We are done for the day

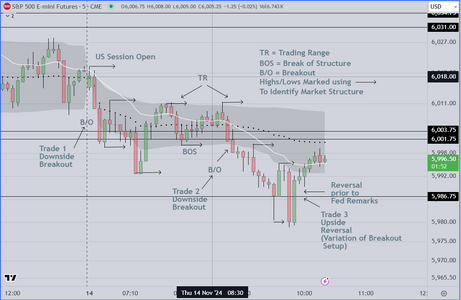

As seen on the chart attached below, the market opened down

providing a nice initial move for +10 pts. Skilled traders will always

act aggressively at these times of day, because they know that the

algos are moving the market and have to obtain at least 10 pts.

After that, we assume that institutions will want to move price down

to a discount level. Why? because they anticipate that Fed Chairman

Powell will have either positive or at the least neutral remarks that

will allow them to buy back their inventory and realize added profit

on the reversal (up)

We had three (3) trades, two (2) shorts and one (1) reversal scalp up

and are done for the day, out as mentioned previously prior to the

Fed comments.

Good Luck

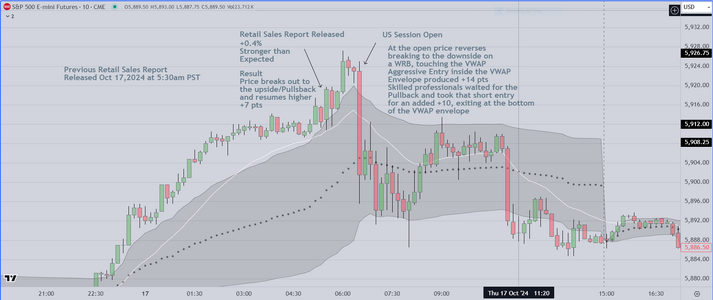

As seen on the chart attached below, the market opened down

providing a nice initial move for +10 pts. Skilled traders will always

act aggressively at these times of day, because they know that the

algos are moving the market and have to obtain at least 10 pts.

After that, we assume that institutions will want to move price down

to a discount level. Why? because they anticipate that Fed Chairman

Powell will have either positive or at the least neutral remarks that

will allow them to buy back their inventory and realize added profit

on the reversal (up)

We had three (3) trades, two (2) shorts and one (1) reversal scalp up

and are done for the day, out as mentioned previously prior to the

Fed comments.

Good Luck