rtsurvivor

Member

- Messages

- 53

- Likes

- 2

Hi Neil. The "Buy On A Stop" is to keep from having an order placed before to target price is met. For example...

A 123UP is forming.

#2 is at 1.3420

A "Buy Stop" will get you a fill if prices hit and exceed the 1.3420 (Normally)

A "Buy Limit" can get you a fill before the 1.3420 price is hit. ( A Limit Order is like an "Or Better" order.) This can be good sometimes. However, what happens if you get a fill at 1.3415 (a 5 pips better fill)and then the market does a flip and goes down before the 1.3420 price is hit. That good fill then turns into an OOPS. 😢

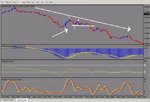

There are a number of things that should be considered with price patterns. One of my rules is to not try to out guess the markets. Also, I have to have at least 2 indicators to confirm the price movement. One of my favorites is the MACD.

ie: If a 123 UP develops and the MACD is not going up in support of the #3 leg when climbing towards a #2 breakout of the pattern then I will pass on the trade.

I'm trying an "Accelerator oscillator" as a qualifying oscillator because it seems to cut the lag time of the MACD.

I hope this helps a bit.

Good trading

RT... :clover:

A 123UP is forming.

#2 is at 1.3420

A "Buy Stop" will get you a fill if prices hit and exceed the 1.3420 (Normally)

A "Buy Limit" can get you a fill before the 1.3420 price is hit. ( A Limit Order is like an "Or Better" order.) This can be good sometimes. However, what happens if you get a fill at 1.3415 (a 5 pips better fill)and then the market does a flip and goes down before the 1.3420 price is hit. That good fill then turns into an OOPS. 😢

There are a number of things that should be considered with price patterns. One of my rules is to not try to out guess the markets. Also, I have to have at least 2 indicators to confirm the price movement. One of my favorites is the MACD.

ie: If a 123 UP develops and the MACD is not going up in support of the #3 leg when climbing towards a #2 breakout of the pattern then I will pass on the trade.

I'm trying an "Accelerator oscillator" as a qualifying oscillator because it seems to cut the lag time of the MACD.

I hope this helps a bit.

Good trading

RT... :clover: