Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

experimenting with portfolio sharpe ratio: #2

Continuing from here:

http://www.trade2win.com/boards/trading-journals/140032-my-journal-3-a-68.html#post1803304

Recapitulating, yesterday I have found out that (cfr. excel file attached in mentioned post):

1) the sharpe ratio doesn't detect DD - could be a problem

2) the sharpe ratio doesn't detect ROI - could be a problem

3) the sharpe ratio rates (slightly) higher a system with more trades (due to stdev function) - not a problem

4) the (portofolio) sharpe ratio could be lower even when combining two systems with identical sharpe ratios (due to stdev changing differently than average trade) - could be a problem

Now I'll keep on experimenting and seeing how different systems interact in a portfolio and how they affect the portfolio sharpe ratio. So far I am not too happy with all these limits I have discovered. I feel like: why not go back to measuring simple profit? Or Return On Investment?

When you go from building a portfolio by rule-of-thumb to building a portfolio via formulas, in a univocal way, what seemed easy and intuitive suddenly becomes a nightmare. That is, if you're not a mathematician.

In a sense, I now understand and agree with the fact that the sharpe ratio penalizes me if I add a system that has the same sharpe ratio as the others, but a much wider standard deviation:

Because now the overall sharpe ratio is affected by a much bigger stdev, yet the average profit doesn't increase to the same extent. Of course to me this is counter-intuitive. I never would have imagined that 5 systems with the same sharpe ratio could have a combined sharpe ratio which is much lower. In fact, except for the mentioned stdev vs. stdevp factor, I don't think that the sharpe ratio can ever increase by combining different systems, except if instead of measuring trade by trade you start measuring day by day.

I will test it now, by using stdevp instead of stdev. And see if I can get a bunch of systems to have, together, a higher sharpe ratio than the average of their individual sharpe ratios.

SHARPE RATIO NO GOOD FOR ASSESSING A PORTFOLIO

Yeah, it was confirmed pretty confidently, by a bit of testing:

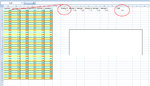

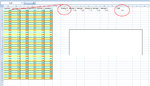

View attachment experimenting_with_sharpe_ratio.xls

This is terrible news: if all trades are taken into account (and you don't change the timeframe used to appraise the sharpe ratio)... I mean this has to be clarified further:

The only reason the sharpe ratio has a tendency to improve by combining systems is (other than mentioned stdev-stdevp issue) if you measure it on a daily profit basis and this is a mistake. If you do that, the wins and losses will offset each other (in favor of profit), and the more systems you add, the better your sharpe ratio gets, because since the systems are profitable, wins will tend to hide losses, and make the equity curve smoother and the sharpe ratio higher, but this is not correct, because the trades taking place in a day do not always happen during the same hours, and therefore the win offsetting the loss could be happening not during but after the loss, which means it only compensates on paper but not in real trading.

So, the only correct way to measure the sharpe ratios and combined sharpe ratio is on a trade-by-trade basis.

And if you do that, adding up systems does not (except for stdev-stdevp issue) in any way improve the sharpe ratio.

But what we do know is that indeed, the more systems you trade the better it is, because you diversify, so how do we deal with the fact that the sharpe ratio doesn't measure it? Why?

(Indeed, the sharpe ratio is at best equal to the average of the sharpe ratios of the systems composing the portfolio).

Why?

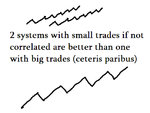

I think the key of this is the drawdown. The problem is that, by counting the daily profit (wrong method) vs the individual trades (right method) we had found an unorthodox way to have the sharpe ratio take into account drawdown and how drawdown is decreased by diversification, because other SR doesn't give a **** about it. It doesn't give a **** about the good effect of diversification, because, as I saw yesterday, the sharpe ratio does not care about the order of the trades, so it doesn't detect the drawdown, and yet the diversification is what reduces the drawdown, and this is a big problem. Big problem. That makes me want to dump the sharpe ratio as far as a tool to build a portfolio.

Yes, I do lack a lot of math skills, which would definitely help in these reasoning. I can't dismiss the sharpe ratio like this without even knowing how to read summation notation. On the other hand, these findings are pretty clear. Excel speaks clearly (cfr. file I attached in yesterday's post).

So I will still use the sharpe ratio for adding up different systems and finding the good ones (because for that specific task it is good), but I will stop using it for building a portfolio, at least until things get clearer (and it'll take a lot of math for that). Instead, for building a portfolio, I will use the following empirical methods.

EMPIRICAL METHODS FOR PUTTING TOGETHER A PORTFOLIO

Here's the deal: monte carlo blender.

1) I identify the good systems with my usual scatter plot with forward-tested trades on x-axis and sharpe ratio on y-axis.

2) I stick the trades by those systems into my monte carlo blender, after having multiplied their trades by thousands (as much as one excel column can hold), and come up with an estimate of the maximum drawdowns by starting on every specific day of the new (resampled and enlarged) sample.

3) If I come up with a zero probability of a drawdown exceeding my capital both in the original sample and in the resampled sample, then the systems are ready to be traded. Obviously there's still going to be a probability of blowing out: it didn't come up just because the resampling wasn't wide enough. And I also know that the systems will work in the future than in the past, so anyway: success is never certain, but what I am saying is that this method of building a portfolio and scaling up is more effective than the sharpe ratio...

I don't know. Maybe not. It is reliable, and I don't know any better, but it's a pain in the ass, it's not smooth, and... it sucks.

But sharpe ratio sucks worse. I need to find something else. I'll still read up on both markowitz and kelly but sharpe ratio right now doesn't seem to be an option any more, mainly for its incapability of detecting Drawdown and Return on Investment.

I might even stop my testing on sharpe ratio altogether. Yeah, I'll stop it for now. I can always resume it later. Maybe after I'll figure out some more math. Math at this point is indispensable, aside from being a personal source of satisfaction and a matter of pride. I want to become proficient in financial math, or even just in portfolio math. My first profits beyond 10k will be reinvested in math private lessons.

[...]

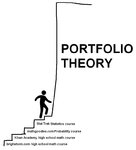

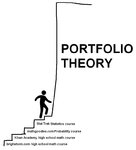

This is a good summary of the size of the steps I've been climbing in the last five months, with my math review, and the steps that I have to climb now. It really sucks that I can't find anything intermediate right now, anything smaller. I went from elementary school math to the end of high school math, but now I skipped 4 years of college math, and am confronted with graduate school math or similar and it's an obstacle that I do not know how to tackle and a step that I don't know how to climb:

Continuing from here:

http://www.trade2win.com/boards/trading-journals/140032-my-journal-3-a-68.html#post1803304

Recapitulating, yesterday I have found out that (cfr. excel file attached in mentioned post):

1) the sharpe ratio doesn't detect DD - could be a problem

2) the sharpe ratio doesn't detect ROI - could be a problem

3) the sharpe ratio rates (slightly) higher a system with more trades (due to stdev function) - not a problem

4) the (portofolio) sharpe ratio could be lower even when combining two systems with identical sharpe ratios (due to stdev changing differently than average trade) - could be a problem

Now I'll keep on experimenting and seeing how different systems interact in a portfolio and how they affect the portfolio sharpe ratio. So far I am not too happy with all these limits I have discovered. I feel like: why not go back to measuring simple profit? Or Return On Investment?

When you go from building a portfolio by rule-of-thumb to building a portfolio via formulas, in a univocal way, what seemed easy and intuitive suddenly becomes a nightmare. That is, if you're not a mathematician.

In a sense, I now understand and agree with the fact that the sharpe ratio penalizes me if I add a system that has the same sharpe ratio as the others, but a much wider standard deviation:

Because now the overall sharpe ratio is affected by a much bigger stdev, yet the average profit doesn't increase to the same extent. Of course to me this is counter-intuitive. I never would have imagined that 5 systems with the same sharpe ratio could have a combined sharpe ratio which is much lower. In fact, except for the mentioned stdev vs. stdevp factor, I don't think that the sharpe ratio can ever increase by combining different systems, except if instead of measuring trade by trade you start measuring day by day.

I will test it now, by using stdevp instead of stdev. And see if I can get a bunch of systems to have, together, a higher sharpe ratio than the average of their individual sharpe ratios.

SHARPE RATIO NO GOOD FOR ASSESSING A PORTFOLIO

Yeah, it was confirmed pretty confidently, by a bit of testing:

View attachment experimenting_with_sharpe_ratio.xls

This is terrible news: if all trades are taken into account (and you don't change the timeframe used to appraise the sharpe ratio)... I mean this has to be clarified further:

The only reason the sharpe ratio has a tendency to improve by combining systems is (other than mentioned stdev-stdevp issue) if you measure it on a daily profit basis and this is a mistake. If you do that, the wins and losses will offset each other (in favor of profit), and the more systems you add, the better your sharpe ratio gets, because since the systems are profitable, wins will tend to hide losses, and make the equity curve smoother and the sharpe ratio higher, but this is not correct, because the trades taking place in a day do not always happen during the same hours, and therefore the win offsetting the loss could be happening not during but after the loss, which means it only compensates on paper but not in real trading.

So, the only correct way to measure the sharpe ratios and combined sharpe ratio is on a trade-by-trade basis.

And if you do that, adding up systems does not (except for stdev-stdevp issue) in any way improve the sharpe ratio.

But what we do know is that indeed, the more systems you trade the better it is, because you diversify, so how do we deal with the fact that the sharpe ratio doesn't measure it? Why?

(Indeed, the sharpe ratio is at best equal to the average of the sharpe ratios of the systems composing the portfolio).

Why?

I think the key of this is the drawdown. The problem is that, by counting the daily profit (wrong method) vs the individual trades (right method) we had found an unorthodox way to have the sharpe ratio take into account drawdown and how drawdown is decreased by diversification, because other SR doesn't give a **** about it. It doesn't give a **** about the good effect of diversification, because, as I saw yesterday, the sharpe ratio does not care about the order of the trades, so it doesn't detect the drawdown, and yet the diversification is what reduces the drawdown, and this is a big problem. Big problem. That makes me want to dump the sharpe ratio as far as a tool to build a portfolio.

Yes, I do lack a lot of math skills, which would definitely help in these reasoning. I can't dismiss the sharpe ratio like this without even knowing how to read summation notation. On the other hand, these findings are pretty clear. Excel speaks clearly (cfr. file I attached in yesterday's post).

So I will still use the sharpe ratio for adding up different systems and finding the good ones (because for that specific task it is good), but I will stop using it for building a portfolio, at least until things get clearer (and it'll take a lot of math for that). Instead, for building a portfolio, I will use the following empirical methods.

EMPIRICAL METHODS FOR PUTTING TOGETHER A PORTFOLIO

Here's the deal: monte carlo blender.

1) I identify the good systems with my usual scatter plot with forward-tested trades on x-axis and sharpe ratio on y-axis.

2) I stick the trades by those systems into my monte carlo blender, after having multiplied their trades by thousands (as much as one excel column can hold), and come up with an estimate of the maximum drawdowns by starting on every specific day of the new (resampled and enlarged) sample.

3) If I come up with a zero probability of a drawdown exceeding my capital both in the original sample and in the resampled sample, then the systems are ready to be traded. Obviously there's still going to be a probability of blowing out: it didn't come up just because the resampling wasn't wide enough. And I also know that the systems will work in the future than in the past, so anyway: success is never certain, but what I am saying is that this method of building a portfolio and scaling up is more effective than the sharpe ratio...

I don't know. Maybe not. It is reliable, and I don't know any better, but it's a pain in the ass, it's not smooth, and... it sucks.

But sharpe ratio sucks worse. I need to find something else. I'll still read up on both markowitz and kelly but sharpe ratio right now doesn't seem to be an option any more, mainly for its incapability of detecting Drawdown and Return on Investment.

I might even stop my testing on sharpe ratio altogether. Yeah, I'll stop it for now. I can always resume it later. Maybe after I'll figure out some more math. Math at this point is indispensable, aside from being a personal source of satisfaction and a matter of pride. I want to become proficient in financial math, or even just in portfolio math. My first profits beyond 10k will be reinvested in math private lessons.

[...]

This is a good summary of the size of the steps I've been climbing in the last five months, with my math review, and the steps that I have to climb now. It really sucks that I can't find anything intermediate right now, anything smaller. I went from elementary school math to the end of high school math, but now I skipped 4 years of college math, and am confronted with graduate school math or similar and it's an obstacle that I do not know how to tackle and a step that I don't know how to climb:

Last edited: