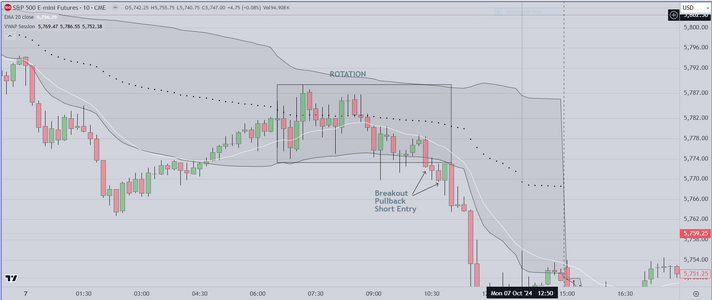

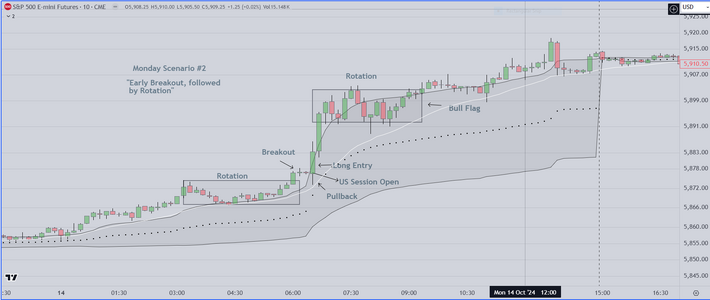

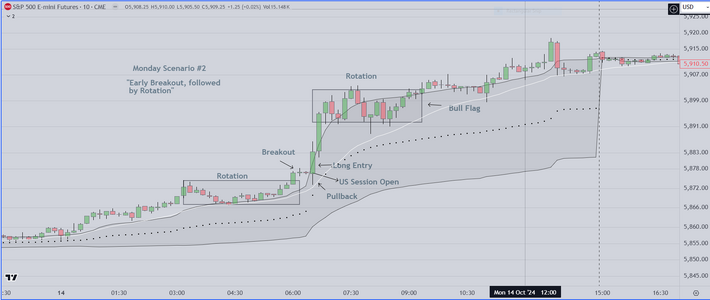

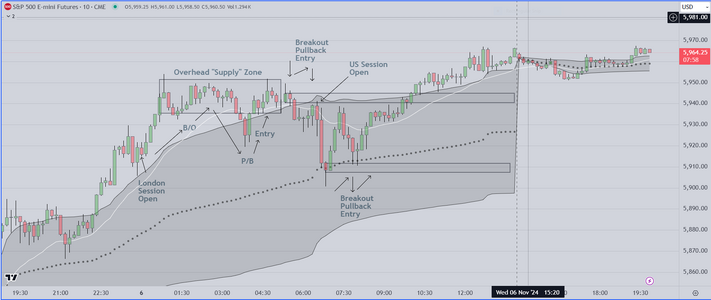

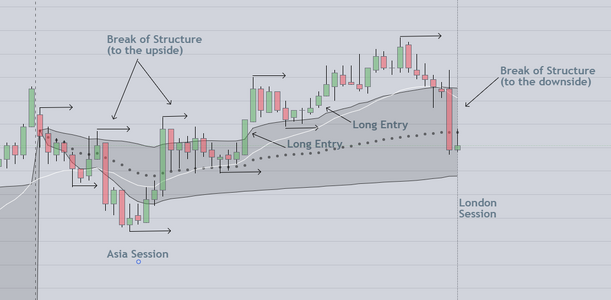

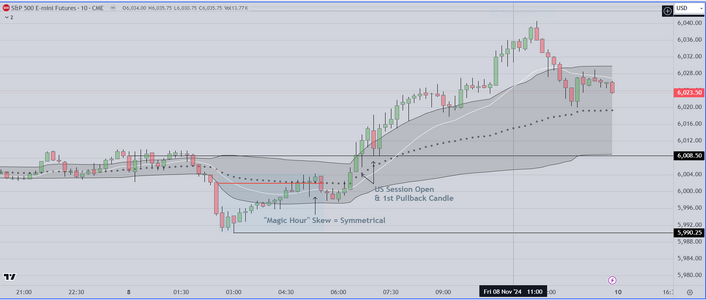

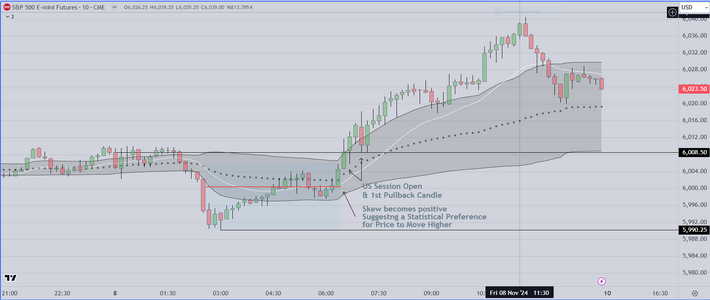

Finally, a couple of scenarios showing how Monday trading

can evolve.

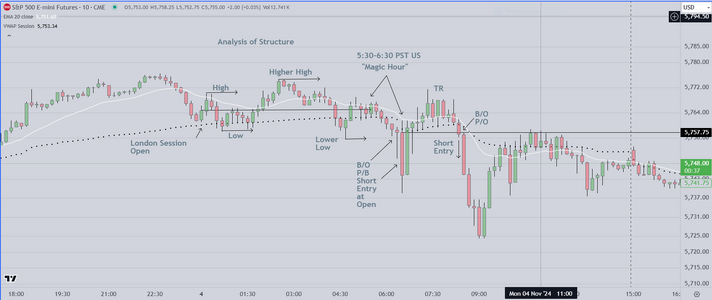

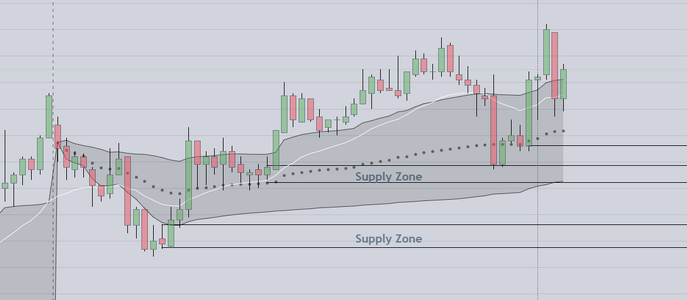

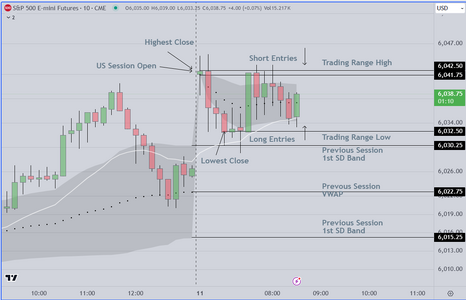

Our advice to struggling traders, and to all retail traders for that matter

is to learn to wait patiently for price to breakout. Trading rotations will

generally result in loss, because amateurs do not know how to recognize

rotation ("also known as "TR" or trading range behavior). Also, they do

not know how to recognize liquidation, which occurs when algos kick in

and false breakouts occur. Learning to read these conditions is critical

and we suggest traders monitor only on Mondays until they learn these

skills as well as how to integrate context (economic news for example)

into their trading plans.

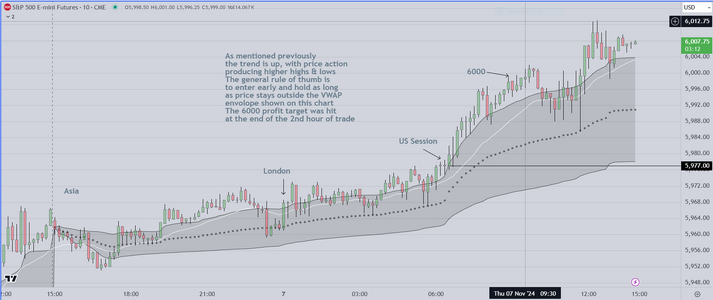

can evolve.

Our advice to struggling traders, and to all retail traders for that matter

is to learn to wait patiently for price to breakout. Trading rotations will

generally result in loss, because amateurs do not know how to recognize

rotation ("also known as "TR" or trading range behavior). Also, they do

not know how to recognize liquidation, which occurs when algos kick in

and false breakouts occur. Learning to read these conditions is critical

and we suggest traders monitor only on Mondays until they learn these

skills as well as how to integrate context (economic news for example)

into their trading plans.