I am done for the day and wanted to publish

this version of the Simple Retail Chart, that I

will be using in my next class

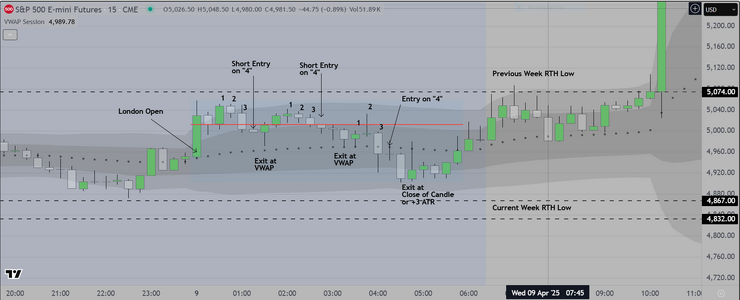

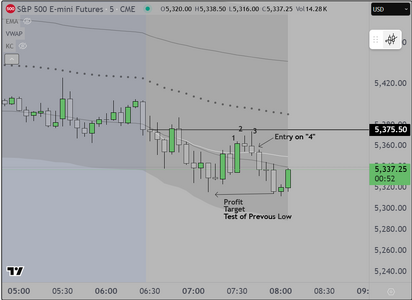

On the left, two (2) minute candles against a

stripped down VWAP Envelope (I have removed

the VWAP median). On this chart one can see the

Buy & Sell Zones, located between the 1st & 2nd

Standard Deviation Lines. Basic parametric statistics

tells us that most (about 2/3rds of prices will fall inside

these lines, AND when price action is "Trading Range"

it will tend to move from the outer bands to the midpoint

and when price trends it will often move from the one side

to the other.

On the right side, the "Big Picture" showing the "Timing Windows"

representing Asia, London and US Sessions. Each is three (3) hours long

and within each window is almost always a trading opportunity. We

suggest students trade within these windows to maximize opportunity

and minimize losses while they learn. Finally the relative position of

the Windows can be used to determine whether the market is trending

or in a trading range (just extend lines from the high/low).

We spend a lot of time showing traders the basic tools of the trade

including 1) VWAP, 2) Volume Profile, and 3) Statistical Skew.

What these three tools have in common is, they are all based on

volume. We have also used "Order Flow" in past and it works IF one wants

to put in the time, however the influence of HFT (high frequency trading)

has made it very difficult for retail traders to learn that style of trade. This

in our experience is much more accessible for amateurs.

Good luck

this version of the Simple Retail Chart, that I

will be using in my next class

On the left, two (2) minute candles against a

stripped down VWAP Envelope (I have removed

the VWAP median). On this chart one can see the

Buy & Sell Zones, located between the 1st & 2nd

Standard Deviation Lines. Basic parametric statistics

tells us that most (about 2/3rds of prices will fall inside

these lines, AND when price action is "Trading Range"

it will tend to move from the outer bands to the midpoint

and when price trends it will often move from the one side

to the other.

On the right side, the "Big Picture" showing the "Timing Windows"

representing Asia, London and US Sessions. Each is three (3) hours long

and within each window is almost always a trading opportunity. We

suggest students trade within these windows to maximize opportunity

and minimize losses while they learn. Finally the relative position of

the Windows can be used to determine whether the market is trending

or in a trading range (just extend lines from the high/low).

We spend a lot of time showing traders the basic tools of the trade

including 1) VWAP, 2) Volume Profile, and 3) Statistical Skew.

What these three tools have in common is, they are all based on

volume. We have also used "Order Flow" in past and it works IF one wants

to put in the time, however the influence of HFT (high frequency trading)

has made it very difficult for retail traders to learn that style of trade. This

in our experience is much more accessible for amateurs.

Good luck

Attachments

Last edited: