One for F:

You keep on hammering on reading price action. Have you got any tips/suggestions to improve reading price action? You noticed somewhere in your 20K posts that you took some things from Al Brooks and Lance Biggs. Have you got anymore documents/books that someone should read in order to understand price actionb etter/

Kind regards,

Koen

Hi BD

Thank you for commenting on my strategy that I have discussed in the other threads etc - I had to try and separate them into like a live trading thread - then the strategy and the LRs etc into different threads etc - simply because it is a complex method and not for all traders etc will get it - and so unless like you they are happy to take the time and study - knowing it might take anything from 4 to 8 months to fully understand it and be able to use it etc,

With regards Price Action - yes Al Brooks and Lance Beggs helped me understand scalping and PA a lot better - but this was maybe over 8 -10 yrs ago and I feel I have moved on so much more by combining more than just PA.

All traders understand the importance of Higher Highs and Higher Lows - and of course in down trends - LH's and LL's - but to just read PA is not really enough in isolation

I have started to understand more over the last 3 yrs the importance of the sessions Price structure bias - as well as how harmonic simple patterns like the ABC or 123 pattern and a Head and shoulders pattern are just as effective for me on a tick chart or 1 min - as for many on a 4 hr or daily.

The big advantage as a retail trader - and not sticking 100's of lots on per pip - but small stakes anything from say $1 to $250 a pip - then we can make a lot more money from what I call the "coalface" area than having to wait days and weeks and months to make say 300 or even 500 pips profit off a 120 pip stop and think that was nice - when really its just a trade with a RR of 2 to 4 - an we can make them in under 30 mins - several times a day.

I really feel the best ways of understand PA is down to focusing ideally at least 3 hrs over a day on the small frame charts noticing how everything moves

Its like watching paint dry - boring - but for me over the years I spotted so many "edges" many tutors or guru's never discuss in books or on courses - ie key times time windows - gameplay and false set ups etc etc

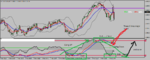

Price structure for me is made easier with the help of my Linear regression indicators

They are so much better than moving averages ( less lag) and I find I can get a set up on a tick or 1 min far earlier than any 5 or 15 min frame chart for intraday

Reading price structure and price action on the tick and 1 min is a skill that can only be learnt doing it. Its like riding a unicycle and juggling 5 balls. You can read all the books in the world on the theory and how to do it etc etc - but by only doing it will you then improve and be successful

Hope that helps and GL with all your studies etc

Regards

F