Cheers Frank,

ok, so i probably need to address a few issues (nothing major) in my short portfolio:

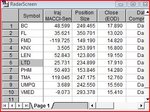

1. in light of the updated short targets list, i may not have enough 'beef' in my current list (ie they have fallen greatly from when the original list was drafted, and are not on the updated list)

2. FMD could be falling into O/S area within next few days. Therefore I may need to move money into a more O/B stock off the weak list.

see how we go

Glen

for clarity these are all paper trades on this thread (i'll let everyone know when i go live)

ok, so i probably need to address a few issues (nothing major) in my short portfolio:

1. in light of the updated short targets list, i may not have enough 'beef' in my current list (ie they have fallen greatly from when the original list was drafted, and are not on the updated list)

2. FMD could be falling into O/S area within next few days. Therefore I may need to move money into a more O/B stock off the weak list.

see how we go

Glen

for clarity these are all paper trades on this thread (i'll let everyone know when i go live)

Attachments

Last edited: