You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

And as predicted, late session break to higher prices

with price entering back into the trading range.

This is a common scenario

This type of day is best left to professionals who

have knowledge necessary to trade with limit orders

and can BLSHS ("Buy Low Sell High Scalp"). Retail

traders trying to operate in this environment usually

lose money.

Good Luck

with price entering back into the trading range.

This is a common scenario

This type of day is best left to professionals who

have knowledge necessary to trade with limit orders

and can BLSHS ("Buy Low Sell High Scalp"). Retail

traders trying to operate in this environment usually

lose money.

Good Luck

Attachments

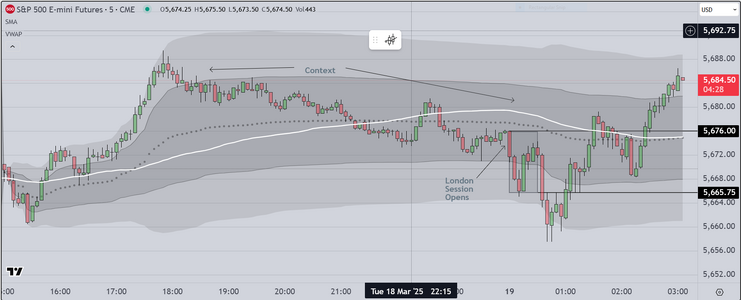

Its Tues 18 Mar

It is day 2 of the test protocol that I suggested to a

friend who is extremely risk averse, but wants to learn

how to trade intraday.

The rules are simple.

1) Observe only for the first 30 minutes of the session

2) Extend horizontal lines from the high & low closes of that time period

3) Wait for price to breakout/retest/then exceed the breakout bar (either direction)

4) Enter and after hearing "Order Filled", simply do not touch the mouse for two (2) minutes

5) If after two (2) minutes, the position shows profit, hold another two (2) minutes (repeat this process)

6) If price returns to test the entry, trader's choice to hold or exit within two (2) minutes

7) Mandatory exit at +9 pts

8) Mandatory exit at -3 pts

With my friend's permission, we show today's chart. Readers can see the result as price broke out, retested

and then continued higher.

My friend reported extreme anxiety as price retested the breakout, then bounced off that price higher followed

by a feeling of accomplishment as price continued higher. Also reported wanting to exit at each successive

pullback, assuming that the market would reverse, resulting in a loss (this is called "catastrophic projection").

We suggested that at every point in time, the trader remind themselves that they have a profit, and can only give

back a portion of that profit (no more than 3 pts). This allows the trader to feel that they control their destiny

and have the opportunity to decide (up to a point) where to exit.

Can anyone guess what the result was?

It is day 2 of the test protocol that I suggested to a

friend who is extremely risk averse, but wants to learn

how to trade intraday.

The rules are simple.

1) Observe only for the first 30 minutes of the session

2) Extend horizontal lines from the high & low closes of that time period

3) Wait for price to breakout/retest/then exceed the breakout bar (either direction)

4) Enter and after hearing "Order Filled", simply do not touch the mouse for two (2) minutes

5) If after two (2) minutes, the position shows profit, hold another two (2) minutes (repeat this process)

6) If price returns to test the entry, trader's choice to hold or exit within two (2) minutes

7) Mandatory exit at +9 pts

8) Mandatory exit at -3 pts

With my friend's permission, we show today's chart. Readers can see the result as price broke out, retested

and then continued higher.

My friend reported extreme anxiety as price retested the breakout, then bounced off that price higher followed

by a feeling of accomplishment as price continued higher. Also reported wanting to exit at each successive

pullback, assuming that the market would reverse, resulting in a loss (this is called "catastrophic projection").

We suggested that at every point in time, the trader remind themselves that they have a profit, and can only give

back a portion of that profit (no more than 3 pts). This allows the trader to feel that they control their destiny

and have the opportunity to decide (up to a point) where to exit.

Can anyone guess what the result was?

Attachments

Last edited:

Attached is my Markup for Tues 18 Mar

On the left, I show the "initial bookends" which are the high

and low closes for a specific time period. The lines are extended

to create a framework that can be traded as price breaks out of

the framework in either direction.

There is a lot more there however I am out of time today and will

have to cover the additional features at another time

Good luck

On the left, I show the "initial bookends" which are the high

and low closes for a specific time period. The lines are extended

to create a framework that can be traded as price breaks out of

the framework in either direction.

There is a lot more there however I am out of time today and will

have to cover the additional features at another time

Good luck

Attachments

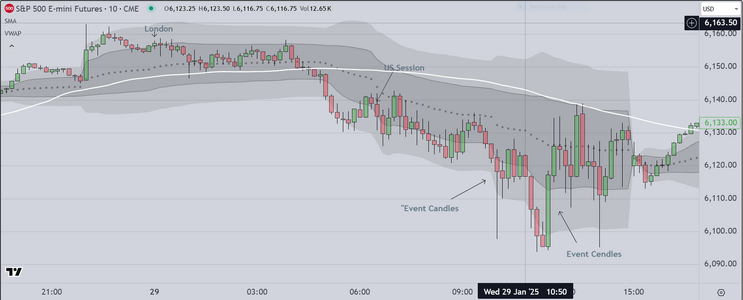

Here is my Markup for the "Overnight" market

(from my perspective in the US). The attached chart

shows the opening of Asia, then proceeding on to

London, and through to the present time

As my mentor taught me, " Context is everything"

I show the elements that I use to create a trading plan

1) Evaluation of previous price action including identification

of trend or trading range, price relative to 1st & 2nd SD bands

and "Leg Count". All of these are critical in making decisions

as to where (and when) to enter a transaction.

2) Because volatility has increased, I am trading prior to specific

economic news events (FOMC days). This allows me to obtain low

risk positions prior to the US session and to then "stand aside"

while the market stalls prior to the announcement. In other words

I am able to hit my profit targets early and then wait until after

the "Event Candles" form (during the US session) to trade again.

Posting London Open first

(from my perspective in the US). The attached chart

shows the opening of Asia, then proceeding on to

London, and through to the present time

As my mentor taught me, " Context is everything"

I show the elements that I use to create a trading plan

1) Evaluation of previous price action including identification

of trend or trading range, price relative to 1st & 2nd SD bands

and "Leg Count". All of these are critical in making decisions

as to where (and when) to enter a transaction.

2) Because volatility has increased, I am trading prior to specific

economic news events (FOMC days). This allows me to obtain low

risk positions prior to the US session and to then "stand aside"

while the market stalls prior to the announcement. In other words

I am able to hit my profit targets early and then wait until after

the "Event Candles" form (during the US session) to trade again.

Posting London Open first

Attachments

Today's Chart

We are done for the day

In this circumstance we see how the market reacts

to FED Chairman Powell deciding to keep rates

stable, but to confirm that two rate changes will be

needed in future. Because this removes uncertainty

it is a "risk on" day so longs were high probability.

We are done for the day

In this circumstance we see how the market reacts

to FED Chairman Powell deciding to keep rates

stable, but to confirm that two rate changes will be

needed in future. Because this removes uncertainty

it is a "risk on" day so longs were high probability.

Last edited:

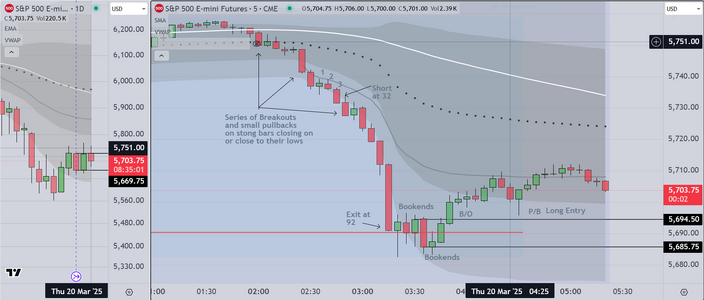

The day after FOMC is often an easy day to trade

because price action moves strongly

London Session was very simple to trade

as price broke out from the early range

As mentioned previously, I monitor the first

30 min, then wait for the B/O-P/B to occur

After than you evaluate based on the strength of the

bars and their position relative to the 1st & 2nd VWAP

bands. Institutional programs are doing the same and

simply adding to profitable positions as long as price

stays outside 1st SD

An interested person asked what theoretical system I teach

and I replied "Modified Auction Theory". I view the market

as being in one of two states, trading range or trend. When in

trading range I mark the "box" using the Bookends technique

then wait for the breakout to occur. Entry after the P/B is some

times complex but the market is very forgiving if you learn how

to identify when it is transitioning from range to trend (from limit

order to stop order).

Good luck

because price action moves strongly

London Session was very simple to trade

as price broke out from the early range

As mentioned previously, I monitor the first

30 min, then wait for the B/O-P/B to occur

After than you evaluate based on the strength of the

bars and their position relative to the 1st & 2nd VWAP

bands. Institutional programs are doing the same and

simply adding to profitable positions as long as price

stays outside 1st SD

An interested person asked what theoretical system I teach

and I replied "Modified Auction Theory". I view the market

as being in one of two states, trading range or trend. When in

trading range I mark the "box" using the Bookends technique

then wait for the breakout to occur. Entry after the P/B is some

times complex but the market is very forgiving if you learn how

to identify when it is transitioning from range to trend (from limit

order to stop order).

Good luck

Attachments

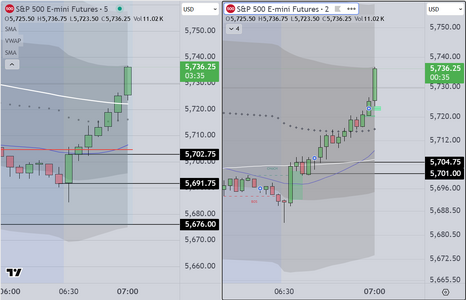

This followup to show how the trade would have

played out on both 5 min and 2 min charts

Also interested readers may remember my work

with a risk averse friend who wanted to learn how

to trade without so much anxiety

Today, I do not have their chart to display (they

use Ninjatrader, however on my charts, this initial

trade shows a nice profit, if one would only hold

for 2 minutes increments. I will post the week's results

on Friday after close of US session.

Good luck

played out on both 5 min and 2 min charts

Also interested readers may remember my work

with a risk averse friend who wanted to learn how

to trade without so much anxiety

Today, I do not have their chart to display (they

use Ninjatrader, however on my charts, this initial

trade shows a nice profit, if one would only hold

for 2 minutes increments. I will post the week's results

on Friday after close of US session.

Good luck

Attachments

And here is my friend's chart capture

for the "2 min test" that I asked them to

document this week. We have one (1) more

day to go and then I analyze the result for

them, to see how they are doing

Today I was not present, so they were "on their

own" so to speak and if you look at the result

you can see just how risk averse they are. Without

being too critical, I can say simply that at this point

they are unable to hold a position for more than a

few seconds (sometimes less than 1 point), before

succumbing to the anxiety and closing the position.

As I have said, and I hope it helps others as well

you have to be able to recognize 1) when to enter, and

2) how long to hold. After all is said and done, these are

the crucial skills a trader needs, and finally of course

one has to learn to control one's emotions. Once you can

do that you have a chance to create a sustainable business

in this profession. Otherwise...

for the "2 min test" that I asked them to

document this week. We have one (1) more

day to go and then I analyze the result for

them, to see how they are doing

Today I was not present, so they were "on their

own" so to speak and if you look at the result

you can see just how risk averse they are. Without

being too critical, I can say simply that at this point

they are unable to hold a position for more than a

few seconds (sometimes less than 1 point), before

succumbing to the anxiety and closing the position.

As I have said, and I hope it helps others as well

you have to be able to recognize 1) when to enter, and

2) how long to hold. After all is said and done, these are

the crucial skills a trader needs, and finally of course

one has to learn to control one's emotions. Once you can

do that you have a chance to create a sustainable business

in this profession. Otherwise...

Attachments

Weekly Review Part 1

This will be a review of the previous week's price action, starting with

Monday 17 March

The Markup shows the initial 30 minute time period in a box outline

I do not trade this time period, because in past I have lost money doing

so. Instead I watch and characterize the price action, hoping to learn from

it and find an edge trading the rest of the session

30 Minutes/Monitor & Characterize Only

In this initial time period we saw a trend move up, followed by a reversal,

a retest of the high, and a failure. Evaluating this, we look for repetition

and we find it (several times). Experience helps of course, but the general

rule is to look for repetition and to trade "what we see" mechanically, as

long as the setups present themselves.

Look to Trade Repetition

What we cannot show is the context, so we will simply state that the obvious.

Price tests & fails initially, and again a 2nd time. In this context we look for

confirmation from "the statistical skew" (which was negative) and for price

to move below the (blue) SMA, and using a simple "1-2-3" algo, we enter

short looking for scalp profits of 3-5 pts. Based on experience, we look for

this pattern to repeat 2-3 times. It is unusual for this (any) pattern to repeat 5 times.

We will continue this review tomorrow, same chart. One of the subjects we will

cover is the London to US Session Overlap, Which begins at 1pm GMT (same as

London Local Time). This Overlap often creates a period of high volatility which

can be seen on the charts and is then simple to trade.

This will be a review of the previous week's price action, starting with

Monday 17 March

The Markup shows the initial 30 minute time period in a box outline

I do not trade this time period, because in past I have lost money doing

so. Instead I watch and characterize the price action, hoping to learn from

it and find an edge trading the rest of the session

30 Minutes/Monitor & Characterize Only

In this initial time period we saw a trend move up, followed by a reversal,

a retest of the high, and a failure. Evaluating this, we look for repetition

and we find it (several times). Experience helps of course, but the general

rule is to look for repetition and to trade "what we see" mechanically, as

long as the setups present themselves.

Look to Trade Repetition

What we cannot show is the context, so we will simply state that the obvious.

Price tests & fails initially, and again a 2nd time. In this context we look for

confirmation from "the statistical skew" (which was negative) and for price

to move below the (blue) SMA, and using a simple "1-2-3" algo, we enter

short looking for scalp profits of 3-5 pts. Based on experience, we look for

this pattern to repeat 2-3 times. It is unusual for this (any) pattern to repeat 5 times.

We will continue this review tomorrow, same chart. One of the subjects we will

cover is the London to US Session Overlap, Which begins at 1pm GMT (same as

London Local Time). This Overlap often creates a period of high volatility which

can be seen on the charts and is then simple to trade.

Attachments

Last edited:

As often happens, life has become complicated as I

rebuild my home.

So I will scale back my scope here, posting only what

I am working on currently

The chart attached below shows an example of the curriculum

that I am completing for future students (if I am able to offer another

course)

Three (3) Day Cycle

The Cycle begins on Monday extending to Wednesday. It "resets" at mid-day

on Wednesday and starts the next three day cycle. Readers will notice

that I have boxes outlining critical time frames for each market session

from Asia, to London to USA. Within these boxes I look for high probability

(repetitive) patterns. The general rule of thumb is to prefer entries at

Weekly & Session Highs/Lows because these entries often provide significant

positive "excursion" necessary to create a sustainable business model.

The attached charts shows price action on a 30 minute basis. Because of space

limitations, the weekly cycle is split into two (2) screens. The basic premise is

that we expect the market to create cyclical (tradeable) weekly highs/lows

The 30 minute candles work to convey the concept, however we use smaller

time frames for entry, trade management and exit.

rebuild my home.

So I will scale back my scope here, posting only what

I am working on currently

The chart attached below shows an example of the curriculum

that I am completing for future students (if I am able to offer another

course)

Three (3) Day Cycle

The Cycle begins on Monday extending to Wednesday. It "resets" at mid-day

on Wednesday and starts the next three day cycle. Readers will notice

that I have boxes outlining critical time frames for each market session

from Asia, to London to USA. Within these boxes I look for high probability

(repetitive) patterns. The general rule of thumb is to prefer entries at

Weekly & Session Highs/Lows because these entries often provide significant

positive "excursion" necessary to create a sustainable business model.

The attached charts shows price action on a 30 minute basis. Because of space

limitations, the weekly cycle is split into two (2) screens. The basic premise is

that we expect the market to create cyclical (tradeable) weekly highs/lows

The 30 minute candles work to convey the concept, however we use smaller

time frames for entry, trade management and exit.

Attachments

Last edited:

ImogenBeaumont

Junior member

- Messages

- 46

- Likes

- 6

That's really cool! Sounds like you’ve got a lot of experience. I’ve heard of tools like VWAP and Volume Profile, but I’m not sure how they work exactly. Do you think they’re super important for beginners to learn?Hello Everyone

I started another thread whose title is "Beyond Price Action"

as a trading journal.

I noticed that there were very few inquiries

I have been trading professionally for about 15 years

My background is diverse, with emphasis on Math (Statistics)

I have used the same tools for many years.

Volume Profile

VWAP

Analysis of Price Action

I hope struggling traders will take a look

and perhaps find something that they can

use to improve their results.

I did this to honor the memory of the gentleman

who trained me. I think he would be proud of my

work and my progress.

Good luck in the markets

Thanks for your important (and complex) question

I want to provide some perspective, that is to say, something that helps you

make good decisions as regards education.

If you are new to trading and just want to learn more, I like the work of Dr. Al

Brooks. He works with a simple setup using only price (candles) and a 20 period

moving average. I have seen him trade. He is highly skilled and honest. For me

skill and honesty are critical. He has written several books however they were (for

me) difficult to get through. I like his video course. I would begin by reviewing the

many free videos he has made available on YouTube, He offers a money back

option if you want to try his course.

I also like Trader Dale, and again he seems honest and skilled. He uses a variety of

methods including Volume Profile, which is (in my view) a good way to learn how

to read the market and can serve as the basis for a reasonable, profitable system.

There are many others, however I would maintain a skeptical approach. Eliminate those

who make outlandish claims (big profits right away).

Long ago I had the good luck to meet a nice gentleman who managed my family's estate

Like the others I mentioned, he was highly skilled, honest and (to me) kind. He knew that I

was skilled at math, and was willing to show me how he used a specific set of tools to trade

as follows

1) VWAP....Volume Weighted Average Price. This is used by top tier institutions, and by 2nd tier

commercial firms, both as a basis for automated (algorithmic or program) trading, and by human

traders as the basis for their work. Even if you have a strong math background it can take a while

to learn. On my charts it is represented as a line of Black Dots.

2) VWAP Envelope.....VWAP can be seen in my charts as a line of Black Dots. Above and below that

line, I also show a dark area called the 1st Standard Deviation, and then another area outside that

darkened zone called the 2nd Standard Deviation. Commercial traders use these boundaries (we call

them "bands", in several important ways. For example, if you watch how price acts, you may notice

that sometimes price will move away from the central VWAP Dots and trend along one of the lines

or stay in between the lines (bands). Alternatively price might move from the outer band toward

the VWAP Dots, and this is called "reversion to the mean". There are many ways to make money

using this tool. It is difficult however to obtain good training, because people who really know how

to use this system don't often make their knowledge public, OR they may be restricted by their

employers if they work for a commercial firm. Again I would go slow and maintain healthy skepticism

especially if a person representing themselves as an educator, does not proceed logically or wants

a lot of money to train others. For me these are red flags.

If you like reading, books by James Dalton ("Mind over Markets", is one example) offers a way to understand

how markets act using a version of volume profile. Books by Al Brooks are good, but are very tedious to understand

and Trader Dales offers some good downloads and books that may be of interest.

I hope some of this is helpful as you move along your path.

Good luck

Postscript

I occurs to me to say, that I intend to record trading sessions and then upload them to a YouTube Channel

so that persons interested in learning can watch me trade. I have been distracted recently because I have

been building a new house (mine was lost in a fire). When that happens I will announce it on my threads

and everyone is invited. Right now I am researching to learn how that is done. Updates to follow

I want to provide some perspective, that is to say, something that helps you

make good decisions as regards education.

If you are new to trading and just want to learn more, I like the work of Dr. Al

Brooks. He works with a simple setup using only price (candles) and a 20 period

moving average. I have seen him trade. He is highly skilled and honest. For me

skill and honesty are critical. He has written several books however they were (for

me) difficult to get through. I like his video course. I would begin by reviewing the

many free videos he has made available on YouTube, He offers a money back

option if you want to try his course.

I also like Trader Dale, and again he seems honest and skilled. He uses a variety of

methods including Volume Profile, which is (in my view) a good way to learn how

to read the market and can serve as the basis for a reasonable, profitable system.

There are many others, however I would maintain a skeptical approach. Eliminate those

who make outlandish claims (big profits right away).

Long ago I had the good luck to meet a nice gentleman who managed my family's estate

Like the others I mentioned, he was highly skilled, honest and (to me) kind. He knew that I

was skilled at math, and was willing to show me how he used a specific set of tools to trade

as follows

1) VWAP....Volume Weighted Average Price. This is used by top tier institutions, and by 2nd tier

commercial firms, both as a basis for automated (algorithmic or program) trading, and by human

traders as the basis for their work. Even if you have a strong math background it can take a while

to learn. On my charts it is represented as a line of Black Dots.

2) VWAP Envelope.....VWAP can be seen in my charts as a line of Black Dots. Above and below that

line, I also show a dark area called the 1st Standard Deviation, and then another area outside that

darkened zone called the 2nd Standard Deviation. Commercial traders use these boundaries (we call

them "bands", in several important ways. For example, if you watch how price acts, you may notice

that sometimes price will move away from the central VWAP Dots and trend along one of the lines

or stay in between the lines (bands). Alternatively price might move from the outer band toward

the VWAP Dots, and this is called "reversion to the mean". There are many ways to make money

using this tool. It is difficult however to obtain good training, because people who really know how

to use this system don't often make their knowledge public, OR they may be restricted by their

employers if they work for a commercial firm. Again I would go slow and maintain healthy skepticism

especially if a person representing themselves as an educator, does not proceed logically or wants

a lot of money to train others. For me these are red flags.

If you like reading, books by James Dalton ("Mind over Markets", is one example) offers a way to understand

how markets act using a version of volume profile. Books by Al Brooks are good, but are very tedious to understand

and Trader Dales offers some good downloads and books that may be of interest.

I hope some of this is helpful as you move along your path.

Good luck

Postscript

I occurs to me to say, that I intend to record trading sessions and then upload them to a YouTube Channel

so that persons interested in learning can watch me trade. I have been distracted recently because I have

been building a new house (mine was lost in a fire). When that happens I will announce it on my threads

and everyone is invited. Right now I am researching to learn how that is done. Updates to follow

Last edited:

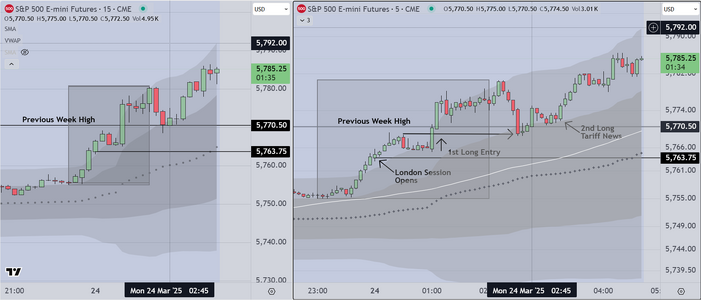

Now that the "News Trade" is over, I will post a

markup and comment as follows

Context

The market closed higher Friday, and in my opinion

it was in part due to institutions deciding that it was

safe to put money to work ("risk on") at least for the

next month or so.

Subsequently I learned (from a reliable source) that

President Trump MAY decide to reduce (some) tariffs

The opportunity to trade this is as follow

1) We do NOT care whether the rumor is true or false

Instead we simply watch the market's reaction.

2) A skilled observer can look at the placement of volume

both at the end of Friday's session, and at the beginning

of the Asia open. The net result is that we see institutions

staging big volume at the end of Friday's session and

a gap up open for Asia, that exhibited continuation. This

aligns with the information we obtained.

3) The chart is marked up to show the London Open and

the strong move up at the end of the first 60 minutes

This is an indication of algorithmic response to news AT A

SPECIFIC TIME (60 Min Breakout)

After that we look for evidence that the move "has legs"

The setups we use are specific to this event (We have posted

on this subject previously).

There were two (2) high odds entries both profitable.

Good luck

markup and comment as follows

Context

The market closed higher Friday, and in my opinion

it was in part due to institutions deciding that it was

safe to put money to work ("risk on") at least for the

next month or so.

Subsequently I learned (from a reliable source) that

President Trump MAY decide to reduce (some) tariffs

The opportunity to trade this is as follow

1) We do NOT care whether the rumor is true or false

Instead we simply watch the market's reaction.

2) A skilled observer can look at the placement of volume

both at the end of Friday's session, and at the beginning

of the Asia open. The net result is that we see institutions

staging big volume at the end of Friday's session and

a gap up open for Asia, that exhibited continuation. This

aligns with the information we obtained.

3) The chart is marked up to show the London Open and

the strong move up at the end of the first 60 minutes

This is an indication of algorithmic response to news AT A

SPECIFIC TIME (60 Min Breakout)

After that we look for evidence that the move "has legs"

The setups we use are specific to this event (We have posted

on this subject previously).

There were two (2) high odds entries both profitable.

Good luck

Attachments

Last edited:

By the way readers, in the premarket Tesla is up

Can you guess who is buying? Does his name begin

with MUSK?

The Big 10 institutions do not hire stupid people

They monitor the volume, and they can guess fairly

accurately who is really buying, Musk is buying back

his own stock at a discount. It is a smart strategy that

may be jumped on by the big participants this week

Lets see.

Can you guess who is buying? Does his name begin

with MUSK?

The Big 10 institutions do not hire stupid people

They monitor the volume, and they can guess fairly

accurately who is really buying, Musk is buying back

his own stock at a discount. It is a smart strategy that

may be jumped on by the big participants this week

Lets see.

Last edited:

As readers may know, I have been working on a curriculum suitable for

retail traders. When I say "suitable" what I really mean is that I want to simplify

my approach so that it reduces the amount of time it takes for an amateur to learn

to make money. To accomplish that objective, I have been testing charts and setups

that use 15 minute candles and two (2) stage pullback/entries

Attached please find one of those charts showing today's entries. After an initial test period of

30 days, the persons to whom I have shown these markup charts, have indicated that there

are fewer false signals, and that the setups are easier to identify.

Good Luck

retail traders. When I say "suitable" what I really mean is that I want to simplify

my approach so that it reduces the amount of time it takes for an amateur to learn

to make money. To accomplish that objective, I have been testing charts and setups

that use 15 minute candles and two (2) stage pullback/entries

Attached please find one of those charts showing today's entries. After an initial test period of

30 days, the persons to whom I have shown these markup charts, have indicated that there

are fewer false signals, and that the setups are easier to identify.

Good Luck

Attachments

Similar threads

- Replies

- 5

- Views

- 4K

- Replies

- 3

- Views

- 4K