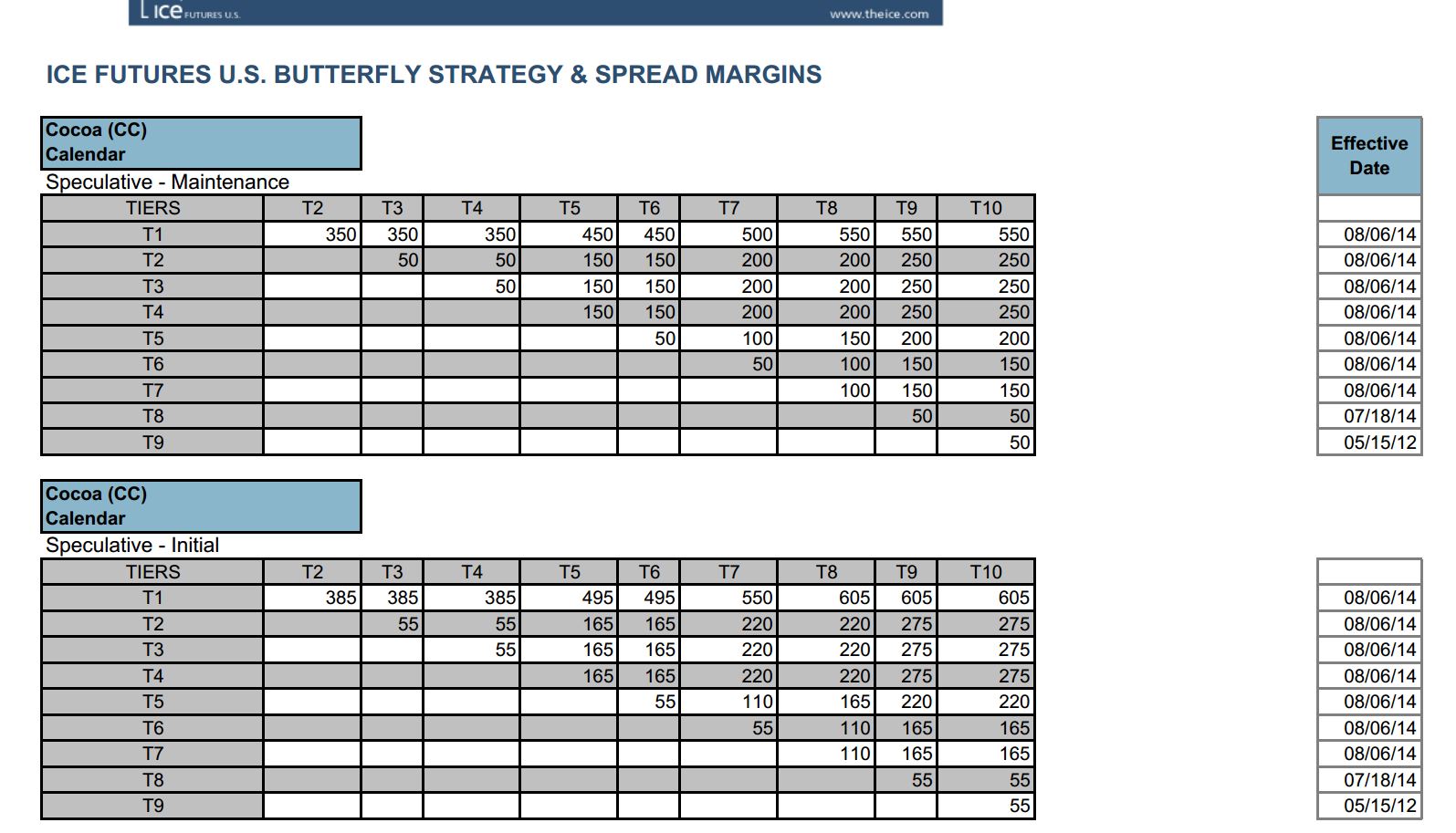

I received an email from a student in Singapore regarding the margin for Spread trading and where to find it. Spread trading is gaining more popularity, even internationally based on the emails I have been receiving. Let’s now look at two different Futures Exchanges and identify the process of figuring out how much Margin (capital) is required to trade these things called Spreads.

Spread trading involves the simultaneous purchase of one month and simultaneous sale of another month of the same Commodity to be an Intra-Commodity Spread. To simultaneously purchase and sell related Commodities is known as an Inter-Commodity Spread.

The Intra-Commodity Spread is the least volatile and risky of the two. Notice I said “least” not “risk...

The prospect of making quick money lures many to the world of day trading. The participants in this game, besides professional traders, can be retirees, executives, teachers, small business owners, housewives, etc. who try and make a fortune through their computer screens. Remember, the profits which may draw you to day trading are virtual and it’s your trading style that can transform them into real gains--a daunting task, especially as a rookie.

There are rules for every game, even day trading! If you are a new player, it’s important that you are mindful of the basic set of rules. These rules are certainly not binding, but they can help you to make some crucial decisions and give broader guidelines.

1. Knowledge

“Knowledge is...

My Background

So my real name is Rob but you don’t have to be a brain surgeon to figure that one out. Also, if you are feeling particularly ‘Miss Marple’, you may have concluded from my handle that I was born in 1970, therefore making me fairly middle aged. Married, 2 children, dog, some chickens, living in a semi-rural location. Work wise I am lucky as I get to choose what I want to do. I do management consultancy/interim management work in my specialist subject of Internet/Telecommunications/Software when I feel like it. I trade when I feel like it. I tend to do one or the other and not both at the same time.

Currently I am on a (roughly) one year assignment somewhere in Europe running a business unit in a turnaround situation for a...