discretionary update

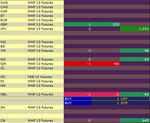

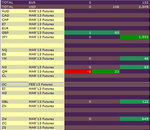

I've updated my ideas on the markets with a synthesis for every future:

View attachment index.html

For the first time, I have developed a comprehensive and articulate action plan.

idea2develop

The principle of my new type of trading (which doesn't mean I am stopping my automated trading) is that I know where we are and how overbought/oversold we are.

Everything can be measured on a scale of overbought/oversold, just as the temperature of now can be measured relative to the season and the other factors.

This scale of "where we should be" varies according to factors such as:

1) day of the week

2) time of the day

3) month of the year

4) day of the year (days before holidays, etc.).

5) politics

6) finance

7) raw resources

...but most of all 8) where price was in the past (and this is a summary of all of the above, and more)

All these factors and more are telling me where price should be. Then I look at where it is, and come up with a trade. And I am doing this assessment once a day, so it's not like I'll come up with several trades in opposite directions. Most likely I will come up with just one trade, to last several hours or days.

What is very important though is to study price and where it's been in the past, something that I've only done in the past as far as the ongoing day and not methodically. This thorough research is as in-depth as I can afford, given limited time and continuously changing markets. All I can afford is to look carefully at the 16 charts on a daily candles timeframe. But this is much better than doing more and doing it incompletely.

Having 16 markets and keeping track of them with a consistent and coherent method is better than looking here and there, and even spend more time on one market than I spend on 16. Because you see, the point is that I am multiplying my opportunities by 16, and I am multiplying my opportunities for every day I monitor them.

So the key here is the speed in monitoring these markets and thoroughness. I am as thorough as I need to be, and use the rest of the time, to monitor as many markets as possible and as frequently as possible. Even here, the frequency, I can only manage to do it twice a day. So I'll settle for that.

So, once again, the key advantages of this technical analysis on many markets that I've implemented with index.html are:

1) opportunities are multiplied by the number of markets I am monitoring

2) opportunities are multiplied by the frequency of monitoring

This is the key to everything. Look from high up above (daily charts), look frequently, look in many places, and spot the opportunity.

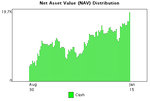

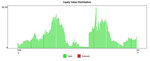

Of course, it'd be perfect to automate all this, but it is impossible as far as my programming skills are concerned. Yet the automation and statistics I've already done are now helping me in my discretionary trading.