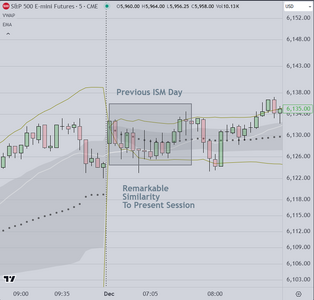

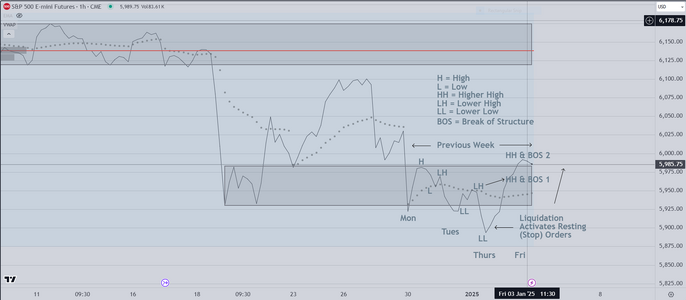

And here is the follow up to the previous post

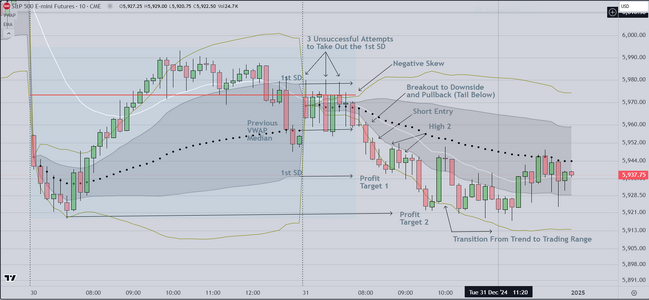

Looking at the right side, you can see profit taking

signaling the end of trade (for the moment at least)

Most of this is automated, in that institutional programs

are activated at +10 pts, or what is (for this time period)

defined as a "measured move".

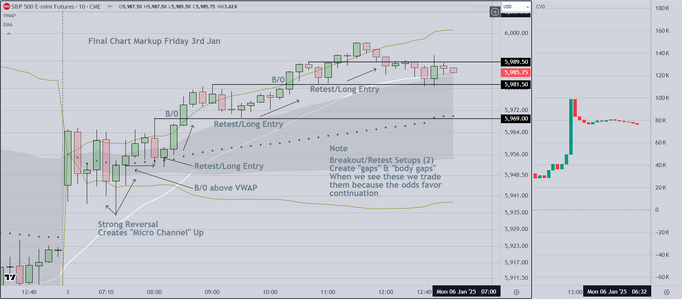

On the right side, this chart shows the profit taking, followed

the programmed buy orders that occur at the 1st SD band

This isn't coincidence. The programs run independently

and are meant to contain (or to try to contain) price within

the envelope until the open of the next US session.

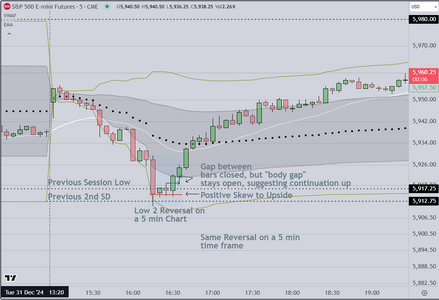

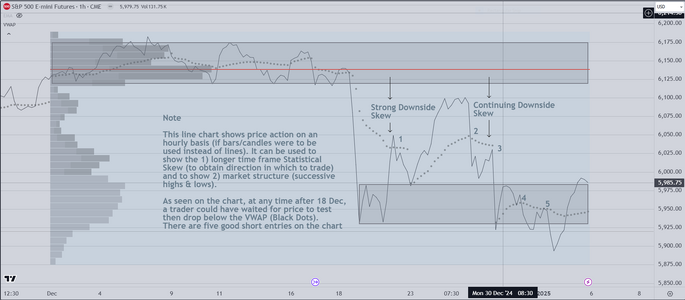

Looking at the right side, you can see profit taking

signaling the end of trade (for the moment at least)

Most of this is automated, in that institutional programs

are activated at +10 pts, or what is (for this time period)

defined as a "measured move".

On the right side, this chart shows the profit taking, followed

the programmed buy orders that occur at the 1st SD band

This isn't coincidence. The programs run independently

and are meant to contain (or to try to contain) price within

the envelope until the open of the next US session.

Attachments

Last edited: