Looking at EA now and thinking why no free trade buy left on that one. Up over 180 pips just today and nearly 480 pips from Wednesday - unfortunately - left nothing on scalp buys and just kept taking scalp profits - must fine tune that part and adjust that on secondary pairs

I said this quote above on Friday afternoon and thinking why I had not been able to leave any free trade on the Eur Aud during a 130+ pip rise over the previous 10 hrs or so

As any followers of this thread know - trade entries for me are of paramount importance and need to be able to work with a maximum of a 7 pip stop and ideally from under 5 pips ( including the dealer spread and commission and in this case on the EA its normally 0.7 to 1.5 pips for the majority of trades I would take on it)

I had commented on both the EA and GA - the PA had been to my liking with say 7 -12 pip rises and then 6 -10 pip falls all within a few minutes. That type of PA may be ideal for quick scalps under a couple of minutes - but not ideal for leaving scalps on and developing them into "free trades" with the new stops in profit.

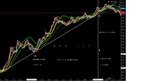

Lets look at what happened - see attached EA chart for the main time between the European Open and the London Close - ( my key trading session)

From after the opens it was possible to enter with a stop at a key support area of say 4639 to 45 ish . The rest of the day - it never went back to test this support area and kept on printing HH's and HL's on the one minute chart - the key chart for accuracy .

I have been asked before why do I not take free trades with 50% stakes instead of only 30% stakes

That is simple to answer - I have more scalps make winning pips than I do free trades - 65% - 85% of scalps make positive pips - whilst under under 50% of free trades left on make double or a lot more than the original scalp part.

So by taking off a 70% stake at a initial target say 7 -10 pips allows the 30% to go back to entry and you still come out with a good profit.

If you are able to take 70% off above 15 pips ( already a RR of 3 ) then you have a better chance of the free trade working and you could even let it go 10 pips below entry and still have a win - ie

Say 10 lots entered and at 15 pips you take 70% stake off - so at that point you have banked $1050 and still have $450 - you could have as well.

If you let that 30% stake go down to 10 pips below your initial entry - then you lose $300 off your banked profit of $1050 and so have a net $750 gain still.

Lets then say the 30% stake only goes 7 pips against your entry and then try again and over the next hr moves up 40 pips - which is really 33 pip gain and 18 pips above the 15 pip exit on the 70% .

Your total winnings then are $1050 + $990 = $2040 total and far better than taking the whole initial stake off at 15 pips - which would have given you only a total $1500 win ( so a 34% extra profit gain )

When a free trade goes on to make say 100 or 200 + pips - that's the real cream on the cake and the you can pyramid and peel on an ongoing basis - if you think the pair still as a lot more pips left in it over a longer period

Hope that explains some of my trade decisions. I do plan to look at taking 65% off and then split the 35% with still leaving 20% on for lot longer periods rather than closing all within the day - to see how that works out

Have a good last trading week of the month

Regards

F