Forexmospherian

Legendary member

- Messages

- 39,928

- Likes

- 3,306

If Sun doesn’t mind, I’ll post my thoughts and questions on this thread as I think we can have similar questions and observations on our learning stages. I don’t post much anyway😉

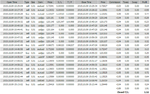

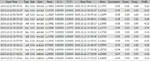

Today I want to share my self-reflection on the relationship between winning % and profit taking. I’ve been having a very decent winning % until some two weeks ago. Why? I want to get more pips on each of my entries, hence left the trades running longer. Yes, I have had some occasional nice trades of 10-15 pips, but the winning % dropped dramatically. I felt very disappointed.

So, I think at this stage, it’s not advisable for me to shoot for profits bigger than 4-6 pips on each trade. As Sun can relate, it’s very…very common to have some +3 - +6 pips in profit which quickly become -3 - -5 and the trade must be closed (and the trade goes your way afterwards). So I’m going to leave a hard take profit limit around +4 pips (3.2 for me and 0.8 for the shark) and hopefully go back to a high winning % with a decent amount of pips. My daily target at this moment is very modest - 13-16 pips, so with 4-5 winning trades I can reach my daily target. I close trades between 3-6 pips in loss, so on average the R:R would be 1:1.

I’ll post how this approach is working out in some 2 weeks when there is a decent sample size to draw a conclusion. Any thoughts/advice is welcome.

Cheers,

Keen246

hI K

Please do - its always good if we can get 3 or 5+ students of the method discussing their own findings and whats going well and whats not working

The more the merrier as far as I am concerned - even if everyone is at different stages in their development etc etc

Also same for remulix - if you want to come on main thread as well - no problem - just put a friends request in and I can then allow you on with questions etc etc - thats as long as you have say 12/18 months minimum FX experience and have read through the other threads to understand the main basics of my method

GL and all the best

Regards

F