You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Best Thread Correlation Trading - Basic Ideas and Strategies

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Sell U/J below 90.91

nope yen is as weak as a kitten ...............WIP on this new Tag indicator for me so be patient all.....

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Hi all

Sorry had an early one at work so a quick catch up now.....

Messy morning but if you stuck to the basics then Gold/USD correlation has been solid as a rock and buying USD will have been fruitful....

GBP has been pretty tough and held its own with the Strong Commdolls.....Euro and CHF have been weak and were the big trades to be selling against USD on in last hour or so.....

Yen is real weak and not supporting USD at present ....despite decent moves by the market....perhaps this will change soon which is why I was hunting a buy Yen into Usd trade earlier....it will crack at some point....but not if the tag switch down as that should send the yen through the floor even more.....

🙂idea: Remember......when tag are moving together there is a descent probability that Yen should accelerate ahead of USd.....so look for selling Yen into USd when tag are falling and buying Yen into USD when TAg are rising :idea:.....still WIP for me though on this one)

later..😛

N

Sorry had an early one at work so a quick catch up now.....

Messy morning but if you stuck to the basics then Gold/USD correlation has been solid as a rock and buying USD will have been fruitful....

GBP has been pretty tough and held its own with the Strong Commdolls.....Euro and CHF have been weak and were the big trades to be selling against USD on in last hour or so.....

Yen is real weak and not supporting USD at present ....despite decent moves by the market....perhaps this will change soon which is why I was hunting a buy Yen into Usd trade earlier....it will crack at some point....but not if the tag switch down as that should send the yen through the floor even more.....

🙂idea: Remember......when tag are moving together there is a descent probability that Yen should accelerate ahead of USd.....so look for selling Yen into USd when tag are falling and buying Yen into USD when TAg are rising :idea:.....still WIP for me though on this one)

later..😛

N

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Hi N

what's the theory here then, with £ & $ strong, € & Yen weak? (5min Corrie on 63 setting) Yen to come back against the £ and re-establish the norm?

Hey mate

correlation has broken down............i'm a believer that the most productive trading is when the Tag team are aligned and moving together (and pref with support from the markets moving together in the opposite direction into tag = 10/10 correlation)

if JPY and USD get divorced for me its then a lucky dip re what G6 to trade against the USD 9or the JPY)........clearly whatever is showing the strongest opposite Bias to your chosen Tag currency - but thats feeble non correlation trading in my book....

and I am still working on how to trade the USD vs the JPY....Work in progress

N

Last edited:

jrplimited

Active member

- Messages

- 249

- Likes

- 1

Hi N & G and anyone else,

Obviously a toughy day for any pair with G in its title due to UK budget speech later on, so I was prepared.... Not!

GU; Entered long on open of 08:05 bar, price went up slightly, stalled, up again to form new local high then just keeled over quickly taking out SL during 08:40 bar for 21 pip loss. Second trade, after 08:55 up bar placed sell stop order at 49694 and next bar filled this, price went down a few pips then sideways, then started to print an upwards bias range for nearly a cursed hour challenging SL twice en route, then 10:20 bar came to rescue and momentum drove price down for three bars forming new local low and tried to rally from 10:35 bar. Exited on close of 11:50 bar for 9 pip profit as time running out.

EU; First trade, took the bait and entered long on close of 08:05 bar, price drifted for four bars then moved down with some momentum taking out SL during 08:35 bar for 18 pip loss. Second trade opened short 34188 at 08:40 and whoopee! Price went straight down for a change, printed new local low, went sideways for two bars, slipped down again for another new local low, tried a weak looking rally from 09:10, made another new local low print at 10:00 but couldnt repeat this for next few bars and exit made on close of 11:10 bar for 51 pip profit.

EG; Entered short at 89517 on open 08:10 bar, price moved south nicely, went sideways for ten bars then resumed a staggered down move forming 10:05 new local low which turned out to be a solid base as price turned up sharply with 10:25 bar taking out TS for 26 pip profit.

I dont know whether or not GU will be worth tracking this afternoon post the UK budget speech so good luck there if watching this - trade well and regards,

Simon.

Obviously a toughy day for any pair with G in its title due to UK budget speech later on, so I was prepared.... Not!

GU; Entered long on open of 08:05 bar, price went up slightly, stalled, up again to form new local high then just keeled over quickly taking out SL during 08:40 bar for 21 pip loss. Second trade, after 08:55 up bar placed sell stop order at 49694 and next bar filled this, price went down a few pips then sideways, then started to print an upwards bias range for nearly a cursed hour challenging SL twice en route, then 10:20 bar came to rescue and momentum drove price down for three bars forming new local low and tried to rally from 10:35 bar. Exited on close of 11:50 bar for 9 pip profit as time running out.

EU; First trade, took the bait and entered long on close of 08:05 bar, price drifted for four bars then moved down with some momentum taking out SL during 08:35 bar for 18 pip loss. Second trade opened short 34188 at 08:40 and whoopee! Price went straight down for a change, printed new local low, went sideways for two bars, slipped down again for another new local low, tried a weak looking rally from 09:10, made another new local low print at 10:00 but couldnt repeat this for next few bars and exit made on close of 11:10 bar for 51 pip profit.

EG; Entered short at 89517 on open 08:10 bar, price moved south nicely, went sideways for ten bars then resumed a staggered down move forming 10:05 new local low which turned out to be a solid base as price turned up sharply with 10:25 bar taking out TS for 26 pip profit.

I dont know whether or not GU will be worth tracking this afternoon post the UK budget speech so good luck there if watching this - trade well and regards,

Simon.

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Hi all

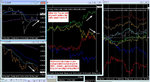

Quick lunchtime peek...........heres my analysis which is good from a learning perspective but no help today re generating pipiitoes !

Naturally you can blindly trade that upward trending USD trend....but I would prefer Yen to be riding shotgun as the dual power of the Tag upwards will generate many more pips for the unlucky fallers in the G6.....

Remember trading the G8 on the corrie is a zero sum game.....so the more "power" the Tag is delivering on one side of the Zero means more power on the other side to trade with and generate profitable moves.....if they are fighting each other it can negate the G6 opportunities.....:smart:

N

Quick lunchtime peek...........heres my analysis which is good from a learning perspective but no help today re generating pipiitoes !

Naturally you can blindly trade that upward trending USD trend....but I would prefer Yen to be riding shotgun as the dual power of the Tag upwards will generate many more pips for the unlucky fallers in the G6.....

Remember trading the G8 on the corrie is a zero sum game.....so the more "power" the Tag is delivering on one side of the Zero means more power on the other side to trade with and generate profitable moves.....if they are fighting each other it can negate the G6 opportunities.....:smart:

N

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Hi N & G and anyone else,

GU; Entered long on open of 08:05 bar, taking out SL during 08:40 bar for 21 pip loss. Second trade, after 08:55 up bar placed sell stop order at 49694 and next bar filled this, Exited on close of 11:50 bar for 9 pip profit as time running out.

EU; First trade, took the bait and entered long on close of 08:05 bar, taking out SL during 08:35 bar for 18 pip loss. Second trade opened short 34188 at 08:40 and exit made on close of 11:10 bar for 51 pip profit.

EG; Entered short at 89517 on open 08:10 bar, with 10:25 bar taking out TS for 26 pip profit.

Simon.

hey mate ..welcome back 👍

mixed bag but your eurosells made the difference........if yen was not so damn weak today i'm sure there would have been more weakess to exploit in the Eurozone tribe......

some you win , some you.....dont win as much (in JRP's case it seems eh everyone 😎 )

N

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

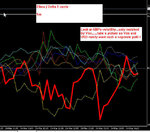

Painful morning..........i've had some lovely signals on my most promising Indicator (in trial mode), but because I am a correlation fan (live by corrie die by corrie 😛) every bloody signal is being blocked by that TAG Divorce....(see my earlier posts today)

Jees - thats the biggest TAG divorce ive seen for a long time today............Yen is as weak as a kitten....and if the markets start climbing with US open it will dissapear off the chart....😱

N

Jees - thats the biggest TAG divorce ive seen for a long time today............Yen is as weak as a kitten....and if the markets start climbing with US open it will dissapear off the chart....😱

N

jrplimited

Active member

- Messages

- 249

- Likes

- 1

Painful morning..........i've had some lovely signals on my most promising Indicator (in trial mode), but because I am a correlation fan (live by corrie die by corrie 😛) every bloody signal is being blocked by that TAG Divorce....(see my earlier posts today)

Jees - thats the biggest TAG divorce ive seen for a long time today............Yen is as weak as a kitten....and if the markets start climbing with US open it will dissapear off the chart....😱

N

Hi N,

Yes this corrie de-coupling is a bit worrying to say the least. You and I picked up on this quite a few weeks ago in a post and today it was quite apparent with the fab 3 (GU, EU and EG) especially on the lower noise tf of H1 charts.

Gut feeling tells me it will [correlation] come back but first markets need to sort out where they are in relation to massive fiscal problems of UK, USA and Europe, until then we have to adapt to these current very volatile conditions and just grab whatever is on the table then get the hell out of Dodge city pdq - Gavin's type of GTFO which is very well expressed!

Simon.

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

hi all..........

tag lools like slooowly turning down to me.....(gold and dow positioning for rises)...that would mean selling Tag into G6.....plus because Yen has been so pants and should get worse as tag falls.....you could punt a buy U/J above 91.96........looks crazily overbought though doesnt it !

N

tag lools like slooowly turning down to me.....(gold and dow positioning for rises)...that would mean selling Tag into G6.....plus because Yen has been so pants and should get worse as tag falls.....you could punt a buy U/J above 91.96........looks crazily overbought though doesnt it !

N

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

yep.........first time today i'm slowly getting aligned sell signals on the Tag (early days and will still chop) so now you have to chose your G6 horse to buy.......all look ok.....Euro is always a safe pair of hands and the GBP....well its weakest of G6....but can easily come back 30-50 pips if it gets a good breeze.....

and now Yen looks nervous to fall......what is it like today ?? .....perhaps that cavenous divergence on USD /JPY will close after all.........(which would be helped by gold rising and Markets falling)

N

and now Yen looks nervous to fall......what is it like today ?? .....perhaps that cavenous divergence on USD /JPY will close after all.........(which would be helped by gold rising and Markets falling)

N

Similar threads

- Replies

- 0

- Views

- 3K