something ain't right in my ROI to variability ratio

Remember how I said that I would divide ROI by margin, and then the whole thing by the stdevp?

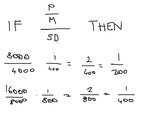

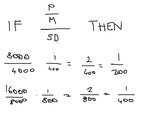

That isn't right, because these two systems should be the same and yet they would not be, if I did things my way:

The performance of those two systems is identical, because the one with the smaller margin of 4000 could be turned into the bigger one simply by trading 2 contracts, and THEN the standard deviation would double, because that's how standard deviation works:

So they're identical, precisely because the two different standard deviations are related to the trade size, margin, and profit. And yet they're rated differently by my ratio. This cannot happen.

You know, I was alerted to this by the fact that a mediocre system, such as the GBP_ID_02, scored very well on my scatter plot. And this morning, while reading in the cab, I was wondering why the hell such a poor... not poor but "so so" system, why it scored so well, if I should enable it for trading, or if something was wrong.

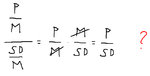

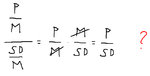

So it's now clear that I need to relativize the standard deviation by the margin (or by the profit?), but then if I do that, and get closer to the original Sharpe Ratio, things do work out, but where does the ROI go?

It doesn't seem right either way.

The previous way wasn't right but this doesn't seem to take ROI into account, does it?

Where does the ROI go? Are we still assessing the ROI? Let's check.

[...]

Busy at the office.

Ok, I think I've got it, once and for all.

The ROITVOR ratio

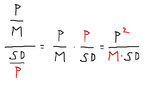

We can't divide SD by margin, because we then lose track of ROI, which comes from Profit divided by Margin.

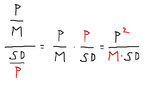

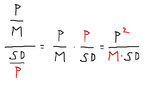

This is what we have to do:

We don't divide SD by margin but by Profit. The number of the numerator, it's clear what it is, and the bigger it is, the better the system is and the bigger our ratio gets. The number on the denominator instead, the bigger it gets, the worse our system gets appraised by the ratio. And if we divide SD by margin, we're not keeping track of ROI any longer, because the two margins (divided by margin, and multiplied by margin) would cancel out... hey, I suck at math, but it's clear that I can't do it and it's clear that with this other formula it works.

Since I suck at math, I had to verify through a practical example:

We have two systems,

1) identical in everything (but with different margins and leverage), and then

2) we have the same two systems where one's margin changes, and then

3) the same two systems where one's SD changes.

The only constant difference is that one system trades a future that's ten times as big as the other one.

[...]

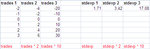

Here's the work on excel:

View attachment two_systems_assessed_with_ROI.to_rel.SD_ratio.xls

and a snapshot:

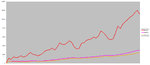

I think I am on to something. This is excellent work of synthesis - whatever you call it in English. I put together everything I knew in a ratio, which I won't call the "travis ratio", but the... since sharpe said

here that his ratio should have been called reward-to-variability ratio, I'm gonna call mine the Reward-On-Investment-to-variability-on-reward ratio (ROITVOR ratio), which is indeed represented by the mentioned equation:

Once I'll get home I'll have to update that excel template file for the tests, because this is a revolutionary change. The ROITVOR ratio is like the Sharpe Ratio (RTV ratio, Reward-To-Variability ratio), but it adds this:

1) it measures profitability

2) it measures profitability based on margin

This is a must for futures traders. I demand a lot of five-star ratings for this invention of mine.

If a system trades 10 times in a year, with a sequence of +2 and -1 trades, the Sharpe Ratio will rate it as well as a system trading 100 times with the same sequence of trades. This is crap as far as I am concerned. The two systems are not the same.

But then, if we measure profitability, we also need to include the margin required to trade the system, and that's where this post comes in. Whatever if anything I did wrong, these are clearly the ruling principles of the whole deal.

If this will work, I will then need to find a way to make it work on a portfolio level, so that I will be able to make theoretical predictions accurate and in line with my blender, the Monte Carlo VaR estimator.

[...]

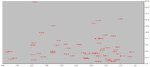

Back at home and having problems. The multiplying of those two ratios causes the scale to be blown out of proportion. The sharpe ratio did not have this problem at least.

But you know, other than the scale, which can be fixed, what's bothering me increasingly is that the standard deviation is after none other than average loss. Isn't the average loss actually even better than the standard deviation?

Downside risk measures was a good point, and it's haunting me. Sortino and company, I mean.

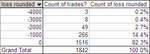

Look, the systems are quite reasonable after all:

I mean the ratio makes sense and brings up the best systems, so I am satisfied. I just mean to make a comparison between max loss, average loss and standard deviation, to see if I can come up with something better.

But other than that, the systems's performance is appraised correctly. For example, in the image above, why is CL_ID_05 three times as good as SI_ID_01, with a score of 36 instead of 12? Because... it's got much more ROI, and all it needs is 2 contracts to make the same money, while still requiring less margin. And also: when it will do that, it will still have less stdevp. Then we'll have to really verify if stdevp is better at measuring downside risk than average loss and max loss are.

Why is NG_ID_04 twice as good as NG_ID_02? Because... with the same investment it makes 25% more profit, and it has 15% less stdevp. So, if and only if, stdevp measures downside risk correctly, then we know this is good stuff, because it compares systems more effectively than sharpe ratio.

[...]

Awesome!!

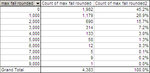

.83 correlation of standard deviation to max losses

.89 correlation of standard deviation to average losses

We can trust standard deviation. So now I just have to fix my scale on the scatter plot and i am set.

And I have to... change developing_my_own_risk_metric.xls" and add these awesome metrics.

[...]

Having problems with the scale. The scatter plot is not clear.