This post marks a departure from my previous work trading Futures.

Based on the Presidential address this previous evening, I will be

looking to "Capitalize" on what I believe may be significant volatility

in the financial markets in the coming months and perhaps throughout

this year. This really depends on how enduringly stupid the US Republican

party is (we will know soon).

Quoting an article by Paul La Monica at Barrons

----------------------------------

“Investors need to be selective,” Jackson Garton, chief investment officer at Makena Capital Management, said in an interview. “But look underneath the surface and I believe there are some opportunities hiding in plain sight.”

Among those opportunities, Garton likes high quality industrial stocks, particularly in the aerospace sector, as well as in biotech and other healthcare companies. Midsize software companies should benefit from the increased use of AI technology.

He also highlights small-caps and mid-caps with a domestic focus: They should hold up better than multinationals if the trade war lingers on. U.S.-focused companies should also benefit from nearshoring efforts, bringing supply chains closer to home.

Wall Street might also be betting that Trump does still care about the stock market, to an extent. He might not want it to fall too sharply.

“If tariffs (or threats of tariffs) lead to very steep market declines, the administration can simply reverse course,” said Tom Essaye, founder and president of The Sevens Report, in a newsletter Tuesday. “Put more plainly, President Trump can simply back off tariff threats and reduce the policy-driven anxiety.”

Essaye says a 10% decline for the S&P 500 could convince Trump to rethink his stance on tariffs. Similar drops during Trump’s first administration often led to “truces” between Trump and Chinese President Xi Jinping, he notes. The S&P 500 is currently hovering just under 5,800, about 5% below its all-time high from last month. It would need to fall just below 5,500 to be in correction territory.

Another sign that the market might be nearing a bottom? The Cboe Volatility Index, or VIX, has shot up nearly 40% this year to about 24. Some think Wall Street’s so-called fear gauge is getting close to a level that might indicate capitulation is soon near.

“Markets are clearly worried about the effect of tariffs, but also the combined effect of all the other new policy measures. We are still looking for the VIX to hit 27 before any sort of tradable low is on the table,” said Jessica Rabe, co-founder of DataTrek Research, in a report Tuesday.

Fear may be the dominant emotion on Wall Street for now. But it may not be long before greed rules the day again.

In fact, Trump has the chance to soothe markets when he addresses Congress Tuesday night. Reassuring comments about the economy could help the market rebound. Doubling down on protectionist trade talk, on the other hand, could further motivate the bears.

Write to Paul R. La Monica at

[email protected]

------------------------------------------

For those who had the stomach to listen to Trump

speak for almost two hours, I congratulate you. For the rest of us

be advised that soon, we will all be affected by this con artist and those

around him and one of the ways to prepare is to learn how to take

advantage of the obvious problems he is creating in the financial

markets. I can assure readers that the big 10 institutions have already

created a plan to handle what is coming. Notice if you will the line

"Fear may be the dominant emotion on Wall Street for now, but it may

not be long before greed rules the day again" Believe me when I say

that they will find a way to make money no matter which way it shakes

out (and so will I).

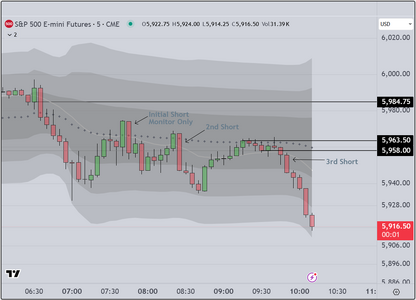

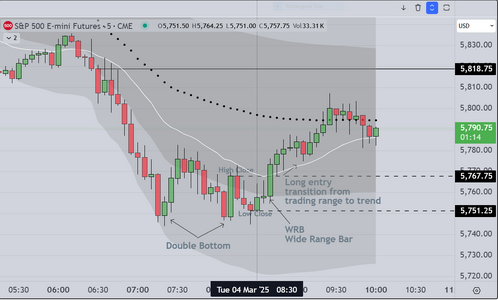

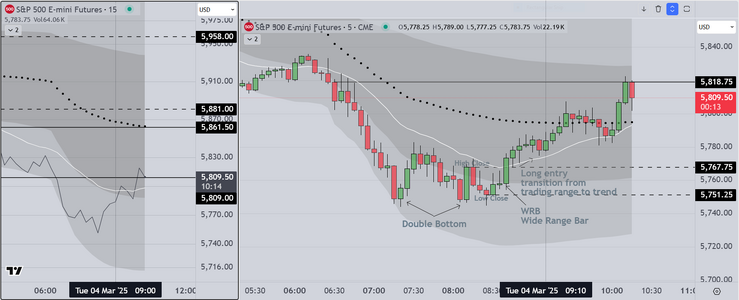

I will assume that the "Retail/Wholesale" model used by professional traders

for decades will continue to work. That is why I continue to use the VWAP

envelope, to tell me when we are in the "buy zone" (able to buy at wholesale)

or in the "sell zone" (able to sell retail premium) back to the public.

In the short term, I will be changing my focus, creating a new thread

where I provide a Weekly List of "Stocks in Play". From that list I will show

how professionals monitor, and then based on a well established "Playbook"

buy or sell ALONG with the institutions. Essentially I will be doing this

in real time either here (if that is possible) or on YouTube so that traders

can see in real time how it is done.

Good luck