Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

putting it together, one more time

I am getting closer and closer to putting it all together, even though once again I don't have a complete formula to summarize the whole process.

We could divide this thing in 2 parts:

1) building the portfolio

2) scaling up and scaling down the portfolio

Building the portfolio

What counts here is picking (profitable) systems with this in mind:

a) % of wins (the higher the better)

b) absolute size of losses (the lower the better)

c) non-correlation of systems to underlying future (the rest will happen by itself, since most futures are correlated with one another).

d) quantity of systems (the more the better)

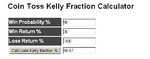

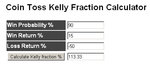

This works like coins, because if you toss one coin per day, you get heads or tails. But if you toss 100 coins, you are unlikely to get all heads or all tails. Therefore the more and the smaller systems you have, the better, because you'll get closer and closer to your expected value.

Scaling up and scaling down the portfolio

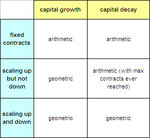

This part, as shown in the previous posts, works like this:

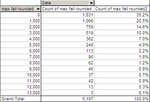

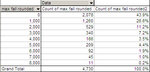

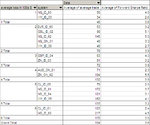

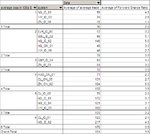

View attachment scaling_up_and_scaling_down_4th_vers.xls

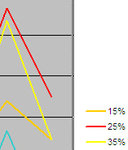

As a summary, you should scale up as your capital increases and scale down as your capital decreases. I think it's called "fixed fractional". At worst you end up with a little less than fixed contracts. But you get a "safe" shot at compounding.

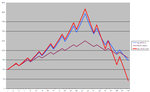

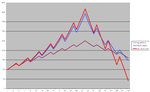

In detail, in the chart above, all 3 portfolios have the same amount of wins, 24, and amount of losses, 18. It's a realistic situation, when things go worse than expected.

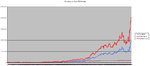

Red line

If you handle it the way we handled it with the investors in September, you're going to lose money like we did, despite the fact that we had more wins than losses (and bigger wins than losses). So, after a year of making money, we lost it all in one month, because of the added contracts: one month of losses was enough to wipe out a year of profit: that's what happens when you scale up on your way up, and do not scale down on your way down:

Violet line

Safe but doesn't benefit from compounding, and only safe if on the way down from a peak. If you instead start falling from the beginning, fixed contracts (just like the previous red line) loses faster than Kelly.

Blue line

Great compounding and safety at once. Optimal method for a system that you expect to make money.

In this situation the blue line makes less money than the violet one only because the losses are so many. We do not expect systems to have such a small edge. 24/18 with win=loss is a profit factor of 1.33. That is not my profit factor. The typical situation is the one you see on the way up. But Kelly is necessary to account for situations where the unexpected happens.

This is what counts. The formulas might be unrealistic and oversimplified but the principle is clear. If things go well, you make much more money. If things do not go well, you lose a little more than fixed. If things go very badly: then you still do better with Kelly than with fixed contracts, because you will decrease the contracts all the way to having 1, whereas fixed contracts will keep them fixed:

The only problem left is to adapt this assumption of infinite divisibility to futures, and to turn this whole recipe into a univocal and unambiguous formula.

I am getting closer and closer to putting it all together, even though once again I don't have a complete formula to summarize the whole process.

We could divide this thing in 2 parts:

1) building the portfolio

2) scaling up and scaling down the portfolio

Building the portfolio

What counts here is picking (profitable) systems with this in mind:

a) % of wins (the higher the better)

b) absolute size of losses (the lower the better)

c) non-correlation of systems to underlying future (the rest will happen by itself, since most futures are correlated with one another).

d) quantity of systems (the more the better)

This works like coins, because if you toss one coin per day, you get heads or tails. But if you toss 100 coins, you are unlikely to get all heads or all tails. Therefore the more and the smaller systems you have, the better, because you'll get closer and closer to your expected value.

Scaling up and scaling down the portfolio

This part, as shown in the previous posts, works like this:

View attachment scaling_up_and_scaling_down_4th_vers.xls

As a summary, you should scale up as your capital increases and scale down as your capital decreases. I think it's called "fixed fractional". At worst you end up with a little less than fixed contracts. But you get a "safe" shot at compounding.

In detail, in the chart above, all 3 portfolios have the same amount of wins, 24, and amount of losses, 18. It's a realistic situation, when things go worse than expected.

Red line

If you handle it the way we handled it with the investors in September, you're going to lose money like we did, despite the fact that we had more wins than losses (and bigger wins than losses). So, after a year of making money, we lost it all in one month, because of the added contracts: one month of losses was enough to wipe out a year of profit: that's what happens when you scale up on your way up, and do not scale down on your way down:

Violet line

Safe but doesn't benefit from compounding, and only safe if on the way down from a peak. If you instead start falling from the beginning, fixed contracts (just like the previous red line) loses faster than Kelly.

Blue line

Great compounding and safety at once. Optimal method for a system that you expect to make money.

In this situation the blue line makes less money than the violet one only because the losses are so many. We do not expect systems to have such a small edge. 24/18 with win=loss is a profit factor of 1.33. That is not my profit factor. The typical situation is the one you see on the way up. But Kelly is necessary to account for situations where the unexpected happens.

This is what counts. The formulas might be unrealistic and oversimplified but the principle is clear. If things go well, you make much more money. If things do not go well, you lose a little more than fixed. If things go very badly: then you still do better with Kelly than with fixed contracts, because you will decrease the contracts all the way to having 1, whereas fixed contracts will keep them fixed:

The only problem left is to adapt this assumption of infinite divisibility to futures, and to turn this whole recipe into a univocal and unambiguous formula.

Last edited: