Back at home. I am going to get drunk now, otherwise I can't sleep.

This thing is still open, I had a margin call warning, but the time period with insufficient funds didn't last long enough for them to close my position.

There was a big rise, but of course from the very low levels it reached today, so I am still very far from break-even.

Now I am losing 2500. I am going to drink my first beer.

I think I have an idea about math. I am going to stop doing so much math at home. The fact that all I do is work, both at the office and at home, may be responsible for my discretionary trading. It could very well be unrelated, but I have to try to find the cause. It could be that, due to working so much, I try to find some sort of escape in discretionary trading. Or that, as I said a few posts back, I try to speed up my profit, because I want to get out of a life where all I do is work.

If instead I relax at home, the need for (compulsive) discretionary trading might decrease. Not that it's frequent, but those two or three trades per month that i place are too much, given that each time it doesn't go my way, the risk is blowing out my account.

So, now I am going to drink beers and find a movie to watch while I try to fall asleep.

I will watch Ironclad:

Watch Ironclad online - download Ironclad - on 1Channel | LetMeWatchThis

Of course every 5 minutes I'll keep checking my fate on TWS.

[...]

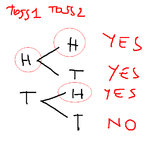

A big part of the problem is that I've had this deeply ingrained feeling throughout my life of being "special", blessed, destined to success and similar feelings. I guess, despite all the criticism, my father gave me a sense of being special, or maybe it's my reaction to his criticism that gave me a feeling of being special. Whatever it is, I have always felt, irrationally, that things will always go fine in the end for me. And this applies to my trading, too. I feel that I am going to get away with things that other people aren't getting away with. I either feel that I am lucky and blessed, or I strongly want to believe that I am lucky and blessed. Whatever it is... I engage in these behaviours that show that I think probability laws do not apply to me.

I talk about probability, i do my work based on it, and then I act as if I were the son of God or God himself. This doesn't get forgiven by the markets. Probability in the long run screws me over.

I don't know how many times I will have to be defeated by probability to realize that I am not special, I am not blessed and I am not lucky. I don't know if it will ever be enough. Even with the profit brought about by my systems, I feel it's not because of my hard, statistical and probabilistic work, but rather because there's someone up there who likes me.

I either believe it, or I want to live my life believing that someone up there likes me. I want to think I am special, in every area of my life, and maybe everyone else does, too. And I end up paying the price of that delusion.

I keep that delusion alive, because it feels good. And I do so, by downplaying everything that denies it, and only remembering those good things that confirm the delusion. In trading this translates into forgetting losses, and remembering wins. But the account balance remembers everything correctly.

In this sense, trading forces you to translate your subconscious thoughts into math, and you find out that the figures don't add up. That your beliefs don't add up.

[...]

Ironclad was crap. This is better:

Watch Just Add Water online free 2008 - download Just Add Water - LetMeWatchThis

Still no margin call.

[...]

Another margin warning. Losing 3500 dollars.

Terrible situation, for an unnecessary trade.

In the meanwhile I've lost that 600 from the two missed trades, which makes it even worse.

The child is screaming.

The mother is talking idiot talk to the child.

I am feeling pretty frustrated. I couldn't even sleep despite drinking two beers.

One contract will very likely be closed within minutes.

I was about to say the idiot voice of the mother will be forever impressed in my memory connected to this awful trade, but it's not the case. Things have been this bad before - my journals are full of these situations. I learned nothing from it. I learned that it's beyond my control, and I can't handle it, nor can I remember it. Each time it's like the first time.

One thing I did learn: it doesn't make sense to say "never again", because I've said far too many times.

I'm gonna drink another beer. It's not like I drink all the time. Only twice a month, for emergencies like this one.

I didn't know prices could fall like a stone (three days of falling):

The systems knew it. That's why they are profitable. But I didn't know it. Each time for me, whatever the market, the optical illusions abound and lure me.

Somehow I got lucky and I didn't get kicked out of this trade. There's still two contracts open. It bounced right after the margin warning.

But now it's falling again:

A lot of "if i had only..." keep surfacing in my mind, and I keep discarding them. This mess definitely has to do with my personality. Which side of my personality...

1) feeling special

2) feeling that I'll get away with things others don't get away with

3) feeling smarter

4) ...

If I knew all the causes, it wouldn't have happened.

In this sense, all these idiots daring to post reprimands, berating me on my journal for the same things I admit, are total idiots. Obviously if I knew what's going on, this would not happen. Besides, what is most stupid is that I got berated for the wrong money management in the previous situation, which wasn't even my own responsibility. So those guys I immediately put on my ignore list.

"Discipline" I keep reading everywhere on financial forums. Since reading that word doesn't help, I have to look for the causes elsewhere. Discipline is not an issue. Once you're convinced of something, you just do it out of reasoning: there's no need for discipline to keep you from losing money. All you need is to be convinced of:

1) that you don't want to lose money (I am assuming I am convinced of that)

2) that by trading discretionary you will lose money in the long run (I might have problems with being convinced of that)

For some reason, I keep testing myself, to try and see if I finally became profitable as a discretionary trader.

...

And I just missed yet another automated entry. Hopefully it will be an unprofitable trade.

...

The thing is that I keep saying "what an irrational thing I did", but that is only judged with the knowledge of now. You'd say "hey, automation was working, plenty of profit in two weeks, no need... why did you do it?". I didn't say "hey, let's lose 3000 dollars" but "let's make another 400 dollars". Then the lack of planning did the rest. I think if there is one mistake, if there were just one mistake in my mind is the one I mentioned earlier, "feeling special". I felt that I could not lose. And I feel like that each time I place a discretionary trade. I don't have an exit plan, because I am certain that we have reached bottom and that I can't lose. If I didn't feel like that, why would I place a trade? I am the guy who thinks his convictions are right and everyone else thinking otherwise is wrong. In the same way I trade: so I can't be wrong there either. This doesn't hurt in everyday life, but in trading I have to give up my entire account each time I am wrong. And this thing has been happening ever since december 1997, every year since then except for a couple of years when I wasn't trading. Yes, 14 years, like some idiots here remind me occasionally (what do I need an idiot to come on my journal and yell it out loud in capital letters, given that I am the one mentioning it every time?).

Yeah, huge problem, this of discretionary trading. Huge. I can't explain it. I mean I explained it in many ways, but it seems impossible for me to change this feeling of being special and this sensation that I can never be wrong, and that I'm blessed by the gods. Now for example I feel the markets "owe me" and I'll probably act on this, sooner or later.

I don't know how much more beating I need to take to get into my head that I cannot fight probability, that I am not blessed, that I am not special and that I am not always right.

I am always so busy trying to make everything perfect that I deceive myself into thinking that I have achieved that perfection. With my stats, my probability, my program, with my estimates...

I guess one who is not an idiot (like some who posted here in the past) could you make this good objection, and I would allow it maybe, and it is: with all this writing, good writing, reasonable, how come you can't produce a change in your behaviour so to avoid discretionary trading? This would be a good point. I wrote thousands of posts about the problems I have because of discretionary trading, and I cannot stop it. If I could put into fixing this problem the same effort I put into writing these journals, hell I would solve it. So what's stopping me? I am not lacking the energies. Open question.

And what about all the work I did with math, with excel, with tradestation, with software, with hardware, at the office? How can a person be so serious, dedicated and hard-working and yet at the same time make the same mistake year after year for 14 years?

There's one guy who said that I don't want to make money, as I mentioned in one of my previous posts. Maybe I'd rather... I prefer the feeling of being special at the cost of losing than the feeling of making money by trading normally and in a boring way.

Certainly I won't solve it unless I change something, because a blown account every once in a while has never solved this problem I have, and for sure it is a problem I have in my mind and nowhere else, and it is not the same problem everyone else has. Yes, sure, similar to the problem others have, but not of the same exact nature.

This is probably closer to compulsive gambling. Many traders lose not because they want to lose, or because they are affected by compulsive gambling, but simply because they haven't figured out a profitable methodology, and I thought I was in this group of people. But now I don't think I am anymore. I have two methods, one that wins (automated) and one that loses (and blows out the account), and I keep using both. Yes, sure I think i will win with both, but I also know my stats, and it's clear that I do not win with discretionary trading.

Open again, another open question. A lot of open questions.

I don't have a problem with addictions, but with urges. I can't resist urges, but I don't get addicted to stuff, like drugs, drinking, smoking and not even to gambling. But occasionally there will an urge to make some extra money, which will blow out my account.

Very complex. And no bull**** psychiatrist can solve this.

...

There's also the very important factor, that others don't have, of not being social, and that I just work all the time. So I never relax, never have fun, never see what other people are doing/thinking (people, that I generally consider stupid), and so I obviously obsess about things, and tend to bring everything to a deeper dimension, which is both good and bad. Free time is good, and work produces results. But when you're unbalanced and not relaxed, and you have in front of you a trading platform that can make the difference, and make you quit your job earlier... then things go wrong: unbalance + desire to quit job + trading platform = blowing out account.

Mental unbalance leads to low balance in the account.

I am almost done with writing, also considering that it never fixed this problem.

A few more lines, a few more sips, and I'll stop writing for the day.

I did keep my promise of not doing any math for the day.

...

What the **** did I learn from this lesson? Nothing. Nothing at all.

Something, but not enough. I don't even know what I learned.

And I don't know if I'll remember it. The past shows... that I just learned something I had already learned but had forgotten.