Forexmospherian

Legendary member

- Messages

- 39,928

- Likes

- 3,306

EU

3 15 pm

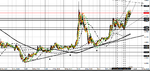

The cut off on 30% stake sells is 0913

Under there we will test 0900 and lower#

If we cannot break lower - then we come back to test 13 and 19

3 15 pm

The cut off on 30% stake sells is 0913

Under there we will test 0900 and lower#

If we cannot break lower - then we come back to test 13 and 19