You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Articles

Filters

Show only:

Loading…

Are you allowing the “noise” to distract you when you are about to get in or you are already in a trade? Noise can be the news, the TV, the temperature in your office, your dog Fido that keeps coming into your office, the charts or your spouse asking you a question. Noise is anything that is in that moment secondary to your trading; in other words, something that is taking your mind away from where it should be, i.e., focused only on the things that are most important to your trade. Those things for the most part are your plan, your rules and the price action. One of the ways to remain focused is to use a process of “mindfulness.” It is a process that keeps your purpose firmly on your dashboard and your intentions for the trade in...

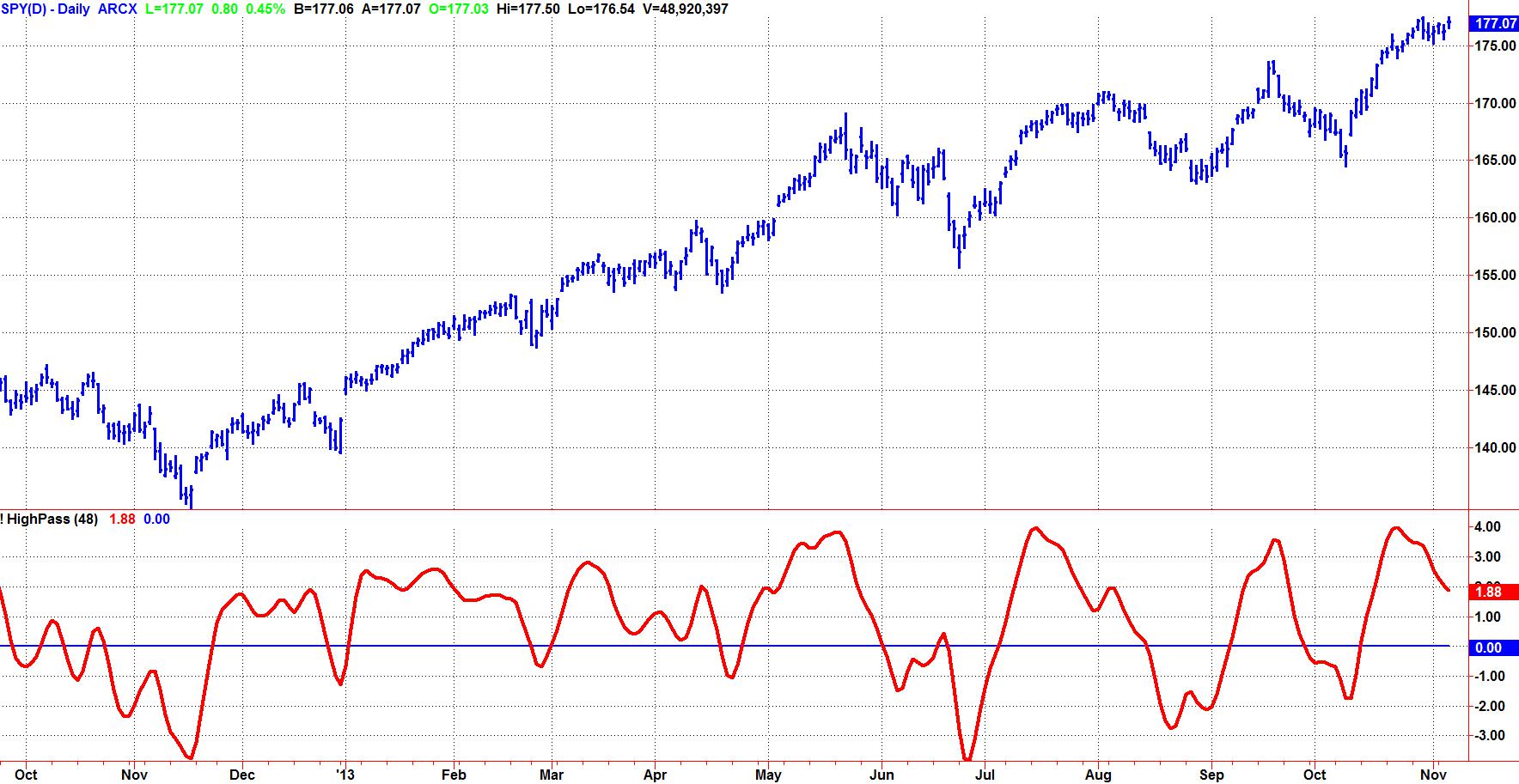

Everyone knows the market data are fractal. You can look at a chart of daily data, look at a chart of weekly data, and the charts basically look the same if the scales are removed. In other words, the amplitude of the cyclic swings scale in direct proportion to the cycle period. I call this effect Spectral Dilation because longer cycle periods have larger swings. The Hurst Coefficient is directly related to the degree of dilation. Fibonccians use the Golden Spiral to show the dilation factor is 1.618. The exact degree of dilation is not important. The fact that dilation exists is beyond question. So, in round numbers, the spectrum amplitude increases 6 dB per octave of cycle period. This “1/F” phenomena seems to be almost...

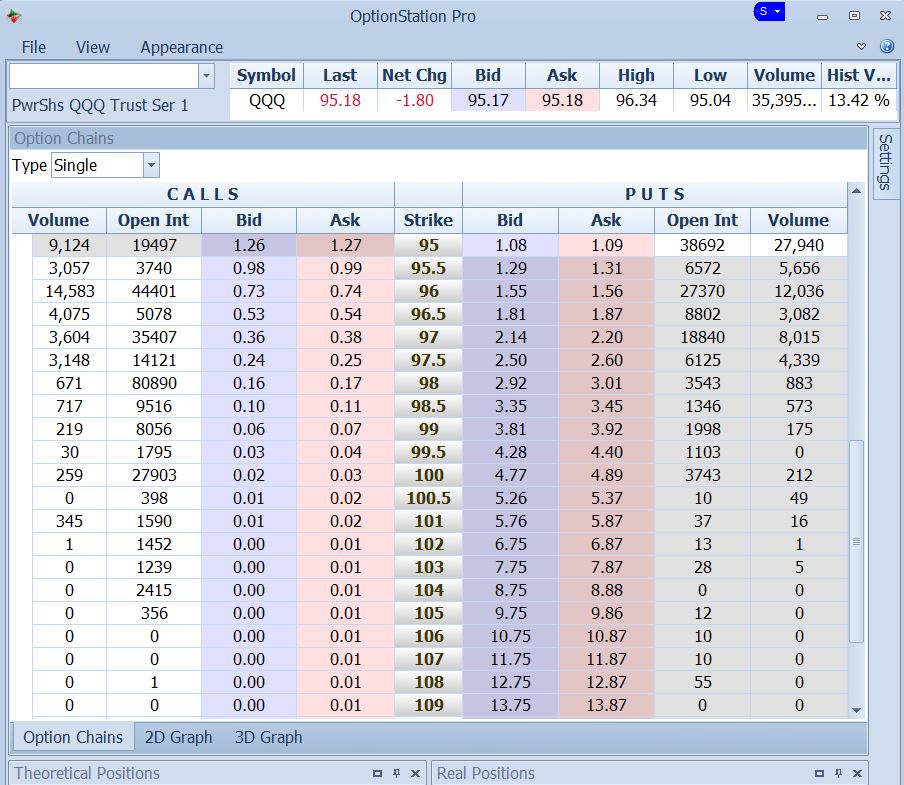

When you click the “Buy to Open” button on your option trading platform, from whom are you buying? And does it matter? Well yes, it does matter. It can affect the price you pay for the option, to the degree that it might make the difference between a winning trade and a losing one.

The options market is made up of multiple exchanges. Each exchange hosts many options “market makers.” The market makers are broker/dealers, whose job is to buy options wholesale and sell them at retail. These dealers are always present in the market.

The market makers’ computer systems make sure that they have a bid price and an offered price in the market at all times for all the options they deal in. This is true whether any trades have taken place in...

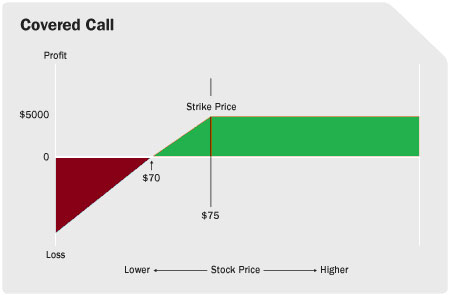

Many investors find volatile – fast moving markets to be very unsettling, but low volatility – sideways markets can be equally frustrating because while risk could be lower, the potential for profit is probably reduced as well because option premiums are lower during these periods.

Here I’ll discuss a few strategies that I believe may be better suited for a low volatility – sideways moving market:

Out-of-the-money (OOTM) Covered Calls

If you already own a stock and it is worth at least as much as you originally paid for it, covered calls can be a great way to generate income. If you sell out-of-the-money calls and the stock remains flat, declines or even increases a little, the options will likely expire worthless and you’ll keep the...

My Background

I was born into a gambling family. My dad and grandfather were Bookmakers back in the 60s & 70s and they were also very successful professional gamblers (mainly horse racing). I used to sit in their back office as a toddler using a toy phone so I could pretend to take/make bets like all the other people sitting around me. Then, when I was a little older, I was on the phones for real to make some extra pocket money.

By thirteen, dad set me up with one of his accounts to bet my own money on the horses and my education went to the next level. It sounds crazy and irresponsible, but they always monitored me closely and I was going to do it anyway….. they wouldn’t have been able to stop me!

By the late 70s I was seventeen and...

Looking for the right Forex broker has been a task that many of us have loved and hated. Sometimes we find the right one pretty much straight away but at other times we struggle so much that we simply want to give up. The problem is that there is so many different Forex brokers out there such as ECN, STP, futures, options and so on. The sheer volume of them available for every sector can become the obstacle in actually finding one. Despite all this however, there is only one type of Forex broker that we should all look for – a business partner.

Business partners tend to have each other’s interests at heart and they both agree on the final outcome of the project, whatever it may be. The final outcome is usually related to profit and the...

A “Risk Reversal Strategy” offers a big potential pay-off for very little premium. While risk reversal strategies are widely used in the forex and commodities options markets, when it comes to equity options, they tend to be used primarily by institutional traders and seldom by retail investors. Risk reversal strategies may seem a little daunting to the option neophyte, but they can be a very useful “option” for experienced investors who are familiar with basic puts and calls.

Risk reversal defined

The most basic risk reversal strategy consists of selling (or writing) an out-of-the-money (OTM) put option and simultaneously buying an OTM call. This is a combination of a short put position and a long call position. Since writing the put...

Long before we had computers to chart price, traders were making a living and doing it by watching price movement. One of the earliest types of charts was called point and figure charting (P&F). It started from traders who would tick off prices as they watched the trading. Eventually the ticks changed to X’s and O’s to note movement in price and even see trends.

Today, many chartists have switched to candlestick charting to make their decisions to buy or sell. A drawback to this style of charting is that many people are prone to exiting early from profitable trades when they see small pullbacks or corrections. An advantage of point and figure charting is that it allows the trader to see the trend and stay in the trend even through...

In my first article last week, I discussed the basics of creating the point and figure style of chart. In this article, I will build upon that knowledge and show more advanced methods for identifying patterns and projecting price movement. I want to mention that I tend to use this method of charting for longer term swing or position trades rather than intraday. Remember that time is not a factor when attempting to achieve targets in P&F and you will likely hold positions for some time. Patterns in P&F charts are a bit different than what you may be used to in candlestick charting. A triple top formation is not necessarily a reversal formation, it could be continuation. It will still offer a trading opportunity however. Look at the...

In my early days, I was always fascinated by the gap in the financial system between those who know what they are doing and profit, and those who don’t and lose money. It was really fascinating, big strong institutions made so much money and were correct most of the time. At the same time, retail traders and investors were equally wrong most of the time and lost tons of money. If I could just figure out how and why an institution made the trading decisions they did, maybe one day I could reap the same rewards was my thinking. I also spent time figuring out why retail traders performed so poorly, that was actually very easy to do. Without going into too much detail, I also realized that most retail traders and investors learned to...

Traders attempt to isolate and extract profit from trends. There are multiple ways to do this. No single indicator will punch your ticket to market riches, as trading involves other factors such as risk management and trading psychology as well. But certain indicators have stood the test of time and remain popular amongst trend traders. Here we provide general guidelines and prospective strategies are provided for each; use these or tweak them to create your own personal strategy.

Moving Averages

Moving averages "smooth" price data by creating a single flowing line. The line represents the average price over a period of time. Which moving average the trader decides to use is determined by the time frame on which he/she trades. For...

Calculating investment performance is one of the first things finance students must learn in business school. Along with risk, return is a fundamental concept that is clearly important when dealing with wealth and how to grow it over time. The compound annual growth rate, or CAGR for short, represents one of the most accurate ways to calculate and determine returns for individual assets, investment portfolios and anything that can rise or fall in value over time.

The CAGR represents the year-over-year growth rate of an investment over a specified time period. And as the name implies, it uses compounding to determine the return on the investment, which we will see below is a more accurate measure when those returns are more volatile...

On the afternoon of May 6, 2010, the Dow Jones Industrial Average (DJIA) plunged 800 points in less than 20 minutes before recovering most of its losses, creating a new term in the financial lexicon – the “flash crash.” The Dow’s intraday drop of 998.5 points or 9.2% was its largest points decline on record, while its intraday swing of 1,010 points was the second-largest in the history of the index, exceeded only by a 1,018-point swing on October 10, 2008. While the Dow’s temporary swoon during the flash crash was a harrowing reminder of the market collapse after the bankruptcy of Lehman Brothers in September 2008, the culprit this time was not overwhelmingly bearish sentiment but something altogether different – program trading.

What...

The bailout of Greece's economy and the subsequent action to restore Cyprus' economy were the big Euro-stories of the last three years. A year on from the Cyprus crisis and a few weeks after the Greek government returned to the private capital markets, all seems to be quiet but is this the lull between storms?

The stories of the fall of both countries' economies has many similarities yet many differences but neither country is out of the woods yet. In this article we examine the causes of the collapse and what the future holds for each.

Behind the terrible state of the Greek economy which first came to light late in 2009 and into 2010 was the systematic fabrication of economic statistics which hid a growing fiscal deficit which was...

Futures’ trading has been around for hundreds of years. Even before Futures Exchanges existed trading was done by either a handshake or a forward contract. Producers and Processors of Commodities both have always needed a way to protect against price risk. The Producer, who owned the Commodity was concerned prices might drop before they delivered their product. Processors always worry that price might rise before they purchase the Commodity to process and later sell. Price risk is always a concern to these entities in the Futures markets.

These entities are comprised of Commercial traders who use a physical Commodity in their day to day business. Commercial traders do approximately 60% of the daily volume in the Futures markets...

Dark pools are an ominous-sounding term for private exchanges or forums for trading securities; unlike stock exchanges, dark pools are not accessible by the investing public. Also known as “dark pools of liquidity,” they are so named for their complete lack of transparency. Dark pools came about primarily to facilitate block trading by institutional investors, who did not wish to impact the markets with their large orders and consequently obtain adverse prices for their trades. While dark pools have been cast in a very unfavorable light in Michael Lewis’ bestseller “Flash Boys: A Wall Street Revolt,” the reality is that they do serve a purpose. However, their lack of transparency makes them vulnerable to potential conflicts of interest...

“What’s going on here?” Sheila all but shouted silently in her head. Her plan was to use the Keltner Channel to signal a price break-out on the NQ E-mini, in tandem with the price action hitting the Demand Zone at the lower end of the channel. The set-up actually was a high probability trade as she had calculated it using her odds enhancers; and all would have been fine if only she had followed through with the plan. There she was, after having entered the trade and was now watching the price action when it began to inch downward toward her stop, which was placed 3 ticks below the distal line of the DZ. At first she felt her stomach knot, but she reassured herself that it was OK and that she would continue to follow her plan...

With the changes in the perception of Forex trading from being a high speed, high risk gamble, to being a scientifically driven investment vehicle, supported by social media, there are likely to be many more Forex traders in the coming years.

All of these will have dreams, big or small; some are destined to fail, many more will make a success of trading and if we were able to see inside the minds of each, we'd find clear reasons why some made it and others fell by the wayside.

Jump in a car for the first time, set off thinking you know what to do because you’ve been a passenger so many times and you’re heading for a crash unless you’re lucky enough to be a natural driver.

The analogy could well be applied to trading Forex where...

My Background

I am a Trade2Win (T2W) home grown lad.

I have no background in trading or technical analysis (TA). My father had no experience in the stock market. He invested some of his savings in the early 1970s and lost most of it when the market crashed in 1974. He did not wait a couple of years for the market to spring back. After watching him go through some pain, I vowed never to invest in the stock market. Luckily, he had some money invested in residential property, so all was not completely lost.

I grew up in Manchester. I am a Manu fan, went to the local grammar school and did science ‘A’ levels. I then went to University College London to study dentistry. I qualified as a dentist and went to work in general practice, which I...

Firstly back-testing should be done as accurately as possible. This means that all the best practices of back-testing should be implemented. Some examples are:

Including reasonable spreads

Avoiding look forward bias

Including any possible forms of commissions if applicable

Using historical data which is as accurate and complete as possible

Ensuring trade logic tested is reasonable and practicable in actual trading

Reducing slippage (although this is normally not a problem with Forex due to its immense liquidity)

With accurate back-testing, characteristics of the trading strategy can be observed and analysed reliably. What this means is the risk and returns profile of the strategy is statistically reliable, and any performance...

Hello traders! This week I will try to explain a bit about relative strength between individual currencies, help you choose which pair to trade, and suggest a couple of rules for your trading plan.

In the classes that I teach, obviously the topic of charts comes up, along with which currency is getting stronger vs. another when looking at the chart. An easy (and somewhat politically incorrect) way of remembering how the charts work is to think about a teeter totter or see-saw from our childhood playgrounds. When looking at that teeter totter from the side, if the right side is pointing up, the kid on the left side of the teeter totter is fatter than the kid on the right side. In the currency market, the base (currency on the left) is...

Of the various jobs that I have had during my twenty two year career at Charles Schwab, I have enjoyed my current role the most. I am the manager of Schwab’s educational webinar program called LiveOnline. I get to interact with fellow traders during virtual training sessions and answer their questions on a wide variety of topics. I have learned some valuable lessons over thirty years of trading that I hope to share with you in this article.

As investors and traders, our past experiences and training can influence how we approach the financial markets. As I found out myself, these experiences can be helpful in trading, but they can also stand in the way of success.

My formal academic training was as a biochemist. I did research...

Much has been written about crowd and group behavior in the investment industry, but one aspect that has received little attention is emotional contagion. As the term suggests, people can infect each other behaviorally. And in the field of investment, this can cost everyone a lot of money.

The term contagion has a negative connotation from its customarily application in the field of medicine and disease. Still, the term is very apt in the context of investment, because contagion frequently leads to irrational or imprudent behavior. It prevents "healthy" evaluations of investment opportunities, and gets in the way of sound judgment in decision-making.

Contagion leads to the classic blunders associated with following the crowd - buying...

Although I was invited to write an article about myself, I initially thought I didn’t have much to offer. After all, I’m not profitable in my trading, nor have I been around the block as often as many of the more senior members.

But thinking about it, my initial struggle to figure out a method and persevere through sometimes painful mistakes could serve as a cautionary tale for anyone starting out. I thus dedicate this article to anyone who is looking to get into trading. Hopefully, those who walk the walk will appreciate what I have to say as well!

My Background

So who am I? Probably unbeknownst to many T2W members, I was actually born hard of hearing. The struggle of dealing with my hearing growing up and going through public...

Every March, and other quarterly months (June, September, and December) the futures contracts that track interest rates, currencies, and the stock index futures come to the end of their contract life, and expire. This necessitates the need for traders engaged in these markets to exit these contracts and roll them over to the next quarterly month.

This phenomenon is unique to the futures market and to someone new to trading these markets it can sometimes be confusing. Because March is the end of the quarter, the “Rollover” event is happening throughout the month across most futures contracts, particularly in the financials since they expire quarterly. We tend to get many questions from our newer futures traders regarding this topic...

Options provide investors with ways to make money that cannot be duplicated with conventional securities such as stocks or bonds. And not all types of option trading are high risk ventures; there are many ways to limit potential losses. One of these is by using an iron butterfly strategy that sets a definite dollar limit on the amounts that the investor can either gain or lose. It's not as complex as it sounds.

What Is An Iron Butterfly?

The iron butterfly strategy is a member of a specific group of option strategies known as “wingspreads” because each strategy is named after a flying creature such as a butterfly or condor. The iron butterfly strategy is created by combining a bear call spread with a bull put spread with an identical...

What is order flow trading? In order to define order flow trading one would first need to delineate exactly the type of trading one is discussing. There is quite a bit of dialogue about order flow trading and misperceptions abound as to the most efficacious manner in which to use this trading method.

Some describe order flow trading as directional trading, i.e., you are betting that prices will either move up or down. If you believe a currency pair will go up, you will execute a buy order, going long. If you believe a currency pair will fall, you can sell it, shorting the trade.

Order Flow-Transaction Flow

Order flow can also be referred to as transaction flow. Transaction flow takes place when someone believes the price of a...

Forex trading is one of the most challenging ventures a person could probably undertake in their life. Going to the gym and building muscle won’t help you, nor will going to university and getting a fancy degree. This job requires psychological features of strength, which most new traders do not have, and sadly may never get.

Successful trading basically comes down to how disciplined you are. You might have the best strategy in the world but if your head isn’t in the right place, you will end up just being another statistic.

Most traders are disappointed with the unlimited money making potential of the market against their own performance, and are acting out of emotions like desperation, greed or fear to try and close the gap. Here...

Gambling is defined as staking something on a contingency. However, when trading is considered, gambling takes on a much more complex dynamic than the definition presents. Many traders are gambling without even knowing it - trading in a way or for a reason that is completely dichotomous with success in the markets.

In this article we will look at the hidden ways in which gambling creeps into trading practices, as well as the stimulus that may drive an individual to trade (and possibly gamble) in the first place.

Hidden Gambling Tendencies

It is quite likely that anyone who believes they don't have gambling tendencies will not happily admit to having them if it turns out they are in fact acting on gambling impulses. Yet discovering...