Hi F,

I just saw this chart on the other thread but figured it would be more useful for readers to make my questions here.

Could you please elaborate a bit on the WHY and WHERE you exited each one of those trades?

Cheers,

K

Hi Keen

I think you mean this chart on the GA posted three plus hours ago with these comments etc

GA

9 33 am

Let me say for a start - I only got 3 of the 5 scalps - one before I went out and 2 since I have been back - the 9 00 am scalp buy explained in last post.

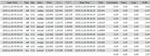

Here's the chart with the Scalps numbered 1 to 5

1 Sell Scalp from after high at 7 51 am - worth 50 pips gross - anything over 30+ pips and you did well - I left part stake on

2 Buy Scalp at 8 05 am - a bouncy ball effect from quick drop - worth gross 30 pips - buy anything over 15 pips is decent from this move

3 Sell Scalp at 8 39 am - Continuation of down bias - not here to take that one neither - dropped approx 50 pips gross again - 30 + pips on the cards there

4 Buy Scalp at 9 00 am - got that one - worth 30 pips gross - 15 -20 pips easy off that scalp all under 6 mins

5 Sell Scalp - could not mark time on chart shown but anytime after 9 07 am - a 30 pip drop again gross - again 15 -20 pips on the cards net

So lets total up the realistic pip count - forgetting partials

These are the pips you should be obtaining on a big moving pair in a busy 90mins to 2 hrs - don't expect the same pips on normal main 4 or 6 pairs - half them as a minimum .

Minimum off 5 scalps - 110 - 130 pip - all with 90 mins - out of possible 200+ pip gross and with total luck of catching all interim highs and lows in the 90 mins.

Then add your partial stakes - remember bias is bear / down - so favoured leaving part stakes on first 2 sells . That gets more complicated and remember we have to learn step by step etc - it complex and far from easy - that's why most traders don't take advantage of trying it

9 21 am on the GA was another scalp buy - no not taken it - already over 11 scalps now and its not even 4 hrs of my trading day and above my target - so no panic

OK

Well lets start by saying the Pound was bearish early AM - the GU started falling after EO at 7 00 am and the GA followed nearly an hr later after making a new morning high in a R area.

Out of the 5 scalps shown - I only took 3 of them - 2 scalp sells and 1 scalp buy - but had left a partial 30% sell on from first scalp sell prior to 8 00 am

The main reason for taking them and the exiting were I did - as follows -

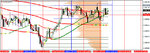

Scalp 1 - SELL after 7 51 am and 8 00 am

Based on level - time and PA movement confirmed with the help of the quick 3 LRs all going over price by before 7 51 am and then over the next 4 mins I had 6 LRs all over price saying sell

With that many LR's over price - maybe on the EU or AU or UJ you expect a 5 -7 pip fall - on the GA you expect a 15 -25 pip minimum fall

The movement was quick and powerful ( it was over the London open period and with 15 mins it had dropped nearly 50 pips . I was seeing 15 + pip 1 min candles falling quickly with no real pullback. All my quick LR's said stay with the scalp sell

With a drop that quick - you expect a "bouncy ball effect" and that came after 8 07 am with the start of the quick LRs going under price - saying scalp buy

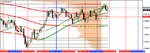

The first 2 x 1 min candles reversed back up over 12 pips but i knew the bias was bearish based on the Longer LRs being breached and price needing to go back over 0920 for it to turn to carry on up

we did not get over 0918 and so now time and quick Lrs said scalp sell again ( I was not here for this next 3rd Scalp sell )

From that level we could join a trendline from the Lower high of morning around 7 45/ 47 am down to 0918/20 and extrapolate

We had also gone over 30 + min from the high - again favoured lower

That third scalp sell was another quick drop of over 50 pips within 20 mins

By 9 00 am time to see price stalling with a LL and LH - but now time and 3 LR's under said look at scalp buys again - again another bouncy ball effect - ie the quicker the drop - expect a larger bounce.

As long as we stayed under 0920 and the down TL - it would be a sell again

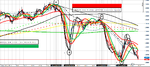

That happened at under 0900 - but this scalp sell did not make a LL and instead over the next hour price bias started to change - with no new low and it holding over 30+ mins with no breach

0862/64 area was support - that was never breached and then after 11 00 am and midday we started the slow move back up again now stopping around R at 0920/25

For me now at after 2 00 pm UK time - above 0862 and 0880 - bias is bullish - but needs back over 0930 and the high of morning at 0960 area

I would only hold scalp sell on longer under 77 - 57 and 50

I hope that starts to make sense - please feel free to question any part of the explanation