You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

A Master Class in FX Intraday Trading by F & Co

- Thread starter Forexmospherian

- Start date

- Watchers 38

- Status

- Not open for further replies.

Hi Liver

Thank you for the comment and you are welcome to please join in with your charts and thoughts etc. Believe it or not - you do need patience even to be a scalper = ideally waiting to cherry pick larger scalp moves of 10 -25+ pips rather than just staying with quick 3 -7 pips - that can be happening many times over a busy 30 min period.

I am sure you might find my LiTs areas interesting for swing trades that can start off from a KT scalp and so end up being taken of a 5 pip stop. Also trades from interim lows and highs

We caught one Friday afternoon on the EU at 3 39 pm from 1097/ 1100 area

It started off as nice bounce / retrace from an interim low area and after 30+ mins confirmed it strength and then went on to be a great 60+ pip move back up.

What pleased me - I was not the only one on the thread who spotted it and NickBK posted his chart showing his multi LR crossover within a few mins of it starting off.

Have a great week and any queries etc - please feel free to ask and also join in etc

Regards

F

Note EA went up 140 pips in that time.

Think I need to specialise in that pair it has some great moves.

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Hi N

The LiTs area is dynamic and is based on a combination of fixed static intraday pivots along with the LR structure taken from the longer 3 LR setting.

Depending the the currency pair and the previous 18 hrs of movement the LiTs area might be anything from just 20 pip to 50 pips for pairs like the GJ. If the price is in the actual "area" then basically we are waiting for it to break out one way or the other which will normally happen after 8 00 am UK time. On trending days the the moves can last 6 to 8 hrs + but Lunchtime news releases can see full reversals

A great example yesterday would be the UJ - its stayed under its LiTs area the whole day session - even including the NFP spike.

With regards to the "Turtles" experiment - I think a more apt name for followers of my method would be "Vultures" - or maybe for the high flyers - "Golden Eagles" ;-)

Sky TV documentary to then follow ( lol)

Regards

F

understood F.........my main interest was aroudn how far back you go in time re S/R levels seeing as we are scalping ..........18 hours it seems

I carry out a similar procedure on the indexes .........particularly the USD that represents 90% of my scalps

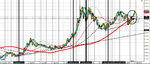

heres last week with some Main and interim H/L's in the frame

Monday was a Boomer so it made the next few days more challenging

Thursday / Friday were easier for me as I could trade direction off the new weekly high for the week ........bouncing them off interim daily lows👍

N

Attachments

Forexmospherian

Legendary member

- Messages

- 39,928

- Likes

- 3,306

understood F.........my main interest was aroudn how far back you go in time re S/R levels seeing as we are scalping ..........18 hours it seems

I carry out a similar procedure on the indexes .........particularly the USD that represents 90% of my scalps

heres last week with some Main and interim H/L's in the frame

Monday was a Boomer so it made the next few days more challenging

Thursday / Friday were easier for me as I could trade direction off the new weekly high for the week ........bouncing them off interim daily lows👍

N

Morning N

Ok - will give the example of the LiTs from Friday on the Eur /Aud pair

It was not on my list last week ( too many already to trades etc) but as Nick says - it can be a great mover with a nice spread and so I should link it up with EU / EJ etc

Will post an example in next 30 mins hopefully - just come back from a 2 mile walk with Basil - an absolute beautiful morning here in the Sunny Midlands so now needy an hearty breakfast

F

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

and while we are on the usd index and highs / Lows ...........

heres the year on the usd .........see the S/R levels and the new yearly high this week ?

who says Price action is only related to markets / charts ?

and look at the peach of a bounce in late August.........that bull bounce has put 250 pips of prime usd pips on any usd pairs already

that's has translated into

500 pip fall on GU (25th Aug)

350 pip rise Uchf (25th Aug)

500 pip fall on EU (25th Aug)

not bad for a simple S/R play ..........scalpers should take a look at their performance over the last 2 weeks or so .........pound to a penny your wins were very loaded on usd buy scalps most days....damn sure mine have been :smart:

N

heres the year on the usd .........see the S/R levels and the new yearly high this week ?

who says Price action is only related to markets / charts ?

and look at the peach of a bounce in late August.........that bull bounce has put 250 pips of prime usd pips on any usd pairs already

that's has translated into

500 pip fall on GU (25th Aug)

350 pip rise Uchf (25th Aug)

500 pip fall on EU (25th Aug)

not bad for a simple S/R play ..........scalpers should take a look at their performance over the last 2 weeks or so .........pound to a penny your wins were very loaded on usd buy scalps most days....damn sure mine have been :smart:

N

Attachments

Forexmospherian

Legendary member

- Messages

- 39,928

- Likes

- 3,306

Finding the Intraday LiTs area on the EA for Friday 4th

To intraday trade any FX pair you have to realise everyday will be different and you need a lot more clues to assist than just a daily / weekly / monthly / pivot or even Fibs areas etc etc. I am not saying they don't help - but for the accuracy we require to take trades with both high probability and a high win rate etc - we need extra "edges"

I did not trade the EA at all on Friday - although last year and early on this year it was second favourite to the EJ

It is a great mover and I know Major M likeS it as well - so maybe we need to add it the list in October after I am back off holiday.

I will show 3 charts - the main one is the 1 min LR chart for the day - showing the area based on the morning levels - and then I will post 2 more 30 min LR charts showing the 1 week and 1 month picture.

I am more interested in the few hours before the European Opens - some days it might just be off that last 4 hrs - backed up by the previous 18 hrs

The Weekly and Monthly view off a 15 or 30 min chart can give you a bigger picture - but as we know - the "devil is in the detail" - ie we want to know what's going to happen today not really bothered to much about yesterday / last week / last month etc although they all are in the "clue base"

The LiTs on the Eur / Aud for the Friday am session was approx about 45 pips - large - but then again its a big mover

The bias for month was still overall bullish - but previous day had been bearish - which changed late afteRnoon evening after it bounced back over 5800

18 hrs or so later it was back up at 6140/50 area - ie a 350 move up

Hands up - did not get none of the rise ;-) - just did not trade it as focused on another 6 pairs.

I know Sir G as been trying to get his PPND system on up to 34 currency pairs - I struggle on 6 to 8 pairs and even many members here think that's not possible - just shows how out of touch they are with the elite FX master traders - but then again there standardS were intermediary at best - not understanding FX is different to trading indices - with a regulated market and even different tick charts etc etc

I would prefer to become a proper master of purely FX pairs rather than a jack of all trades covering everything from stocks and shares / indices/ FX / etc etc

In my view its like asking Ronaldo and Messi to play Australian football rules - or even Rugby - or even Lewis Hamilton to do Rally cross - yes I am sure they would still all be good at similar sports - but no longer at the very top level they achieved by concentrating on just one area.

Just my own view and don't want to put any one off taking some of the FX tips they learn here into other areas - but will the work as well ??? - I don't know

EA - LiTs area shown for Friday - favours sell below and buys above

EA - 30 min week view

EA - 30 min 1 month big picture view

The I min chart is the intraday trading chart for me - although the tick helps with some scalping and the 30 min can give a bigger picture view

Hope that helps N

Regards

F

To intraday trade any FX pair you have to realise everyday will be different and you need a lot more clues to assist than just a daily / weekly / monthly / pivot or even Fibs areas etc etc. I am not saying they don't help - but for the accuracy we require to take trades with both high probability and a high win rate etc - we need extra "edges"

I did not trade the EA at all on Friday - although last year and early on this year it was second favourite to the EJ

It is a great mover and I know Major M likeS it as well - so maybe we need to add it the list in October after I am back off holiday.

I will show 3 charts - the main one is the 1 min LR chart for the day - showing the area based on the morning levels - and then I will post 2 more 30 min LR charts showing the 1 week and 1 month picture.

I am more interested in the few hours before the European Opens - some days it might just be off that last 4 hrs - backed up by the previous 18 hrs

The Weekly and Monthly view off a 15 or 30 min chart can give you a bigger picture - but as we know - the "devil is in the detail" - ie we want to know what's going to happen today not really bothered to much about yesterday / last week / last month etc although they all are in the "clue base"

The LiTs on the Eur / Aud for the Friday am session was approx about 45 pips - large - but then again its a big mover

The bias for month was still overall bullish - but previous day had been bearish - which changed late afteRnoon evening after it bounced back over 5800

18 hrs or so later it was back up at 6140/50 area - ie a 350 move up

Hands up - did not get none of the rise ;-) - just did not trade it as focused on another 6 pairs.

I know Sir G as been trying to get his PPND system on up to 34 currency pairs - I struggle on 6 to 8 pairs and even many members here think that's not possible - just shows how out of touch they are with the elite FX master traders - but then again there standardS were intermediary at best - not understanding FX is different to trading indices - with a regulated market and even different tick charts etc etc

I would prefer to become a proper master of purely FX pairs rather than a jack of all trades covering everything from stocks and shares / indices/ FX / etc etc

In my view its like asking Ronaldo and Messi to play Australian football rules - or even Rugby - or even Lewis Hamilton to do Rally cross - yes I am sure they would still all be good at similar sports - but no longer at the very top level they achieved by concentrating on just one area.

Just my own view and don't want to put any one off taking some of the FX tips they learn here into other areas - but will the work as well ??? - I don't know

EA - LiTs area shown for Friday - favours sell below and buys above

EA - 30 min week view

EA - 30 min 1 month big picture view

The I min chart is the intraday trading chart for me - although the tick helps with some scalping and the 30 min can give a bigger picture view

Hope that helps N

Regards

F

Attachments

Forexmospherian

Legendary member

- Messages

- 39,928

- Likes

- 3,306

and while we are on the usd index and highs / Lows ...........

heres the year on the usd .........see the S/R levels and the new yearly high this week ?

who says Price action is only related to markets / charts ?

and look at the peach of a bounce in late August.........that bull bounce has put 250 pips of prime usd pips on any usd pairs already

that's has translated into

500 pip fall on GU (25th Aug)

350 pip rise Uchf (25th Aug)

500 pip fall on EU (25th Aug)

not bad for a simple S/R play ..........scalpers should take a look at their performance over the last 2 weeks or so .........pound to a penny your wins were very loaded on usd buy scalps most days....damn sure mine have been :smart:

N

I agree with you N - bias is important - but it can be the failure of so many traders

That's why you need a trading "toolbox" with not just one or two tools - but with a good mix that works for you.

You need to be a scalper / short term swing / main swing trader / Position trader and have a total open view to maximise your opportunities

If you can also achieve all this with stops moved into profits as well - you have cracked it 👍

Regards

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

To intraday trade any FX pair you have to realise everyday will be different and you need a lot more clues to assist than just a daily / weekly / monthly / pivot or even Fibs areas etc etc. I am not saying they don't help - but for the accuracy we require to take trades with both high probability and a high win rate etc - we need extra "edges"

I would prefer to become a proper master of purely FX pairs rather than a jack of all trades covering everything from stocks and shares / indices/ FX / etc etc

In my view its like asking Ronaldo and Messi to play Australian football rules - or even Rugby - or even Lewis Hamilton to do Rally cross - yes I am sure they would still all be good at similar sports - but no longer at the very top level they achieved by concentrating on just one area.

Just my own view and don't want to put any one off taking some of the FX tips they learn here into other areas - but will the work as well ??? - I don't know

Hope that helps N

Regards

F

Hi F - yes it does...........thanks

and I have highlighted one response above that I 100% agree with ............your Expertise is in forex ........and most of the others who join you here are forex based traders as well - including me

I feel that one has to be very specialised to make the best calls consistently and with focus...........if people are calling across a range of markets then fair do's .........but certainly not scalping .........I cant see how they keep the focus

N

Forexmospherian

Legendary member

- Messages

- 39,928

- Likes

- 3,306

Do you really need 10K hours ?

Many theorists disagree with Malcolm Gladwell thesis that it takes 10,000 hrs to learn a new skill and master it .

Here's a short article to begin with -

Do you believe it takes 10,000 hours to master a skill? Are there any shortcuts?

I think the idea of “mastering” a skill when you’re just getting started is counterproductive: it can be a significant barrier to exploring a new skill in the first place.

The original research that resulted in the “10,000 hour rule” is valid, as far as it goes. Dr. K. Anders Ericsson of Florida State University, as well as other researchers, have found that it takes around 10 years or 10,000 hours of practice to reach the top of ultracompetitive, easily ranked performance fields, like professional golf, music performance, or chess. In those fields, the more time you’ve spent in deliberate practice, the better you perform compared to people who have practiced fewer hours.

Most of the time, however, performance in ranked competition against world-class rivals isn’t the goal: it’s far more likely that you want to pick up a new skill to get a particular outcome. For career skills, the focus is on performing well enough to produce a result that’s meaningful to you. For personal skills and hobbies, the focus is on enjoying the process and having fun.

In these instances, the “10,000 hour rule” and the idea of “mastery” can actually serve as barriers to sitting down to practice – if you believe it takes that long to see results, you’re less likely to start in the first place. The real priority is to practice enough to get the results you’re looking for, not to attain a certain level of status or competitive performance.

I think it all depends on the "skill" that you are trying to learn

How many hours did it take you from getting in a car and learning to drive and passing your test ?? - 15 hrs - 30 hrs - 100 hrs etc

How long did you go before you had your first car accident ( of any type - ie backing into a pillar etc ) - 50 hrs - 200 hr - over 1 yr - over 3 yrs ?

How long does it take to train to become a Doctor or a Lawyer / Accountant / Mechanical Engineer - 1 day - 1 week - 1 year 3 + years ?

Why do 80 -95% of all FX Traders fail to make consistent monies after 2 or 3 or 5 years and most just give up ??

Oh yer - forgot trading easy - piece of cake - you should be able to know enough in a day or a week - certainly 1 month - ROFLMAO

Please - if you think it is easy and only takes a month or so to get to a profitable level - then don't even bother following me or my method

More of my gems of wisdom to follow ;-)

Many theorists disagree with Malcolm Gladwell thesis that it takes 10,000 hrs to learn a new skill and master it .

Here's a short article to begin with -

Do you believe it takes 10,000 hours to master a skill? Are there any shortcuts?

I think the idea of “mastering” a skill when you’re just getting started is counterproductive: it can be a significant barrier to exploring a new skill in the first place.

The original research that resulted in the “10,000 hour rule” is valid, as far as it goes. Dr. K. Anders Ericsson of Florida State University, as well as other researchers, have found that it takes around 10 years or 10,000 hours of practice to reach the top of ultracompetitive, easily ranked performance fields, like professional golf, music performance, or chess. In those fields, the more time you’ve spent in deliberate practice, the better you perform compared to people who have practiced fewer hours.

Most of the time, however, performance in ranked competition against world-class rivals isn’t the goal: it’s far more likely that you want to pick up a new skill to get a particular outcome. For career skills, the focus is on performing well enough to produce a result that’s meaningful to you. For personal skills and hobbies, the focus is on enjoying the process and having fun.

In these instances, the “10,000 hour rule” and the idea of “mastery” can actually serve as barriers to sitting down to practice – if you believe it takes that long to see results, you’re less likely to start in the first place. The real priority is to practice enough to get the results you’re looking for, not to attain a certain level of status or competitive performance.

I think it all depends on the "skill" that you are trying to learn

How many hours did it take you from getting in a car and learning to drive and passing your test ?? - 15 hrs - 30 hrs - 100 hrs etc

How long did you go before you had your first car accident ( of any type - ie backing into a pillar etc ) - 50 hrs - 200 hr - over 1 yr - over 3 yrs ?

How long does it take to train to become a Doctor or a Lawyer / Accountant / Mechanical Engineer - 1 day - 1 week - 1 year 3 + years ?

Why do 80 -95% of all FX Traders fail to make consistent monies after 2 or 3 or 5 years and most just give up ??

Oh yer - forgot trading easy - piece of cake - you should be able to know enough in a day or a week - certainly 1 month - ROFLMAO

Please - if you think it is easy and only takes a month or so to get to a profitable level - then don't even bother following me or my method

More of my gems of wisdom to follow ;-)

Forexmospherian

Legendary member

- Messages

- 39,928

- Likes

- 3,306

Monday 7th September 2015 - Pre Opens

Good Morning to all FX Intraday Traders.

The start of a new trading week and by the look of it - maybe a slow Monday with no real red news releases and later on today a Bank Holiday for the US and Canada

This will be the first full week for this new FX trading journal and I hope to be around most days - but I do welcome input from all other members who maybe already scalp or intraday trade etc and also welcome all charts and calls and comments etc

Its nice to think that you can now comment here knowing that no multi nic disser will interrupt and basically try and "bully " you away calling you all names possible to put you off.

I presently have a pending list of members wanting to join and participate but unfortunately the multi nics are easy to spot. If any do get through - I will soon take them off the contact / friends list and stop them interrupting and report them as well.

OK - will start of with the LiTs areas and a quick comment on my scalps.

I must be the only trader who tells them in ADVANCE of the action - with the main ones this hour being 6 00/1 am - 6 09 am - 6 21 am - 6 30 am - 6 39 am - 6 51 am and then 7 01 am after EO.

Even then some of the dissers still have trouble following and understanding - but then that's not my concern

Have a good trading day and a great week

All the best

F

Good Morning to all FX Intraday Traders.

The start of a new trading week and by the look of it - maybe a slow Monday with no real red news releases and later on today a Bank Holiday for the US and Canada

This will be the first full week for this new FX trading journal and I hope to be around most days - but I do welcome input from all other members who maybe already scalp or intraday trade etc and also welcome all charts and calls and comments etc

Its nice to think that you can now comment here knowing that no multi nic disser will interrupt and basically try and "bully " you away calling you all names possible to put you off.

I presently have a pending list of members wanting to join and participate but unfortunately the multi nics are easy to spot. If any do get through - I will soon take them off the contact / friends list and stop them interrupting and report them as well.

OK - will start of with the LiTs areas and a quick comment on my scalps.

I must be the only trader who tells them in ADVANCE of the action - with the main ones this hour being 6 00/1 am - 6 09 am - 6 21 am - 6 30 am - 6 39 am - 6 51 am and then 7 01 am after EO.

Even then some of the dissers still have trouble following and understanding - but then that's not my concern

Have a good trading day and a great week

All the best

F

Nice one Nick

Cheers

Forexmospherian

Legendary member

- Messages

- 39,928

- Likes

- 3,306

6 45 am

LiTs area for the main FX pairs for Monday AM Session

EU - 1135 - 1160 ish - 6 30 am 1147/8 scalp sell

GU - 5185 - 5195 - 6 00 am scalp sell taken at 5188/7

EJ - 132 70 - 132 90 ish

UJ - 119 15 - 119 45 ish

UChf - 9712 - 9723 ish

UCad - 3250 - 3275 ish

AU - 6960 - 6962 ish

LiTs area for the main FX pairs for Monday AM Session

EU - 1135 - 1160 ish - 6 30 am 1147/8 scalp sell

GU - 5185 - 5195 - 6 00 am scalp sell taken at 5188/7

EJ - 132 70 - 132 90 ish

UJ - 119 15 - 119 45 ish

UChf - 9712 - 9723 ish

UCad - 3250 - 3275 ish

AU - 6960 - 6962 ish

Forexmospherian

Legendary member

- Messages

- 39,928

- Likes

- 3,306

Morning F,

Already over 40 points on EA this morning, so not such a slow day.

Have a good one.

Cheers

Morning Nick and Liver

WD - nice start to the morning

I have only taken 2 scalps so far - both sells - GU from 6 00 am and EU from 6 30 am and near 19 pips total so far

Have a good day guys

F

Forexmospherian

Legendary member

- Messages

- 39,928

- Likes

- 3,306

EU

6 52 am

I scalp sold it at 6 30 am ish from the 1149 area but did not get that entry price

Its in a tight range inside the LiTs area atm with the first interim support at 1140/42 and R at 55 to 57

Under 1175 and 1157 favours a down bear bias - but of course it will all depend on the supports at 1100 - 1120 and 1135 to 40 area

6 52 am

I scalp sold it at 6 30 am ish from the 1149 area but did not get that entry price

Its in a tight range inside the LiTs area atm with the first interim support at 1140/42 and R at 55 to 57

Under 1175 and 1157 favours a down bear bias - but of course it will all depend on the supports at 1100 - 1120 and 1135 to 40 area

Forexmospherian

Legendary member

- Messages

- 39,928

- Likes

- 3,306

6 52/3 am has provide good bounce / scalp buy opportunities on both EU and GU

I have just exited 70% stakes on the sells for now and will look after 7 00 am for my next scalp

Scalp for next for the dissers who have trouble reading and understanding my method -

7 01 am - 7 09 - 7 21 - 7 30 - 7 39 - 7 51 am

For members following - then we need the LR's etc and levels to match up with the the times give or take a minute

Will give you a great example in a bit on the GU

I have just exited 70% stakes on the sells for now and will look after 7 00 am for my next scalp

Scalp for next for the dissers who have trouble reading and understanding my method -

7 01 am - 7 09 - 7 21 - 7 30 - 7 39 - 7 51 am

For members following - then we need the LR's etc and levels to match up with the the times give or take a minute

Will give you a great example in a bit on the GU

- Status

- Not open for further replies.

Similar threads

- Replies

- 1K

- Views

- 163K

- Replies

- 67

- Views

- 23K

- Replies

- 11

- Views

- 3K

- Replies

- 10

- Views

- 8K