Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

...As part of a transition toward around-the-clock trading, the Chicago Board of Trade announced this week its grain contracts would begin trading expanded hours, trading nearly uninterrupted from Sunday night through Friday afternoon. The new 22-hour-per-day schedule is slated to begin later this month and will apply to corn, soybeans, wheat, rice, oats, ethanol, soybean oil and soybean meal.

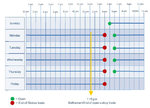

Effective May 20, 2012, for trade date May 21, 2012, electronic trading hours for CBOT Corn, Mini-Sized Corn, Soybeans, Mini-Sized Soybeans, Wheat, Mini-Sized Wheat, Soybean Meal, Soybean Oil, Rough Rice, Oats, and Ethanol futures and options plus all related calendar spread options and inter-commodity spread options will be extended to:

Sunday to Monday, 5:00 p.m. to 4:00 p.m. CT

Monday to Friday, 6:00 p.m. to 4:00 p.m. CT.

The documentary starts with describing of the technology that they claim has been 'buried and hidden, despite of its ability of gas mileage improvement in cars and also reducing oil consumption'.

Concluding Remarks

Over the past century, world economic development has been

fundamentally shaped by the availability of abundant, low-cost oil. Previous

energy transitions (wood to coal, coal to oil, etc.) were gradual and

evolutionary; oil peaking will be abrupt and revolutionary.

The world has never faced a problem like this. Without massive

mitigation at least a decade before the fact, the problem will be pervasive

and long lasting.

Oil peaking represents a liquid fuels problem, not an “energy crisis” in

the sense that term has been used. Accordingly, mitigation of declining

world oil production must be narrowly focused, at least in the near-term.

A number of technologies are currently available for immediate

implementation once there is the requisite determination to act.

Governments worldwide will have to take the initiative on a timely basis,

and it may already be too late to avoid considerable discomfort or worse.

Countries that dawdle will suffer from lost opportunities, because in every

crisis, there are always opportunities for those that act decisively.

The world is faced with a daunting risk management problem.

Prices of natural gas for end-consumers vary greatly throughout Europe.[16] One of the main objectives of the projected single EU energy market, is a common pricing structure for gas products. Europe's main natural gas supplier is Russia. Since the major pipelines pass through Ukraine there is an ever arising dispute on the supply and transition prices between Ukraine and Russia.

...Right now, there is no pathway for U.S. gas to reach higher paying markets. But exports of liquefied natural gas (LNG) are right around the corner. That will be a game-changer, where if nothing else, arbitrage will cause global prices to converge.

Japan, the world’s biggest importer of liquefied natural gas, is in talks to start shipping the fuel from the continental U.S. after the ***ushima disaster last year shut most of the country’s nuclear power plants.

Japan is seeking to buy part of the combined 30 million metric tons a year of LNG to be shipped from Cameron in Louisiana, Cove Point in Maryland and Freeport in Texas, Hisayoshi Ando, director general of natural resources and fuel at the trade ministry, said in an interview.

LNG imports have risen as only two of Japan’s 54 reactors are operating after the March 11 earthquake and tsunami triggered the worst atomic disaster since Chernobyl. Increased U.S. gas output from shale formations drove prices to a 10-year low and led owners of LNG import terminals to consider exports.