You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

barjon

Legendary member

- Messages

- 10,752

- Likes

- 1,863

Black Bear reports a bad day at the office and the loss of 3 claws on one paw 😱

:

hey, andy - you should've sent those indians on patrol first 😉

won't be about much next few weeks. it's that time of the year again and i'll be diverted doing breeding bird counts at crack of dawn.

cheers

jon

barjon

Legendary member

- Messages

- 10,752

- Likes

- 1,863

what does everyone think will happen with ftse and dow on friday ??

I suspect a decent start for ftse, then a sell off in time for the close and weekend.

Could be decent day to go short on the index at some point.

S

hi, sul

as good a scenario as any i suppose, but look where opinions got andy (black bear) 🙄

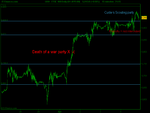

The 3 bar swings are looking messy now, but might see another potential swing high today otherwise some may be looking for short if 5864 goes.

cheers

jon

black bear

Guest

- Messages

- 1,303

- Likes

- 165

Mad Bear re-groups

Hi Jon

Think thats good advice Jon

Waited till I cooled down before posting

what a nana head, just goes to show that Warren geezer is correct, some lessons you need to learn more than once 😱

Plan for longer timeframe and opinion trades is under construction Jon the usual is not transferable in the moment of battle, every indian needs to no his job before hand.

Most of the Indians are resting back at camp, most being the operative word 😱

Good rest to you Jon

hey, andy - you should've sent those indians on patrol first 😉

won't be about much next few weeks. it's that time of the year again and i'll be diverted doing breeding bird counts at crack of dawn.

cheers

jon

Hi Jon

Think thats good advice Jon

Waited till I cooled down before posting

what a nana head, just goes to show that Warren geezer is correct, some lessons you need to learn more than once 😱

Plan for longer timeframe and opinion trades is under construction Jon the usual is not transferable in the moment of battle, every indian needs to no his job before hand.

Most of the Indians are resting back at camp, most being the operative word 😱

Good rest to you Jon

Attachments

Last edited:

hey, andy - you should've sent those indians on patrol first 😉

it's that time of the year again and i'll be diverted doing breeding bird counts at crack of dawn.

cheers

jon

Over in The Caymans. 😀

black bear

Guest

- Messages

- 1,303

- Likes

- 165

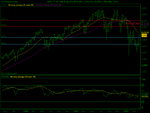

Thought for the week......with a new plan

some time latter .............................🙂

trading in range top of wide bar and previous days highs

news out later

No trade it, but its up I think, may spike down but just feel its got more to go yet, built a little base over last few days, could see a spike under at the news maybe a shake into close

Dow to go on one into the weekend after the ftse closes and after inicial flaps over :arrowu: = more shorts covering monday on the ftse

Minor Short zone from 6008 ~ 6090 june fut, major 6200 ish

favour 200 ish which will take us to the decending trend channel (weeks)

See where the locations X (pdh & L etc) next week

I think I may then launch a small well planned raiding party and see how it goes 🙂

time to check weapons and feed the war ponies up

Good weekend all and good luck next week :clover:

some time latter .............................🙂

trading in range top of wide bar and previous days highs

news out later

No trade it, but its up I think, may spike down but just feel its got more to go yet, built a little base over last few days, could see a spike under at the news maybe a shake into close

Dow to go on one into the weekend after the ftse closes and after inicial flaps over :arrowu: = more shorts covering monday on the ftse

Minor Short zone from 6008 ~ 6090 june fut, major 6200 ish

favour 200 ish which will take us to the decending trend channel (weeks)

See where the locations X (pdh & L etc) next week

I think I may then launch a small well planned raiding party and see how it goes 🙂

time to check weapons and feed the war ponies up

Good weekend all and good luck next week :clover:

Attachments

Last edited:

SuddenDeath

Legendary member

- Messages

- 14,063

- Likes

- 143

Friday dont we get US jobs data today, i shorted ftse100 cash @ 5669/842 need it to drop.

I tink volatility is very low becuase banks have been supported and they were the ones responsible for most of the volatility.

I tink volatility is very low becuase banks have been supported and they were the ones responsible for most of the volatility.

black bear

Guest

- Messages

- 1,303

- Likes

- 165

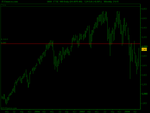

News ............YES

red on the news bit :cheesy:

some time latter .............................🙂

trading in range top of wide bar and previous days highs

news out later

No trade it, but its up I think, may spike down but just feel its got more to go yet, built a little base over last few days, could see a spike under at the news maybe a shake for or into close

Dow to go on one into the weekend after the ftse closes and after inicial flaps over :arrowu: = more shorts covering monday on the ftse

Minor Short zone from 6008 ~ 6090 june fut, major 6200 ish

favour 200 ish which will take us to the decending trend channel (weeks)

See where the locations X (pdh & L etc) next week

I think I may then launch a small well planed raiding party and see how it goes 🙂

time to check weapons and feed the war ponies up

Good weekend all and good luck next week :clover:

red on the news bit :cheesy:

Attachments

Last edited:

wow what a session!!

I was short on the ftse 40 a point at 5920 ,

was eeking before the numbers from us came out as ftse was around 5950

Numbers come out dip to less than 5910, manage to get out with 10 point profit.

And now ftse is back up again!!

Trying to trade in range but quite nervous about it!

I was short on the ftse 40 a point at 5920 ,

was eeking before the numbers from us came out as ftse was around 5950

Numbers come out dip to less than 5910, manage to get out with 10 point profit.

And now ftse is back up again!!

Trying to trade in range but quite nervous about it!

black bear

Guest

- Messages

- 1,303

- Likes

- 165

Bulls and Bears

Hi sul2soul

mind how you go,

See earlier post by myself, you could end up on the end of a bad un if you hang around relying on the news to drive it your way, better sat other side if you can manage it before it comes out, or pass and wait in my very very humble opinion

Been there done that = got the bloody nose to prove it 😱😱😢

Look them Bulls have horns on them :-0

wow what a session!!

I was short on the ftse 40 a point at 5920 ,

was eeking before the numbers from us came out as ftse was around 5950

Numbers come out dip to less than 5910, manage to get out with 10 point profit.

And now ftse is back up again!!

Trying to trade in range but quite nervous about it!

Hi sul2soul

mind how you go,

See earlier post by myself, you could end up on the end of a bad un if you hang around relying on the news to drive it your way, better sat other side if you can manage it before it comes out, or pass and wait in my very very humble opinion

Been there done that = got the bloody nose to prove it 😱😱😢

Look them Bulls have horns on them :-0

Attachments

appreciate the advice andy.

also very wise words.

I have been on the wrong side far to many times to!

Been doing ok with the range so far. Taking small profits in moves.

However the ftse seems to be in very positive mood today compared to all the other indices.

Normally we are the first to wave the white flag! lol

S

also very wise words.

I have been on the wrong side far to many times to!

Been doing ok with the range so far. Taking small profits in moves.

However the ftse seems to be in very positive mood today compared to all the other indices.

Normally we are the first to wave the white flag! lol

S

barjon

Legendary member

- Messages

- 10,752

- Likes

- 1,863

mmm, the advancing army is approaching the 6000 fortress again where the defenders are heating up the oil and priming their canons. Will the army turn tail and run or call the battering rams into action? Or will the opposing forces call a temporary cease fire and play football in no-mans-land for a while. Book your seats, ladies and gentlemen, for the 6000 show.

Course, we have a potential swing high today with a short triggering at below 5888 to keep you entertained as well.

jon

Course, we have a potential swing high today with a short triggering at below 5888 to keep you entertained as well.

jon

I have FTSE sell order below Friday's close. I suspect FTSE will trade low early to re-balance with indecisive S&P. If the short is triggered this will only be a morning hold for me as the US indices don't look that bearish any more, probably relief buying in the financials as somebody said above, and I may look to go long on the Dow if it opens strong. Not a legendary strategy but I don't see any other obvious swing opportunities anyway.

mmm, the advancing army is approaching the 6000 fortress again where the defenders are heating up the oil and priming their canons. Will the army turn tail and run or call the battering rams into action? Or will the opposing forces call a temporary cease fire and play football in no-mans-land for a while. Book your seats, ladies and gentlemen, for the 6000 show.

Course, we have a potential swing high today with a short triggering at below 5888 to keep you entertained as well.

jon

There aren't any indians amongst that lot, are there? 😀

black bear

Guest

- Messages

- 1,303

- Likes

- 165

Little Big Horn just a head a bit ..............

Hi Split

love it don"t you

When those indians come out to play ~ war party size General Custer was one very sorry General, wished he had not divided his forces up that day for sure Split :-0

Remains of an Indian war party have just returned and bring information regarding Custers forces.

War chiefs are gathering and talk of a great victory is in the air if the forces of the indian nations can unite and fight as one 🙂

mmm, the advancing army is approaching the 6000 fortress again where the defenders are heating up the oil and priming their canons. Will the army turn tail and run or call the battering rams into action? Or will the opposing forces call a temporary cease fire and play football in no-mans-land for a while. Book your seats, ladies and gentlemen, for the 6000 show.

Course, we have a potential swing high today with a short triggering at below 5888 to keep you entertained as well.

jon

There aren't any indians amongst that lot, are there? 😀

Hi Split

love it don"t you

When those indians come out to play ~ war party size General Custer was one very sorry General, wished he had not divided his forces up that day for sure Split :-0

Remains of an Indian war party have just returned and bring information regarding Custers forces.

War chiefs are gathering and talk of a great victory is in the air if the forces of the indian nations can unite and fight as one 🙂

Attachments

black bear

Guest

- Messages

- 1,303

- Likes

- 165

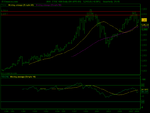

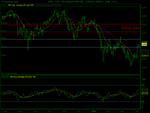

Battle of the Little Big Horn

The Battle plan shows the possible site of the battle

The Battle plan shows the possible site of the battle

Attachments

black bear

Guest

- Messages

- 1,303

- Likes

- 165

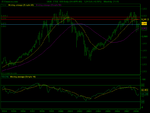

Nations have agreed on a plan of action

Talks and plans are going well

Nations have decided to give ground to the 7th Cavalry in the hope of a much better opportunity in the high ground later on. War parties around the 6000-200 level marked on the post above will be limited to small war parties fighting from pd highs only they will hold out and look for follow through at pd lows. (risk per war party 1 % intra day account) The nations think they will be at a disadvantage fighting the 7th Calvalry in Territory they have just fought over. Scouts have reported the 7th Calvalry have managed to errect some fixed defences which will make life very hard for their own lightly armed warriors. The 7th Cavalry only recently launched an assault on the 6000 area and are sure to be better prepared this time round.

The nations hope to draw the enemy away from their supply lines and inflict a total route in the opening minutes of battle which will be on ground of their choosing.

War parties in action at pdh over the coming days will harass the enemy and cause as much damage as possible in order that the main war party can rest up and be fully prepared for battle in the high ground. Their orders are to get in and out quick and only hold and press their advantage if the 7th Cavalry break from their quickly erected field Fort.

Nations battle plan will follow method of the below link in principal

T2W Day Trading & Forex Community

Charts marked and entry will be made contra in the short term trend (days) in red marked zone, Entry day will be a narrow range day and preferably a monday and the 1st of the month 🙂

Battle rules

Old Rules...but Very Good Rules.

If I've learned anything in my 17 years of trading, I've learned that the simple

methods work best. Those who need to rely upon complex stochastics, linear

weighted moving averages, smoothing techniques, fibonacci numbers etc.,

usually find that they have so many things rolling around in their heads that

they cannot make a rational decision. One technique says buy; another says

sell. Another says sit tight while another says add to the trade. It sounds like a

cliché, but simple methods work best.

1. The first and most important rule is - in bull markets, one is supposed to

be long. This may sound obvious, but how many of us have sold the first

rally in every bull market, saying that the market has moved too far, too

fast. I have before, and I suspect I'll do it again at some point in the

future. Thus, we've not enjoyed the profits that should have accrued to

us for our initial bullish outlook, but have actually lost money while being

short. In a bull market, one can only be long or on the sidelines.

Remember, not having a position is a position.

2. Buy that which is showing strength - sell that which is showing

weakness. The public continues to buy when prices have fallen. The

professional buys because prices have rallied. This difference may not

sound logical, but buying strength works. The rule of survival is not to

"buy low, sell high", but to "buy higher and sell higher". Furthermore,

when comparing various stocks within a group, buy only the strongest

and sell the weakest.

3.When putting on a trade, enter it as if it has the potential to be the

biggest trade of the year. Don't enter a trade until it has been well

thought out, a campaign has been devised for adding to the trade, and

contingency plans set for exiting the trade.

4.On minor corrections against the major trend, add to trades. In bull

markets, add to the trade on minor corrections back into support levels.

In bear markets, add on corrections into resistance. Use the 33-50%

corrections level of the previous movement or the proper moving average

as a first point in which to add.

5.Be patient. If a trade is missed, wait for a correction to occur before

putting the trade on.

6.Be patient. Once a trade is put on, allow it time to develop and give it

time to create the profits you expected.

7.Be patient. The old adage that "you never go broke taking a profit" is

maybe the most worthless piece of advice ever given. Taking small profits

is the surest way to ultimate loss I can think of, for small profits are

never allowed to develop into enormous profits. The real money in

trading is made from the one, two or three large trades that develop

each year. You must develop the ability to patiently stay with winning

trades to allow them to develop into that sort of trade.

8.Be patient. Once a trade is put on, give it time to work; give it time to

insulate itself from random noise; give it time for others to see the merit

of what you saw earlier than they.

9.Be impatient. As always, small losses and quick losses are the best losses.

It is not the loss of money that is important. Rather, it is the mental

capital that is used up when you sit with a losing trade that is important.

10.Never, ever under any condition, add to a losing trade, or "average" into

a position. If you are buying, then each new buy price must be higher

than the previous buy price. If you are selling, then each new selling

price must be lower. This rule is to be adhered to without question.

11.Do more of what is working for you, and less of what's not. Each day,

look at the various positions you are holding, and try to add to the trade

that has the most profit while subtracting from that trade that is either

unprofitable or is showing the smallest profit. This is the basis of the old

adage, "let your profits run."

12.Don't trade until the technicals and the fundamentals both agree. This

rule makes pure technicians cringe. I don't care! I will not trade until I am

sure that the simple technical rules I follow, and my fundamental

analyses, are running in tandem. Then I can act with authority, and with

certainty, and patiently sit tight.

13.When sharp losses in equity are experienced, take time off. Close all

trades and stop trading for several days. The mind can play games with

itself following sharp, quick losses. The urge "to get the money back" is

extreme, and should not be given in to.

14.When trading well, trade somewhat larger. We all experience those

incredible periods of time when all of our trades are profitable. When that

happens, trade aggressively and trade larger. We must make our

proverbial "hay" when the sun does shine.

15.When adding to a trade, add only 1/4 to 1/2 as much as currently held.

That is, if you are holding 400 shares of a stock, at the next point at

which to add, add no more than 100 or 200 shares. That moves the

average price of your holdings less than half of the distance moved, thus

allowing you to sit through 50% corrections without touching your

average price.

16.Think like a guerrilla warrior. We wish to fight on the side of the market

that is winning, not wasting our time and capital on futile efforts to gain

fame by buying the lows or selling the highs of some market movement.

Our duty is to earn profits by fighting alongside the winning forces. If

neither side is winning, then we don't need to fight at all.

17.Stock Markets form their tops in violence; Stock markets form their lows in quiet

conditions.

18.The final 10% of the time of a bull run will usually encompass 50% or

more of the price movement. Thus, the first 50% of the price movement

will take 90% of the time and will require the most backing and filling and

will be far more difficult to trade than the last 50%.

There is no "genius" in these rules. They are common sense and nothing else,

but as Voltaire said, "Common sense is uncommon." Trading is a common-sense

business. When we trade contrary to common sense, we will lose. Perhaps not

always, but enormously and eventually. Trade simply. Avoid complex

methodologies concerning obscure technical systems and trade according to

the major trends only

Initial war party will have 5% max risk upon entry combined nations have 5000 braves ready for action

Talks and plans are going well

Nations have decided to give ground to the 7th Cavalry in the hope of a much better opportunity in the high ground later on. War parties around the 6000-200 level marked on the post above will be limited to small war parties fighting from pd highs only they will hold out and look for follow through at pd lows. (risk per war party 1 % intra day account) The nations think they will be at a disadvantage fighting the 7th Calvalry in Territory they have just fought over. Scouts have reported the 7th Calvalry have managed to errect some fixed defences which will make life very hard for their own lightly armed warriors. The 7th Cavalry only recently launched an assault on the 6000 area and are sure to be better prepared this time round.

The nations hope to draw the enemy away from their supply lines and inflict a total route in the opening minutes of battle which will be on ground of their choosing.

War parties in action at pdh over the coming days will harass the enemy and cause as much damage as possible in order that the main war party can rest up and be fully prepared for battle in the high ground. Their orders are to get in and out quick and only hold and press their advantage if the 7th Cavalry break from their quickly erected field Fort.

Nations battle plan will follow method of the below link in principal

T2W Day Trading & Forex Community

Charts marked and entry will be made contra in the short term trend (days) in red marked zone, Entry day will be a narrow range day and preferably a monday and the 1st of the month 🙂

Battle rules

Old Rules...but Very Good Rules.

If I've learned anything in my 17 years of trading, I've learned that the simple

methods work best. Those who need to rely upon complex stochastics, linear

weighted moving averages, smoothing techniques, fibonacci numbers etc.,

usually find that they have so many things rolling around in their heads that

they cannot make a rational decision. One technique says buy; another says

sell. Another says sit tight while another says add to the trade. It sounds like a

cliché, but simple methods work best.

1. The first and most important rule is - in bull markets, one is supposed to

be long. This may sound obvious, but how many of us have sold the first

rally in every bull market, saying that the market has moved too far, too

fast. I have before, and I suspect I'll do it again at some point in the

future. Thus, we've not enjoyed the profits that should have accrued to

us for our initial bullish outlook, but have actually lost money while being

short. In a bull market, one can only be long or on the sidelines.

Remember, not having a position is a position.

2. Buy that which is showing strength - sell that which is showing

weakness. The public continues to buy when prices have fallen. The

professional buys because prices have rallied. This difference may not

sound logical, but buying strength works. The rule of survival is not to

"buy low, sell high", but to "buy higher and sell higher". Furthermore,

when comparing various stocks within a group, buy only the strongest

and sell the weakest.

3.When putting on a trade, enter it as if it has the potential to be the

biggest trade of the year. Don't enter a trade until it has been well

thought out, a campaign has been devised for adding to the trade, and

contingency plans set for exiting the trade.

4.On minor corrections against the major trend, add to trades. In bull

markets, add to the trade on minor corrections back into support levels.

In bear markets, add on corrections into resistance. Use the 33-50%

corrections level of the previous movement or the proper moving average

as a first point in which to add.

5.Be patient. If a trade is missed, wait for a correction to occur before

putting the trade on.

6.Be patient. Once a trade is put on, allow it time to develop and give it

time to create the profits you expected.

7.Be patient. The old adage that "you never go broke taking a profit" is

maybe the most worthless piece of advice ever given. Taking small profits

is the surest way to ultimate loss I can think of, for small profits are

never allowed to develop into enormous profits. The real money in

trading is made from the one, two or three large trades that develop

each year. You must develop the ability to patiently stay with winning

trades to allow them to develop into that sort of trade.

8.Be patient. Once a trade is put on, give it time to work; give it time to

insulate itself from random noise; give it time for others to see the merit

of what you saw earlier than they.

9.Be impatient. As always, small losses and quick losses are the best losses.

It is not the loss of money that is important. Rather, it is the mental

capital that is used up when you sit with a losing trade that is important.

10.Never, ever under any condition, add to a losing trade, or "average" into

a position. If you are buying, then each new buy price must be higher

than the previous buy price. If you are selling, then each new selling

price must be lower. This rule is to be adhered to without question.

11.Do more of what is working for you, and less of what's not. Each day,

look at the various positions you are holding, and try to add to the trade

that has the most profit while subtracting from that trade that is either

unprofitable or is showing the smallest profit. This is the basis of the old

adage, "let your profits run."

12.Don't trade until the technicals and the fundamentals both agree. This

rule makes pure technicians cringe. I don't care! I will not trade until I am

sure that the simple technical rules I follow, and my fundamental

analyses, are running in tandem. Then I can act with authority, and with

certainty, and patiently sit tight.

13.When sharp losses in equity are experienced, take time off. Close all

trades and stop trading for several days. The mind can play games with

itself following sharp, quick losses. The urge "to get the money back" is

extreme, and should not be given in to.

14.When trading well, trade somewhat larger. We all experience those

incredible periods of time when all of our trades are profitable. When that

happens, trade aggressively and trade larger. We must make our

proverbial "hay" when the sun does shine.

15.When adding to a trade, add only 1/4 to 1/2 as much as currently held.

That is, if you are holding 400 shares of a stock, at the next point at

which to add, add no more than 100 or 200 shares. That moves the

average price of your holdings less than half of the distance moved, thus

allowing you to sit through 50% corrections without touching your

average price.

16.Think like a guerrilla warrior. We wish to fight on the side of the market

that is winning, not wasting our time and capital on futile efforts to gain

fame by buying the lows or selling the highs of some market movement.

Our duty is to earn profits by fighting alongside the winning forces. If

neither side is winning, then we don't need to fight at all.

17.Stock Markets form their tops in violence; Stock markets form their lows in quiet

conditions.

18.The final 10% of the time of a bull run will usually encompass 50% or

more of the price movement. Thus, the first 50% of the price movement

will take 90% of the time and will require the most backing and filling and

will be far more difficult to trade than the last 50%.

There is no "genius" in these rules. They are common sense and nothing else,

but as Voltaire said, "Common sense is uncommon." Trading is a common-sense

business. When we trade contrary to common sense, we will lose. Perhaps not

always, but enormously and eventually. Trade simply. Avoid complex

methodologies concerning obscure technical systems and trade according to

the major trends only

Initial war party will have 5% max risk upon entry combined nations have 5000 braves ready for action

Attachments

Last edited: