This is a real dilemma. Damn US holidays!

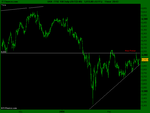

FTSE action Friday not a great help for next week - very negative from early morning and a wide range (2.6%). Anyone placing buys and sells above and below Thursday would have seen both entry points hit in one day as it breached both triangle trendlines - thanks for your help London. This was a swing down day so technically I should have shorted Friday from 5859 as we breached Thursday's low and would have if not for the US holiday.

The S&P is my usual guide for the week ahead, and as well as being more influential also shows more visible TA. Very narrow range, easily an NR7: actually its an NR36, narrowest range since 26/12 (coincidentally? the base day for the current symmetrical triangle). Dow also easy NR7 for Friday, both ranges less than 1%. Did not breach triangle trendlines. Each formed a hammer, often bullish after a downtrend: but we weren't in a downtrend, so I suspect we can put a discount on the significance of the S&P and Dow hammers (one is yin and one yang anyway).

NR7s suggest imminent increase in price volatility and breakout through the triangle. Better late than never but which direction? The London suits covered both options by trading up, then way down, but they were only trying to re-balance with the Dow as suggested and I don't see the range as significant re future price action. This range, 2.7%, is too extended for me to derive a stop-loss. In any case, opening a position over the weekend or on Monday could be a blind gamble in the absence of US direction.

Anyway, I won't be opening any FTSE positions over the weekend or on Monday and will only do so Tuesday pm if we have cleared 5939 as bullish continuation or 5681 as bearish continuation. However, I feel a better option would be to place a buy order above and sell order below either S&P or Dow Friday ranges and await developments. The range is narrow so the opposite extreme would be a viable stop (though at under 1% these ranges make it more possible that whipsaw would hit both entry points in one day). Of course, I don't really expect the markets to break out of the triangle northwards any more than Tim does. Should be another interesting week.