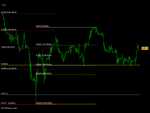

Dow and S&P completely bullish Wednesday, little fall from open and both finished very near day's highs. FTSE, however, looked tentative and failed to match Tuesday's high, so significantly lagging US indices. So, expecting FTSE to gap higher in the morning I am long intra-day. Course, it may then have a regular attack of timidity and fall back, but must surely push higher as US open approaches. Should be third up day in swing upleg, several indices approaching 50EMA, S&P skirmishing with 2007 lows, and we should see FTSE re-attempt 6000. Could be quite bullish if we establish bridgeheads above these various obstacles. Remain long from swing trade 12/02.