frugi

1

- Messages

- 1,843

- Likes

- 133

Hampy,

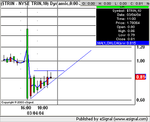

Just a word about your second short if I may (no offence intended). Look at the big triangle and the volume pattern while it forms. It takes 4 hours to coil up tighter and tighter while the volume dries up to almost nothing. Everyone is awaiting the big move and it's going to be big because the waiting period has been long and frustrating. The breakout comes on two much bigger vol bars that close above the triangle (confirmation) and then the target is 1152 or so. After a long wait like that I wouldn't stand in the way of the resulting move unless a target had been met (though I often do 😀) and the little triangle where u shorted was too close to the triangle.

However I do sympathise because it was close to the bottom of the long term channel that we fell out of this morning. I closed a long there, in fact, so I'm not qualified to chastise anyone! Oops.

Sorry if this sounds a bit harsh mate - it's not meant to. We're all learning at the end of the day 😀 I got a lot wrong today. We must learn to trust the triangle with confirmatory volume and perspective!

Just a word about your second short if I may (no offence intended). Look at the big triangle and the volume pattern while it forms. It takes 4 hours to coil up tighter and tighter while the volume dries up to almost nothing. Everyone is awaiting the big move and it's going to be big because the waiting period has been long and frustrating. The breakout comes on two much bigger vol bars that close above the triangle (confirmation) and then the target is 1152 or so. After a long wait like that I wouldn't stand in the way of the resulting move unless a target had been met (though I often do 😀) and the little triangle where u shorted was too close to the triangle.

However I do sympathise because it was close to the bottom of the long term channel that we fell out of this morning. I closed a long there, in fact, so I'm not qualified to chastise anyone! Oops.

Sorry if this sounds a bit harsh mate - it's not meant to. We're all learning at the end of the day 😀 I got a lot wrong today. We must learn to trust the triangle with confirmatory volume and perspective!

Attachments

Last edited: