Hi Forexmospherian -- Been lurking a while on this thread and first time I've posted on here in quite a while so you must have something that interests me.

Firstly well done on deflecting all the bullets over the last few months , that takes some perseverance.

I can't see , unless I've missed it the process to send you a P.M. so have had to ask on here.

Re. gu above, I have read about your time window ( 9 minutes either side of the hour and the half hour right ? ) but exactly how do you use it ? Do you trade within these windows or keep out ? Also what is your reason for this ? I am guessing that you take greater importance of the price action within these windows than outside of them ? If you trade within these windows are you saying you never trade outside of them ?

Why does going under 72 confirm the trade short , why 72 specifically and where would you have got in to this trade had you been trading it ?

Apologies for all the questions , just interested in picking your brains.

Thank you in anticipation.

Hi KLW

No problems - i will try and explain it from a general over view and then it might raise more questions etc - depending on what level of trading you are at.

Basically my own criteria is to trade 5 days a week taking short term trades from say approx 6,30 / 7 00 am in the morning to normally 5 00 - 6 00 pm - but not spending those 12 hrs stuck glued to the screen

I am full time ( but semi retired as 60 yrs old this year) and don't mind spending 4 - 6 hrs most days trying to make over a minimum 50 pips per day from say on average 10 -20 trades.

I have found that rather than just enter a trade when the technicals line up on a chart - i prefer that this happens at a time window ( as you have mentioned)

So out of every 60 mins in the hour - I am looking at a key 36 min period to enter new trades and to exit. Normally I don't take above 3 or 4 trades in an hour - even on 2 or 3 pairs - and sometimes I can go an hour with only one opportunity.

I look upon the exact hr change and half hr change as being used as decision points and then the 9 mins either side - to either exit or enter.

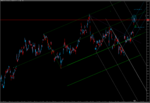

So with the GU one - as an example the 6579 price just prior to the time window - was a benchmark price to check out - it was a new high and had risen encouraging more bulls to enter - but after any new high or low - you normally get a pull back

If its 2- 5 pips - only really scalpers would take - but if its say 7 - 15+ pips - then I want it - as it gives an RR of over 1 with a tight stop and in some cases it can be a RR of 3 ie 15 -17 pips - all within 10 -15 mins - excellent profitable efficient trade.

If i can get 10 or more of these a day i would be delighted - but being normal ( i think ) i do make mistakes and expect 1 to 3 bad trades a day - that I try and get out of as quickly as possible

On a really bad day i might need over 15 trades and have 4 wrong - to achieve my target

On a good day - i might do it in 2- 3 hrs on just 5 trades.

i don't stop if I make my target - i just take more care and reduce lot sizes and dont chase every scalp.

Remember besides time - my clues are from Linear Regression indicators - S & R's - PA - prior 10 min movement - news - gameplay etc etc

It really is a combination of things to achieve a high win ratio with tight stops - ask MM - he been trying my methods last 3 months - and some days - he's well on it - and gets over 80% wins on 20+ trades - and then other days - he might only just hit say 50% wins - simply because its like learning to juggle balls - 2 is easy - 3 is OK - 5 is difficult and 7+ takes a lot of skill and time to get there.

In conclusion - my time windows are just one part of the "clues" equation - its an important part - but so are HL's and HH's and others I have mentioned as well

Hope this helps and then please join in etc if you see a situation on any currency pair you need to see how I would judge it ;-))

Regards

F

PS - 72 was under a previous LH to previous 74 - so just extra confirmation for staying in the scalp sell