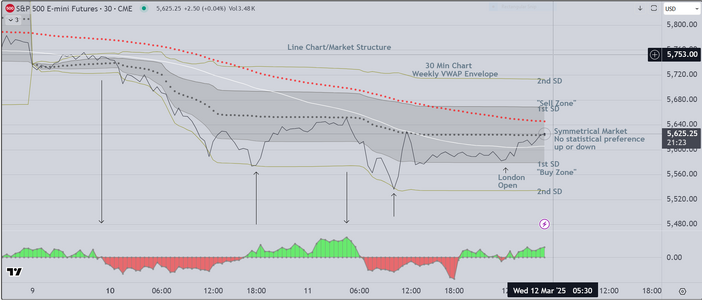

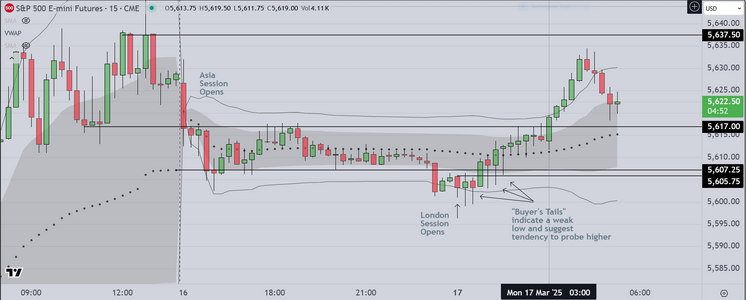

Since there have been no questions we will post

today's chart and leave it at that. Readers of previous

posts will notice that we forecast this downturn days ago

AND we believe that the odds favor continuation down to

5,500. The reason for this is that the misguided fiscal policies

put in place by convicted felon Trump are sure to cause an

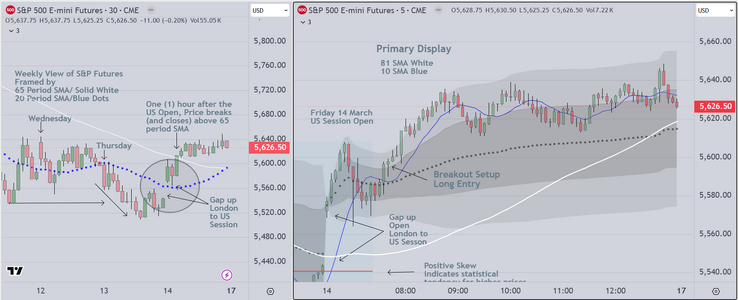

eventual recession. Institutions know the odds of this are high

and so they will reduce CAPEX, and look to buy back shares of

the S&P 500 stocks, however that will not happen until they

obtain a sufficient discount (Wholesale prices). At that point

they will come in to buy and wait to mark the inventory up and

distribute later at a premium. This is a reliable way for the big

participants to create profit on a quarterly basis (when the next

earnings reports are scheduled.

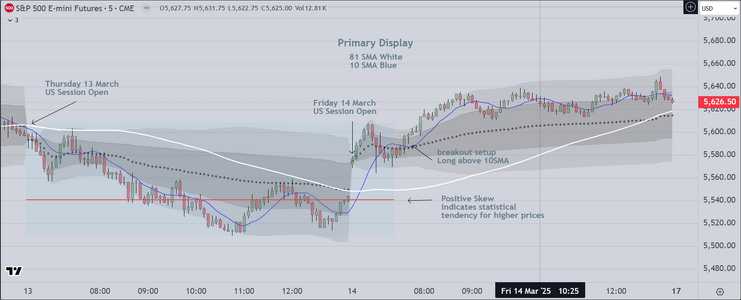

As easy day so far.

Good luck

today's chart and leave it at that. Readers of previous

posts will notice that we forecast this downturn days ago

AND we believe that the odds favor continuation down to

5,500. The reason for this is that the misguided fiscal policies

put in place by convicted felon Trump are sure to cause an

eventual recession. Institutions know the odds of this are high

and so they will reduce CAPEX, and look to buy back shares of

the S&P 500 stocks, however that will not happen until they

obtain a sufficient discount (Wholesale prices). At that point

they will come in to buy and wait to mark the inventory up and

distribute later at a premium. This is a reliable way for the big

participants to create profit on a quarterly basis (when the next

earnings reports are scheduled.

As easy day so far.

Good luck