To be honest, I'm not quite sure at the moment. I'm in the process of going back over several years of market history, trying elicit some common traits.

My hypothesis is that sector rotation may be pronounced at climatic sell offs. I may be completely wrong in this.

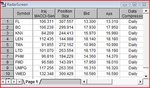

Yahoo Industries with worst relative strength over last 5 days are Personal Computers, Health Care Plans, Drug Manufacturers, Other health industries, biotech, telecom etc

thanks for the input,

keep us posted on how your getting on

glen