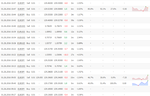

No of trades:23

PL: -31

Win rate: 43%

We had a talk about it on F's thread.

Today sharing an interesting statistics with time profitable , Entry & exit accuracy & profit missed.

View attachment 215576

View attachment 215578

Just look at those profit missed section, I had 15 pips hard stop loss on trades.

It shows that I missed total, 45 pips ! Thats something...

Hi Sun

We need to speed you up

Maybe on demo - you are more relaxed and you enter quicker etc and so make profits

On real live account - you are too slow for the method - awaiting confirmations and missing the lows and highs of wave movements

Its an art and skill and by going on a tick chart - we might be able to speed you up - meaning on good scalps you make and extra 2 -5 pips - and you get out bad trades quicker - under minus 3 or 4 rather than 6 or 8 pips

Also after using a tick chart - a 1 min will appear slow - and thats what I need - you to feel the 1 min frame is slow - that means then you are reacting to price as it happens and then with earlier entries - and you are up say 5 pips a 3 pip retarce will not throw you out etc

If you can always get near to an interim high or low - great example on UCad - 4220 price as a sell - then you are in a position to leave part stakes on

OK that dropped over 140 pips and did not need any more than a 5 pip stop - because once you are up say 25 or 40 pips in profit - 7 or 12 pip pullbacks are no worry - you are still in profit etc

I have posted a t13 tick chart on other thread

It will seem strange for a start - but it should get you reacting quicker

See when you came out the UCad buy with a small loss - you should have then thought - i need to sell - - instead your reaction would be - oops - another loss and your mind would freeze and not look at the sell opportuntity

That sell lasted so far over 3 hrs and still going on

They are the moves you want - not small counter bias trades for 3- 7 pips

Remember - we get bias off the longer LR's and LiTS LEVEL

Once we are in a bias price section - then we should aim to take scalps in direction of the bias - even if we miss out on some counter scalps of 3 -15 pips etc - wait to those finish and then join the bias trend

Also the 30+ time rules can then be breached after 50 -60 mins

Ideally lows or highs holding need over both 30 and 60 mins to be firm - and the 30 min rule only helps from say 25 to 45 mins on a direction - thats if the move carries on

If an interim high or low is breached in under 30 mins - then you know anyway the move is still on going etc.

There is a lot to get your head around in the heat of the moment - but its like anything - the more you get used to it - the better you cope and the easier it gets etc etc

Regards

F