Good Morning US Traders/Good Afternoon UK

Today is known by commercial traders as "rebound day"

Top Tier Institutions decided that this would be an opportunity

to buy at a discount, mark the market up and then (presumably)

sell the premium later this month.

As regards use of the basic tools, it was an easy day to trade IF

you took the setups, and held. The basic premise we offer struggling

traders is as follows

1) Find an edge. We have talked about this in detail in previous posts

We use pre-market analysis of the market heavily influenced by response

to economic news, and we bring extensive experience to this subject as well.

Based on this analysis we create multiple tentative scenarios

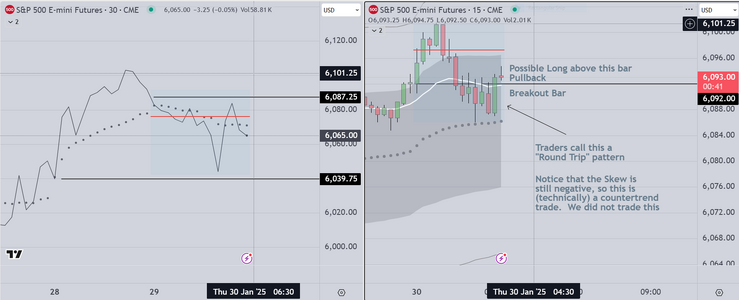

2) At the open we look for "tells". This term is common to persons who play

the card game poker. In a nutshell, we look for a confluence of several signals

including skew, position of price relative to the VWAP envelope, and the initial

response to economic news (when it occurs). We assume that the initial response

will repeat later during the session (for example, on today's chart we see price

move higher at the VWAP (1st trade) and retest the VWAP later (3 times before

resuming higher).

3) When these planets align, we look for one of the preferred setups (previous posts)

we take a small position, and add on pullbacks, or retests of the point of entry.

On the rare occasions when we train retail traders, we suggest trading sim or

if they wish to risk capital, to trade the Micro contract. The basic approach is

taken from game theory and we model it for them by trading two (2) contracts

initially, relying on our stop. At +3 to + 5 pts, we take profit on one (1) contract

This is called "buying a stop", because it provides the trader with an emotional cushion

as they watch the trade play out. If the trade continues positive, they can simply hold.

If the market retests the entry (as it often does), they have two choices. They can exit

the balance for a profit, or they can add, risking up to breakeven. If the market continues

positive, they can choose when to exit, however we always suggest +10 min on the balance.

We are done for the day