You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Best Thread Correlation Trading - Basic Ideas and Strategies

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

the last post.......

off again to meetings..........

well heres perfecto signals at the moment .....🙄

The tag are dominating the Elevators

almost every market is in the lower half of the indexcorrie

lots of HH and HL on the USD in the 1000/1's

so it'll probably bomb then any minute.........😆

whatever...........JRP wrap it up later if you get time and post in the P forum

if you want to discuss anything....

i'll post here over weekend....!

thks !

N

off again to meetings..........

well heres perfecto signals at the moment .....🙄

The tag are dominating the Elevators

almost every market is in the lower half of the indexcorrie

lots of HH and HL on the USD in the 1000/1's

so it'll probably bomb then any minute.........😆

whatever...........JRP wrap it up later if you get time and post in the P forum

if you want to discuss anything....

i'll post here over weekend....!

thks !

N

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Absolute carnage.............

Hi Everyone .......just here to close out the week

WOW !!!!!

USD took off like a scalded cat a(from my comments in previous post) and its been a pipfest all aftenoon !!!!

Ive shown 3 charts to share the results.....

a 500/2 corrie index (thats gold being creamed)

the 5m 1000/1

the G/U chart

wow .......perfection as markets fell and USD rose.....50-60-70 pips.....take your choice of profits.....thats 3 days work in an afternoon :clap:

JRP...you alive ?

signing off.......

NVP

Hi Everyone .......just here to close out the week

WOW !!!!!

USD took off like a scalded cat a(from my comments in previous post) and its been a pipfest all aftenoon !!!!

Ive shown 3 charts to share the results.....

a 500/2 corrie index (thats gold being creamed)

the 5m 1000/1

the G/U chart

wow .......perfection as markets fell and USD rose.....50-60-70 pips.....take your choice of profits.....thats 3 days work in an afternoon :clap:

JRP...you alive ?

signing off.......

NVP

Attachments

jrplimited

Active member

- Messages

- 249

- Likes

- 1

Re: Absolute carnage.............

Hi N and everyone else,

Managed to actually switch off my pcs after making last post and walk away for the afternoon, well one pc left on just to see what was happening but with no trading app running - I promise!

That was a nuke going off for sure, NFP came in so far below forecasts it blew the lid off. I saw the corrie indy going wild and yes N, there looked to be at least 40 safe pips sitting on the table waiting to be grabbed but I personally would have waited for the corrie to settle down somewhat before dipping the toes in so if we allowed for that then probably a good 20 pips scalp potential there.

Quel a week! I think we are now beginning to grasp the power of the corrie indy so its only a matter of "harnassing" this to a workable strategy and then off we jolly well go.

Really looking forward to next week as this is now getting very interesting - enjoy the weekend everyone, trade well and regards.

Simon.

Hi N and everyone else,

Managed to actually switch off my pcs after making last post and walk away for the afternoon, well one pc left on just to see what was happening but with no trading app running - I promise!

That was a nuke going off for sure, NFP came in so far below forecasts it blew the lid off. I saw the corrie indy going wild and yes N, there looked to be at least 40 safe pips sitting on the table waiting to be grabbed but I personally would have waited for the corrie to settle down somewhat before dipping the toes in so if we allowed for that then probably a good 20 pips scalp potential there.

Quel a week! I think we are now beginning to grasp the power of the corrie indy so its only a matter of "harnassing" this to a workable strategy and then off we jolly well go.

Really looking forward to next week as this is now getting very interesting - enjoy the weekend everyone, trade well and regards.

Simon.

jrplimited

Active member

- Messages

- 249

- Likes

- 1

Re: Absolute carnage.............

Hi N and everyone else,

Attached is my chart for today's (04-12-09) M5 G/U afternoon session - the time axis is GMT (London) minus 5 hours offset or actual EST - and if you look back at N's various postings this afternoon for the relevant corrie indy, you can see where excellent entry points are to be had.

The blue line in my attachment represents a buy above zone and the red line a sell below zone, the black and virtually stepped line shows additional buy / sell opportunities relevant to immediate price action. The sub graph is a histogram to show me above zero line equals buy confirmation (dark blue strong, light blue weak) and below zero line equals sell confirmation (dark red strong, light red weak) - my youngest daughter selected these colurs and shades for me as I'm just about colour blind so just see "shades" of varying degrees!

BIG NOTE; I did not trade this afternoon session as stated in previous posts - but curse my luck here as it looked really fantastic!

Going from left to right on the graph:-

08:25 through to 08:45 represents NFP announcement that shocked everyone, U strengthens against G as data was very positive for USA economy, corrie indy picks this one up nicely but I would have staid on side lines until market settled down;

08:50 through to 10:15 shows a rally back again but histogram dosent confirm this apart from 10:15 bar but this only just manages to penetrate buy zone line with no real conviction - a real "if in doubt, stay out" situation for me personally here;

10:20: through to 10:30 shows a strong punch down through sell zone with both histogram and virtual stepped line price action confirmation - my personal decision would have been to sell (market order) at open of 10:35 bar.

10:35 through to 14:35 has a short taken at 1.65696 (maximum adverse excursion [MAE] equals 1.65744 on traded bar) on the 10:35 bar open and price then heads south in a fairly (for M5 tf) consistent manner, pausing only at 12:10 and 12:40, where it raised its ugly head above the virtual stepped line price action indy for one bar (price couldnt even think about penetrating the blue buy zone line, besides which the histogram was far into selling only mode). Finally around anytime between 14:15 and 14:30 (19:15 and 19:30 local London time) was an ideal point to close out this trade due to imminent weekend closing of markets. For argumants sake, lets assume a close at the high (ie a tight TS) of the 14:15 bar which was 1.64572, so thats over 100 plus pips profit to be had less your broker's spreads.... Hmmm rather nice me thinks!

This chart shows my own personal and preferred indicators and what I'm doing now (and have been doing in the past two weeks or so) is trying to construct a workable strategy which incorporates the corrie indy with these to produce steups for trading opportunities - more later on in the coming days as I continue to real time test this theory.

Hey, its Friday night and I've yet to spill the glass of giggly juice all over my keyboard - a sure sign that not enough of the nectar has yet been consumed, so where is that bottle? Ooops, here comes the wife and threats of the betty ford clinic yet again....

Trade well and regards,

Simon.

Hi N and everyone else,

Attached is my chart for today's (04-12-09) M5 G/U afternoon session - the time axis is GMT (London) minus 5 hours offset or actual EST - and if you look back at N's various postings this afternoon for the relevant corrie indy, you can see where excellent entry points are to be had.

The blue line in my attachment represents a buy above zone and the red line a sell below zone, the black and virtually stepped line shows additional buy / sell opportunities relevant to immediate price action. The sub graph is a histogram to show me above zero line equals buy confirmation (dark blue strong, light blue weak) and below zero line equals sell confirmation (dark red strong, light red weak) - my youngest daughter selected these colurs and shades for me as I'm just about colour blind so just see "shades" of varying degrees!

BIG NOTE; I did not trade this afternoon session as stated in previous posts - but curse my luck here as it looked really fantastic!

Going from left to right on the graph:-

08:25 through to 08:45 represents NFP announcement that shocked everyone, U strengthens against G as data was very positive for USA economy, corrie indy picks this one up nicely but I would have staid on side lines until market settled down;

08:50 through to 10:15 shows a rally back again but histogram dosent confirm this apart from 10:15 bar but this only just manages to penetrate buy zone line with no real conviction - a real "if in doubt, stay out" situation for me personally here;

10:20: through to 10:30 shows a strong punch down through sell zone with both histogram and virtual stepped line price action confirmation - my personal decision would have been to sell (market order) at open of 10:35 bar.

10:35 through to 14:35 has a short taken at 1.65696 (maximum adverse excursion [MAE] equals 1.65744 on traded bar) on the 10:35 bar open and price then heads south in a fairly (for M5 tf) consistent manner, pausing only at 12:10 and 12:40, where it raised its ugly head above the virtual stepped line price action indy for one bar (price couldnt even think about penetrating the blue buy zone line, besides which the histogram was far into selling only mode). Finally around anytime between 14:15 and 14:30 (19:15 and 19:30 local London time) was an ideal point to close out this trade due to imminent weekend closing of markets. For argumants sake, lets assume a close at the high (ie a tight TS) of the 14:15 bar which was 1.64572, so thats over 100 plus pips profit to be had less your broker's spreads.... Hmmm rather nice me thinks!

This chart shows my own personal and preferred indicators and what I'm doing now (and have been doing in the past two weeks or so) is trying to construct a workable strategy which incorporates the corrie indy with these to produce steups for trading opportunities - more later on in the coming days as I continue to real time test this theory.

Hey, its Friday night and I've yet to spill the glass of giggly juice all over my keyboard - a sure sign that not enough of the nectar has yet been consumed, so where is that bottle? Ooops, here comes the wife and threats of the betty ford clinic yet again....

Trade well and regards,

Simon.

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Hi JRP...

Thankyou JRP :cheesy:

I have been indeed very very lucky and privilidged on this thread in that those people who have become involved posting here in public (and then the private Forum) are very talented traders bringing their own skills and methodologies to the table 👍

I am obviously delighted that you would share some ideas here with us - but appreciate that we all have things we may decide to keep more confidential in nature so whatever you can share is fine with me....dont feel under pressure to do it and also your time is limited the same as all of us 👍

pm me this weekend for any other thoughts / ideas if you can....I have plenty bubbling around in the grey fuzzy matter after the last 2 weeks "live" action on this thread...I am gradually warming up again after a lot of years in the wilderness away from Trading (long story!) 😀

HEY - everyone else.....c'mon join the party, its free to get the Corrie (page 64 post #505) and it can only get better as we develop more and more ways to use it 👍

NVP

Thankyou JRP :cheesy:

I have been indeed very very lucky and privilidged on this thread in that those people who have become involved posting here in public (and then the private Forum) are very talented traders bringing their own skills and methodologies to the table 👍

I am obviously delighted that you would share some ideas here with us - but appreciate that we all have things we may decide to keep more confidential in nature so whatever you can share is fine with me....dont feel under pressure to do it and also your time is limited the same as all of us 👍

pm me this weekend for any other thoughts / ideas if you can....I have plenty bubbling around in the grey fuzzy matter after the last 2 weeks "live" action on this thread...I am gradually warming up again after a lot of years in the wilderness away from Trading (long story!) 😀

HEY - everyone else.....c'mon join the party, its free to get the Corrie (page 64 post #505) and it can only get better as we develop more and more ways to use it 👍

NVP

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

A private message

Hi Everyone - excuse this post - its a message to a special person who knows who they are ....

Sylvie this is my thread !......I said one day I would publish the stuff - and its going ok (so far) 👍

thanks again for your endless love and support to me and my (sadly departed) family over the years and I am glad you are getting better now as well

God bless

Neil xxx😍

Hi Everyone - excuse this post - its a message to a special person who knows who they are ....

Sylvie this is my thread !......I said one day I would publish the stuff - and its going ok (so far) 👍

thanks again for your endless love and support to me and my (sadly departed) family over the years and I am glad you are getting better now as well

God bless

Neil xxx😍

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

gold lovers beware....It dont like Fridays !

Hi all......😴

when you cant sleep......post !

just looking through last weeks action in the eyes of corrie and its derivatives....

Friday was fun..but not for Gold !

in fact we might need to rewrite the famous boomtown rats song for Gold if this happens next week again...

heres the index correlator (markets + Tag team) on the 1hr on a 14/3 setting (roughly a 20MA) for last 2 weeks........see anything ?

Gold has suffered high single digit % drops twice in a row now......and its becoming a habit !.......

sure the USD rocked this friday gone....therefore markets were falling etc etc but last friday there was total discorrelation** as everything seemed to be falling...and Gold again was top of the list....

gold is becoming a real volatile little dude these days and I want to get it into my corrie thread more seriously soon....so watch this space

for newbies to correlation...(See my post #11 at the start of thread) the general accepted theory is that when markets are rising (Stocks,commodities, traders blood pressures) then the lower interest returning Currencies get sold to finance the feeding frenzy....Yens been in this category forever and more recently the USD has arrived on the scene.....theres loads of other sub-theories per individual cases but this is it in terms of simplicity...

the index corry is used in my set-ups to show if we have this correlation in the market for appropriate TF's....if it is happening this gives us more comfort on making trades.....well pehaps until we prove otherwise !

is it time to get up yet ?

N

**is that a word ? :whistling

Hi all......😴

when you cant sleep......post !

just looking through last weeks action in the eyes of corrie and its derivatives....

Friday was fun..but not for Gold !

in fact we might need to rewrite the famous boomtown rats song for Gold if this happens next week again...

heres the index correlator (markets + Tag team) on the 1hr on a 14/3 setting (roughly a 20MA) for last 2 weeks........see anything ?

Gold has suffered high single digit % drops twice in a row now......and its becoming a habit !.......

sure the USD rocked this friday gone....therefore markets were falling etc etc but last friday there was total discorrelation** as everything seemed to be falling...and Gold again was top of the list....

gold is becoming a real volatile little dude these days and I want to get it into my corrie thread more seriously soon....so watch this space

for newbies to correlation...(See my post #11 at the start of thread) the general accepted theory is that when markets are rising (Stocks,commodities, traders blood pressures) then the lower interest returning Currencies get sold to finance the feeding frenzy....Yens been in this category forever and more recently the USD has arrived on the scene.....theres loads of other sub-theories per individual cases but this is it in terms of simplicity...

the index corry is used in my set-ups to show if we have this correlation in the market for appropriate TF's....if it is happening this gives us more comfort on making trades.....well pehaps until we prove otherwise !

is it time to get up yet ?

N

**is that a word ? :whistling

Attachments

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Weekly roundup

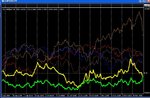

Chart 1 is the standard 1Hr corrie on the 1000/1...all G8 dudes on the screen

(c/mon you know the colours by now !)

Chart 2 is the index corrie 1000/1....Gold(gld),Ftse (red),Dax(blue),Oil,(Brwn),S&P30(Grey) + the Tag who are in bold and are the same as in Chart 1 above

Yen

the yens ascendance 2 weeks ago has been completely given back this week

...I would like to say this is because of markets rising and indeed tues and Wed were generally good days (chart2) so this did hit the Yen hard....other things could have been at play (?) as whilst Yen fell generally through the week USD held a little better and I think this was BOJ intervention swapping Yen for USD....(hey I like consiracy theories! - I mentioned to watch for this in a post last week)......but then again USD is never as volatile as Yen so you pays your money and takes your choice 😏 !

USD

fell in first half of the week then came back with a vengence Thurs and of course Friday.......lurvely !

Others - (chart 1)

Nice solid week for the Australasia twins....(did NZD increase their int rates as well ?)

NZD made back everything it dropped the week before so if you had sold NZDJPY

2 weeks ago (all week) then reversed that trade at the start this week just gone you

would now be the smuggest trader on the planet !👍

CAD & GBP...what do you want me to say ?....they go up, they go down, they go up again already...😱....correlationwise CAD vs OIL...you tell me...i'm not a great fan of following that strategy - but very happy to help someone set some corrie style customised charts up on this thread and they can post as much as they like to prove me wrong !

Euro and Swissie........😴😴

The markets (Chart 2)

S&P and Gold had brilliant first halfs....(look at gold !), everyone else (espec the Dax) struggled badly to their mid week positions....with wed pretty good all round..except S&P which was flat ....thurs/friday was scrappy but on balance bearish due to the collapse of Gold....

thats it......just 1 more quick post on what to watch for next week !

N

Chart 1 is the standard 1Hr corrie on the 1000/1...all G8 dudes on the screen

(c/mon you know the colours by now !)

Chart 2 is the index corrie 1000/1....Gold(gld),Ftse (red),Dax(blue),Oil,(Brwn),S&P30(Grey) + the Tag who are in bold and are the same as in Chart 1 above

Yen

the yens ascendance 2 weeks ago has been completely given back this week

...I would like to say this is because of markets rising and indeed tues and Wed were generally good days (chart2) so this did hit the Yen hard....other things could have been at play (?) as whilst Yen fell generally through the week USD held a little better and I think this was BOJ intervention swapping Yen for USD....(hey I like consiracy theories! - I mentioned to watch for this in a post last week)......but then again USD is never as volatile as Yen so you pays your money and takes your choice 😏 !

USD

fell in first half of the week then came back with a vengence Thurs and of course Friday.......lurvely !

Others - (chart 1)

Nice solid week for the Australasia twins....(did NZD increase their int rates as well ?)

NZD made back everything it dropped the week before so if you had sold NZDJPY

2 weeks ago (all week) then reversed that trade at the start this week just gone you

would now be the smuggest trader on the planet !👍

CAD & GBP...what do you want me to say ?....they go up, they go down, they go up again already...😱....correlationwise CAD vs OIL...you tell me...i'm not a great fan of following that strategy - but very happy to help someone set some corrie style customised charts up on this thread and they can post as much as they like to prove me wrong !

Euro and Swissie........😴😴

The markets (Chart 2)

S&P and Gold had brilliant first halfs....(look at gold !), everyone else (espec the Dax) struggled badly to their mid week positions....with wed pretty good all round..except S&P which was flat ....thurs/friday was scrappy but on balance bearish due to the collapse of Gold....

thats it......just 1 more quick post on what to watch for next week !

N

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Weeks outlook

OK - Heres a 4h G8 corry 1000/1.....

sorry never pretty and much to confused - so load your own and do the analysis yourself 😛

hmmm......looking for any interesting trends or S/R points

USD breached prev weeks high and now is highest value since june....nice steady trend now but perhaps a retrace coming this week ?

Yen was totally out of correlation with USD in second half of last week....would prefer to see them kissing and making up please....just not good for business....the yens virtually though that wall of resistance so could keep going ??.....not sure 😏

The Aussie twins have plenty of upside left so could be a good week

CAD & GBP...I can safely predict this week they will go up, they will go down....they will go up again...:cheesy: seriously both could be heading into a little resistance this week so perhaps some retraces imminent

Euro and Swissie.....😴😴.(I dont know what to say !)...if you're a longer TF fan use the Swissie to pair with more volatile bets like GBP, CAD and of course the Yen.

N

OK - Heres a 4h G8 corry 1000/1.....

sorry never pretty and much to confused - so load your own and do the analysis yourself 😛

hmmm......looking for any interesting trends or S/R points

USD breached prev weeks high and now is highest value since june....nice steady trend now but perhaps a retrace coming this week ?

Yen was totally out of correlation with USD in second half of last week....would prefer to see them kissing and making up please....just not good for business....the yens virtually though that wall of resistance so could keep going ??.....not sure 😏

The Aussie twins have plenty of upside left so could be a good week

CAD & GBP...I can safely predict this week they will go up, they will go down....they will go up again...:cheesy: seriously both could be heading into a little resistance this week so perhaps some retraces imminent

Euro and Swissie.....😴😴.(I dont know what to say !)...if you're a longer TF fan use the Swissie to pair with more volatile bets like GBP, CAD and of course the Yen.

N

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

the markets next week

here the market corrie on the same 4h but a 500/2 setting

The feeds are more limited in history for these markets (ODL feed) and ive had to reduce MA to get some results

500/2 is ok....its not as pure as 1000/1 for S/R's but ok for this purpose

hmmmm.....I used to spend hours trying to tease things out of these suckers but now I look for things that jump out and then forget it...if its not there its not there !

if you study this chart from the start (sept 09) you can see why people say markets rise and tag team falls (and vice versa)

October was classic correlation throughout....the markets rise, the markets fall and the tag responds inversely....November was scrappier although at the end it really kicked back in with those Market falls against the tag's rises....early Dec has been a problem due to Yens strength I feel and other intervention going on...(see how Octobers market rises pushed the Yen gradually back at the USD....however much less market action recently, but look how Yen collapsed into the Dollar....hmm😏)

So what do I see ?

Gold nearly back to Oct levels...bounce back ?....(although its volatility is explosive)

to me every other market seems to be slowly cycling downwards...which should encourage the Tag to rise (if they can get their act together this week !)

thats it...bring on monday morning !

N

here the market corrie on the same 4h but a 500/2 setting

The feeds are more limited in history for these markets (ODL feed) and ive had to reduce MA to get some results

500/2 is ok....its not as pure as 1000/1 for S/R's but ok for this purpose

hmmmm.....I used to spend hours trying to tease things out of these suckers but now I look for things that jump out and then forget it...if its not there its not there !

if you study this chart from the start (sept 09) you can see why people say markets rise and tag team falls (and vice versa)

October was classic correlation throughout....the markets rise, the markets fall and the tag responds inversely....November was scrappier although at the end it really kicked back in with those Market falls against the tag's rises....early Dec has been a problem due to Yens strength I feel and other intervention going on...(see how Octobers market rises pushed the Yen gradually back at the USD....however much less market action recently, but look how Yen collapsed into the Dollar....hmm😏)

So what do I see ?

Gold nearly back to Oct levels...bounce back ?....(although its volatility is explosive)

to me every other market seems to be slowly cycling downwards...which should encourage the Tag to rise (if they can get their act together this week !)

thats it...bring on monday morning !

N

Attachments

Last edited:

jrplimited

Active member

- Messages

- 249

- Likes

- 1

Re: the markets next week

Hi N and everyone else out there,

Attended my first Christmas party of the festive season last night and got cursed for ongoing financial crunch, banks implosion, pension funds collapse, lousy X Factor series, wet weather, price of fish (WTF?).... Nobody mentioned Engerland's easy '10 WC group allocation though - perhaps they couldnt think of a "link" to blame or credit me for that?

Also, spent the first night of the festive season in the spare room courtesy (read command!) of wifey aka de boss - oh yes, Christmas really has arrived now in a big way for me.

N, saw your observations above into next week and these looked very interesting based on your corrie indy. Personally as a price action "fan" I dont delve into the forecasting thingy and prefer to let the market dictate what it wants to do, but for my 2 cents worth I think the market will still be in shock over last Friday's (04-12-09) NFP data release and needs some while to "adjust" itself before marching on in its merry and very erratic way.

Whatever, we will see what Monday brings us in (for me) the penultimate full trading week prior to the festive season and its accompanying horribly low volume period.

Trade well and regards,

Simon.

Hi N and everyone else out there,

Attended my first Christmas party of the festive season last night and got cursed for ongoing financial crunch, banks implosion, pension funds collapse, lousy X Factor series, wet weather, price of fish (WTF?).... Nobody mentioned Engerland's easy '10 WC group allocation though - perhaps they couldnt think of a "link" to blame or credit me for that?

Also, spent the first night of the festive season in the spare room courtesy (read command!) of wifey aka de boss - oh yes, Christmas really has arrived now in a big way for me.

N, saw your observations above into next week and these looked very interesting based on your corrie indy. Personally as a price action "fan" I dont delve into the forecasting thingy and prefer to let the market dictate what it wants to do, but for my 2 cents worth I think the market will still be in shock over last Friday's (04-12-09) NFP data release and needs some while to "adjust" itself before marching on in its merry and very erratic way.

Whatever, we will see what Monday brings us in (for me) the penultimate full trading week prior to the festive season and its accompanying horribly low volume period.

Trade well and regards,

Simon.

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Re: the markets next week

Hi JRP......you get the hotel room as well eh?.....thought it was just me..., my work shindig next week so already booked the private suite with a wake up call around 8am ish...:innocent:

Hey mate................you are completely rights about trying to make predictions....I think my early sunday morning ramblings had reached fever pitch so I went for it.....😴

most you will see from me in future is any points of interest re S/R levels or good Price action patterns...i'll let the market do its own thing.....we must keep this thread bullsh*t free... so good red card on me 👍

speaking of predictions....I must ask Saxo bank for a job....some howlers here !

http://www.generationaldynamics.com/cgi-bin/D.PL?xct=gd.e081219

NVP

Hi N and everyone else out there,

Attended my first Christmas party of the festive season last night and got cursed for ongoing financial crunch, banks implosion, pension funds collapse, lousy X Factor series, wet weather, price of fish (WTF?).... Nobody mentioned Engerland's easy '10 WC group allocation though - perhaps they couldnt think of a "link" to blame or credit me for that?

Also, spent the first night of the festive season in the spare room courtesy (read command!) of wifey aka de boss - oh yes, Christmas really has arrived now in a big way for me.

N, saw your observations above into next week and these looked very interesting based on your corrie indy. Personally as a price action "fan" I dont delve into the forecasting thingy and prefer to let the market dictate what it wants to do, but for my 2 cents worth I think the market will still be in shock over last Friday's (04-12-09) NFP data release and needs some while to "adjust" itself before marching on in its merry and very erratic way.

Whatever, we will see what Monday brings us in (for me) the penultimate full trading week prior to the festive season and its accompanying horribly low volume period.

Trade well and regards,

Simon.

Hi JRP......you get the hotel room as well eh?.....thought it was just me..., my work shindig next week so already booked the private suite with a wake up call around 8am ish...:innocent:

Hey mate................you are completely rights about trying to make predictions....I think my early sunday morning ramblings had reached fever pitch so I went for it.....😴

most you will see from me in future is any points of interest re S/R levels or good Price action patterns...i'll let the market do its own thing.....we must keep this thread bullsh*t free... so good red card on me 👍

speaking of predictions....I must ask Saxo bank for a job....some howlers here !

http://www.generationaldynamics.com/cgi-bin/D.PL?xct=gd.e081219

NVP

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Fantastic opening period

yum yum...just got better and better since 7am (GMT)

about 60-70 pips already on G/U.....awesome !

look at the correlations stacking up...Beautiful !🙂

interestingly Lance Beggs made a brilliant observation in his recent Newsletter re first 15m (7am GMT) bar on the G/U and the predicted market action following

and boy was he correct today again.....go read and learn from a great price action trader and generous contributor to others....👍

http://www.yourtradingcoach.com/Articles-Strategy/Forex-Opening-Range-Breakout-Strategy.html

NVP

PS - when the 1min corrie goes off the charts you always know theres tremendous volatility !

yum yum...just got better and better since 7am (GMT)

about 60-70 pips already on G/U.....awesome !

look at the correlations stacking up...Beautiful !🙂

interestingly Lance Beggs made a brilliant observation in his recent Newsletter re first 15m (7am GMT) bar on the G/U and the predicted market action following

and boy was he correct today again.....go read and learn from a great price action trader and generous contributor to others....👍

http://www.yourtradingcoach.com/Articles-Strategy/Forex-Opening-Range-Breakout-Strategy.html

NVP

PS - when the 1min corrie goes off the charts you always know theres tremendous volatility !

Attachments

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Re: the markets next week

you see JRP...........put about every combination in your forecasts for the week and one of them is BOUND to be True (tee hee):cheesy:

NVP Morgan

here the market corrie on the same 4h but a 500/2 setting

The feeds are more limited in history for these markets (ODL feed) and ive had to reduce MA to get some results

500/2 is ok....its not as pure as 1000/1 for S/R's but ok for this purpose

hmmmm.....I used to spend hours trying to tease things out of these suckers but now I look for things that jump out and then forget it...if its not there its not there !

if you study this chart from the start (sept 09) you can see why people say markets rise and tag team falls (and vice versa)

October was classic correlation throughout....the markets rise, the markets fall and the tag responds inversely....November was scrappier although at the end it really kicked back in with those Market falls against the tag's rises....early Dec has been a problem due to Yens strength I feel and other intervention going on...(see how Octobers market rises pushed the Yen gradually back at the USD....however much less market action recently, but look how Yen collapsed into the Dollar....hmm😏)

So what do I see ?

Gold nearly back to Oct levels...bounce back ?....(although its volatility is explosive)

to me every other market seems to be slowly cycling downwards...which should encourage the Tag to rise (if they can get their act together this week !)

thats it...bring on monday morning !

N

you see JRP...........put about every combination in your forecasts for the week and one of them is BOUND to be True (tee hee):cheesy:

NVP Morgan

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

right i'm mega busy this morning but one more post....

the 1000/1 corrie is not rocket science....use price action patterns on it for 2-3 TF's and you will get a great feel fo rthe market and its intentions

look below,,the 30m far right....thats the market low for GBP for about last 3 days and the USD is about ot hit its high again for at least a month

I'm backing that there could be first retrace of the day......hopefully markets will help confirm that

later........

N

the 1000/1 corrie is not rocket science....use price action patterns on it for 2-3 TF's and you will get a great feel fo rthe market and its intentions

look below,,the 30m far right....thats the market low for GBP for about last 3 days and the USD is about ot hit its high again for at least a month

I'm backing that there could be first retrace of the day......hopefully markets will help confirm that

later........

N

Attachments

Similar threads

- Replies

- 0

- Views

- 3K