First, Thanks Trader 333 for your kind note

And here is an example of what CAN happen once a trader learns

to recognize opportunity in the market.

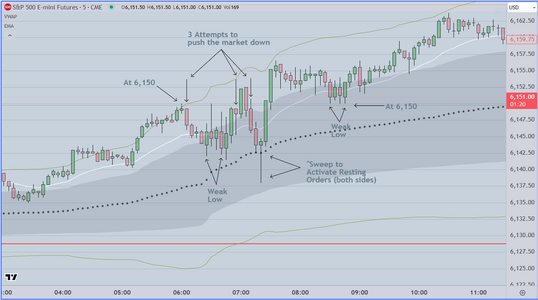

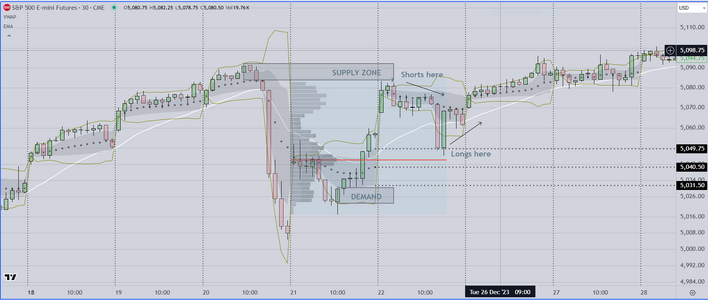

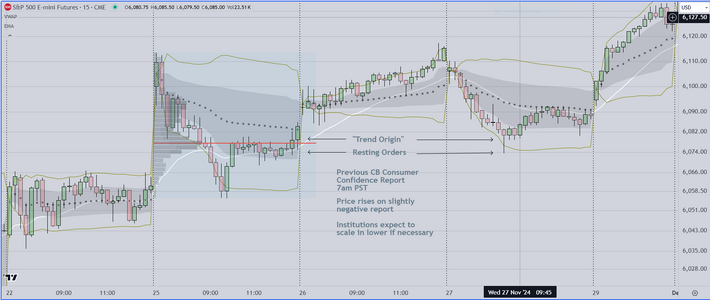

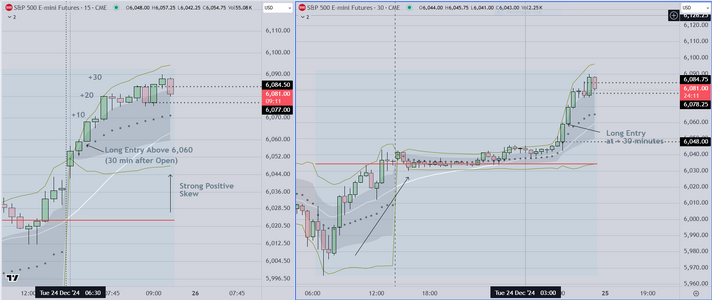

Most amateur traders do not know what a "failed auction" (also called

a "weak high or low") is. They are usually unfamiliar with the term "Sweep"

which means that the institutions probe above or below a "Key Reference"

(in this case the VWAP median) to activate resting orders. In the popular

literature it is sometimes referred to as a "stop hunt". Skilled professionals

recognize it as it develops, and once the spike candle completes they jump

on as the train leaves the station for a +10 ride.

I have an appointment this morning so I am done for the day +10 pts

Final Note

If I had the time, I would be monitoring and waiting for the end of day

reversal which sometimes occurs at about 10am PST (US time) which is

about 6pm London time

Good luck

And here is an example of what CAN happen once a trader learns

to recognize opportunity in the market.

Most amateur traders do not know what a "failed auction" (also called

a "weak high or low") is. They are usually unfamiliar with the term "Sweep"

which means that the institutions probe above or below a "Key Reference"

(in this case the VWAP median) to activate resting orders. In the popular

literature it is sometimes referred to as a "stop hunt". Skilled professionals

recognize it as it develops, and once the spike candle completes they jump

on as the train leaves the station for a +10 ride.

I have an appointment this morning so I am done for the day +10 pts

Final Note

If I had the time, I would be monitoring and waiting for the end of day

reversal which sometimes occurs at about 10am PST (US time) which is

about 6pm London time

Good luck

Attachments

Last edited: