brutusdog

Guest

- Messages

- 759

- Likes

- 194

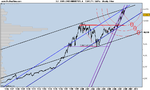

cover drive or quick single

there she is.....😆 😆 😆

As I said Bulls have to take out 180+ at the very minium tonight

So we'll have to see if they have a stab... I'd like that... 😀

there she is.....😆 😆 😆