Forexmospherian

Legendary member

- Messages

- 39,928

- Likes

- 3,306

Sure, I asked the reasons to exit the trades. It's important to understand when to exit a trade, as Sun and myself are struggling with that. On movements of say 20 pips we end up with just 4-6 pips at most. Price in our charts never goes straight from entry to +20 pips in our direction. It can make several pullbacks with stalls in price where one can be prone to exit, to see a bit latter price carrying on with the move, but without you because you exited on the pullback stall or strong retracement candles.

Anybody trading real time can relate to that experience. That's the difference between trading real time and on hindsight.

Cheers,

K

Hi K

They happen every day on many pairs - but sometimes you might have to wait over a 2 hr session to see them

If you can cover say a 8 hr period and just spend anything from 12 min to 30 mins every hr - so in total min under 2 hrs - max over 4 hrs - you will see many

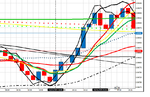

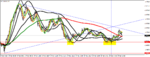

Here's a perfect example - over 33 pips net in 8 mins - 8 1 min candles moving up from 1 min before a KT

OK - if you wanted to be fussy - 10 11 am UK time to 10 15/16 am with a 3 pips spread you still get 20 pips - say 5 mins in total - 2 quick LR's spaced nicely .

I have so many advantages over anybody not used to the method - as I have been trading this way over 10 yrs with nearly 8 yrs full time.

I guess I should be more skilled than any traders not continually doing it approx 200 + days per annum.

I agree you don't get so many moves like this on the EU / AU / UJ in 5 or 8 mins - only expect 7 -10 pips off them - but on the more volatile pairs with ok larger spreads - 25 to 40 pip continual moves over 10 to 15 mins happen a few times - everyday

The question to ask yourself ?

If you had been watching the GA at 10 07 / 08 / 09 am UK time today - would you have scalp bought ??

If you say yes - that's good - then I would have expected you to have got 15 to 30 pips - and I am sure you would have been delighted at any number of pips in between ;-)

Regards

F

Attachments

Last edited: