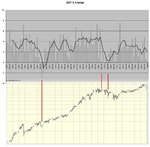

Our portfolio is already in positive. You missed the first day which was an awesome opportuinty to take a short postion other wise you would have been in profit already .

ON top of swing positions we also intra day trade against any swing losses as a hedge .

NEWS ON TMA

(RTTNews) - Monday after the closing bell, residential mortgage lending company Thornburg Mortgage,

Inc. (TMA) said that its earnings available to common shareholders for the fourth quarter declined on

fall in interest and non-interest income.

Thornburg Mortgage's net income available to common shareholders was $44.8 million or $0.33 per share,

down from $76.8 million or $0.68 per share in the same quarter of the prior year. On average, ten analysts

surveyed by First Call/Thomson Financial estimated earnings of $0.27 per share.

Net interest income for the fourth quarter fell 4% to $87.2 million from $90.7 million in the same

quarter of last year. Non-interest income plunged to $355 thousand from $17.2 million in the same quarter

of the previous year.

Provision for credit losses was $1.9 million, compared to $1.4 million in the same quarter of the

prior year. Allowance for loan losses totaled $17.6 million or 0.07% of total loans and allowance for

losses on REO properties totaled $4.2 million or 24.96% of the total REO portfolio.

The portfolio yield during the fourth quarter increased to 5.75% from 5.40% in the prior quarter.

The company's average cost of funds decreased to 5.04% in the fourth quarter from 5.26% in the prior

quarter.

During the recent quarter, the company acquired $995.4 million of new mortgage securities at an average

price of 99.61% of par and average approximate yields of 6.30% and originated $516.7 million of loans

at an average price of 101.01% of par and average anticipated yields of approximately 6.49%.

The company realized loan losses of $735 thousand during the fourth quarter and recorded $601 thousand

in write downs related to REO that it expects to sell in the future.

During the fourth quarter, Thornburg Mortgage raised net proceeds of $91.0 million through the sale

of additional common equity during the quarter at an average net price of $9.80 per share.

For the fiscal year 2007, the company's net loss available to common shareholders was $915.4 million

or $7.48 per share, compared to net income of $286.9 million or $2.58 per share in the previous year.

Eight analysts, on average, targeted a loss of $7.23 per share.

Net interest income fell to $316.3 million from $346.7 million in the earlier year. Non-interest

loss was $1.10 billion, compared to income of $50.7 million in the preceding year.

TMA closed Monday's regular trading session at $11.28, down 37 cents or 3.18%. In the extended hours

trading, the stock gained $1.47 or 13.03% to trade at $12.75.

For comments and feedback: contact

[email protected]

Copyright(c) 2008 RealTimeTraders.com, Inc. All Rights Reserved

Grey1