Continuing from here:

http://www.trade2win.com/boards/trading-journals/140032-my-journal-3-a-42.html#post1782586

Ok, since i've got some free time, I'll resample the relativized (by today's prices) trades from the present portfolio of 13 systems, of which one I've enabled just yesterday. I will describe the findings here below.

Simon & Garfunkel, Bridge Over Troubled Water, Central Park - YouTube

[...]

Ok, so I've got 5200 trades from those 13 systems, and i have on excel 65536 rows, so I can only multiply the trades by 12 times, before mixing them up as usual.

ELVIS - Bridge Over Troubled Water (NEW mix! Great sound!) - YouTube

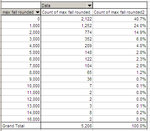

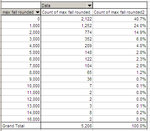

But even before that, let's look at what the non-resampled relativized trades show as my probability of blowing out at the present level of capital:

Right now, having a bit over 9000, I can afford to lose 7000 and still trade, but not more. How much does that 7k cover? All losses within 7k, which amount to a... 97.6%. If the past repeated itself,

not randomly - what I mean if the edge I've had in back-testing kept being of the same quality and performance, but not in a random order (the trades have to happen in the same exact order) - then I'd have a 97.6% chance of making it and not blowing out. But now, since I cannot count on the 5200 trades to happen in the same exact sequence, let's resample them. I'll do it twice, to double-check if the two resamplings match.

I will then accept as valid results whatever is worse between "exact order" (backtested trades as they happened) and "same trades but in random order".

Bridge Over Troubled Water (Live at Pearl's)- Eva Cassidy - YouTube

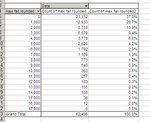

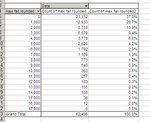

Ok, I've done it twice, and once again, I got almost the same exact results from both random resampling of the 65k trades (the original trades multiplied by 12 times). Here's the worst one of the two:

How did mixing up the trades affect my probability of not blowing out the account? Simple. What did I say earlier about my chances according to the back-tested chronological order of the trades? Here it is:

How much does that 7k cover? All losses within 7k, which amount to a... 97.6%. If the past repeated itself, not randomly - what I mean if the edge I've had in back-testing kept being of the same quality and performance, but not in a random order (the trades have to happen in the same exact order) - then I'd have a 97.6% chance of making it and not blowing out.

So, how was my probability of losing more than 7k affected by the resampling? At worse, it turned out to be this: 96.1% of survival (on the other resampling it was 97%). So, by resampling, I lose about 1% of probability in my favor.

Baden Powell - Violão Vagabundo - YouTube

How does all this compare to the combination I was trading previously and was it worth changing it and why?

The previous set of trades went from a % point higher to a % point lower, just like for this one, but it was also a point higher than this one (it went from 98 to 97, rather than from 97 to 96), so why did I accept increasing risk by one percent point?

Simple, these reasons:

1) due to inaction and boredom and lack of trades, I have found myself placing discretionary trades, which have proven to be unprofitable. By allowing more actions by the systems, I will be less likely to seek action on my own.

2) The back-tested (relativized) profit goes from 350k to 460k. That is a 30% increase. This will bring monthly profit from 3500 per month (the back-tested sample is 100 months) to 4600 per month. This in turn means:

a) I go up faster and therefore maximize using systems while they work (because in the long run they'll stop working)

b) I go up faster and the more capital I have, the less the chance of blowing out

3) Maybe this is magical thinking (rather than probability theory), but it can't hurt: i have just seen a big drawdown in the CL_ID_05 and I feel it is not likely to continue. I do know that, according to probability theory, the future drawdown is NOT affected by the immediate history of trades behind it. So I guess what subconscious reasoning is telling me is that it is not exactly like this and the past does affect the future. However, even if this were all wrong, then it would be random, so starting after a drawdown it won't hurt me, but just be a neutral action. And the points #1 and #2 are enough to justify my move of including the CL_ID_05 in my portfolio.

On top of everything, I studied in detail CL_ID_05 (of course I created it, but 120 systems I often forget what they do) and it seems a very healthy system. It goes both long and short, it trades often, and it is simple.

Aileen Stanley - I'll Get By (As Long As I Have You) (1929) - YouTube

Now let's study how this affected my forward-tested results. I am not going to do a resampling because I am tired now.

All right, I will do a resampling for forward-tested trades, too.

By the way, you do realize that if everything goes according to... luck, then I will be making at least 4k per month, and if I don't run into the bad luck of (less than) 1 out of 20 chances, then I will not blow out, while making more than my salary. This means drugs, women... but no treating anyone to restaurants. I've banned that from my life. I will not be exploited, by you mother ****ers who call yourselves "friends".

Ok, let's tackle this last feat.

You know, if I ever have extra money, I will spend it to boycott google, because the search settings never stick. These mother ****ers in control of google, excel, windows nowadays have trashed the work of their predecessors. They deserve to go to jail or at least be fired.

lionel richie-say you say me - YouTube

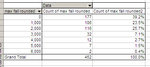

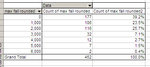

Ok, here's the original performance of the 13 systems on the forward-tested sample:

Now, this looks really good of course, and it shows I have NO chance of blowing out whatsoever, but it's because, with so few trades, of course the chance of getting really big drawdowns is smaller. All it tells me is that, even if performance stayed as good, with 452 trades and a capital of 9k, my chance of blowing out is zero. But what happens with more trades? Even assuming performance stays exactly as good.

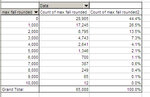

So now I'll do the resampling, to see what happens when I multiply the same trades by 144 times (the maximum my excel 2003 allows, given that the new excel is by idiots and for idiots) and mix them up.

Coração Vagabundo - Gal Costa - YouTube

Meu coração não se cansa

De ter esperança

De um dia ser tudo o que quer

Meu coração de criança

Não é só a lembrança

De um vulto feliz de mulher

Que passou por meus sonhos

Sem dizer adeus

E fez dos olhos meus

Um chorar mais sem fim

Meu coração vagabundo

Quer guardar o mundo

Em mim

Meu coração vagabundo

Quer guardar o mundo

Em mim

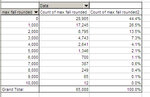

Ok, here it is:

The trades are the same, the edge is the same, but they're mixed differently and the results get worse. With a capital of 9k (a few hundreds higher), my chance of losing more than 7000 and blowing out is 0.5%, meaning I have a 99.5% chance of surviving any drawdown.

But then I am wondering this: are the systems performing better in the forward-tested period than in the back-tested period? I would expect that, since I've been choosing the systems to enable based on their forward-tested performance.

Let's check the two different sharpe ratios (non resampled trades), one for back-testing and one for forward-testing.

Homme - Brazilian Girls Lyrics - YouTube

Ok, the 452 forward-tested trades have this sharpe ratio:

=15.8*AVERAGE(A2:A453)/STDEV(A2:A453)

=2.67

And the 5208 back-tested trades have this sharpe ratio:

=15.8*AVERAGE(A2:A5209)/STDEV(A2:A5209)

=2.12

So now it's all clear.

New York State Of Mind / Billy Joel - YouTube

Am I gonna be lucky and not incur those... at worst 10% chances of blowing out? Yeah, on paper it's just a 3% chance of blowing out in back-testing, and 0.5% in forward-testing. But let's say it's 10%, because things are going to be worse in the future than they were in the past, for many reasons mentioned repeatedly in previous posts.

Anyway, regarding that 10% chance of blowing out, I am going to pretend I am confident that I'll be lucky. I am going to think of the future, as if I won't blow out the account.

Assuming I'll be lucky, what will I do with this money? 4k per month, more or less.

Well, first of all, in 3 months, I should reach the safer capital of 20k.

Then I'll add a few more systems, and this will increase the profit made per month. So, in 3 months I'll be able to spend and withdraw without worrying about it, but I still will not do it, because my objective is to retire as quickly as possible.

I want the chances of blowing out to decrease and decrease. I shouldn't even be able to spot anything that could blow out my account after a resampling of 65k rows. That should be the rule, before adding any new systems. Not even spotting one chance in 65,000 trades of blowing out.

Let's dream for a while. Once I'll reach 20k, then, in two months, I'll reach 30k, with 30k... basically my rate of return would be about... with a safe investment approach... yeah, the return would be about 20% per month, so I can simply compound capital at this rate and seeing where this will take me.

This is the capital progression I have ahead of me for the next 12 months, if I don't screw up in any way (namely compulsive gambling or scaling up too fast):

9

12

15

18

22

26

31

37

45

54

64

77

93

That's nothing that will allow me to retire within a year.

Let alone that if I want to decrease risk as i go along, it's unlikely that the advantages from diversification will allow me to scale up and keep the same profitability.

Also, given how much my trading has suffered from over-leverage, I should underbet to be on the safe side.

So that progression will probably start at 20% a month in the first month above 20k of capital, but it will slowly decrease to less and less.

However, it is clear that the absolute monthly profit will increase, and so it can only go from the present estimated 4k to above.

This money will not be enough to allow me to retire so I have to come up with something. Some idea to justify quitting my job, or to make my job lighter and lighter.

With that kind of monthly profit, I can take all the cabs I want. But that's not going to be enough to make my job lighter.

I should corrupt my boss into giving me a part-time schedule that only makes me go there once a year. But this is science fiction.

So, this profit won't get me anywhere in the short term, so let's think small once again and stop drugging myself with dreams.

The first thing I should do once I reach 30k is repay my debt with my bank. Or at least begin to do that.

...

Long story. Basically I should stop getting into the frenzy of scaling up fast, because it never got me anywhere and it will never get me anywhere except blowing out the account. I should take my time, because that's the only way to avoid blowing out the account. Once I get to 20k, I can add a couple of systems, but for the rest this portfolio should stay just the same. Then risk will go lower and lower, and I can start repaying the debt, and relaxing a bit. I should just stop thinking about this for a few months.

You know? If I added even just one more system, I would pretty much screw myself with my own hands. I better stop thinking about this. Yes, sure I'll keep studying math. But I've gotta stop obsessing about scaling up with the hope to impress my parents and have their blessing on quitting my job. That's not going to happen, probably ever.