Hi R,

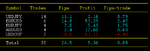

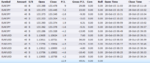

Thanks for your reply. Now I understand your approach. So with you having a 30-35 pips Stop loss you win/lose 1%. Then basically you’re making around 2% daily, which is pretty good.

Now I see why you trade GA. With that SL it’s possible, but with F’s method I don’t think it’s possible with a soft SL of 5 pips.

Keep up the good trading👍.

Cheers,

Keen246

Hi K and R

I would agree that if you can make just 1 or 2% per day fairly consistently - then you are doing well - anything over 25% per months non compounded is a good return

However the real trick is still having as tight as stops as possible - ie 3 to 7 pips maximum - ie 3 to 5 pip stops on spreads of 1 or less and 5 to 7 pips stops on spreads of 2 or 3 pips.

You dont have to risk 1% or 2% of your capital - just 0 3 to 0 5% on say 5 pips.

That means when you multi trade with say 15 or 20+ trades you are efficient and not waste time making just 17 pips and only getting a 1% or less gain - or on 20 -30 pip stops wasting 30 or 60 mins before getting stopped out.

You want to know the trade is working ASAP. So a 5 pip stop and a 22 pip result on a busy pair in say 15 mins makes you a RR of 4 and 2% return on 0 5% or even 4% return on just 1% stake size.

By having stops at 20 to 35 pips for 1% - then even a 22 pip move does not make you a 1% return. Thats no good

OK you might say - but I keep getting stopped out on 5 pip stops and my win ratio is under 50%

If thats the case - then you have not reached the level I require on scalping - ie stage 1 to stage 3 - win ratios of 65% to 80% on batches of 100 trades with average 5 pips stops.

Once you have cracked perfect or near perfect entries - and they are possible when you reach the required skill level - suddenly 4 to 8% winning days are on with just risk of 0 5 % stake per trade.

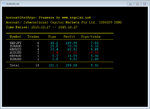

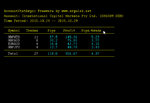

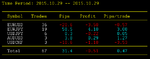

Major Magnum was some days doing over 20% per day on a live account with multi stakes and trades and stakes under 1% and win ratios over 80% on batches of 100 trades after about 6 months - with no previous experience on scalping - so rest assured it can all be done - even without having taken 5 or 10k live trades

I suggest you want a method that makes you just 1 or 2% on bad days - 2 to 4% average days and good days - ie the 100 pip + days then look at 6% +

Losing days should never be over 3% - ie 6 consecutive losses in a row at 0 5 % stake size- meaning if on a 18 day trading month - if you had 3 losing days until you are very experienced - you lost no more than 10% of your account - but the other 15 winning days of a low 1% to a high 8% make say 30 to 50% giving you a net 40% gain ROC in a month ( remember no compounding and retail size accounts - not multi million capital accounts - totally a different ball game )

So R - we need to get your entries accurate. If you love the GJ and other pairs with 3 pip spreads - then stops can be 7 pips - but no more .- yes it can be done - PS my spreads on GJ are 2+ to 3 pips and EA 1.6 to 2 pips on average.

EU / AU / UJ etc pairs with spreads now under 1 pip can be taken with 3 or 4 pips soft stops - never wait neither if you have a 5 or 7 pips stops - if its not working - then get out minus 3 pips don't wait for minus 5 or minus 7.

More on this over the next few days

Regards

F